Summary:

- Google Cloud is experiencing strong momentum, with 32% growth year-on-year.

- YouTube Shorts growth to be driven by creators.

- Overall, robust results with positive notes on Google Cloud and YouTube.

400tmax

Business Overview and Investment Thesis

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) operates a business model that centers around advertising and cloud computing services. GOOGL advertising revenue is generated primarily through Google search engine, YouTube, and Google Networks, which amounts to approx. 90% of total revenues. The remaining 10% of the revenue is generated through Google Cloud and, to a much smaller extent, Other Bets. Google Cloud segment is responsible for the company’s efforts to diversify its revenue streams and is becoming an increasingly important part of its business.

I believe Google remains an attractive investment opportunity, as the company continues to perform well, with its cloud business experiencing strong momentum and an already dominant advertising business. As such, I consider GOOGL stock a buy. Let’s take a look at the fourth quarter results.

GOOGL Fourth Quarter Results

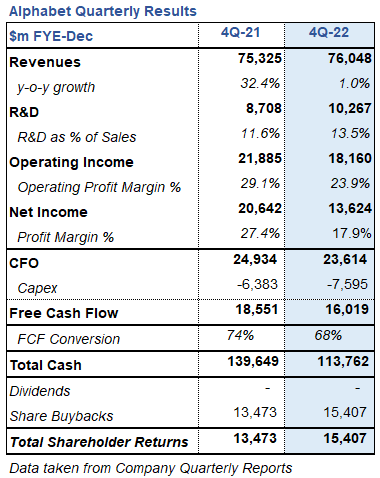

Alphabet Quarterly Results (Company Quarterly Results)

During the fourth quarter of 2022, GOOGL recorded a slight revenue increase of 1% to $76 billion. Results were impacted by Google Advertising, which suffered a 3.6% revenue decrease, mainly as a result of pullbacks in advertiser spend during the fourth quarter. This decrease was completely offset by the strong growth in Google Cloud, increasing revenues by 32% year-on-year. Operating expenses for the quarter increased, with the bulk of increases coming from cost of revenues and R&D expenses. GOOGL spent $10.3 billion or 13.5% of total revenues in R&D as the company continues to invest in its AI capabilities. Here it is important to note that AI is a strategic priority for the company, and management mentioned during the Q4 investor call it sees a huge opportunity ahead.

Due to the higher operating expenses GOOGL recorded an operating profit of $18.1 billion for the period, net income was depressed to $13.6 billion as a result of unrealized losses of equity securities of $1.5 billion. In comparison, GOOGL reported a $2.5 billion unrealized gain of equity securities during the same period last year.

GOOGL recorded a strong free cash flow amounting to $16 billion, which was mainly used to cover shareholder returns totaling $15.4 billion for the period. On a final note, management repurchased a staggering $59 billion of Class A and Class C shares during 2022.

Google Cloud

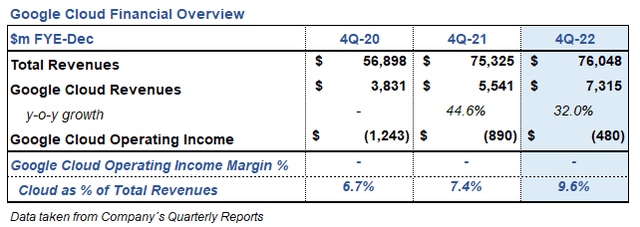

Google Cloud Financial Overview (Company’s Quarterly Reports)

Google Cloud continues seeing strong momentum, with revenues increasing by 32%. It should be noted that this is a decrease compared to the 44.6% growth rate during the same period last year. Nonetheless, what Google Cloud has achieved is spectacular. The segment has been able to double its quarterly revenues within 2 years and could continue seeing double-digit growth rates for some time.

When it comes to the cloud market, Google Cloud competes with industry leaders Amazon (AMZN) Web Services (“AWS”) and Microsoft (MSFT) Azure. As per the fourth quarter of 2022, Google Cloud saw the highest percentage gain in comparison to its peers. Despite Google Cloud being a distant third when it comes to revenues, it continues to grow at a rapid rate. The segment now contributes to ~10% of the company’s top line. It should also be mentioned that the segment continues to be unprofitable, however, operating losses have seen a substantial decrease compared to 2020 and 2021.

The segment remains unprofitable because Google management continues to invest ahead of revenues in order to ensure the company is equipped to support customers across segments around the world.

YouTube

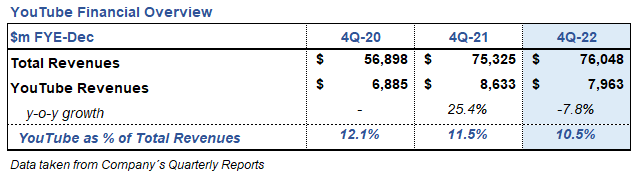

YouTube Financial Overview (Company’s Quarterly Reports)

YouTube saw a decrease in revenues of 7.8% as the advertising market continues seeing slow down. Despite this decrease, there is exciting news for YouTube, management has announced its continued prioritization of continued growth in YouTube Shorts. An important fact here is that YouTube Shorts now averages over 50 billion daily views, up from the 30 billion announced on the Q1 2022 investor call. Furthermore, YouTube Music and Premium passed the 80 million subscribers mark during the fourth quarter of 2022.

Management has also implemented a four pillar growth strategy for YouTube. This strategy will reward creators and help improve the Shorts experience as well as enhance the viewer’s experience. Here are the four pillars for growth as enumerated by management during the investor call.

- Number one, ramping Shorts.

- Number two, accelerating engagement on a large screen.

- Number three, investing in subscription offerings.

- Number four, a long-term effort to make YouTube more shoppable.

Despite the revenue decrease, the future prospects and strategy for YouTube remain convincing.

Workforce Reduction and Cost Optimization

In January 2023, Google announced a reduction of its workforce by approx. 12,000 employees. The company expects to incur employee severance and related charges from $1.9 billion to $2.3 billion, which will be recognized during the first quarter of 2023. Management is also taking actions to optimize global office space. These initiatives are in line with other tech giants’ actions during the last two months.

Bottom Line

I continue to maintain my positive outlook on Alphabet Inc. Management continues working towards its revenue diversification, presenting a great opportunity in both the cloud computing and artificial intelligence markets. Further to this, Google has very strong fundamentals, with over $113 billion in cash and cash equivalents. Finally, Google management is clearly investing in the future of the company, spending substantial amounts of resources in its AI capabilities.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.