Summary:

- YouTube ads reported 8% YoY decline in the recent quarter which was one of the key reasons behind the bearish sentiment.

- A big chunk of additional YouTube user engagement is going into YouTube Shorts.

- A TikTok ban could be closer than expected in U.S. and other key regions which can be a strong tailwind for YouTube.

- Lower competition in short-form video should allow Google to rapidly increase monetization and improve the ad revenue metric.

- We should see a strong upswing in YouTube ads in the next few quarters, which can change the stock trajectory.

Alena Kravchenko

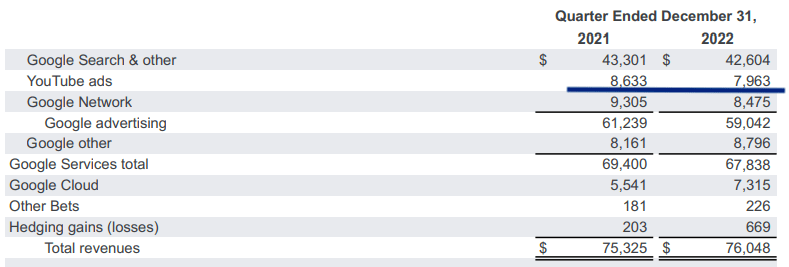

Recent earnings report by Alphabet (NASDAQ:GOOG) led to a minor correction in the stock as its performance in many segments was below expectations. One of the key growth segments for Google has been YouTube ads. This business showed a massive 8% YoY decline and dropped to $7.96 billion compared to $8.63 billion a year ago. Macroeconomic factors played a role in this decline but there were some company-related issues also. There has been a massive growth in user engagement on YouTube Shorts which is not being monetized at a high rate. The daily views on YouTube Shorts crossed 50 billion compared to 30 billion daily views in Q1 2022.

The Wall Street Journal recently reported that TikTok could soon be banned if its Chinese owners don’t sell their stake. TikTok CEO is set to appear before Congress and we could see increasing calls for a ban on TikTok from both sides of the aisle. This would be a massive tailwind for YouTube Shorts which is already growing rapidly. Monetization and higher user engagement on YouTube Shorts could help Google report rapid growth in ad revenue in the next few quarters. This should improve the sentiment towards the stock and increase the valuation multiple.

TikTok bans seem imminent

Geopolitical tensions have been rising for the past few months. It is highly likely that we will see a complete ban on TikTok in US as data security and national security become the top priority. Legislators from both sides of the aisle are pushing for it. As we head into the next Presidential election cycle, TikTok will face greater calls for a ban.

The rise of TikTok has been one of the fastest-growing startups. A recent transaction has valued the company at a staggering $220 billion which reflects the ad potential in this segment. Any increase in rivalry between US and China can lead to an immediate ban on TikTok. In 2020, India banned TikTok despite the massive userbase of this app due to a border skirmish with China.

A ban in US can also lead to a domino effect where other Western countries also follow. Recently, Belgium and Denmark have announced a partial ban on TikTok which could be expanded in the near term. This would be a huge tailwind for YouTube Shorts which is trying to increase its market share within the short-form video format.

The potential of YouTube Shorts

Google needs to show good growth in its YouTube segment as it is one of the key drivers for the company. The big decline in YouTube ad revenue was a setback for the company and led to bearish sentiment over the long term growth runway in this business.

Company Filings

Figure 1: Decline in YouTube ads in the recent quarter.

A ban on TikTok will push the users to other options which include YouTube Shorts and Instagram Reels. It will reduce the competition for Google and also allow the management to start monetizing users at a quicker pace.

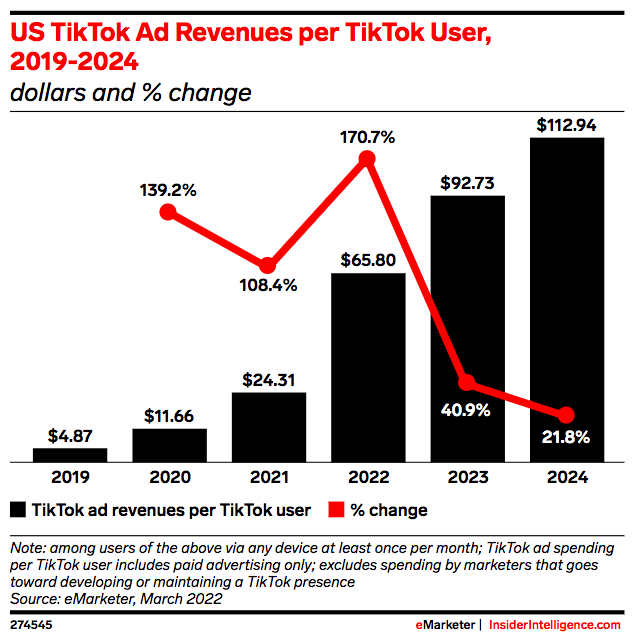

eMarketer

Figure 2: Massive revenue per TikTok users in US.

We can see from the above chart that TikTok app has gained substantial revenue per user due to higher engagement. In this report, eMarketer predicted that TikTok would gain a staggering $112.94 per user in US by 2024. If a ban is announced, most of this revenue could be cornered by YouTube Shorts and Reels. There are over 100 million active TikTok users in US which would allow the company to gain over $11 billion in ad revenue by 2024.

If YouTube Shorts is able to grab 40% of this ad revenue potential, it would increase the quarterly ad revenue by $1.2 billion or 15% of the current revenue base of YouTube ad segment. A ban in other key regions like UK, Western Europe, and Japan could further increase the revenue base of YouTube Shorts. It is likely that with lower competition, YouTube Shorts should get better ad rates and higher user engagement. This can lead to further growth potential within this business segment.

Increase in Google’s moat

One of the key issues with new tech trends is that they can easily fall apart. If YouTube is able to build a successful business from its Shorts app, it would show the robustness of its platform and the ability to use new trends to gain better user engagement and monetization options.

YouTube is already building a successful subscription business and has reported that its subscriber base has reached 80 million. A year ago, this subscriber base was 50 million which shows 60% YoY growth. At the current growth pace, YouTube could hit 200 million subscribers by 2025 which will further increase the moat for the company. YouTube Shorts is a key platform to attract and retain a younger crowd and to move this user base towards a more regular subscription option.

Impact on Google stock

Google’s ad revenue still makes up the bulk of company’s revenue base. The decline in YouTube ad revenue has been a key reason behind the recent bearish sentiment. A change in this metric would lead to rapid improvement in stock trajectory. As mentioned above, TikTok ban seems to be highly likely and could happen within a few months. This should be a massive tailwind for YouTube Shorts which can lead the company to improve its ad rates and accelerate monetization on this platform.

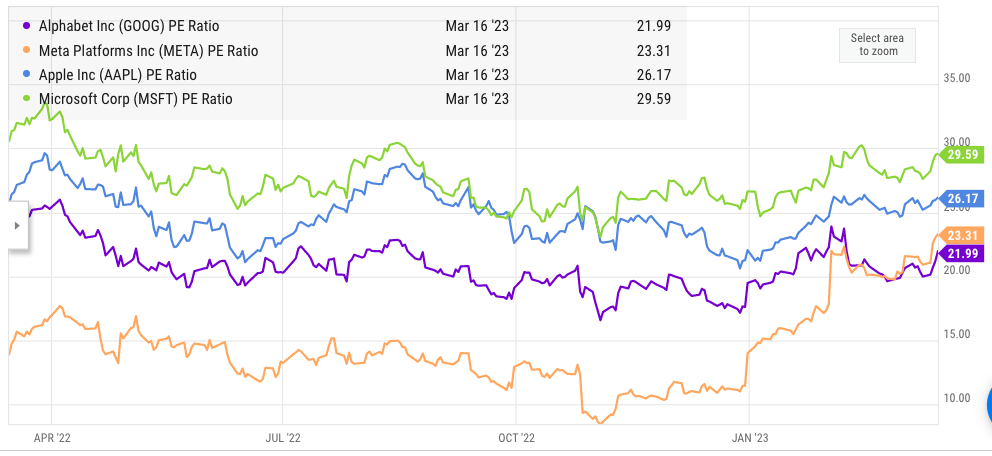

Ycharts

Figure 3: Alphabet trading at a lower PE ratio compared to other peers.

YouTube ad makes up 12% of the total revenue base of Google. Hence, a TikTok ban can improve the revenue growth trend for YouTube ad business as well as the overall revenue base. Wall Street could give a sharp bullish momentum to Alphabet stock in case of a wider TikTok ban and also increase the long-term growth projections for the company.

Investor takeaway

A TikTok ban could be imminent as the Biden administration has asked the owner’s stake to be completely divested. The increase in data security concern is felt in US as well as other Western countries. Many EU countries have also announced partial TikTok bans. This will lead to more users using YouTube Shorts and reduce competition for the company.

An improvement in YouTube ad revenue would be a big boost for Alphabet stock. The company recently reported 8% decline in YouTube ad compared to 1% growth in overall revenue. Future growth in YouTube ad business is very important for the growth trajectory of the stock. Any news regarding a ban on TikTok should help the sentiment around the stock and also improve the long-term returns for investors.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.