Summary:

- Google’s acquisition of YouTube has generated nearly $40 billion in trailing twelve month (TTM) revenue, with AI providing advertisers with excellent results.

- Google Cloud has overcome cumulative operating losses of nearly $13 billion and is now well-positioned to see meaningful operating income in the future.

- Despite concerns about AI offerings cutting into Google’s digital ad market share, the rapid growth of the digital ad market may offset any decrease in share.

Ekaterina79

Introduction

My thesis is that Google (NASDAQ:GOOG) (NASDAQ:GOOGL) has many positives.

Acquiring YouTube for $1.65 billion in 2006, Google has transformed it into a business that generated almost $40 billion in trailing twelve month (“TTM”) revenue. The future is bright with YouTube as Google uses AI to give advertisers excellent results.

Over the last 3.5 years, Google Cloud has cumulative operating losses of nearly $13 billion. Google shareholders can be assuaged about these losses by recognizing that they represent a formidable barrier for any new companies thinking about entering the hyperscale cloud space. Google Cloud had its first quarter with positive operating income in 1Q23 and I am optimistic that they now have the scale to see meaningful operating income in the years ahead. Amazon CEO Andy Jassy noted in the 1Q23 call that more than 90% of the global IT spend is still on-premise. Google Cloud, Amazon (AMZN) AWS and Microsoft (MSFT) Azure are all well positioned to flourish in the years ahead as the world continues to use more AI and move IT spend to the cloud.

Headlines focus on the fact that ChatGPT and other AI offerings will cut into Google’s share of the digital ad market. This is a legitimate concern, but it might be possible for the digital ad market to grow so fast that Google’s decrease in share is outweighed by the growing space. In other words, it can be better to have a small slice of a big pie than a big slice of a small pie. We’ve seen this type of thing happen with Amazon’s AWS over the years as revenue has climbed nicely while market share has gone down. TechCrunch sums up Google I/O 2023 by reviewing the many ways Google will become a better company with their AI improvements.

YouTube

In the 1Q23 call, Senior VP Philipp Schindler boasted about the ROI advertisers see when using YouTube. Using YouTube, advertisers can target younger viewers who are otherwise unreachable. The ROI on YouTube ads is much higher than what advertisers are used to with linear TV:

In one of our largest marketing mix modeling studies to date, YouTube ROI is 40% higher than linear TV and 34% higher than all other online video, according to a customer analysis from January 2020 to March 2022 of Nielsen Compass ROI benchmarks across 16 countries and 19 billion of total media spend measured. This proves YouTube’s ability to drive effectiveness at scale.

YouTube allows advertisers to reach young people globally. Per comments from YouTube CEO Neal Mohan at the May 23rd SVB MoffettNathanson conference, 95% of Gen Z say they use YouTube on a regular basis. He noted that YouTube has 80 million YouTube Premium subs and more than five million YouTube TV subs. Citing Nielsen, Senior Research Analyst Michael Nathanson pointed out that YouTube now has more streaming viewership than Netflix in the US. Mohan responded by noting that YouTube is also doing well outside the US; they’re a global phenomenon. Mohan went on to say that YouTube generated nearly $40 billion TTM revenue. Looking at filings, we see that $29 billion of this $40 billion figure is from advertising. Mohan stressed the democratization of content at the SVB MoffettNathanson conference:

I saw a stat recently [that] said something on the order of 3 out of 4 of every Gen Z in the U.S. uploaded a video online in the last year. So, that’s a pretty profound change in terms of creation of content, the democratization of content creation. And so, that’s a big priority for us. It’s mobile-first. A lot of it is short-form, YouTube Shorts, of course, we can talk more about. But for us, it’s really multi-format, mobile-driven, participatory in nature, and so really making sure that we have the tools and capabilities from a creation standpoint. One of those capabilities, of course, that I’m very excited about that’s also going to revolutionize creation, of course, is generative AI.

Google Cloud

In the 1Q23 call, CEO Sundar Pichai said Google Cloud is the only provider to announce availability of NVIDIA’s new L4 Tensor Core GPU:

We are the only cloud provider to announce availability of NVIDIA’s new L4 Tensor Core GPU with the launch of our G2 VMs, which are purpose-built for large inference AI workloads, such as generative AI.

Google Cloud finally had positive operating income in 1Q23 but AWS had a 4-year head start such that they are well advantaged with operating margins:

|

in millions $ |

||||||

|

Google Cloud Qtr End |

Google Cloud Operating Income |

Google Cloud Revenue |

AWS Qtr End |

AWS Operating Income |

AWS Revenue |

|

|

Dec 2019 |

$ (1,194) |

$2,614 |

Dec 2015 |

$580 |

$2,405 |

|

|

Mar 2020 |

$ (1,730) |

$2,777 |

Mar 2016 |

$604 |

$2,566 |

|

|

Jun 2020 |

$ (1,426) |

$3,007 |

Jun 2016 |

$718 |

$2,886 |

|

|

Sep 2020 |

$ (1,208) |

$3,444 |

Sep 2016 |

$861 |

$3,231 |

|

|

Dec 2020 |

$ (1,243) |

$3,831 |

Dec 2016 |

$926 |

$3,536 |

|

|

Mar 2021 |

$ (974) |

$4,047 |

Mar 2017 |

$890 |

$3,661 |

|

|

Jun 2021 |

$ (591) |

$4,628 |

Jun 2017 |

$916 |

$4,100 |

|

|

Sep 2021 |

$ (644) |

$4,990 |

Sep 2017 |

$1,171 |

$4,584 |

|

|

Dec 2021 |

$ (890) |

$5,541 |

Dec 2017 |

$1,354 |

$5,113 |

|

|

Mar 2022 |

$ (931) |

$5,821 |

Mar 2018 |

$1,400 |

$5,442 |

|

|

Jun 2022 |

$ (858) |

$6,276 |

Jun 2018 |

$1,642 |

$6,105 |

|

|

Sep 2022 |

$ (699) |

$6,868 |

Sep 2018 |

$2,077 |

$6,679 |

|

|

Dec 2022 |

$ (480) |

$7,315 |

Dec 2018 |

$2,177 |

$7,430 |

|

|

Mar 2023 |

$ 191 |

$7,454 |

Mar 2019 |

$2,223 |

$7,696 |

|

|

$ (12,868) |

$ 61,159 |

$15,316 |

$57,738 |

Valuation

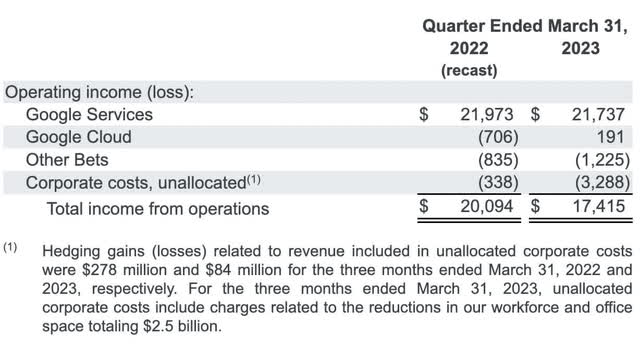

The 1Q23 release shows operating income by segment:

Segment operating income (1Q23 release)

Image Source: 1Q23 release

YouTube revenue rolls into the Google Services segment, but search ads are by far the biggest factor for this segment. Through 1Q23, Google Services had TTM operating income of $86,336 million or $21,737 million + $86,572 million – $21,973 million. This was based on TTM revenue of $254,017 million or $61,961million + $253,528 million – $61,472 million. I believe the segment is worth 18 to 20x operating income implying a rounded range of $1,555 to $1,730 billion.

Google Cloud had 1Q23 revenue of $7.5 billion such that the run rate is $30 billion. Eventually I’m optimistic that this business can have an operating margin of 15% to 20% which is well below the long-run operating margin we’ve seen at AWS. Applying this hypothetical margin implies operating income potential of $4.5 to $6 billion with a valuation of $80 to $120 billion if our multiple is 18 to 20x.

My sum of the parts valuation is as follows:

$1,555 to $1,730 billion Google Services

$80 to $120 billion Google Cloud

$0 Other Bets

—————————–

$1,635 to $1,850 billion Total

The 1Q23 10-Q shows 5,941 million A shares plus 882 million B shares for a sub total of 6,823 million which we multiply by the May 30 GOOGL share price of $123.67 to get a partial market cap of $844 billion. We then multiply the 5,874 million C shares times the May 30 GOOG price of $124.64 to get the remaining market cap component of $732 billion. Summing up, the total market cap is $1,576 billion. The enterprise value is well under the market cap due to $115 billion in cash, equivalents and securities.

The market cap is lower than my valuation range and I think the stock is a buy for long-term investors.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, GOOGL, AMZN, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.