Mastercard: The Company’s Moat Is Still Being Undervalued

Summary:

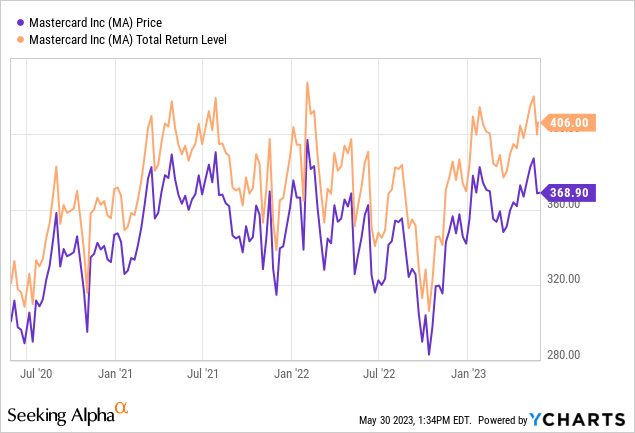

- Mastercard has consistently grown earnings at a double-digit rate and outperformed Visa in the last five years, with strong international growth.

- The company has unique competitive advantages, including a dominant position in the US payment processing market and a multi-rail network for various business deals.

- Mastercard’s strong balance sheet, undervalued stock, and projected growth make it a good buy for investors looking for a growth stock.

jir

Traditional and well-established companies are sometimes overlooked. While start-ups and newly formed corporations are often seen as having significant room to expand, older and more mature companies usually are not viewed as growth stocks.

One well-known company that has continued to consistently grow earnings at a double-digit rate for some time is Mastercard (NYSE:MA). This leading financial company provides transaction processing as well as payment related products and servicing in the US and internationally.

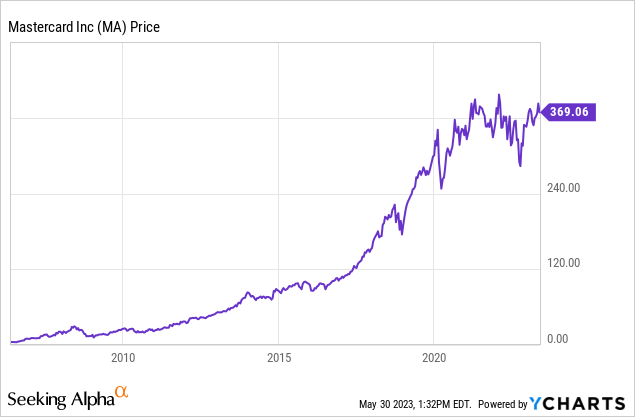

Mastercard has been one of the best performing stocks in the market since the company’s IPO in May of 2006.

Mastercard is up 7,754% since 2006, while the S&P 500 is up 833.10% during this time.

Still, the company has underperformed the S&P 500 over the last three years.

Mastercard is up 22.48% since 2020, while the S&P 500 has risen 40.42% during this same time period.

Investment Thesis

Today, MasterCard is a buy. This company should be able to sustain a double-digit growth rate, management has a lot of flexibility because of how strong the company’s balance sheet is, and the core business model still has a number of unique competitive advantages. The stock also looks cheap using several metrics.

Recent Developments

Mastercard’s first quarter earnings report showed continued strength across all core segments. Management reported first quarter earnings of $2.80 a share versus expectations of $2.71 a share. This was also an increase from earnings of $2.76 a share in the first quarter of last year. The company stated that revenues were $5.75 billion, versus expectations of $5.64 billion. This was an increase from net revenues of $5.17 billion in the first quarter of last year. Cross-border volumes increased 35% year-over-year, and switched transactions rose 12% year-over-year. The company guided to double-digit net revenue growth this year, with management also saying operating expenses should rise at a low-double digit rate.

Overview

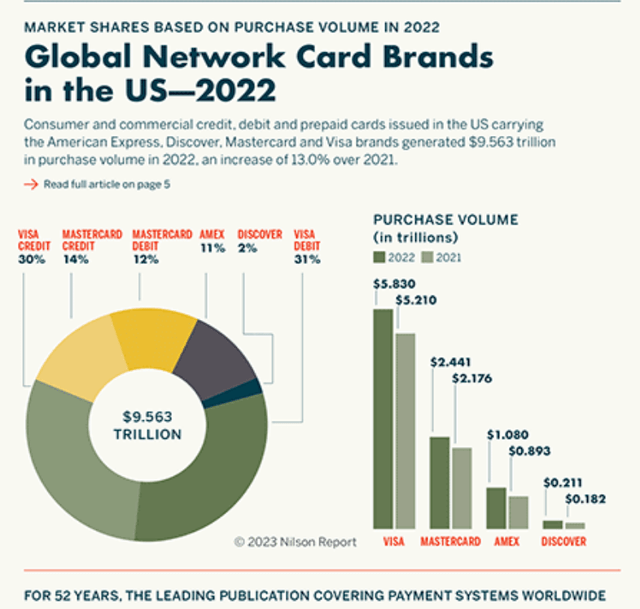

Mastercard also has a number of unique competitive advantages. The company is a multi-rail network that covers domestic, cross-border, card-based, and account-to-account business deals. Visa (V) and Mastercard dominated the US payment processing market, and this gives these companies significant pricing power. These two companies control nearly 87% of all processed debit, prepaid, and credit card payments in the US. Since Mastercard and Visa have such strong control of the US payment processing market, new companies have a hard time entering and undercutting these companies’ pricing power. Mastercard and Visa probably have no incentive to get into pricing wars, and these companies should continue to maintain their impressive market share.

A chart showing market share in the US payment processing industry (Nilson Report)

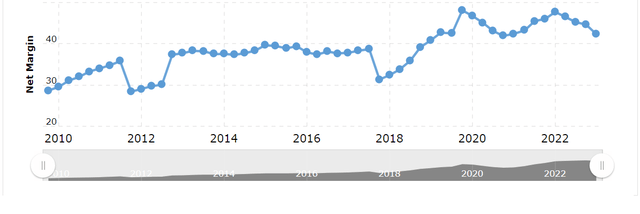

Visa has nearly 61% of the US debit and credit card market, while Mastercard card has 26% market share in the United States. The pricing power these companies have with their dominant position in this market is the main reason why Mastercard’s current net margin is an impressive 42.33%, which is near a 10-year high for the company. The average net margin for an S&P 500 company of 11.2%.

A Chart of Mastercard’s Net Margins (macrotrends)

Mastercard has also outperformed Visa over the last five years, with the company executing better than its peer, in particular overseas. Visa only bought back and took control of Visa Europe in 2015, Mastercard has been developing relationships and building out the company’s network in this region for some time. Visa had no control in Europe until they bought back the brand, while Mastercard has continued to make acquisitions and form partnerships in this region for decades. Mastercard is also up 91% in the last five years, while Visa’s stock has risen 69% during the same time period. Mastercard recently saw 15% transaction growth for the full year in 2022 in the Asia-Pacific, Middle East, and African region. The company also saw payment transactions increase by 11.82% in Europe. Mastercard’s international growth has been particularly important, nearly 65% of the payments the company processes are outside of the United States.

Mastercard has also been more aggressive than Visa making acquisitions. The company has made six acquisitions, including three in the last five years. Mastercard has been building networks and establishing relationships overseas for much longer than Visa. Mastercard’s more aggressive approach to making acquisitions and new investments has also give the company an edge against Visa as well. Mastercard’s management team has done a better job than Visa over the last five years of using acquisitions and investments to build out the company’s market share. Visa has only been more active in this region recently since 2015 when the company took control of their brand in Europe.

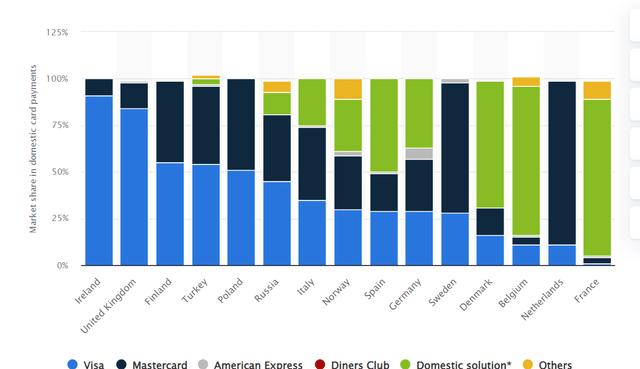

A chart of payment processor’s market share in Europe (statista)

Visa has 61% of the US credit card and debit card markets, but Mastercard has been more competitive with Visa internationally in regions such as Europe. Mastercard’s large four rail network also gives the company unique competitive advantages over most local competitors in emerging markets in regions such as Latin America, Central and Eastern Europe, and Southeast Asia.

Valuation

This is also why in my view Mastercard is undervalued. The company currently has a very strong balance sheet with operating cash flow of $11.33 billion and levered free cash flow $10.8 billion. Mastercard only has $15.57 billion in debt that the company could easily buy back, so management has a lot of flexibility to maximize shareholder returns. The company currently has a $9 billion dollar share buyback program that was recently initiated at the end of last year. Mastercard’s strong balance sheet and recent share buybacks should mean the company will likely continue to reduce the share float by 1-2% per year.

A company with a double-digit growth rate in a noncompetitive industry that has the flexibility to buy back a significant amount of the float without taking on debt should trade at more than 30x likely forward earnings. Mastercard’s business model is also not as cyclical as many financial companies, since consumers spending even during periods of recent economic weakness has still been fairly stable. The current multiple of 30.49x projected forward earnings looks cheap. Analysts are projecting the company to grow at 12-15% over the next five years, with earnings supposed to nearly double by 2028. Mastercard is also trading below the company’s average 5-year valuation of 37.74x project forward earnings, and the company’s dominant market control also means there is minimal risk to current analyst estimates in my opinion.

Risks

All investments have risks, and Mastercard may face greater regulations and scrutiny in the US because the dominant positions that the company and Visa have in this market. Mastercard’s best growth opportunities moving forward are also overseas, where the company is facing local companies that know the countries they operate in very well. Payment volumes also obviously decline during periods of economic weakness, so if there was a recession, as looks increasingly likely, Mastercard could see their business soften in the short-term.

Conclusion

Mastercard has been one of the best performing stocks in the market since the company went public nearly two decades ago. Even though the company’s growth rate has predictably moderated, Mastercard is still expected to continue to consistently grow earnings at a double-digit rate, and the company’s strong balance sheet should enable management to continue to aggressively buyback shares and pursue new acquisitions as well. While Mastercard is one of the more well-known companies worldwide, this company should also be well-positioned to be a strong growth stock for years to come as well.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.