Summary:

- Airbnb is likely to face growth headwinds going forward, and in the event of a recession, margins could fall substantially.

- Longer term, Airbnb has a strong competitive position and a number of growth levers it can still pull, but high double-digit growth rates are likely a thing of the past.

- Airbnb’s valuation is elevated given potential near-term problems, but absent a recession, it may not compress significantly further given the quality of the business.

igoriss

Airbnb (NASDAQ:ABNB) has been a large beneficiary of the macro environment over the past 18 months, but conditions are now becoming increasingly unfavorable. There is a reasonable probability of a recession over the next 12-18 months, which would impact travel spending, and there is likely a bubble in Airbnb supply that will deflate at some point. Airbnb’s business model should help to limit the impact of a recession, but investors need to be wary of overpaying for earnings that may prove illusory in the near term.

Airbnb

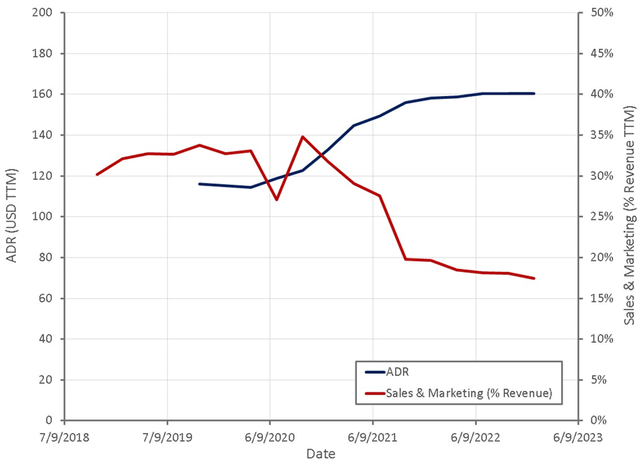

Prior to the pandemic, Airbnb was spending around 1 billion USD a year on marketing, the vast majority of which was performance marketing. A large portion of this has now been cut, without negatively impacting Airbnb’s business. This is not that surprising, as the majority of bookings come from past guests and 90% of Airbnb’s traffic comes direct. This really speaks to the strength of Airbnb’s business. Few organizations could cut sales and marketing expenses like this without negatively impacting revenue.

It is probably reasonable to question whether Airbnb’s marketing expenses will rise somewhat going forward, though. The company has benefitted from a strong demand environment in the wake of the pandemic, resulting in easy growth. While Airbnb still has many growth levers they can pull, maintaining double-digit growth will be harder going forward and may require a greater investment in marketing.

Figure 1: ADRs and Sales and Marketing Expenses (Source: Created by author using data from Airbnb)

Taking part in the current zeitgeist, Airbnb has also been extolling the virtues of AI for its business. Like many digital businesses, discovery is a crucial part of Airbnb’s offering, and this stands to benefit from the use of LLMs to summarize reviews. Airbnb could also potentially utilize AI for vector search or visual search, benefitting the long tail of their inventory. This will likely be important when Airbnb inevitably begins to offer services like sponsored listings and search advertising.

AI can also be used to assist with service delivery in areas like responding to customer queries. Developer productivity is another area where Airbnb could benefit from AI. Airbnb’s management believes that tools like GitHub’s Copilot could increase developer productivity by up to 30%.

Airbnb’s strong brand and ability to attract a large number of website / app visitors without requiring advertisers can also be leveraged to introduce a range of new services. Airbnb has already begun to offer a number of insurance products. For example, travel insurance was recently launched in eight countries, which has reportedly been successful. The ultimate success of this initiative could depend on where Airbnb sits in the buying journey. For travel involving flights, it seems likely that accommodation would sit downstream of organizing flights and insurance.

Airbnb also recently improved AirCover for Hosts by enhancing guest identity verification, expanding reservation screening, and increasing damage protection to 3 million USD. AirCover for Hosts provides personal liability coverage and protection against property damage.

Experiences are another potential growth area for Airbnb. These are short experiences hosted by locals that could help Airbnb expand beyond its core category. These types of initiatives are not new for Airbnb, but have been put on the back burner over the past few years as Airbnb has concentrated on profitability. Prior to the pandemic, Airbnb had 10 divisions, including Home, Experience, Transportation, and Magazine.

Airbnb Friendly Apartments was launched in November 2022. Renters interested in hosting can browse more than 175 apartment buildings in the US. Airbnb has been working with real estate developers like Greystar, and currently has buildings in Phoenix, Jacksonville, and Houston, amongst other cities. Management believe that this initiative could unlock a large amount of inventory in multifamily homes in urban areas. This is a potentially risky move though in what has been a tight rental market. Airbnb is probably a contributor to high property and rental prices, and moves like this could increase regulatory risk.

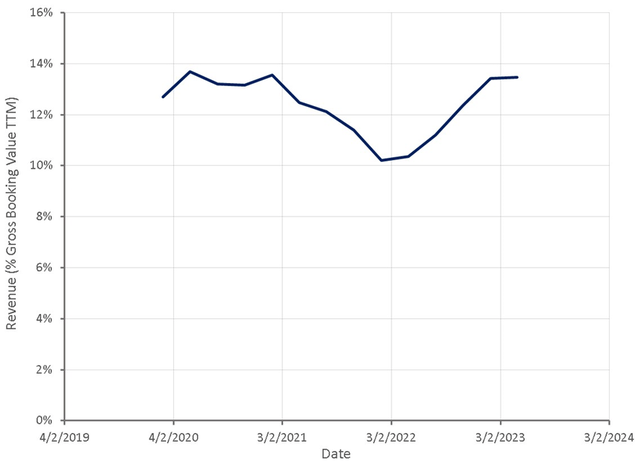

Airbnb could also increase its take rate given the lack of competition, although its ability to do this would likely be limited by the economics of hosting. Airbnb’s take rate appears to have stabilized near pre-pandemic levels, but this remains another growth lever the company could pull if it feels financial pressure.

Figure 2: Airbnb Revenue as a % Gross Booking Value (Source: Created by author using data from Airbnb)

There is also likely to be a long-term demographic tailwind as Airbnb’s user base skews younger, with 62% of guests under the age of 34. This is potentially going to be a headwind in the near term as student loan repayments are about to recommence in the US. This will directly impact discretionary spending amongst Airbnb’s core customers. While it is currently unclear how consumers will prioritize spending, student loan repayments will have a large impact and travel and entertainment are likely to suffer.

Airbnb is underpenetrated in many markets globally, and these markets are becoming a focus area. While this will help to drive growth, it is also likely to pressure margins in the near term, as expansion markets will generally have lower ADRs and require greater sales and marketing efforts.

Financial Analysis

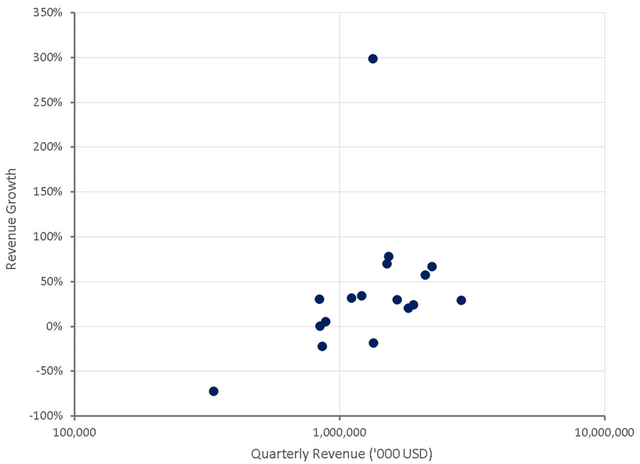

While Airbnb’s growth is still fairly robust, the company is no longer small, and maintaining double-digit growth is going to become increasingly difficult over the next five years. Airbnb still has a lot of options to increase revenue, but this is still likely to be at a lower rate than in the past. Growth in the second quarter is expected to be approximately 14%.

Figure 3: Airbnb Revenue Growth (Source: Created by author using data from Airbnb)

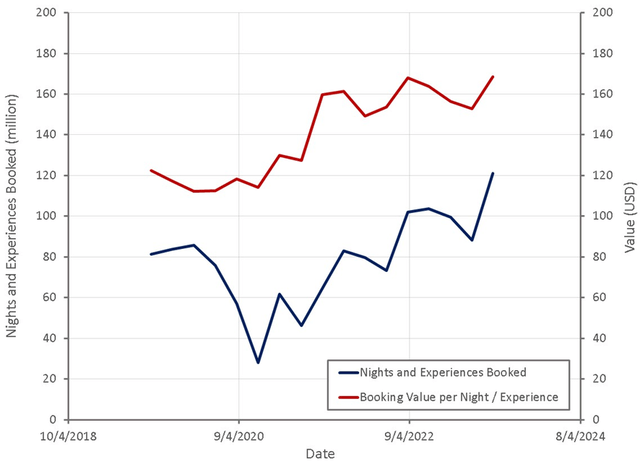

Recent growth has been driven by a combination and strong bookings and price growth. ADRs are significantly above pre-pandemic levels, but have begun to level off in recent quarters. Over the next 12 months, Airbnb expects ADRs to decline modestly, primarily as a result of a mix shift, as travel to urban areas and cross-border travel to lower ADR regions increases. High ADRs are likely supportive of higher gross profit margins, and if ADRs decline going forward, this could reduce profitability.

In addition to this, high prices in the US appear to have been a problem and Airbnb is introducing measures to counter this. Airbnb Rooms will provide inventory at a lower price point. Airbnb is also increasing transparency around fees, which will helps users to find inventory with lower total costs. The company is also providing hosts with a tool that provides greater insight into the pricing of similar inventory, which could increase price competition.

Figure 4: Airbnb Bookings (Source: Created by author using data from Airbnb)

Prior to the pandemic, Airbnb was a budget travel site and 80% of its business was either urban or cross-border. Airbnb also had limited upmarket penetration, and most bookings were short-stays. The pandemic caused a shift towards more premium inventory, and around a fifth of nights booked are currently longer stays. In recent periods, the business also skewed towards domestic and non-urban travel.

Guests are now increasingly returning to cities and travelling internationally, though. Cross-border nights booked increased 36% YoY in the first quarter of 2023 and high density urban nights grew 20%.

China outbound travel should provide a sizeable boost in 2023. Pre-COVID, China’s contribution to the business was in the low single-digit percentage range of gross booking value.

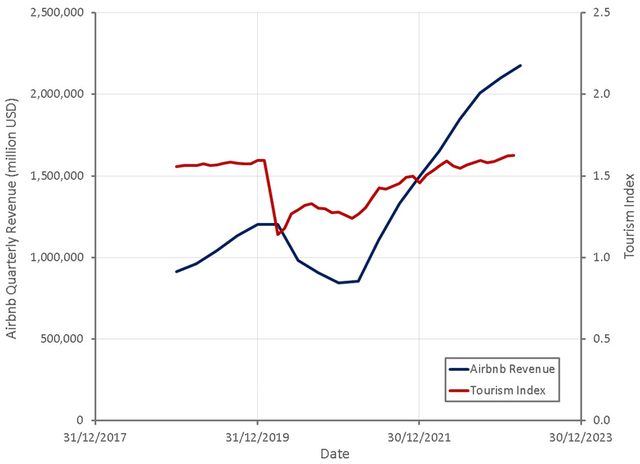

Airbnb’s recent strong growth has been driven in part by a normalization of travel and tourism. This process now appears to be largely complete, which could mean that Airbnb’s growth decelerates significantly over the course of 2023.

Figure 5: Airbnb Revenue (Source: Created by author using data from Airbnb)

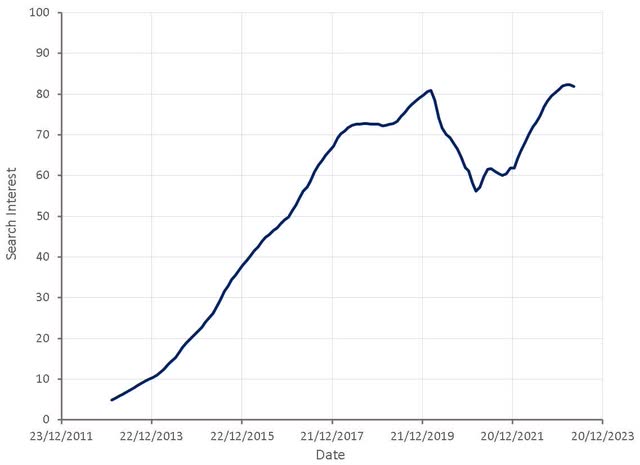

Search interest also indicates that the business has recovered from COVID, and growth is likely to be more difficult going forward.

Figure 6: “Airbnb” Search Interest (Source: Created by author using data from Google Trends)

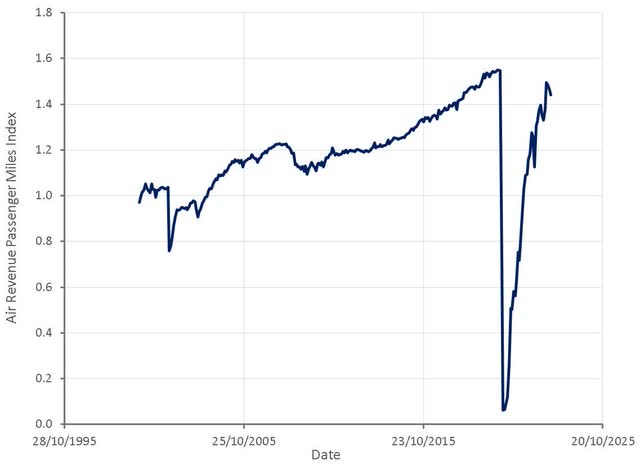

It should also be kept in mind that travel is sensitive to the macro environment, and Airbnb’s business is likely to suffer significantly in the event of a recession. Many areas of the economy have already been slowing, but travel has been isolated from this as it has still been recovering from the pandemic. If consumers remain pressured and job losses mount, this could add to a growth deceleration.

Figure 7: Air Passenger Revenue Miles Index (Source: Created by author using data from The Federal Reserve)

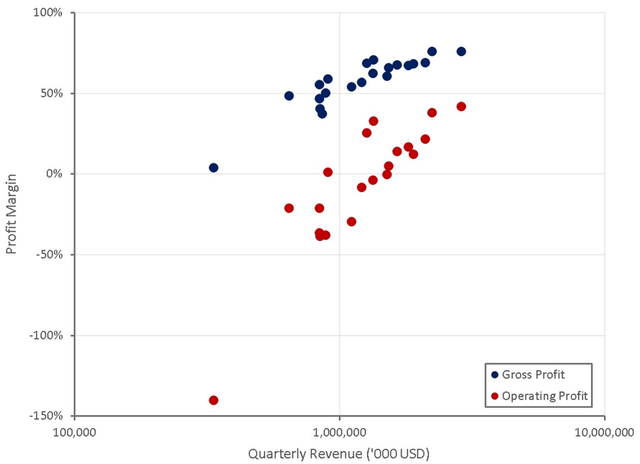

Over the past few years, Airbnb has demonstrated that there is a large amount of leverage inherent in its business model. This has worked in the company’s favor as bookings and ADRs have increased, but could result in margin compression in the event of a downturn. This would be exacerbated by increased marketing costs in a more normal demand environment.

Figure 8: Airbnb Profit Margins (Source: Created by author using data from Airbnb)

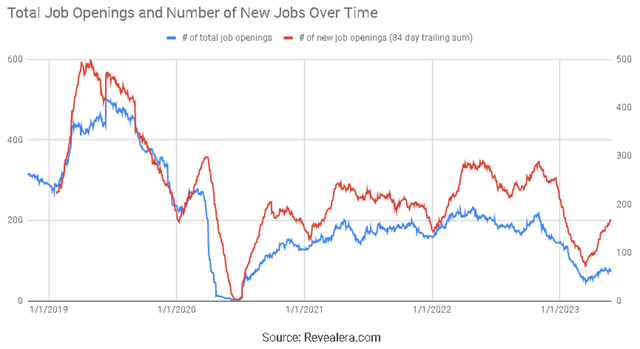

Airbnb job openings could suggest that the business has slowed in 2023, although hiring has recovered somewhat in recent months. There also appears to be a seasonal aspect to this, though.

Figure 9: Airbnb Job Openings (Source: Revealera.com)

Valuation

Airbnb repurchased 2 billion USD worth of shares over the past nine months. This probably has little to do with valuation, and is more to do with offsetting SBC dilution and a desire to distribute free cash flows to shareholders.

Airbnb’s stock isn’t overly expensive if growth and margins can be maintained going forward. Absent a recession, it is not clear how much further Airbnb’s valuation will compress, given the quality of the business.

Exhaustion of excess savings, the resumption of student loan repayments and a potential increase in unemployment present a risk to travel in the near term, though. Declining ADRs and a greater need for marketing investments could also cause a near-term drag on margins.

Figure 10: Airbnb PE Ratio (Source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.