Summary:

- Alphabet Inc./Google’s I/O 2024 event showcased key features and technological updates, although it still moderately lagged OpenAI’s innovation.

- The company’s core strengths, including its wide network of products and user base, give it an advantage despite not being as innovative as OpenAI.

- Google’s I/O event has set a formative base for the company to see its valuation multiples expand, making it a buy.

- From here on, my models suggest at least 16% upside for Google stock from current levels.

lerbank/iStock via Getty Images

Investment Thesis

Alphabet Inc. aka Google (NASDAQ:GOOG, GOOGL) just wrapped up its annual I/O 2024 developer conference, announcing key features and technological updates. The full presentation can be watched here, whereas the company also has a brief summary of its presentation in under 10 minutes.

Expectations were high for Google to deliver a clear plan that demonstrated its innovation roadmap in AI with enough ramp to monetize its AI products and features. The stakes were even higher as OpenAI, an increasingly relevant peer to Google’s innovation prowess held its own presentation, this week, on their new GPT-4o models and pricing plans.

After watching both presentations, I believe Google still lagged its pace of innovation that OpenAI was able to demonstrate via its GPT-4o model.

But, at the same time, I believe Google still has the advantage of its wide network of products, devices, apps, solutions, user base, and user data, which is still quite advantageous to the search giant. The innovations, which I will recap below, may not be as innovative as OpenAI, but I believe they were done keeping Google’s deep distribution network in mind.

Keeping in mind Google’s core strengths, I believe Google’s I/O 2024 event has created a formative base for the company to see its valuation multiples expand, and I believe Google is a Buy here.

Recapping key insights from Google’s I/O event

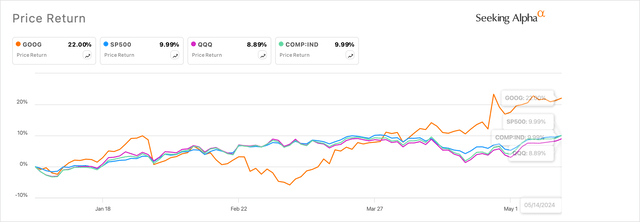

Heading into the I/O event, Google’s stock had begun outperforming the broader market and its peer group, as shown in Exhibit A below. To me, this looked like investors’ expectations were rising with the event.

Exhibit A: Google’s stock has woken up beating market indices and peer groups (SA)

The I/O event is meant to be a conference for developers to showcase all the latest Google technologies, software, and app plugins they can use to build their apps and products by harnessing Google’s technology and wide reach. By doing so, Google stands to benefit as well, since consumers on its network benefit from a wider availability of developer products that incrementally improve the quality of their experience across Google’s network. This is the main reason I believe Google holds the I/O event every year, and I believe Google did well this year.

I believe the following four takeaways should have immediately started impacting Google in some way:

First, let me start with Google’s core search product. Google announced that it has redesigned its Search product, which now includes AI Overviews. I noticed how Google, via AI Overviews, produces highly action-oriented summarized results that keep the user engaged and active on Google Search or the Google App. At the same time, the company also mentioned that it will produce search links to web pages if users want to dive further. I believe this increases the scope for advertisers to buy ad inventory via AI Overviews, possibly even paying more per ad impression to be highlighted in AI Overviews.

This also ties into the comments management made on a previous earnings call:

We’re continuing to experiment with new ad formats on SGE. It’s extremely important to us that, in this new experience, advertisers still have the opportunity to reach potential customers along their Search journeys.

Second, Google demonstrated how it is deepening the reach of its LLM models across its network. Some of those demos that I can highlight include a demonstration of Google’s Gemini LLM searching through emails, providing a summary, crafting email replies, or Google’s Ask Photos feature, which can now help search for old photos of someone’s driving license, ID cards, etc.

Third, I was pleased to see Google’s AI research arm, DeepMind, spend more time on stage detailing and expanding on all the work they were doing on Google’s AI ambitions. In addition to their Gemini Pro model launched last month, Google also launched Veo, a generative video model. But what has me more interested is Google’s launch of lightweight models, such as the Gemini 1.5 Flash and the updated Gemma 2 model. Flash looks to be designed for environments that require “high-frequency and narrow tasks” but “complex and general” in the “fastest response time.” To me, this looked like Flash and Gemma2 could be easily used in price-sensitive markets that are low-latency yet low-cost-to-serve-think emerging markets such as India, Brazil, etc.

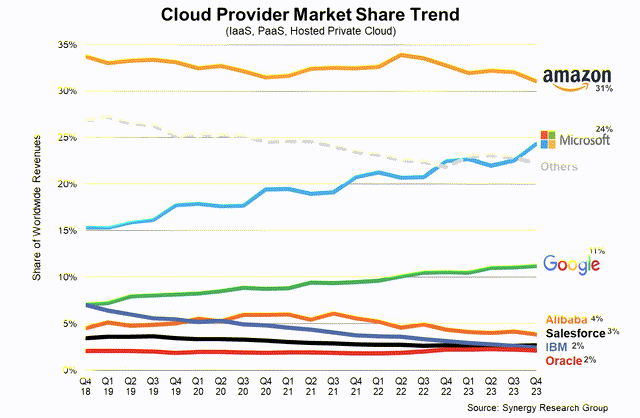

Finally, for the enterprise, Google also launched the availability of its AI-focused data center chip, Trillium. I suspect that Google threw its hat into the ring to help enterprises wean off their dependence on NVIDIA Corporation (NVDA). While encouraging, I don’t see how much of an immediate impact this can have on Google’s GCP segment. Nvidia is still the market leader, holding ~80% of the datacenter chip market, per Reuters. I still added this solely because Google may play some role as it claws back more market share from some of its hyperscale peers, as seen in Exhibit B below.

Exhibit B: Google, Microsoft are winning some market share from some of its peers (Synergy Research Group)

The metrics that matter for Google’s growth from here on

In my view, I believe there are two major factors that will impact every technology company in the post-pandemic era: interest rates and AI. Despite these headwinds/tailwinds, Google must demonstrate its ability to innovate and grow at the same time, the former of which I believe it has demonstrated in its I/O. I believe this should positively impact its growth rates in the near term.

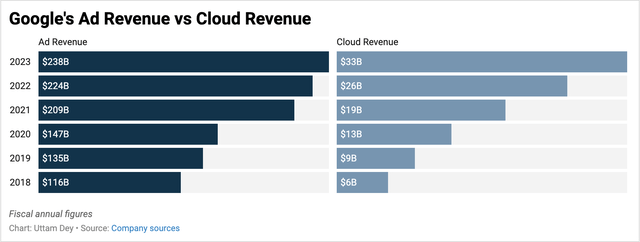

As seen in Exhibit C below, Google’s ad revenue has grown at a compounded growth rate of 12% since 2019. This includes tailwinds from the pandemic and headwinds from 2022’s interest rates. Between 2010 and 2020, Google’s ad revenue grew ~15% CAGR. Separate research points to double-digit growth in digital ads this year.

Exhibit C: Google’s Ad Revenue growth vs Cloud revenue growth (Company sources)

Compared to that, Google’s cloud revenue segment has posted strong 40% growth rates over the same time period since 2019. For the sake of reference, Google’s total revenue has grown in the mid-teens since 2019. As long as Google can maintain a pace of growth in similar ranges, it should be able to post at least double-digit growth over the next 3-4 years, in my view, and the current set of announcements should get Google there.

To get to that level, Google must continue spending and investing while balancing its investments and expenses in line with its revenue growth rates. One of the key metrics that I look at is Google’s capital expenditures vs. its levered free cash. From Exhibit D below, I see that while capex has been growing in the mid-single digits on a compounded basis, free cash has been growing in the high teens. In my view, Google has been meaningfully growing its capex to date, unlike Meta, which is raising its capex guidance. In fact, I believe Google still has room to expand capex, given its past revenue and free cash growth rates.

Exhibit D: Google’s capital expenses vs free cash (sa)

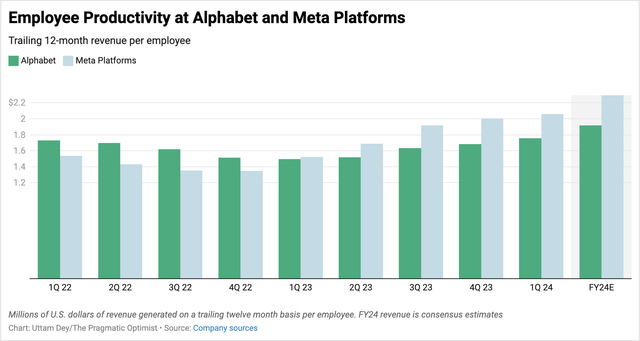

And finally, I believe that Google will continue to be harshly judged by the same standards that most Big Tech companies are looked at due to elevated employee hiring levels from previous years. Meta Platforms, Inc. (META) demonstrated its rapid turnaround in employee productivity through its Year of Efficiency, as can be seen in the revenue per employee metric improving in the Exhibit E below.

Exhibit E: Google vs Meta’s Revenue per Employee on a trailing twelve month basis (Company sources)

From the Exhibit E above, I note that Google has started to demonstrate progress with a combination of revenue growth and right-sizing their employee base, although not at the pace of Meta Platforms. Management still has some progress to make in this metric if it needs to catch up to its digital neighbor, Meta.

Google has an upside in the near term

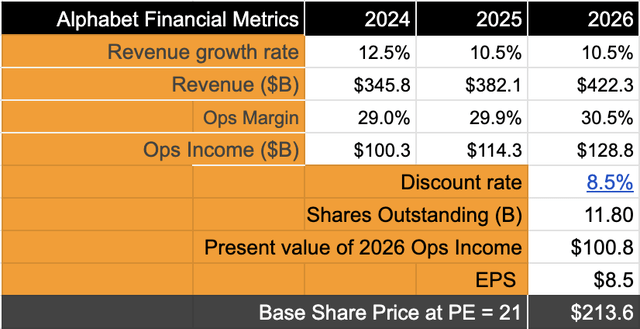

Per my assumptions and estimates stated in the earlier section, I will expect Google to grow revenue by ~11% between FY23 and FY26. Over the same investment horizon, I expect Google to expand its operating margin by an average of 60 BP each year to 30.5% margins, equaling its FY21 margin profile. I will apply a discount rate of ~8.5% based on assumptions here, plus assume a -2% share dilution rate in line with their previous dilution rates.

Exhibit F: Google vs Meta’s Revenue per Employee on a trailing twelve month basis (Author)

Per Exhibit F above, I note that while sales are expected to grow at 11% CAGR, operating income is expected to grow at 13.5% CAGR. This is higher than the long-term earnings growth rates posted by the S&P 500 (SP500). Given these growth rates, a forward P/E of 25 would be reasonable here, which implies at least a 16-17% upside from current levels.

Risks and other factors to look for

While comparing Google’s I/O to OpenAI’s ChatGPT demo, I did feel OpenAI outperformed Google’s Gemini on the multi-modality feature as well as other features. Personally, I believe OpenAI was able to demonstrate a wide range of use cases that ChatGPT could do versus Google. Google has been playing catchup in this area over the years, but as an investor, I believe Google still has many advantages in the near term. That being said, Google will need to keep up the pace of innovation; otherwise, its dominance may be threatened by OpenAI, as well as by its other peers such as Microsoft Corporation (MSFT), Amazon.com, Inc. (AMZN), Meta Platforms, etc.

One of the other immediate risks to the bullish thesis here is if Google’s LLM models corrupt the user experience with incorrect advice or false facts, which could be detrimental to Google’s image. The company has already recently apologized for its Gemini model incorrectly re-creating certain historical images. It faces credibility risk if the company’s model performs similar tasks down the road.

Google also talked about Project Astra, its multi-modal response to OpenAI’s GPT 4o’s multi-modal capabilities. While impressive, no specific release date was mentioned. A quicker launch of this service allows deeper integration of AR products with Project Astra.

Note: Microsoft has their own developer conference, Build 2024, next week, May 21, followed by Apple’s WWDC event on June 10th.

Takeaway

Based on the I/O event by Google, I believe the company has struck the right tone by launching its innovative products and setting itself on the right path to grow sustainably in double digits. The company has a huge advantage of its deep distribution network scattered across its products, apps, and users, and the slate of products released in the last few days attests to that vision of harnessing its wide network power and reach.

Based on my analysis, I recommend buying Google stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GOOG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.