Summary:

- Alphabet/Google’s stock price is near a record high but still has large potential for further growth.

- The company’s business unique model, combining mature segments and new frontiers (e.g., AI and cloud), provides a strong foundation for sustainable growth.

- The current P/E is still too low both in absolute and comparative terms.

yuriz

Google is near record price

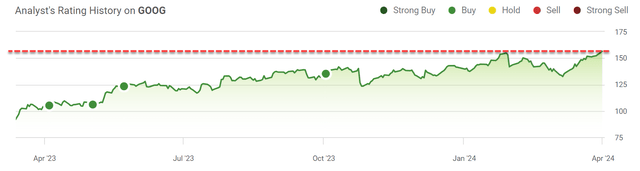

Readers following our writing know that we have been steadfast bulls for Alphabet Inc. aka Google (NASDAQ:GOOG, NASDAQ:GOOGL). As seen in the chart below, we have been arguing for a buy rating when the stock was still trading around the $100 level. Today, as the stock prices advance to all-time high levels, we began to receive questions if our thesis has changed.

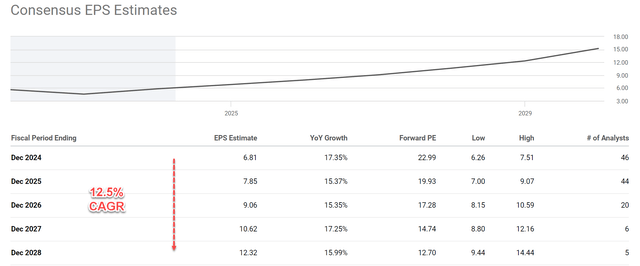

Against this background, the goal of this article is very straightforward: we will explain why our answer is a definitive no. We still do not think the stock’s return potential is fully priced in even at these price levels. The stock still trades at a very attractive valuation with an FY1 P/E of around 23x (more on this later). The chart below shows analyst estimates for Google’s future EPS growth and implied P/E ratios. As seen, the EPS is projected to grow to $12.32 in 5 years (i.e., for the fiscal year of 2028), representing a 12.5% CAGR. By that time, the implied P/E would only be 12.7x at today’s price.

Next, I will elaborate on the company’s growth catalysts and explain why I think the above projections are totally plausible.

Business model and growth catalysts

To me, there are a few key differentiation factors in GOOG’s business model, and they provide a wide moat for sustainable growth.

Firstly, GOOG features a well-balanced combination of mature segments and new frontiers that have explosive growth potential. The company is an internet powerhouse in my view with an incredible ecosystem consisting of some of the most popular services such as search engines, YouTube, Gmail, maps, Android, etc. These services have some of the largest user base globally and help Google improve search results by understanding user intent and behavior. They can offer highly targeted advertising across their platforms, making their ads more valuable to businesses.

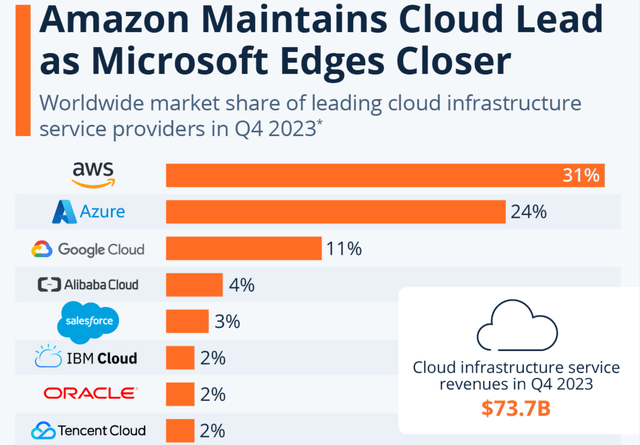

Secondly and probably more crucially, the data collected in its mature segment can help fuel the development of new products and services, creating a more comprehensive and competitive ecosystem. The top new services in my mind are its Cloud and AI services. As of Q4 2023, GOOG Cloud is one of the top 3 leading cloud infrastructure service providers (see the chart below), capturing a market share of 11%. Admittedly, it is still lagging behind the top 2 players (Amazon.com, Inc.’s (AMZN) AWS and Microsoft Corporation’s (MSFT) Azure) by a large margin. However, it has been growing at a rapid pace. In the last quarter of 2023 alone, Google Cloud generated more than $9.1 billion in revenue. It is also the quarter that the cloud segment began to report a positive income of $864 million (operating income), compared to an operating loss of $186 million a year ago.

More fundamentally, I see some unique advantages for GOOG by combining its vast amount of data and its cloud service. Such a combination could create deeper customer insights, improve search relevancy, and eventually enable GOOG to develop targeted cloud solutions and create customer lock-in potential.

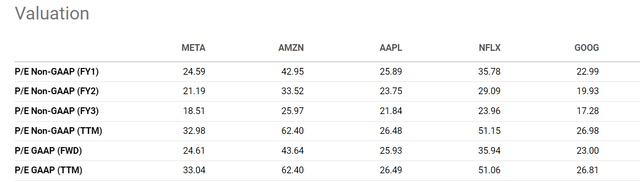

For AI, many investors have been concerned about the competition from other AI products and the threat it poses to GOOG’s bread-and-butter search business (e.g., from the Bing-ChatGPT combination) – rightfully so. However, my view is that the concern is overblown judging by the P/E gap between GOOG and MSFT (which trades at 36x FWD P/E vs GOOG’s 23x). Google’s search engine market share remained essentially the same since the launch of ChatGPT.

Moreover, my observation is that Google’s search engine is still the trusted/preferred method for obtaining information, while many of us have developed an increasingly stronger sense of skepticism toward the answers provided by chatbots. Finally, GOOG itself is a strong competitor in the AI space too. It has been investing in the areas since at least a decade ago and built two of the leading AI centers in the world (i.e., Google Brain and DeepMind).

And here again, I see many potential synergies between GOOG’s existing services and the AI future, such as the potential of understanding complex search queries, predictive searches, fact-checking, credibility assessment, et al. These opportunities could allow Google to offer a more sophisticated and user-friendly search experience, potentially leading to increased user engagement and loyalty.

That said, large language models, or LLMs, and other forms of Generative AI have grown in popularity and usage over the course of 2023 because they are already useful for some tasks and becoming useful for more tasks with each passing day. We can see how they could evolve to become a very significant way for people to interact with their personal devices and with the Internet.

Google’s return projections

Despite the wide moat and a near-record price, Google is still trading at a very reasonable valuation in my view, either in absolute or relative terms. In absolute terms, it trades at ~23x FWD P/E as mentioned earlier, nothing too outlandish for a high-quality business. In relative terms, an FWD P/E of ~23x is the lowest among the FAAGN group as seen in the next chart below.

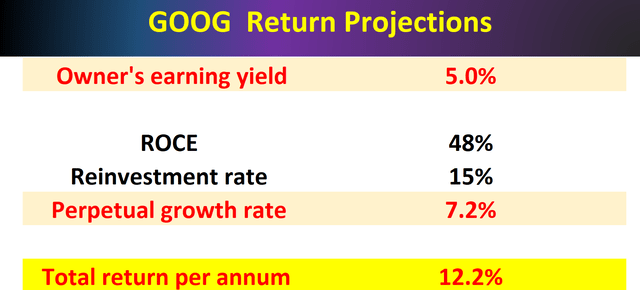

I think the combination of growth potential and valuation makes a compelling case here. If you recall earlier, the consensus projects a growth rate of 12.5% CAGR in the next 5 years. Again, I think GOOG has good odds to materialize such growth. I have a more conservative estimate (shown below), but even this estimate is sufficient for general market-beating total returns in the double-digits range. My estimate is about 12% per annum as seen below, driven by about 7% of organic growth and about 5% of the owner’s earning yield.

To wit, I projected its growth rate based on its average ROCE (return on capital employed, which turns out to be about ~48%) and its reinvestment rate (~15%) in recent years. As such, my estimate of its sustainable long-term growth rate is about 7.2% (48%*15%). As for the owner’s earning yield, the analysis was detailed in my earlier article. The end result is that:

For GOOG, its accounting EPS systematically underestimates its true economic earnings power by 10% to 15%. Thus, in terms of owners’ earnings, its P/E is around 20x and thus generates an owner’s earning yield of more than 5%.

Author based on Seeking Alpha data

Risks and final thoughts

I’ve been focusing on the positives so far. There are a few negatives, too. Competition is fierce, and GOOG needs to constantly adjust its priorities and commit substantial CAPEX to stay ahead. For example, earlier this year, GOOG announced layoffs across the company’s hardware, voice assistant, and engineering teams. The goal was to control costs and shift companies’ focus on investments in growth opportunities such as AI. It has also committed ~$1.0 billion in investment in the United Kingdom toward a data center. I view it more as a response to an arms race, as Microsoft has recently announced plans to invest approximately $3.2 billion in the United Kingdom to support its AI growth strategy.

Also, the company is constantly fighting legal battles, and I don’t see the lawsuits going away. A recent example involves a $5 billion settlement a few months ago. The lawsuit involves consumer privacy violations (again), and there are other lawsuits ongoing too.

All told, I am still seeing a very asymmetric return/risk profile here. Despite a strong run-up in GOOG’s stock price, I see several factors that make it a compelling buy candidate. To reiterate, the top factors in my mind include the company’s very reasonable P/E ratio (especially relative to its growth potential) and the unique combination of its mature segments and new frontiers (such as AI and cloud services).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.