Visa: Strategic Acquisitions, Multiple Growth Drivers Make This A Buy

Summary:

- Visa is a solid buy and hold stock, despite trading at the upper end of its 52 week range and a high forward P/E multiple.

- Visa has a strong dividend history, backed by rapid free cash flow growth and share buybacks.

- Visa is well-positioned for future growth in the global digital payment market, with a dominant market share in the US.

Justin Sullivan

Warren Buffett once stated-

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”

As I continue to research and analyze stocks, the above quote is something I’ve constantly been reminding myself of. Considering this quote, there is one company that immediately comes to mind, and that is Visa (NYSE:V).

Visa is a company that is trading on the upper end of its 52 week range, is up over 22% in the past year, and trades at the high forward P/E multiple of 28.16. Despite all of this, I believe this could still be a solid buy and hold for the long term investor.

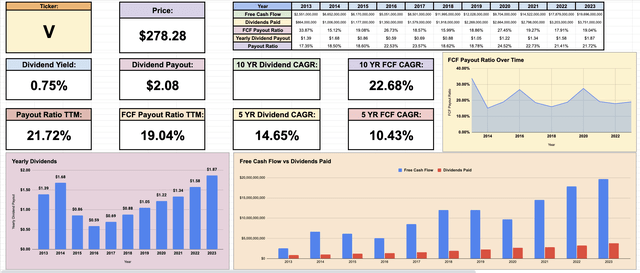

Dividend Metrics

Although Visa has a low starting yield of just 0.75%, it remains one of my favorite stocks from a dividend perspective for a multitude of reasons. Visa has a great history of increasing their dividend payments for 15 consecutive years (when adjusted for the stock split in 2015). Visa has a nice low free cash flow payout ratio, and that ratio has stayed in a healthy range of about 15% to 30% over the past decade.

Visa Dividend Metrics (Tickerdata.com)

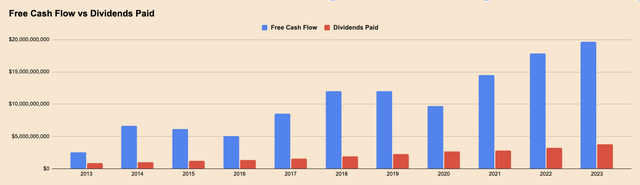

But here’s the real beauty behind Visa’s dividend growth. It is completely backed by their phenomenal free cash flow growth over the past decade. From 2013 to 2023, Visa had a free cash flow CAGR of 22.68%! This has allowed them to have a 10 year dividend CAGR of 18%.

When we look at the free cash flow vs dividends paid chart, we can see a clear visual of Visa’s free cash flow growing rapidly, while easily covering their growing dividend payments. As a dividend growth investor, this is exactly what I want to see from my investments.

Visa Free cash flow and dividends (Tickerdata.com)

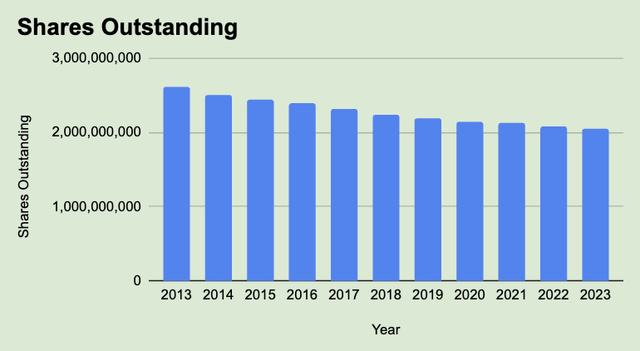

In October of 2023, Visa not only announced a 15.6% increase to their annual dividend payments, but also announced a $25 billion share repurchase program. From 2013 to 2023, shares outstanding went from 2.61 billion to 2.04 billion, which was a decrease in shares outstanding of nearly 22%! So not only is a rapidly growing dividend part of this company’s capital allocation plan, but so are massive share buybacks.

Visa Shares outstanding (Tickerdata.com)

Growth Runway

Over the last 10 years, Visa’s revenue has gone from $14.5 billion to $32.6 billion. So the question we need to answer-

Is this level of growth still possible for Visa over the next decade?

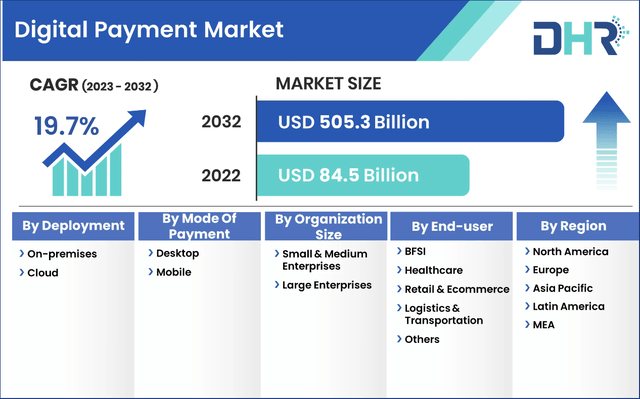

Visa is set to be the largest beneficiary of the rapidly growing global digital payment market. According to DataHorizzon Research-

The digital payment market size was valued at 84.5 Billion in 2022 and is expected to arrive at a market size of 505.3 Billion by 2032 with a CAGR of 19.7%.

Visa digital payment market (DataHorizzon Research)

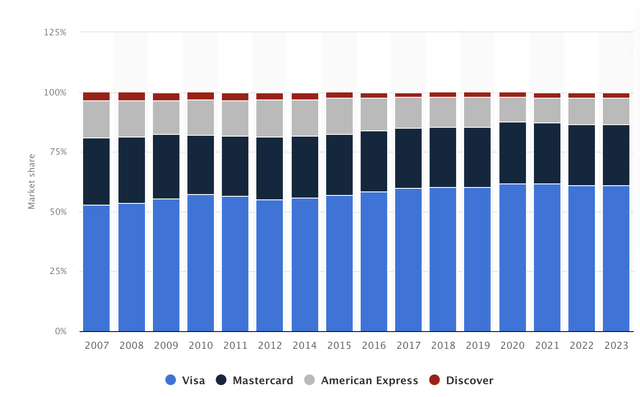

One of the main reasons Visa is set to take advantage of this growth, is because they have 61% of the market share in the United States based on the value of transactions. They’ve done an incredible job of maintaining their market share over the past 15 years, and have even slightly increased their market share during this time period.

Visa market share over the past decade (Statista.com)

Other key statistics we should consider, according to the federal reserve–

82% of American adults had a credit card in 2022, according to the Federal Reserve.

There were more Visa credit cards in circulation than any other type of credit card in 2022.

Credit card spending grew 19.5% from 2021 to 2022.

Credit cards accounted for $5.6 trillion (53%) while the purchase volume from debit and prepaid cards was $4.9 trillion (47%) in 2022.

Visa also announced last year that they would be acquiring Pismo for $1B in cash. Pismo operates as a financial technology infrastructure platform. It allows customers to launch products for cards and payments, digital banking, digital wallets, and marketplaces. Visa also announced they would be buying a majority stake in Prosa, which is a payments processor in Mexico.

So Visa’s growth not only comes from organic growth in their market, but also from the key strategic acquisitions the company is actively pursuing to ensure growth and increased market share.

Valuation

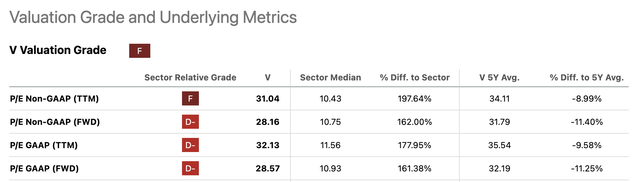

Visa is currently trading at a 28.16 forward price to earnings, much higher than the forward price to earnings of 20.96. But the reality is that this company always trades at a premium. Their 5 year average forward P/E Non-GAAP is sitting at 31.79. Taking this into consideration, it actually appears this company is trading at a lower valuation than it typically trades at.

Visa P/E Ratios (Seeking Alpha)

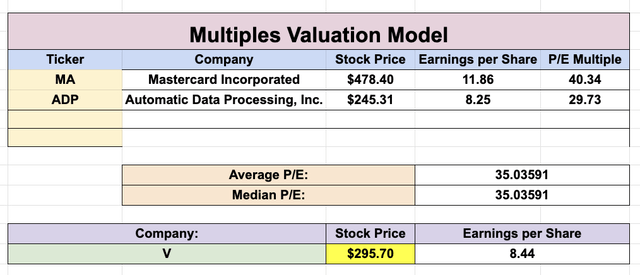

If we run Visa through a multiples valuation, we can see that the average P/E ratio for their peers is currently sitting at 35.03. Assuming this same valuation multiple for Visa, we come to an intrinsic value of $295.70.

Multiples Valuation (Tickerdata.com)

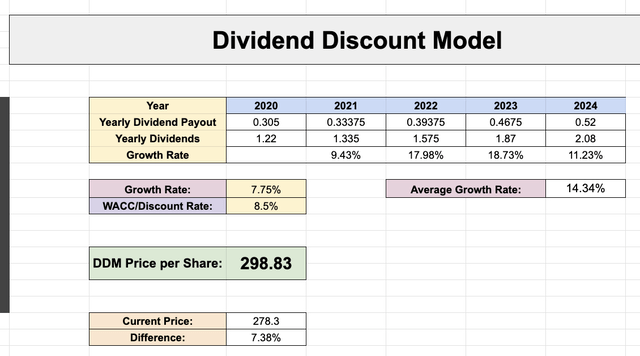

Utilizing the dividend discount model, we see that we come to a similar result. In this model, I’m assuming 7.75% dividend growth, as well as an 8.5% discount rate. This leads to a dividend discount model valuation of $298.83.

Dividend Discount Model (Tickerdata.com)

So while Visa is up 21.52% over the past year and trades at a multiple far higher than that of the S&P 500, one can still make the argument that Visa is close to fair value and potentially even undervalued. In my opinion, it makes complete sense that this company would trade at a premium due to the quality of the business, its market share, and the growth it is projected to have over the next decade.

Risks

The best place to analyze the risks of any business is a form 10-k, and after carefully reviewing this document, I believe the main risks of owning this company in your portfolio are the following:

- Visa is a global payments technology company, meaning they are subject to complex regulations that change often from governments across the world that govern their operations

- Government-imposed obligations and/or restrictions on international payment systems may prevent Visa from being able to compete in some countries, mainly in India and China

- Laws and regulations regarding the handling of personal data may make operations more expensive for Visa

- Visa is subject to intense competition in their space with new competitors constantly entering the game

While these are real risks that we need to take into consideration when examining Visa, these risks do not deter me from remaining bullish on the company.

Conclusion

To quote Warren Buffett again-

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

This appears to be the case for Visa. Despite the company’s high price to earnings, they have a clear path moving forward to sustain the same levels of growth they have seen over the past decade, they have a rapidly growing dividend payment, they are buying back shares, they are making strategic acquisitions, and are currently in control of the market share in their industry.

While no one knows how the price of this stock will move over the next year, I know I can feel completely confident if the market shut down and I had to hold this stock for the next 10 years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.