Summary:

- AT&T has been viewed as a “show me” stock, with investors waiting for results before buying in.

- I see good odds for it to get over this hurdle soon.

- I see good catalysts for it to reach the 2024 FCF promise of $17 billion-$18 billion.

- Reaching this goal could allow it to be viewed as a successful turnaround story, resume its dividend growth, and drastically change market sentiment.

Auris

A “show me” stock

AT&T Inc. (NYSE:T) has largely become a “show me” stock recently, in my view. That is, I think investors are saying “show me” the results before they’re convinced to buy in. Of course, there are good reasons. It’s difficult to argue against the attractiveness of the company’s stock price (a sector leader trading at 7.9x FWD P/E). However, there are indeed many uncertainties about the company’s future performance. I cannot blame anyone for deciding to wait and see if the company can deliver on its promises or potential before investing.

Against this background, the thesis of this article is to explain why I think that T can deliver a key promise soon and overcome the “show me” hurdle. The key promise involves its free cash flow goal of $17 billion-$18 billion for 2024.

In the remainder of this article, I will further detail why I think T is very likely to achieve this goal and why achieving it might be the inflection point for the market sentiment.

2024 FCF goal

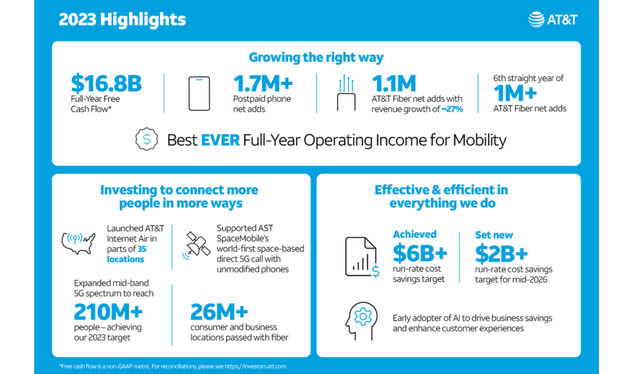

To provide a broader context, the company did a good job of surpassing its free cash flow guidance last year, generating $16.8 billion in free cash. It’s about $800 million more than its original guidance and about $300 more than its late-year increased guidance. For 2024, management is calling for $17 billion-$18 billion in free cash flow. I see good catalysts, both on the revenue front and expense front, for T achieving its FCF target.

On the revenue front, the top drivers on my list are the 5G and fiber expansion, the continued growth of its wireless customer base, and the growth in its Mexico operations. Continued growth in 5G and fiber optic Internet subscriptions can significantly boost revenue and T has been very successful on this front. As seen in the chart below, it has reported a 1.1M net add in 2023 and a revenue growth of 27%. This also marks 2023 the sixth straight year of net adds exceeding 1M. As our life and work style depends more and more on digital assets (social media, video conferencing, AI, etc.) I anticipate the demand for high-bandwidth data to enjoy secular growth.

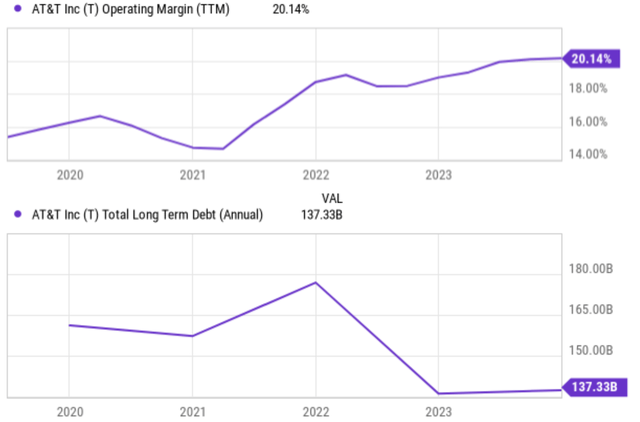

To add further potency to the topline growth, T also has been enjoying margin expansion and debt reduction. The chart below shows T’s operating margin compared to its historical average (top panel) and its debt level (bottom panel). As seen, AT&T’s operating margin currently sits at 20.14%, which is the highest level in at least five years. In the meantime, its total long-term debt has been reduced by a good amount, from a peak level of almost $180B to the current level of $137B. Such a sizable reduction will free up a significant amount of cash flow currently used for interest payments.

Why achieving the FCF goal is a big deal

Now, let’s see why achieving this goal could be an inflection point for T to reverse its multi-year downtrend. I see at least two reasons. The first reason involves market perception and investor psychology. As mentioned at the beginning of this article, I view T as a “show me” stock in recent years. Surpassing the FCF target two years in a row could change the market’s perception of AT&T from a declining company to one with a successful turnaround story. This positive shift in sentiment, if it materializes, can attract new investors and drive up its stock prices tremendously.

Second, achieving this target also would open the possibility for T to resume its dividend growth. T has been one of the most iconic dividend stocks and its dividends play a large role among its investors. As such, market sentiment is quite sensitive to its dividend payouts. As a reflection of such sensitivity (in the negative direction though), it has had to reduce and freeze its dividend payouts in recent years (due to the WarnerMedia spinoff, high debt, and profitability pressure). Shares have remained in a downward trend in tandem. If the FCF expands to the $17 to $18B range, I see excellent coverage that could allow it to resume the payout increase. If this happens, it can send a strong signal of confidence and change market sentiment.

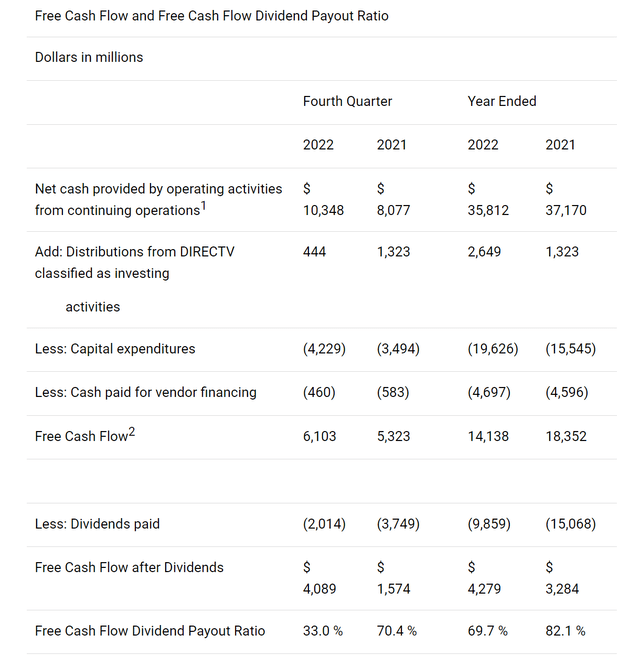

After this big picture, now let’s look at the specific numbers. At its current quarter payout of $0.2775 per share and share counts, its 2024 dividend obligations should be around $8.13B. Thus, a $18B FCF would imply an FCF payout ratio of 45%, a very safe range that has room for increases. A payout ratio of 45% is even stronger when compared to its recent track record (see the next chart below). According to T’s 2022 earnings release, its FCF payout was 69.7% for 2022 and 82.1% for 2021.

Other risks and final thoughts

My above analysis is largely near-term oriented, focusing on the catalysts for 2024. Expanding the horizon a bit, I also feel positive about many of AT&T’s differentiation factors in the telecom industry for long-term growth. As a sector leader, AT&T boasts a vast national wireless and fiber optic network, reaching a large customer base. Such a reach can be leveraged in many ways, for example, by offering bundled services. AT&T has been successfully offering such bundled packages that combine wireless, Internet, and TV services. This convenience can attract customers who prefer a one-stop shop for their telecom needs. Also, thanks to its scale and reach, AT&T has strategic partnerships with content providers, such as HBO Max, which can enhance their service offerings and attract customers.

On the negative side, T faces all the risks common to its telecommunication peers, such as price competition, technological disruption (i.e., from new technologies like satellite Internet), regulation, etc. However, T faces a few risks that are more particular to itself but not to other telecommunication stocks. The top one is its high debt burden, in my view. Despite the sizable debt reduction mentioned above, AT&T still has a significant amount of debt compared to some of its peers such as Verizon Communications Inc. (VZ). Also, as a sector leader with a long history, T still maintains some of its legacy businesses, such as wireline services. These services are experiencing a decline in demand. This can weigh down on overall growth prospects and the extent and timeframe for such a decline is unclear to me at this point.

All told, my overall conclusion is that AT&T presents a compelling opportunity under current conditions. The potential rewards outweigh the risks. Especially in the near future (say the next ~1 year), I see good odds for the stock price to reach an inflection point and overcome a multi-year downtrend. I think T can deliver its FCF promise of $17 billion-$18 billion for 2024. If this materializes, it could drastically change market sentiment. The stock could resume its dividend growth, overcome the “show me” hurdle, and regain investors’ confidence, thus triggering large price advances.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.