Summary:

- Federal judge rules Google has an illegal monopoly in search and text advertising primarily due to payments to Apple.

- Alphabet plans to appeal the ruling even before the remedies stage.

- Potential scenarios for Google include prohibiting pay-for-default arrangements, breaking up Android, or facing a big fine.

- All of which raise the risk and uncertainty, but don’t hurt the long-term thesis.

NickS

Last Monday, Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) (NEOE:GOOG:CA) was deemed an illegal monopoly in the search and text advertising markets. Specifically, the ruling holds that Alphabet’s annual payments to Apple, estimated at $20 billion, effectively disable competition.

Alphabet said it will appeal the ruling, which does not include remedies at this stage.

Let’s shed some light on the decision and discuss its potential implications for Google.

Introduction

I’ve been covering Alphabet on Seeking Alpha since March of last year, maintaining a ‘Buy’ rating all throughout the period. In a series of five articles, my main theme was, and still is, that Google does have efficiency problems, but its valuation is too attractive to ignore considering its wide moat and portfolio of extraordinary assets in YouTube, Android, GCP, and more.

Antitrust Judge Rules Against Google

Let’s try to make it short and simple. Google has a 91% market share in search. The two primary ways to use Google are either on a PC or on a handset (tablet or smartphone).

In some cases, Google controls the operating system of the device and sets itself as the default search engine (mainly Android devices). In others, Google is achieving the default position naturally, either because of users using its Chrome browser, or because of users setting it as the default actively.

However, in the most popular and most relevant case, Google is paying to become the default search engine. Google spent nearly $51 billion on such arrangements in 2023, classified under Traffic Acquisition Costs. The primary beneficiary of those payments is Apple, which reportedly receives approximately $20 billion annually from Google.

According to the Judge’s ruling, arrangements like the one Google has with Apple help the company maintain its dominance in the search market through anticompetitive illegal behavior.

That is the bottom line. We still don’t know if this means a large fine, an injunction that blocks such arrangements for Google going forward, or something even more extensive like forcing Google to break up parts of its business.

Google plans to appeal this ruling even before the remedies stage, which means we’re still far from knowing the ruling’s de facto outcome. That said, I think there are three primary scenarios investors should consider.

Base Case Scenario: Google Can No Longer Pay To Be Default

I think that the most likely remedy here is disallowing Google from paying hefty sums to become the default search engine. In some ways, this actually makes legal sense.

No company in the world comes close to Google Search in terms of monetization. This segment generates over $175 billion in high-margin net sales for Google, which means for each dollar Google spends on TAC, it generates a little over 3.5x that. Competitors can’t come close to that, which creates what the judge defines as a ‘Negative Loop’.

Google gets more users, more capabilities, more data, and better monetization. In turn, it can pay even more for the default status.

So, let’s assume Google can no longer pay TAC, or at least not to Apple.

In that scenario, Google will “automatically” keep ~$20 billion in its pocket, but the question is how much it will end up losing.

It’s important to understand that TAC is not an arbitrary payment. It’s actually a revenue share between the search engine and the device. That is why Apple denied Microsoft Corporation’s (MSFT) Bing, even if Microsoft was willing to give up more in a deal.

Alphabet is making so much money with Google Search, that a small share of that pie, in terms of percentage, is worth much more than a bigger share in any other pie.

The most likely and simple outcome here is that Apple enables some kind of choice for users, whereby Google is not the default, but rather a choice. Both parties will still have a revenue share agreement, but it should be slightly less favorable as the decision to make Google the default engine will no longer be made by Apple.

Some people argue that Apple will try to develop its own search engine, and/or make a similar arrangement with a competitor like Bing. I think those people severely underestimate the amazing economics Apple gets from the revenue share arrangement, in addition to the fact it saves the company a lot of time, effort, resources, and brand image, as it doesn’t have to deal with the rising competition from AI, and doesn’t really have to deal with content moderation.

In my view, the base case scenario will have a marginal effect on the long-term investment thesis in Google.

Bear Case Scenario: Google Can No Longer Tie Its Search Engine, Nor Pay For Default Status

While Google does spend a lot on TAC, owning Android arguably saves the company even more. According to estimates, iPhones represent approximately 28% of smartphones worldwide, while Android holds around a 71% share.

Just imagine what it would cost to be the default on Androids.

Luckily for Google, it owns Android and is therefore able to get the default position for essentially free.

Probably the worst outcome for Google would be if its relationship with Android is deemed illegal.

It’s important to note that it’s somewhat similar to the old Microsoft antitrust case. In that case, Microsoft bundled its Internet Explorer browser into its Windows operating system, while allegedly hurting competitors’ alternative offerings.

I’m not sure how hard Google is making it for Android users to switch from Chrome or from its search engine, if at all. I think that’s the biggest risk here, although it seems highly unlikely.

Bull Case Scenario: Big Juicy Fine

Regulatory interference in contracts or companies’ structure isn’t that common. After all, many times in the ruling, the court essentially admits Google is the best search engine for users.

As it stands today, I think that if all Apple users had to make a one-time decision to pick their default search engine, Google would most likely maintain its market share, being that the average person never even heard of Google alternatives like DuckDuckGo.

Therefore, I think that the big and juicy fine route, which has become a business-as-usual event for big tech, does have some probability.

However, I am no legal expert, but the legal problem that arises from the ruling isn’t one that can truly be remedied by a fine.

In most cases, big tech changes its illegal behavior and then pays a fine. In this case, just being a one-time fine and continuing with the same model seems somewhat off the mark.

Valuation & Investment Thesis Update

Google still has one of the strongest portfolios of businesses in the world.

Search, despite constant worries of disruption, grew nearly 14% last quarter. YouTube is becoming arguably the most valuable media platform in the world, with ad revenue growth of 13% in Q2’24, and well over 100 paying million subscribers. Google Network is declining, as open web advertising is becoming increasingly less attractive, yet it remains a decent high-margin business, and it’s never been core to the thesis.

Subscriptions, platforms, and devices are growing rapidly, and the Pixel phone is set to benefit from Google’s significant leadership in AI.

Lastly, Google Cloud had another quarter of acceleration and meaningful margin expansion. There’s still significant room for margins to expand here, with 11.3% operating margins in the quarter, compared to Amazon’s AWS and Microsoft’s Intelligent Cloud, which are significantly higher.

I never discussed Other Bets as a primary value contributor, but it should be noted Alphabet’s Wayo is making big strides, and there are several other potential large businesses under that umbrella, primarily in healthcare.

In addition, the company’s capital allocation is improving, with the initiation of a dividend as well as accelerated buybacks. And, hopefully, the new CFO will provide value and deliver on investors’ expectations.

The bottom line, this is a wide moat double-digit growth story for years to come. At a reasonable price:

Conclusion

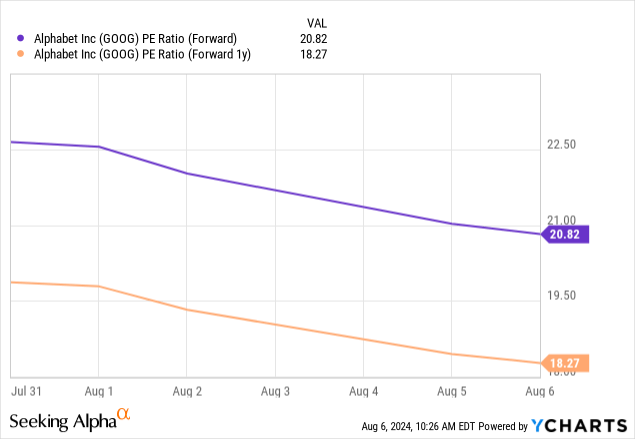

At 21 times forward earnings and 18 times 2025 earnings, Alphabet is trading significantly below historical levels, and below the market average.

I can’t say there isn’t uncertainty surrounding the stock at the moment. In fact, it’s definitely increasing amid recent regulatory developments and the rise of AI-driven search platforms like Perplexity and ChatGPT.

Still, I think investors will do very well if they buy during this downturn and have an overweight exposure to Google.

The most likely scenario following the ruling, in my view, will not have a material effect on the company in the long term.

Therefore, I reiterate Alphabet at a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, AMZN, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.