Summary:

- Google struggled initially in the AI market post ChatGPT launch but has now become a market leader with Gemma 2 model based on market share data.

- Gemma 2 offers class-leading performance, while Google DeepMind’s new AI training method enhances performance and power efficiency.

- Google’s financial performance is strong, with robust advertising growth and AI integrations driving market dominance and a bullish outlook for investors.

- Current EPS estimates for the upcoming quarter show strong growth estimates, making me reiterate my strong buy belief.

Justin Sullivan

Investment Thesis

Initially, Google (NASDAQ:GOOG) (NASDAQ:GOOGL) (NEOE:GOOG:CA) struggled to position itself in the AI market post ChatGPT launch because it was overshadowed by its rivals such as Microsoft (MSFT). However, I believe with their recent advancements, particularly the introduction of the Gemma 2 model, the company has turned around their AI prospects. I think they are now either at or quickly becoming the market leader.

Gemma 2, which was launched in June, is available in 9 billion (9B) and 27 billion (27B) parameter sizes. Google claims it delivers class-leading performance that outpaces competitors of similar and even larger sizes. In my opinion, Gemma 2 marks Google’s transition from merely surviving in the very competitive AI industry to setting a new standard for open models in terms of performance and cost-efficiency.

Google DeepMind also unveiled a new AI training method named JEST, which the company claims to enhance performance by 13 times and improves power efficiency tenfold compared to existing methods. This was introduced this month to reduce computing costs and energy consumption, which is needed for sustainable AI development and its applications in eCommerce and global customer support

I think that Google’s initiatives now offer optimism among investors. While their models do not still benchmark closely to OpenAI’s latest models or Anthropic’s Claude, the company’s shift towards actively leading in AI innovation is a clear indicator that they have not only caught up but are now ahead in the AI market. I’ll talk about this later, but their market share is catching up as well.

Alphabet’s financial performance reflects these technological strides. As of mid-July, the company’s stock surged 27.18% year-to-date, bolstered by robust advertising growth and AI integrations that maintain its market dominance. Alphabet’s Q1 results showed a 28% increase in Google Cloud’s revenue, highlighting the economic impact of their AI advancements

I believe this progress supports a bullish outlook on Google’s shares, particularly as they head into their earnings reports. The advancements in AI, exemplified by Gemma 2, suggest there is even more upside potential for Google, making a strong case for me. I continue to be a strong buy going into earnings.

Why I’m Doing Follow-Up Coverage

In my last report, I wrote how Google went from the AI underdog, to now firing on all cylinders. Back then, Gemini 1.5 Pro exemplified Alphabet’s progress in AI. CEO Sundar Pichai described the AI transition as a “once-in-a-generation opportunity,” highlighting AI-driven enhancements in Search, digital advertising, and cloud computing capabilities.

Alphabet’s 1Q 2024 results also demonstrated an EPS of $1.89, which exceeded expectations by 25%, and total revenue of $80.54 billion clocking in at 15.41% YoY growth. Google Search and digital advertising generated $61.66 billion, a 13% YoY increase, while Google Cloud revenue rose 28% to $9.6 billion.

These gains were bolstered by the integration of AI and machine learning technologies, attracting enterprise customers like Bayer, Cintas, and Walmart. YouTube also saw a 21% YoY revenue increase, driven by innovative ad strategies and the potential user shift from TikTok due to regulatory uncertainties. These innovative ad strategies were also driven by AI.

Now the company is starting to pull ahead from a business standpoint, especially with the expected introduction of Gemini 2 later this year.

AI Deep Dive: Where Is The Market In Summer 2024?

Like many tech companies in the AI space, Google faces challenges in monetizing their AI progress, particularly at the software layer for enterprise applications. The struggle to turn AI hype into profits is rooted in the non-deterministic nature of many AI models and the resulting variability in quality, which can hinder their adoption in enterprise environments.

Non-determinism in AI models means that given the same input, the models can produce different outputs. This variability, while potentially beneficial for creativity and innovation, is problematic for organizations that require consistent and reliable performance.

For instance, non-deterministic outputs can lead to inconsistent product descriptions, which may confuse customers and damage brand credibility. This unpredictability impact consistency and reliability of output. Many key AI use cases involve being deployed in high trust situations.

Alphabet’s efforts to monetize their AI innovations are further complicated by the challenges in integrating AI solutions into existing enterprise workflows. Companies are often hesitant to adopt AI technologies that do not guarantee deterministic and high-quality outputs, leading to slower uptake and limited profitability from these innovations.

Pressures from investors and the necessity to fund ongoing research have pushed these organizations towards more commercial activities, which can sometimes conflict with their foundational principles of ethical AI use. Google has a rare approach; however, I think this is key.

Freemium Model

Google (along with Meta (META)) now both employ a classic Silicon Valley strategy of offering valuable services for free or as part of existing premium (or free) subscriptions to hook users and later capture value on the backend. This approach is evident in the company incorporating advanced AI features into their subscription G-Suite services to reflect a shift in their business model. It’s definitely a response to competition from AI companies such as OpenAI’s ChatGPT.

Google’s Google One AI Premium plan was launched in early 2024, and offers advanced AI capabilities through the Gemini Ultra 1.0 model. This model, according to the company, allows better handling of complex tasks involving text, images, and code, and is integrated with Google’s productivity apps like Gmail and Google Docs.

I believe that this strategy allows Google to familiarize users with their AI capabilities and create a dependency on these tools, which can potentially increase the likelihood of long-term subscription renewals. This playbook relies on the resources and extensive user networks of companies like Google and Meta, enabling them to absorb initial costs while establishing an ecosystem that users can be reliant upon.

However, this approach is not without challenges. Google’s consideration of charging for AI-powered search features reflects the high costs associated with generative AI and the need to find sustainable revenue streams.

GPU Spend

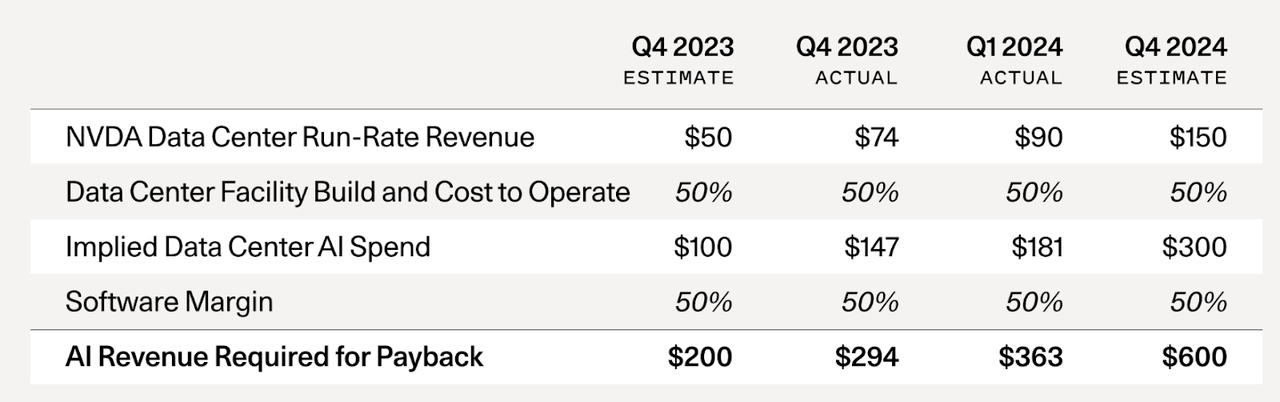

A recent report from VC firm Sequoia highlights that the AI industry requires an estimated $600 billion in software spend to AI companies to support the necessary upgrades for GPU infrastructure, which is a core component for training and deploying advanced AI models. Google is known for their substantial investments in AI, and is poised to make this expenditure work due to their large financial resources and freemium approach to AI integration.

AI Payback Math (Sequoia Capital)

The company’s capital expenditures are projected to increase by 33% this year, reaching nearly $43 billion. This investment is necessary since AI models, particularly those leveraging generative AI, demand computational power. Google’s infrastructure investments in GPUs are important to maintain their edge in AI and to support the deployment of advanced AI features across their platforms.

Google’s AI Market Share

Google’s extensive existing infrastructure through their current search, cloud, advertising, and YouTube platforms plus continuous innovation are key factors driving their market strength in the AI market.

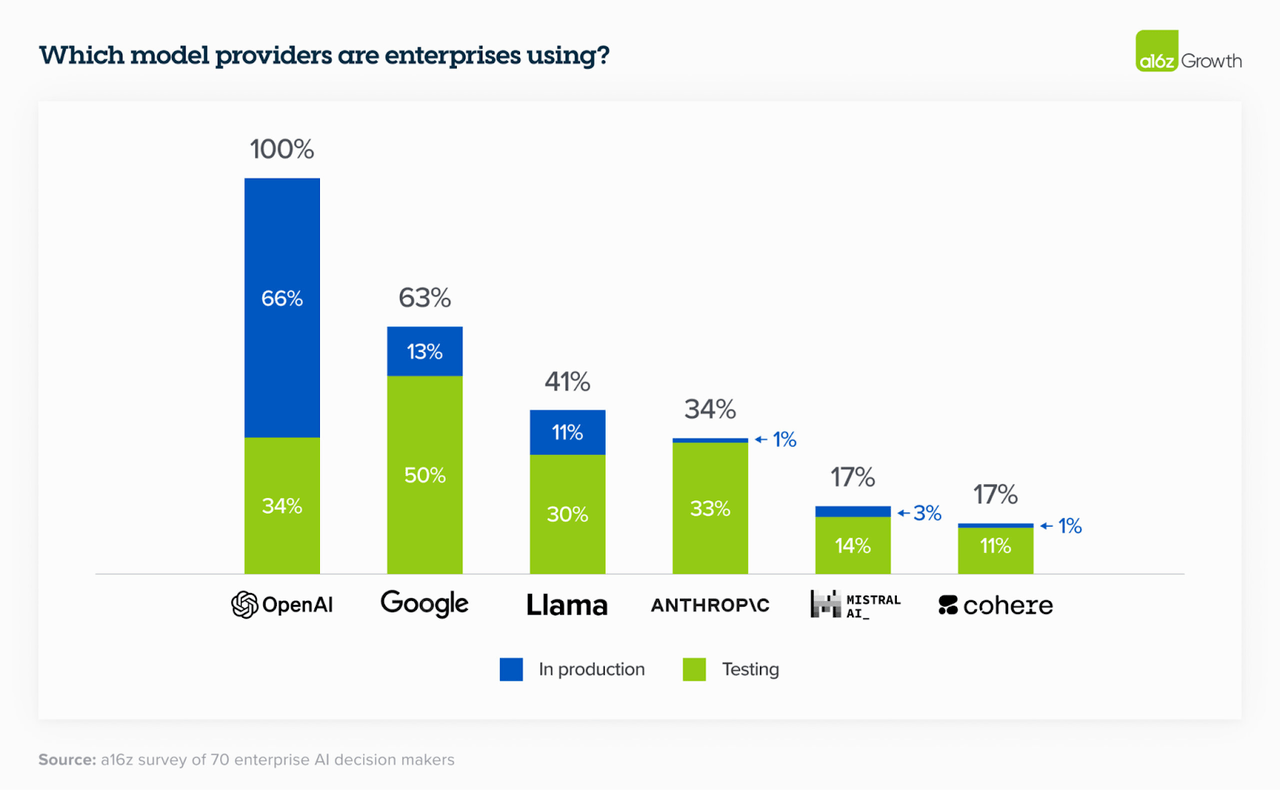

Google ranks among the top model providers for enterprise users. Although Open AI dominates the models in production with 66% over Google’s 13%, the latter outpaces Open AI in terms of models in testing with 50% compared to Open AI’s 34%. Google has a huge opportunity to grow.

A16 Market Share Analysis (A16)

What I’m Looking For In Earnings

I believe Alphabet is set to report EPS of $1.84/share and revenue for Q2 2024 of $84.30 billion with earnings on Tuesday (July 23rd), which aligns with the consensus estimates from analysts. This represents a 27.66% year-over-year growth, highlighting the company’s robust performance in the face of ongoing market challenges. This growth is driven by the parent company’s diverse revenue streams and strategic investments in AI and cloud services. The company’s legacy search division is firing on all cylinders. Their cloud division is also accelerating. Now they have a unique AI strategy that is helping as well.

Google’s strong profitability metrics further support the positive EPS outlook. The company’s net income margin stands at 25.90%, higher than the sector median of 3.22%, showcasing Alphabet’s superior operational efficiency and profitability. I am on par with the street for estimated EPS should be for the quarter.

In addition, their return on equity (ROE) is an impressive 29.76%, far exceeding the sector median of 3.23%, indicating effective management and strong shareholder returns. Not only as an innovator, I also believe Google and their management are effective capital allocators.

On Google’s next earnings call, I’m focusing my attention on qualitative examples of the company generating strong AI use cases with clients that demonstrate practical, scalable applications of their technology. Google’s efforts in AI have already led to partnerships and real-world implementations across numerous industries. I expect more of these to be highlighted.

For instance, at the Google Cloud Next ’24 event, many high-profile organizations showcased how they are leveraging Google’s AI solutions. Best Buy (BBY), for example, is using Google’s Gemini AI to launch a generative AI-powered virtual assistant to troubleshoot product issues, manage subscriptions, and enhance customer service both in-store and online.

Wrapping up my expectations, I’m looking for more examples of companies adopting Google’s AI freemium model in their businesses and proving how this is helping them personally as an advantage for their respective businesses. The freemium model, which provides basic services for free while offering premium features at a cost, has been enhanced by AI to drive both user engagement and revenue growth. Google’s approach integrates AI into their core offerings so users can leverage their Gemini AI assistant and AI-powered features in services like Gmail and Google Docs, available through the Google One premium subscription. I think this is key. I expect them to talk about this model as well.

Valuation

Google presents a case for a reassessment of their valuation metrics, particularly the PEG non-GAAP forward ratio, currently at 1.32, which differs by -11.51% below the sector median of 1.49. This valuation seems incongruent given the robust EPS growth Alphabet has demonstrated. Specifically, Alphabet’s EPS growth forward (FWD) stands at an impressive 23.76%, surpassing the sector median of 7.56% by over 214%. This suggests that the market may be undervaluing Alphabet’s EPS growth potential.

In addition, as I mentioned before, the company’s return on common equity (ROE) further improves their financial performance with 29.76%, which is 791% above the sector median of 3.34%. I believe this indicates that Alphabet is efficient in generating profits from their equity and superior to their peers in the sector. Strong capital allocators are strong shareholder management teams.

Given these metrics, I believe Alphabet deserves a premium valuation. If their PEG ratio were adjusted to reflect a 30% premium above the sector median (to reflect part of the incredible EPS growth), rather than the current discount, it would translate to a PEG ratio of approximately 1.95.

To quantify this, if we consider the sector median PEG as a baseline and apply a 30% premium, the implied upside in Alphabet’s share price would be considerable, or approx. another 47.72% in upside in shares. The company has real growth. I think they have real upside from here.

Risks

The landmark antitrust trial against Google, which concluded on May 2nd, represents a challenge to the tech giant’s business practices. The trial focused on allegations that Google has maintained a monopoly over online search and search advertising through anticompetitive tactics. Central to the case is Google’s practice of paying billions to companies like Apple (AAPL) and Mozilla to be the default search engine on their devices and browsers.

The Justice Department and a coalition of state attorneys general argued that these payments have unfairly stifled competition, keeping rivals such as Microsoft’s Bing and the privacy-focused DuckDuckGo from gaining a foothold in the market. The government claims Google’s $26.3 billion expenditure in 2021 alone, with $18 billion going to Apple, was designed to secure its dominance and suppress potential competitors.

During the trial, Google defended their practices, arguing that their dominance is due to the superior quality of their search engine rather than any illicit activity. Superior products and business models are not illegal in the US. This is the result of effective capitalism.

With this, Google’s dominance in search spend remains critical for their business model. According to a report, Google continues to be the top destination for ad spending due to their reach and effectiveness in search advertising. The company’s search advertising business, which generates $175 billion annually, is an important source of their revenue stream. Ad spend has increased by 17% as reported early this year.

I’m confident that Google has a huge potential to corner the growing AI market in the coming years. Their leadership in AI was recognized in the 2024 Gartner Magic Quadrant for Cloud AI Developer Services. This is in line with their offerings in the AI sector.

Bottom Line

Initially, I believed Google was struggling to position itself in the AI market because it was often overshadowed by its rivals. However, with their recent advancements, particularly the introduction of the Gemma 2 model, the company has turned around their AI prospects. This development marks Google’s transition from merely surviving in the highly competitive AI industry to setting a new standard for open models in terms of performance and cost-efficiency. Recent market share data from A16 shows this as well.

At the same time, the main risks associated with Google’s business model have dissipated over the past six months, while the opportunities arising from their strategic advancements are expanding. I think this evolution suggests that Google’s shares have more room to appreciate despite the recent tech selloff. The pros are increasing, the cons are falling off.

Alphabet’s financial performance reflects these technological strides, with stronger advertising growth, and a 28% increase in Google Cloud’s revenue in 1Q 2024. I believe shares remain a strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.