Summary:

- Google looks like a very fundamentally strong company. The corporation benefits massively from its monopolistic-like position in the Search advertising market.

- I see 4 main reasons to buy Google including Services recovery, YouTube’s strength, profitability of the cloud segment, and more.

- I see 2 main reasons to sell Google: recession factor and high valuations.

JHVEPhoto

Main thesis

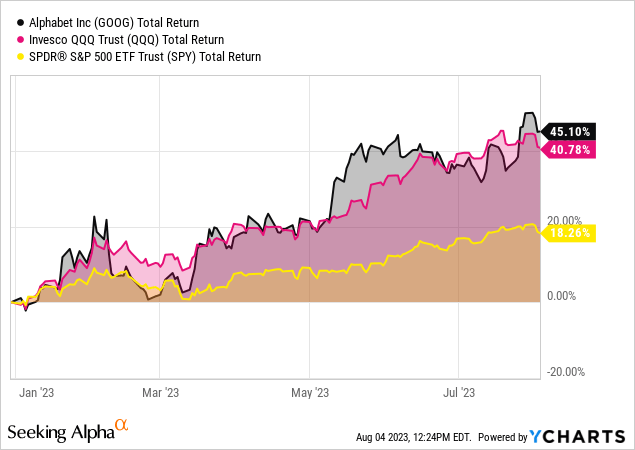

Alphabet, parent company of Google (NASDAQ:GOOG)(NASDAQ:GOOGL), has been crushing it this year beating the broader market this year. The AI mania as well as strong quarterly results and many other individual factors continue to keep the stock at multi-month highs and support the bull thesis.

At the same time, Google is still facing downside risks, in my opinion, just as every tech outperformer right now.

Bull reason 1: Services recovery

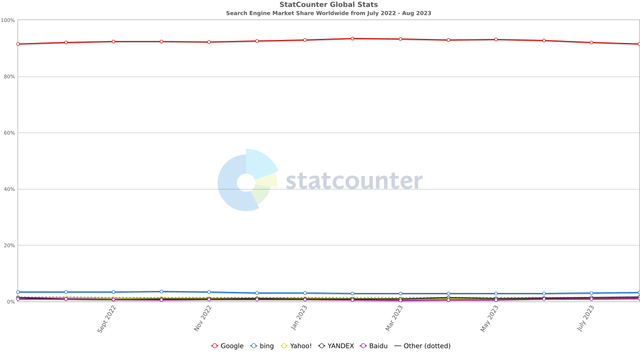

Despite AI-related fears that Google might lose its dominance in the search engine market and, therefore, in the digital advertising market, the empire hasn’t been challenged (yet). Google.com still stands at an unbeatable 91.5% market share. Thanks to the economies of scale, as well as an efficient ecosystem of services, Alphabet maintains a leading position in the digital advertising market. Ad revenues from Google Search, YouTube, and Network account for 87% of the total Services segment.

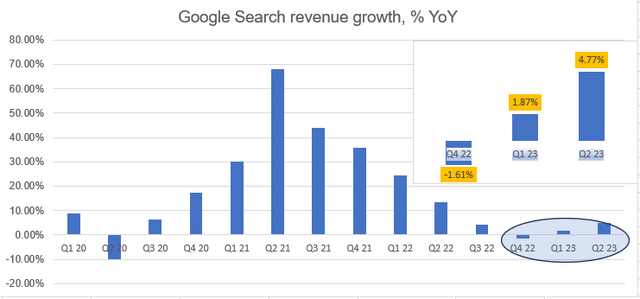

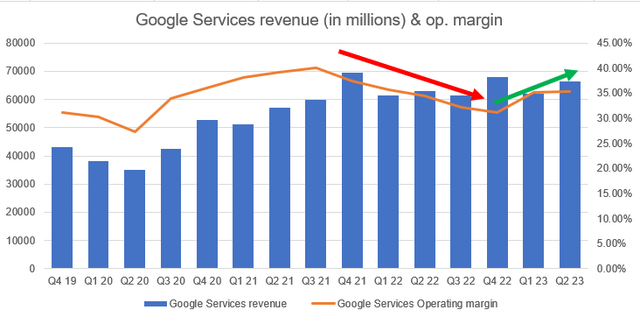

For the previous 2 consecutive quarters, the ad revenues growth has been negative as the slowdown in the advertising industry as a whole, the high base of the previous year, and unfavorable exchange rate fluctuations prevailed. However, in the last quarter, the situation with advertising revenue began to recover, which had a massive beneficial effect on overall results. Alphabet’s Q2 advertising revenue was $58.1 billion, up from $56.3 billion last year, ad revenue growth was 3% YoY. YouTube’s revenue is up again (+4% YoY) after declining for several quarters. Google Search revenue is up 5% YoY, while Google Network revenue continues to decline (-5% YoY). During the conference call, management talked a lot about bringing generative AI to various products, including search engine and advertising algorithms.

The most important thing here is that in 2023, after falling for 5 quarters in a row, the operating margin of the Services finally began to recover (35.4% in Q2’23 vs 31.1% in Q4’22).

Bull reason 2: YouTube strength

YouTube’s development strategy has four main areas: short videos (Shorts), becoming an alternative to television channels (Connected TV), subscription services (Music and Premium), and the introduction of e-commerce elements. Shorts currently have 50 billion views per day, up from 30 billion a year ago and 7.5 billion two years ago. The company is already testing monetization in YouTube Shorts. In terms of subscription services, YouTube Music and YouTube Premium now have over 80 million paid subscribers.

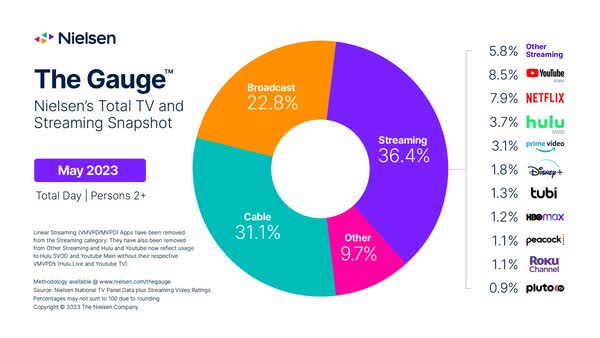

The company also notes that users are increasingly watching YouTube on large screens. According to Nielsen, YouTube leads all streaming services in the US in terms of TV watch time.

Nielsen

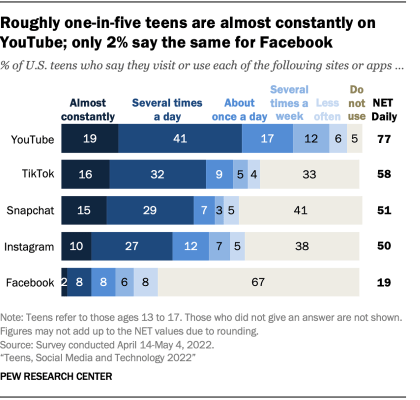

And, most importantly, it’s way more popular than competitors among teens with 19% of all US teens constantly on the platform.

PEW Research Center

In addition, Google plans to make YouTube an online shopping platform similar to Pinterest (PINS). Given the strong foothold in the form of an incredibly active audience, this idea has every chance of success. There are currently more than 2.5 billion users worldwide on the platform, while 26% of all consumers say they discovered new products via YouTube ads. There is a lot of additional revenue Google might be missing here.

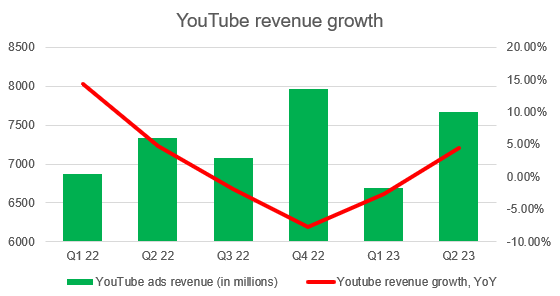

In line with the Services segment, YouTube revenues saw a recovery in H1’23 growing 4.43% YoY.

Author, Alphabet Filings

Bull reason 3: Cloud profitability

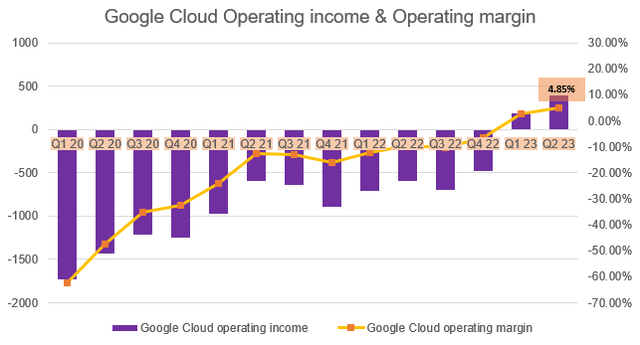

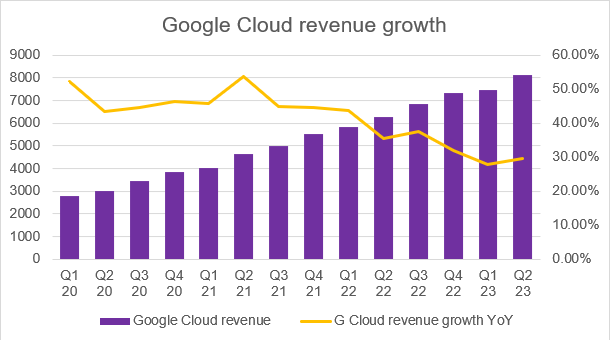

With the slow growth of the advertising business, the cloud segment is becoming one of the main factors keeping overall revenues from declining. Google Cloud platform revenue grew by 28% YoY in Q2, as in Q1, and reached a record $8 billion.

Author, Alphabet Filings

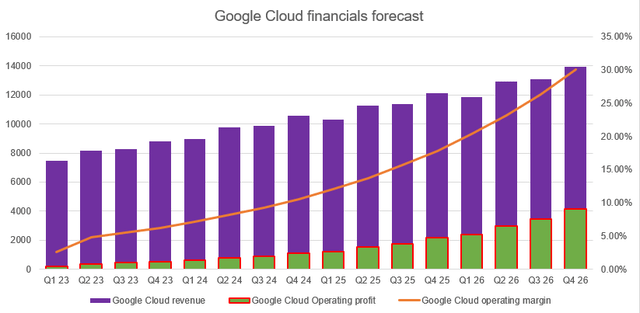

Moreover, the cloud segment is finally on its way to operating profitability as the operating margin reached 4.85% in Q2.

Google continues to improve the customer focus of its cloud division. An excellent example is the acquisition of Mandiant in 2022, which specializes in cybersecurity solutions. The new assets entered the Google Cloud segment and allowed the company to expand and improve its cybersecurity offerings. Alphabet has done well in this area, although it has to compete with niche companies. It is convenient for Google Cloud customers to use built-in services because in this case, they do not need to think about integration with third-party applications. Leveraging Mandiant’s experience, Google Cloud should expand its offerings to provide customers with a comprehensive suite of advanced security solutions for cloud and on-premise environments. The information security industry, like the cloud computing industry, can be classified as non-cyclical. The industry is projected to grow at around 10% YoY in 2023, with long-term growth rates on the horizon through 2030 estimated at a CAGR of 13.8%.

I believe that Google Cloud could reach 30% in operating margin by 2027 given that AWS and Microsoft Intelligent Cloud have 35.3% and 42.7% respectively, while also benefiting from a low base effect. Thus, if the cloud’s revenue grows at a YoY CAGR of 20% up to Q4’24 and at a CAGR of 15% up to Q4’26, the operating profit should reach $4.2 billion.

Bull reason 4: Massive buybacks & Costs optimization

In order to reduce operating costs, Alphabet, in addition to layoffs, plans to improve business processes and increase the efficiency of technological infrastructure through automation, reviewing relationships with suppliers and contractors, and optimizing working hours and jobs. Google will save on equipment replacement, for this the company has extended the life of servers and network equipment, which will reduce depreciation and capital investments. During a conference call, top management basically said that cost structure optimization is not a quick process, and therefore the main effect will be noticeable only in 2024.

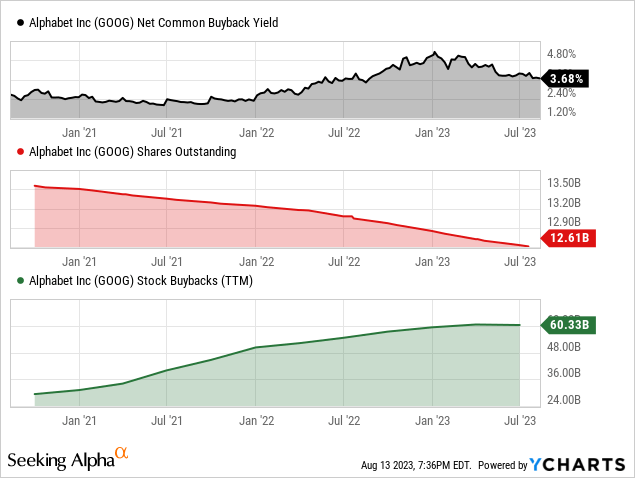

I believe that shareholders would benefit directly from cost optimization as it will allow the company to increase its massive buyback program (the current one is $70 billion in repurchases). Alphabet is one of the top 5 largest companies in terms of buyback volume in the US market. The stock repurchases totaled $29.5 billion since the start of the year at the end of Q2.

Bear reason 1: Exposed to a recession

When speaking of bear cases, we’ve got to speak macro. CPI in the US in July was expectedly 0.2% MoM and 3.2% YoY, core CPI was also 0.2% MoM, but 4.7% YoY. Services were the main contributor to price growth, adding 0.3% MoM and 5.7% YoY – annual growth rates remained at June levels. Services excluding energy added 0.4% MoM and 6.1% YoY.

Monthly inflation in the last couple of months has been kept within the Fed’s target, but trend indicators and separately the services sector are still likely far from what the Fed would like to see in my view. I believe rate cuts too soon in this environment would be too dangerous. The Fed’s transmission is working but it’s just gaining momentum so the losses in the system keep accumulating and in my opinion, the financial sector still could be shaken. This, among other things, should cause a recession.

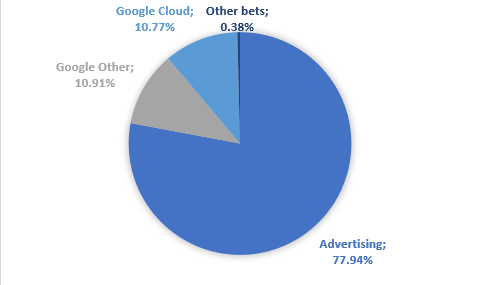

The potential impacts of a recession could be massive for Google. The digital advertising market is as cyclical as it has ever been. Advertising currently accounts for 78% of total revenue.

Author, Alphabet filings

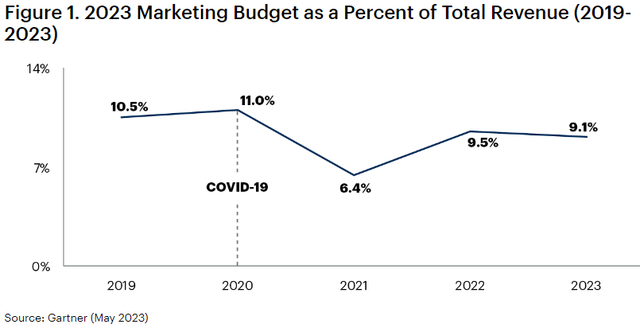

During a possible recession massive advertising spending cuts are likely. During the times of economic slowdown enterprises usually cut their marketing expenses as a part of overall spend cutting programs. In 2023, the overall marketing budgets, according to Gartner, have decreased slightly but this did not affect digital advertising. In fact, 53% increased their investment in social advertising, 51% are spending more on digital video advertising and 40% expect search channel budgets to grow (vs 26% decreasing investment in search advertising).

Thus, digital advertising expenses are still yet to be cut, even if the economy could be under pressure.

Bear reason 2: Big Tech with the Big Tech valuation

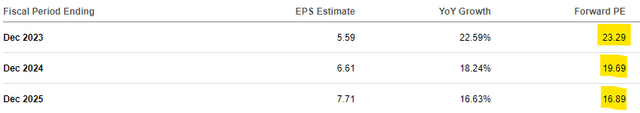

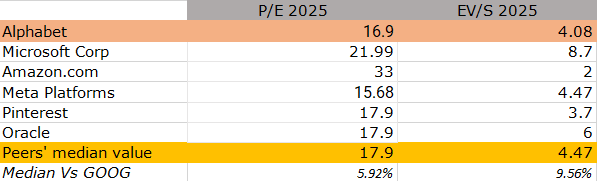

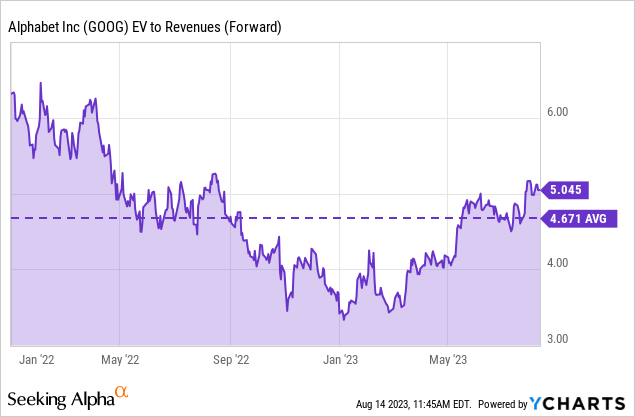

As Alphabet’s shares rose 45% this year, so did the valuation. Google is trading at 4.8x of 2024 sales and 4.3x 2025 sales. Looking at earnings, the valuation, thanks to expected cost optimization, is at 16.9x 2025 P/E.

In a comparison with peers, Google looks more or less fairly valued, if we use 2025 P/E and EV/S values. At the end of 2025, the effect of improving the company’s efficiency will be best seen in my opinion.

Author, Seeking Alpha

However, it is still higher than the historical average. Google is almost as expensive as other big techs, the undervaluation due to the rally this year has completely disappeared. Such a valuation well above the broader market would likely send stocks down 20-30% in a global market trend reversal.

Conclusions

Google looks like a very fundamentally strong company. The corporation benefits massively from its monopolistic position in the Search advertising market. With the recovery of Search and YouTube, Services segment revenue and margins are showing strength in 2023. Also, given the strength of YouTube and the growing profitability of Google Cloud, I think Alphabet will maintain its previous high growth rates in the next few years.

However, just like most of other Big Techs, it is very vulnerable to a recession and has high valuations.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.