Google: Searching For Gains While Protecting Against A Pullback

Summary:

- Google shares have had a nice run lately and are approaching a key resistance level.

- We expect the Federal Reserve’s rate decision and commentary to move markets; however, we are not sure which way that volatility will take us.

- In order to justify deviating from recent trends in the market and our trading, we are looking to hedge our downside exposure in order to hang around for possible upside.

brightstars

The recent run-up in the market has been a classic market bounce off of bad news. While the market attempts to figure out whether we are now in for a hard landing and/or facing a financial crisis caused by the Federal Reserve raising rates and some banks having made horrible duration bets on their fixed income holdings, the play has been to keep market exposure by staying as liquid as possible and seeking safety in numbers. Banks and small caps have taken a beating, however “Big Tech” has fared much better, as many market participants (institutional and retail) view these names as some of the safer plays (there is also a contingent still buying into the notion that lower rates are better for growth and tech names too, which helps on the margin) out there.

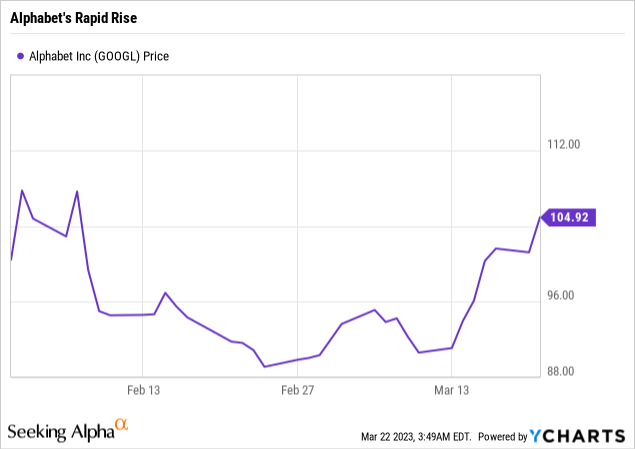

The rebound in some of these names has been swift and decisive. The chart below shows the recent price action of Alphabet Inc. (NASDAQ:GOOGL) (“Google”), one of the names which has risen sharply in recent sessions.

After breaking $100/share, Google stock had issues in the $95 to $98/share range; mostly caused by market events, including the bank worries in recent weeks. With rates having fallen and expectations for possible Fed rate hikes coming down dramatically, a perfect storm was put in place for investors to venture back into the market via the big market-cap, “Big Tech” names.

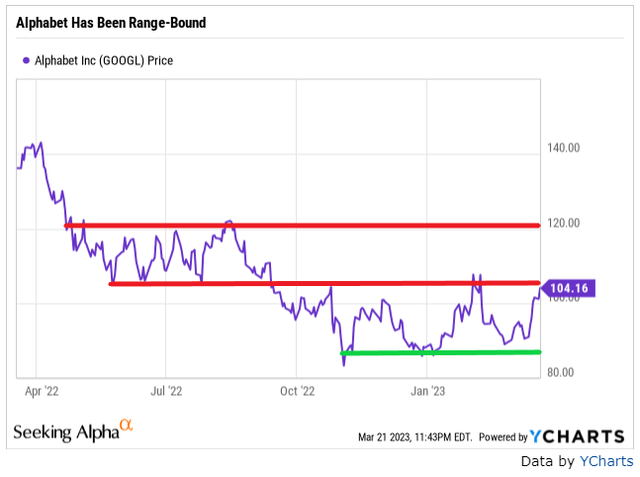

We are not in our normal office, so we do not have access to some of our data providers and their charting services, but the chart below this paragraph puts into perspective our thoughts on Alphabet right now; cautiously optimistic.

Alphabet shares have been trading in a pretty defined range with the recent highs all running into resistance in the $105 to $107/share range. (YCharts)

The last year has seen Alphabet shares trade in a series of ranges – with two large moves lower, creating two defined trading ranges after each of those moves. While it certainly appears that shares are trying to make another run to exit this lower range, we recognize the fact that this rally is running right into the Fed meeting – which has us evaluating our current positioning.

Volatility Has Been Friendly To Traders

We have been sellers of calls against our various positions the last few months, which has served to generate premiums that we could bank. Trading in and out of these positions around Alphabet’s moves has been the profitable trade. Moving in and out of the calls as the shares rise and fall has actually been the move since late September 2022. The number of 5-10% cumulative moves has been impressive, but this run feels different, so we think that it is time to change up the playbook a bit.

So What Are We Looking To Do?

While we have been happy to dabble in trading around the name, we find ourselves questioning the current run (not the run itself, just the overall strength and really the speed of it with questions still lingering around the financial sector). If the Fed was still on track for its planned hikes, which the market had a pretty good grasp on only a few weeks ago, we would feel comfortable simply selling calls and collecting a pretty solid premium. However, we think that the market has met the Fed at a crossroads of sorts, where if the Fed is able to show that it has a grasp on the economy and the ability to continue to fight inflation, prevent bank runs and not cause a hard landing, then some names in the market (including Alphabet) are positioned to move higher.

With the possibility of the Fed being a little more accommodative moving forward, Alphabet could make a move higher that takes it to around $120/share. Quite honestly, selling calls around the $120/share area does not generate the premiums we are interested in (at least for the maturity dates we would be interested in selling for), so we are looking at keeping the potential upside as we do like the story around “Big Tech” right now and instead will look to buy puts as insurance against a move lower.

What Is The Trade?

We think that there are two possible puts to buy for those looking to protect their downside while keeping the upside. We are trading the March 24, 2023, Puts with a $102 strike price, which are trading with a bid/ask of $0.55/$0.57 and the April 6, 2023, Puts with a $100 strike price, which are trading with a bid/ask of $1.07/$1.08 as we write. These are not lotto tickets or an attempt to play the Fed and make a ton of money in the options market, rather we are utilizing these specific contracts to manage our downside risk for what we think could be a potential worst-case scenario resulting from the Fed’s actions today and market reaction in the next few days and weeks. It is important to note that because we are utilizing OTM (out-of-the-money) puts, we are buying each one of these contracts per 100 shares we are hedging.

We are utilizing strike prices which are out of the money, but strategically selected based on our estimates of potential downside moves and where we would want to stem losses. We are also utilizing a 2:1 ratio for the current week by buying the March 24th expiration, which basically covers us for a greater than 2% move lower in the next two days. The April 6th maturity is about 5% out-of-the-money and at a cost of about 1% serves as an insurance policy moving forward in case there is a delayed move downward (which is strong in nature).

While some might argue that staying the course and simply selling OTM calls would be the play, we believe that trade exposes one to unnecessary downside risk. Selling OTM calls, even if it generated a $1/share premium at $120/share would keep you in the game for the upside, but it only protects your downside by $1 (assuming that is what you attempted to collect by going out on maturity). It is not a trade that suits us here, which is why we are actually buyers of puts here.

Final Thoughts

This is not a trade that is supposed to make a ton of money, or even any money at all. We are strictly utilizing the options market to add some downside protection and create a better risk/reward scenario moving forward. In order to play for a potential $15/share move higher we are spending about $1.63 per share, or about 1.5% in order to minimize our losses in the current week to no more than roughly $3.50/share (option premium and share price decline) and if the downward move happens after this week then no more than about $6.60/share (option premiums and share price decline).

If Google shares continue trading like they have off of news, a move to $100/share, $95/share or even $90/share is not out of the question if that move is lower, especially if the Fed shocks the market for some reason. Taken in that context, $1.63/share in total option premiums to stay in the game for up to $15/share in gains is quite logical. And for those who think upside might only be $5-$10/share upside, then this would make even more sense as it allows one to justify hanging around Google longer by capping downside losses.

Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We have various positions in GOOGL and GOOGL derivate positions, with the net effect of us being long. Any puts are structured to support long positions, or going long.