Summary:

- The recent rally has made the stock significantly overvalued, which seems unreasonable given the steadily deteriorating market share in search.

- My valuation analysis suggests that the business’s fair value is $1.7 trillion, which is approximately 27% lower than its current market capitalization.

- Google’s overreliance on search poses a secular problem for investors, as generative AI shows signs of disrupting the search industry.

- In the new era of generative AI, Google’s position is weaker as it lags behind OpenAI’s ChatGPT, with competition set to intensify.

400tmax

Investment thesis

My previous bearish thesis about Google (NASDAQ:GOOG) (NASDAQ:GOOGL) (NEOE:GOOG:CA) did not age well because the stock gained 20% since April, significantly outpacing the broader U.S. market.

The massive optimism around Google is backed by its recent financial performance. However, as a long-term investor who heavily relies on fundamentals, I prefer to look beyond a company’s accounting books. The emergence of AI chatbots continues to disrupt the Search Engines industry, which we see from the rapid expansion of ChatGPT-powered Bing’s market share. The growth in Google Cloud revenue might be impressive without context. However, the company’s market share in this industry remains the same, which is miles away from industry leaders. In the context of these secular challenges, I think that the current premium valuation looks undeserved. All in all, I downgrade GOOGL to “Strong Sell”.

Recent developments

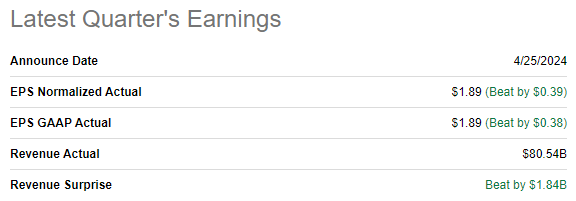

The latest quarterly earnings were released on April 25 when the company surpassed consensus estimates. Revenue growth accelerated to 15.4% on a YoY basis, and the adjusted EPS expanded from $1.17 to $1.89.

Seeking Alpha

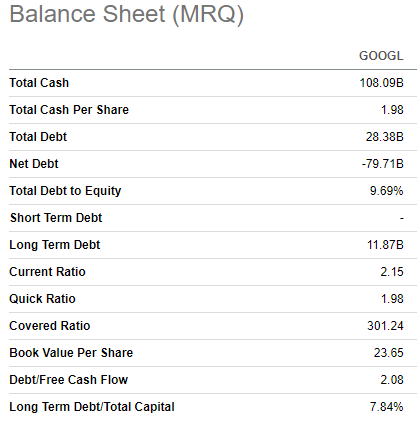

The EPS expansion was achieved with substantial operating leverage, as the EBITDA grew by around 48% on a YoY basis. Strong performance allowed GOOGL to generate $12.3 billion in free cash flow, which significantly contributed to its fortress balance sheet. The company had more than a hundred billion USD in cash as of March 31, and the net cash position was around $80 billion. That said, Google boasts massive financial flexibility.

Seeking Alpha

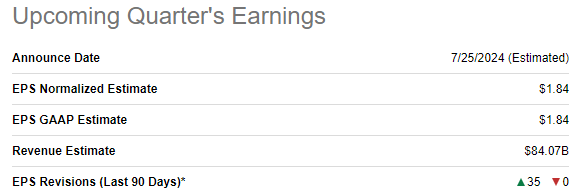

The upcoming quarter’s earnings release is scheduled for July 25. Consensus sentiment around the upcoming earnings release is extremely bullish, with 35 EPS upgrades over the last 90 days. The Q2 revenue is projected by consensus to be $84.07 billion, 12.6% higher on a YoY basis. The adjusted EPS is expected to expand YoY from $1.44 to $1.84.

Seeking Alpha

The massive optimism around Google is backed by its strong financial performance, with revenue growth accelerating to double digits after single-digit topline increase delivered in FY 2022 and 2023. Expanding profitability also adds optimism to the market.

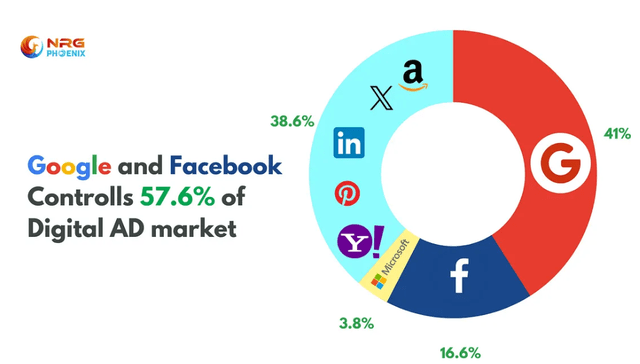

I tend to agree with being optimistic when a company’s financial performance improves. However, as an investor who relies on fundamentals, I have to look beyond the company’s accounting records as well. According to the latest 10-Q report, digital advertising still represents the lion’s portion of Google’s sales, which is 78%.

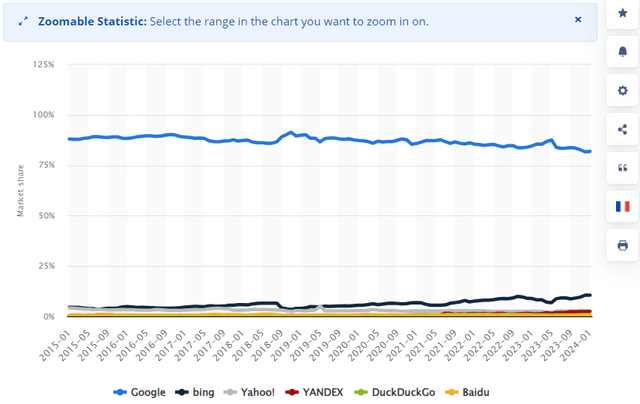

Such a massive reliance on the one revenue stream increases concentration risks for any businesses. The company’s revenue on 57% consists of sales generated from Google Search. This overreliance on the Search appears to be a fundamental risk for investors as Google’s market share deteriorates as the competition intensifies. Google still has around 82% market share among desktop search engines, but this is significantly lower compared to a 92% market share in 2018. Moreover, the emergence of generative AI engines disrupts the industry, and the market share of Microsoft’s (MSFT) Bing [powered by ChatGPT] has increased from 6.8% to 10.5% over the last twelve months. This dynamic indicates that the industry is being disrupted by generative AI.

Google bulls will certainly disagree with me, as Google still dominates the market. On the other hand, the strength of disruptors lies in their ability to beat established leaders without looking at their market shares. Kodak had an 80% market share of the photographic film market in the U.S. before it was disrupted by the revolution in digital cameras. Nokia (NOK) also felt extremely well and dominated the global mobile phones industry with almost a 40% market share before Apple (AAPL) rolled out its iPhone.

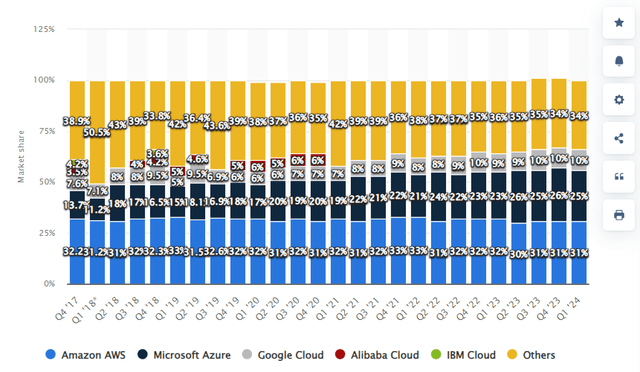

Another reason for the market’s optimism around Google is an accelerated 28% YoY Google Cloud’s revenue growth in Q1. While this growth looks impressive and outpaced Amazon’s (AMZN) AWS and Microsoft’s (MSFT) Azure, I have to add some context here. Google Cloud’s market share is not expanding, and its latest success allowed it to return to the late 2022 levels. That said, from the market positioning point of view not much changed and GOOGL is still miles behind Azure and AWS in the cloud industry.

Google remains the laggard in generative AI as ChatGPT dominates the LLM industry with a 77% market share, according to the source. There was a slight pullback in ChatGPT’s market share, from 80% to 77%. I expect the trend to reverse back once OpenAI releases its GPT-5 upgrade, which will be much smarter, according to Sam Altman.

Moreover, ChatGPT is not the only competitor to Google’s Gemini. Anthropic’s Claude LLM also evolves rapidly and its 3.5 Sonnet version was recently recognized as the top choice for business and finance in S&P AI Benchmarks by Kensho. Anthropic is a startup backed by AWS, the key player in the cloud industry. Therefore, Google’s position in the emerging LLM industry is also questionable.

Valuation update

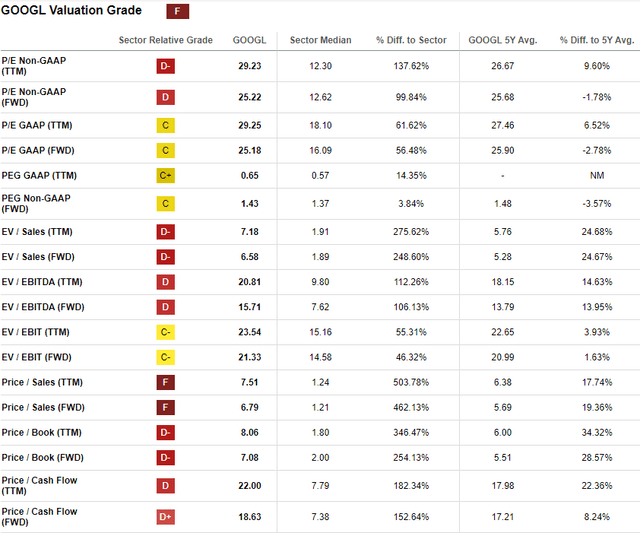

GOOGL gained 62% over the last twelve months, substantially outperforming the broader U.S. stock market. The YTD performance is also strong compared to the S&P500 with a 35% rally. Some of the valuation ratios are mostly in line with historical averages, which might indicate that GOOGL is attractively valued. On the other hand, current P/S and P/Cash Flow look elevated and signal overvaluation.

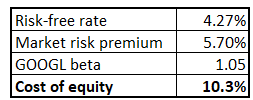

Looking only at valuation ratios is not sufficient for a well-rounded valuation analysis. Therefore, I proceed with the DCF simulation. As Google’s balance sheet above demonstrates, the company’s reliance on debt is very low. Therefore, the company’s cost of equity will be used as a discount rate for the DCF model. Google’s cost of equity is 10.3%, according to the below CAPM calculation.

Author’s calculations

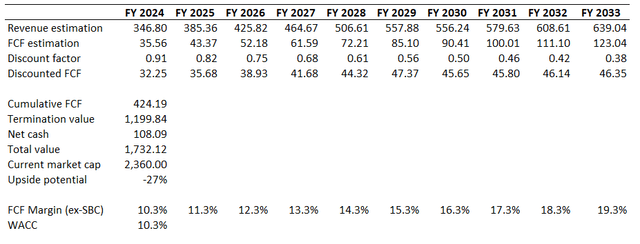

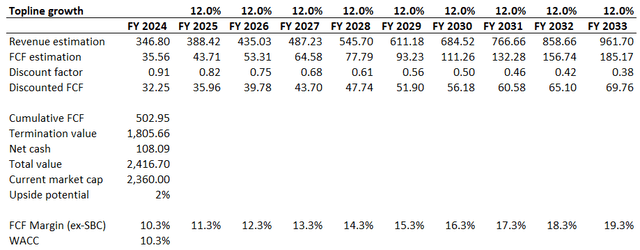

Consensus estimates project a 7% revenue CAGR for the next decade. This might look too pessimistic for a company like Google. However, I believe this growth rate is fair given all the fundamental risks I have described in the previous section of my analysis. The TTM FCF ex-SBC margin is 10.3%, which will be the base year’s assumption. Google’s stellar profitability and historical trend of its expansion along with revenue growth add me enough optimism to incorporate a one percentage point yearly expansion for the FCF margin.

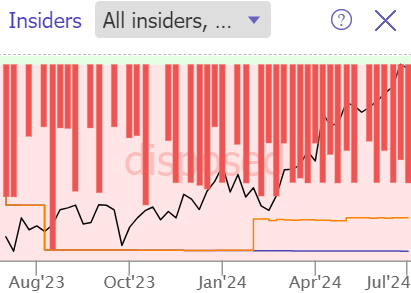

According to my DCF simulation, GOOGL is 27% overvalued. The current market cap is significantly above the business’s fair value even with aggressive FCF margin expansion assumptions. Another indication why the stock is highly likely overvalued is that insiders were only selling the stock over the last twelve months. The fact that insiders are selling does not necessarily mean overvaluation because all people have their bills to pay. However, literally zero insider buys suggests that insiders see not much further upside potential.

TrendSpider

Risks to my cautious thesis

The DCF model is vulnerable to changes in assumptions, especially related to the revenue growth rate. While I believe that my base case scenario with a 7% revenue CAGR reflects Google’s fundamental challenges, my sensitivity analysis suggests that the market highly likely prices a 12% revenue higher. Of course, this is substantially higher than the initial assumption of 7%. However, a 12% CAGR does not look unrealistic in the context of Google’s historical revenue growth trends and a double-digits topline CAGR delivered over the past decade.

Despite lagging in the AI race and facing the risk of being disrupted, Google still dominates the global digital advertising space with a staggering 41% market share. This enables Google to generate substantial free cash flows, $59 billion in FY 2023. The company’s balance sheet is clean, meaning that the company has massive resources to continue investing in innovation. Therefore, despite having a substantial gap in the cloud market and generative AI advancements, there is a slight probability that Google might make a comeback. Given all Google’s weaknesses in the AI race I have mentioned above, I consider odds for such a scenario to be low, however.

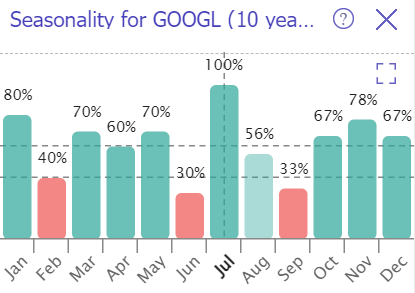

Looking at the stock’s long-term seasonality trends is also quite useful. From this perspective, my thesis might not work well in July, as GOOGL has a 100% success rate in this month. On the other hand, GOOGL’s seasonality did not work well in June as GOOGL rallied by 5% and the below chart suggests that June is historically the weakest month for the stock.

TrendSpider

Bottom line

To conclude, I downgrade Google to “Strong Sell” because the recent rally made its valuation too generous. I think that the valuation is underserved, especially in the context of secular risks its cash cow, the Search Engine business, faces. I also think that the optimism around Cloud is overestimated, as this segment continues to be miles behind industry leaders and nothing changed much in terms of the market share despite solid revenue growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.