Summary:

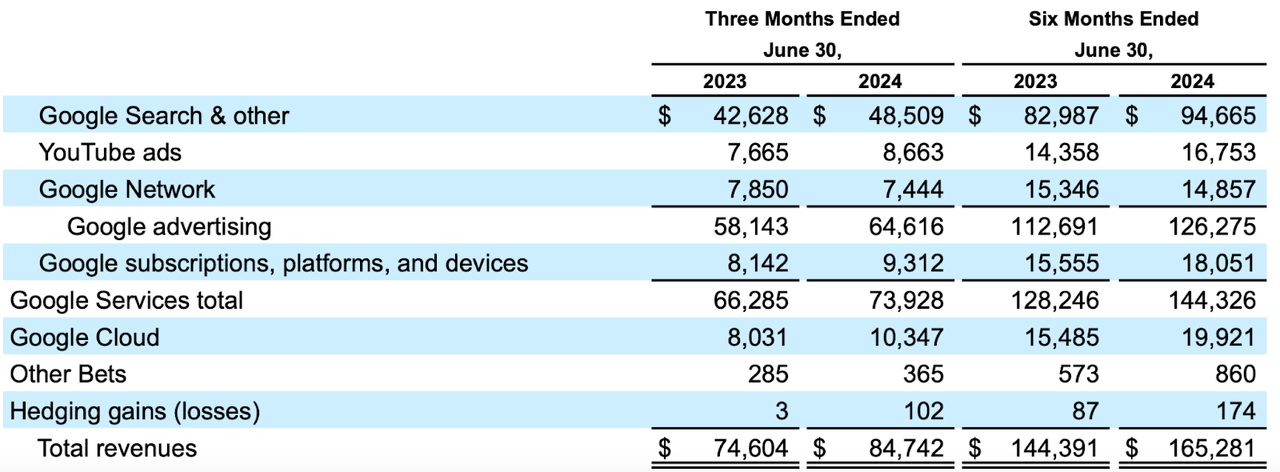

- Alphabet’s Q2 2024 revenue reached $85 billion, a 14% year-over-year increase, driven by growth in Google Cloud and AI integration.

- Google Cloud revenue surged by 29% YoY to $10.35 billion, marking its first-ever $1 billion in quarterly operating income, with a margin of 11%.

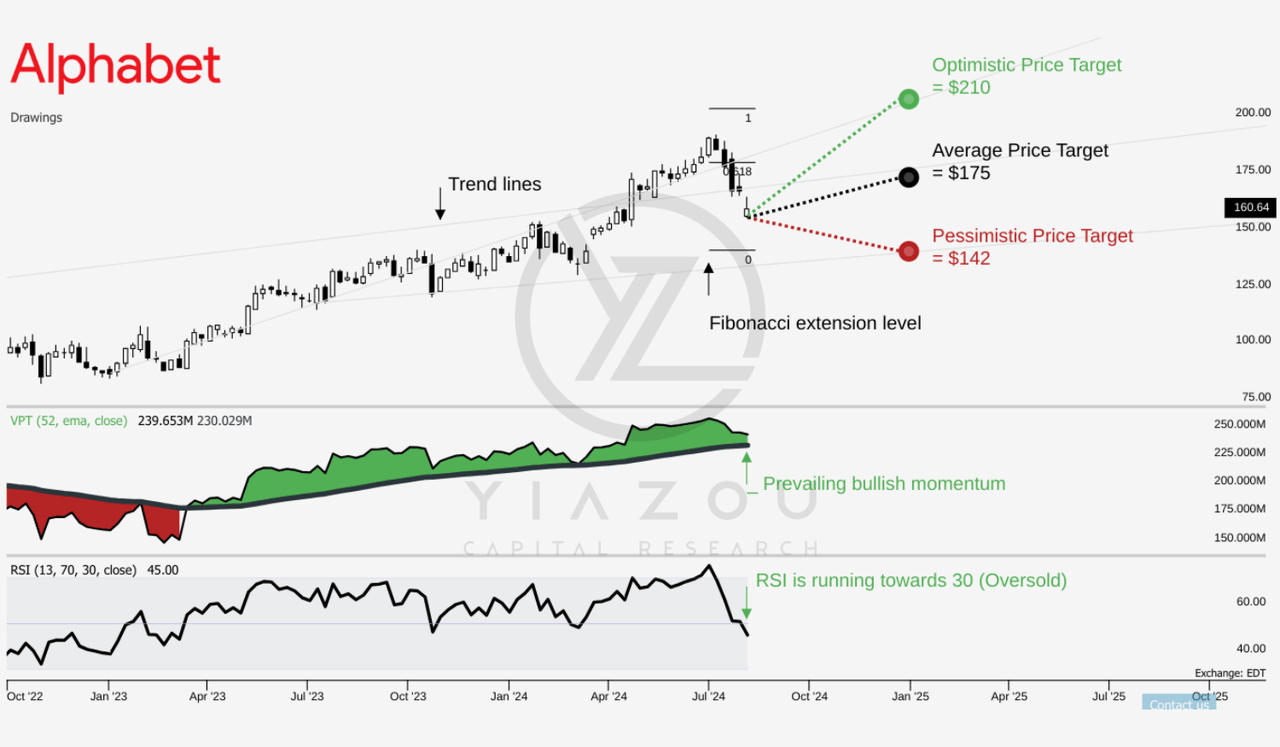

- GOOG’s RSI dropped to 45, nearing oversold territory, with potential resistance at $175 and bullish solid momentum if it approaches $210.

- Alphabet’s strategic investments in AI across its services, especially Google Search and Cloud, are critical to maintaining its market dominance and future growth.

da-kuk

Investment Thesis

Our previous analysis two months ago for Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) included a bearish divergence warning, with an RSI fast approaching 70, signaling it was overbought. GOOG has dropped 7% since then, against our cautious view, despite the positive outlook for the long term.

However, the overall bullish thesis remains intact. The recent decline has brought the RSI down to 45, signaling that GOOG is approaching oversold territory, though not fully there yet. Ideally, a clearer oversold signal would occur around an RSI 30, which could present a more compelling buying opportunity.

As it stands, GOOG is getting closer to a potential new bull run, making it a stock to watch closely in the near term. Investors should consider this dip a potential entry point, especially if the RSI continues to decline towards more oversold levels, which would align with a more robust bullish setup.

Resistance at $175 or Rally to $210?

GOOG’s price of $165 sits below the average price target for 2024 of $175, which aligns with the Fibonacci retracement level of 0.618, suggesting potential resistance. The optimistic target of $210 corresponds with the Fibonacci level of 1, indicating strong bullish momentum if this level is approached. Conversely, the pessimistic target of $142 aligns with the Fibonacci level of 0, indicating strong support if the price declines.

The Relative Strength Index (RSI) is at 45, showing no bullish or bearish divergence, with a downward trend indicating waning momentum. A long setup is identified at an RSI of 30, suggesting a potential buy signal if the RSI continues to decline. The Volume Price Trend (VPT) line is also trending downward, with the current VPT at 239.69 million and the moving average at 230 million. The VPT is approaching a bottom touchdown on its moving average, hinting at a possible reversal.

Based on the last ten years of monthly seasonality, August 2024 has a 45% chance of a positive return, indicating moderate seasonal strength. Overall, the technical indicators suggest caution with potential buy opportunities if key support levels are reached.

Alphabet’s AI Revolution: Powering Growth and Dominance in Cloud and Search

Alphabet’s strategic investments in AI are crucial to stimulating future growth. The company has injected AI technologies into all its services, which help raise more revenue and increase user engagement. The AI enhancements on Google Search have also tried to boost user activity, especially among the young generation.

Adding AI solutions to the part of Google Cloud has been the center of the segment’s growth. Cloud revenues jumped 29% during the second quarter to over $10 billion, and the cloud is fast emerging as the other big revenue generator for the behemoth. Over 2 million developers already use Google’s Gemini, including Alphabet’s robust AI strategy comprising infrastructure and apps.

Google’s Search Fortress Faces AI Showdown: Can It Maintain Its Dominance?

Google Search has long been the backbone of Alphabet, maintaining a stable market share even amid growing competition. However, the company’s stronghold on search has been continuously disputed for the last year due to improvements made in the frontier of generative AI, especially from Microsoft Corporation’s (MSFT) Bing.

Even with all the fierce efforts Microsoft is making to replace Bing as a credible alternative, Google’s market share does not seem to have taken a serious hit. Sundar Pichai’s approach of sticking to Google’s core strengths rather than retrofitting a response to competitors indicates that the company is assured of its products.

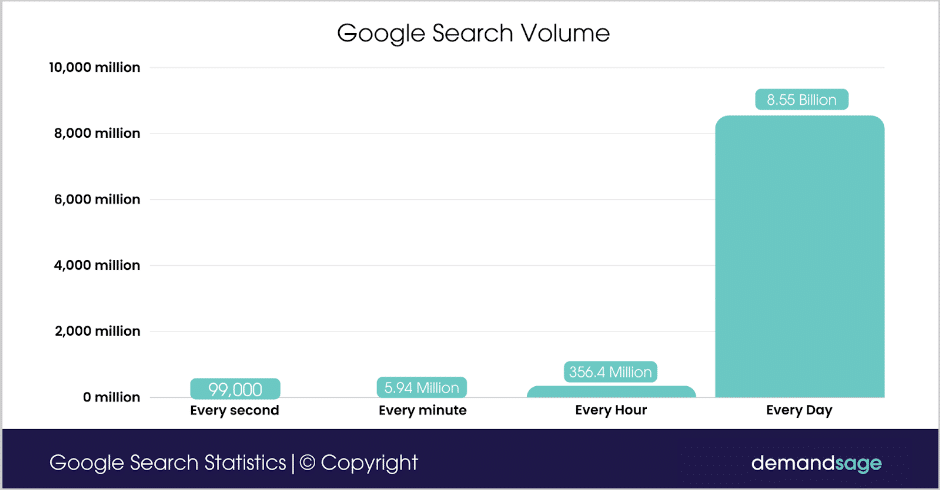

According to Deepwater Asset Management, Google Search remains strong due to its habitual nature. Almost 8.55 billion searches are hosted daily. This habit-based usage is further entrenched with continued AI enhancements underpinning Google’s position against potential disruption.

demangsage

The unfolding of the prototype for OpenAI’s SearchGPT may now threaten Google’s monopoly on search. Financed by Microsoft and currently collaborating with Apple Inc. (AAPL), OpenAI possesses an avant-garde new search product that continues to stumble and find its way to acceptance in the market. This product is still in the testing phase, and its legitimacy in the market remains unproven, as noted by concerned Alphabet investors.

Credibility, resources, and capability are all on the side of OpenAI. Still, developments that Alphabet is now making in AI-with its leading edge regarding victories in AI competitions-cemented its commitment to stay in AI. Having more than $100 billion of cash reserves, Alphabet has what it takes to keep investing in AI and ward off competitive threats.

Therefore, to maintain its competitive advantage over SearchGPT, Google can leverage its massive user base and extensive data, enhancing search results’ accuracy and relevance. Its deep AI and machine learning expertise, exemplified by advanced models like BERT and MUM, allows Google to deliver superior, personalized search experiences.

Finally, integrating Google’s services, such as YouTube and Google Maps, creates a seamless ecosystem that keeps users engaged and loyal. Continuous innovation in AI-driven features like Google Lens and voice search will enable Google to stay ahead of competitors, ensuring it remains the dominant search market.

Rising CapEx and Margin Growth: Alphabet’s Balancing Act

Alphabet recorded solid financial performance in Q2; nevertheless, the market wasn’t pleased as the CapEx was perceived as higher than expected. While Alphabet’s strategic investments in AI certainly have a lot of promise, they also carry a lot of inherent risks-the market reacts out of fear over near-term margin pressure from the higher CapEx spending, with management looking forward to the optimism of AI monetization opportunities but investors looking for immediate returns.

Management’s commitment to not underinvest in the critical areas-despite potential short-term concerns about profitability-signals a long-term strategic vision. Alphabet is confident of the eventual AI monetization opportunities that can be opened by this means, coupled with developing further operational efficiencies.

Doubts over Alphabet’s margin sustainability intensified after it announced plans to at least maintain, if not step up, quarterly CapEx for the remainder of the year. Management’s cautious tone regarding probable margin pressures in Q3 adds to these concerns. However, the risks can be mitigated due to Alphabet’s proven record of reengineering its cost base and enhancing operating efficiencies.

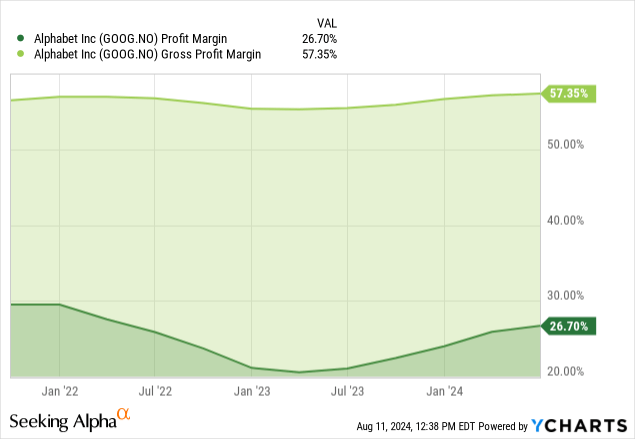

The operating margins have shown a positive trajectory, and one of Alphabet’s operating improvements attests to the success of its cost-cutting and efficiency drives. As a result, Google reported an operating margin of 32% in Q2 2024, compared to 29% in 2023. Hence, this improvement indicates Alphabet’s robust financial health and investment capacity for future growth.

Takeaway

Alphabet is one of the strongest technology firms, perhaps primarily due to heavy investments in AI and cloud services. While some remain concerned about high CapEx levels and near-term pressure on operating margins, Alphabet has long positioned itself for long-term growth through innovation and investment in its infrastructure.

For this reason, investors seeking sustained revenue growth should monitor developments in Google Cloud and AI integration closely. Nevertheless, Alphabet remains a solid investment due to its sound financials and leadership in important technology sectors-even as the market is likely to remain volatile.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.