Summary:

- Short interest in Alphabet has surged by 10.4% in the latest cycle.

- It seems like the Street is expecting Alphabet’s shares to remain subdued in the near future.

- Investors may want to rethink their thesis in the name.

JHVEPhoto

Alphabet’s (NASDAQ:GOOGL) (NASDAQ:GOOG) shares are down nearly 30% over the past year, but the shareholder’s pain might still continue. Latest data reveals that short interest in the stock surged by over 10% in the last reporting cycle. This indicates that market participants have actively shorted Alphabet’s stock in recent weeks and suggests that they anticipate the downtrend to continue in the near future as well. This should come across as a concerning sign for Alphabet’s long-side investors. Let’s take a closer look to gain a better understanding of it all.

Rise Of The Shorts

For the uninitiated, short interest is basically the total number of short positions that are open and are yet to be covered at the end of each reporting cycle. A sharp rise in the metric indicates that market participants actively shorted a stock with the anticipation of profiting from a swift decline in the underlying stock’s value. Conversely, a notable decline in the metric indicates that market participants have actively wound up their short positions in the concerned stock as, perhaps, they feel it has become fairly or even undervalued. So, the short interest metric basically helps us in gauging the Street’s ever-evolving sentiment pertaining to any given stock.

Coming to Alphabet, its short interest amounted to 41.39 million at the end of the last reporting cycle, which was up 10.4% sequentially. As a personal rule of thumb, I consider short interest fluctuations to be material if they move in excess of 10% in either direction. So, Alphabet met that threshold this time around, which is why it caught my attention. Also, for the record, the data being referenced here is from the cycle ending mid-February and the data was disseminated in the public domain less than a week ago as of this writing. So, the data is still fresh and relevant to our discussion here.

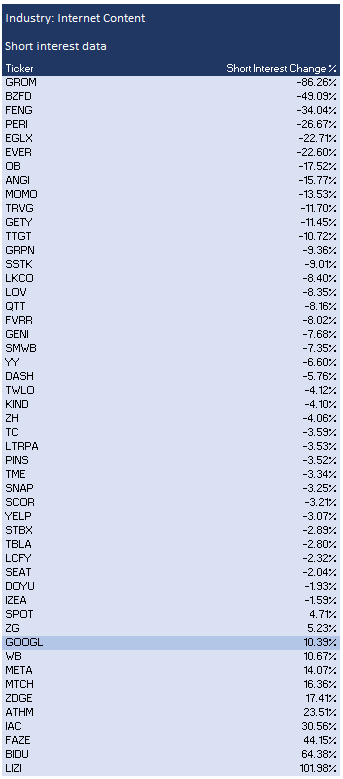

Having said that, I wanted to understand if market participants grew bearish specifically on Alphabet or on the entire industry in general. After all, if the Street had placed bearish bets on the entire industry, then Alphabet wouldn’t stand out, we’d consider it a cyclical industry trend and our discussion would end right here. So, I compiled the short interest data for 50 US-listed stocks that are classified in the Internet Content industry.

Finra website

The results were rather interesting. Out of the 50 stocks in our study group, a staggering 38 stocks saw a reduction in their short interest figures. Alphabet happens to be in the group of remaining 12 stocks that saw a short interest buildup in the last cycle. This is a clear indication that a broad swath of market participants grew neutral or even bullish on a lot many names in the Internet content industry, but they particularly grew bearish on Alphabet in recent weeks.

Now that we’ve established this fact, we’re led to another important question – why is the Street placing bearish bets against Alphabet in the first place?

Reasons for Pessimism

There are broadly three reasons, in my opinion, that have resulted in heightened shorting activity in Alphabet of late. First, Microsoft announced its multi-billion-dollar investment in a highly popular AI tool called ChatGPT nearly 6 weeks ago. It opens a plethora of opportunities for Microsoft (MSFT) – such as a more powerful search engine, enhanced grammar correction suggestions in MS Word, targeted advertising capabilities – all of which pose serious risks to many of Google’s services and threatens its core search business.

Google tried to showcase the capabilities of its own AI-bot called Bard last month, in an attempt to take on ChatGPT, but it showed inaccurate results which brought along more harm than good. Investors are now wondering if Google’s Bard will be ready for release anytime this year, and if it’ll be capable enough to compete with the already popular ChatGPT. This heightened fear, due to ChatGPT’s success and Bard’s failure, is the main reason that’s driving shorting activity in Alphabet of late.

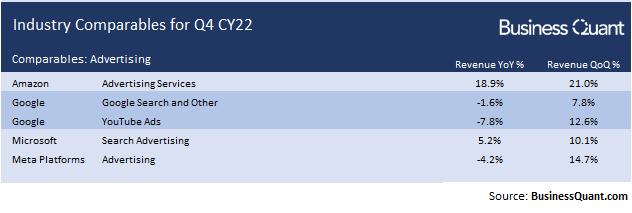

Secondly, as we companies continued to post their Q4 results throughout January and February, it became clear that Alphabet significantly underperformed its prominent rivals in its latest quarter. For instance, Google Search and YouTube Ads revenue during Q4 were down 1.6% and 7.8% year over year, respectively. On the other hand, Microsoft’s search advertising and Amazon’s (AMZN) advertising services segments posted much higher revenue growth rates of 5.2% and 18.9%, respectively. A similar picture emerged when we looked at quarter on quarter growth rates as well. This suggests that advertisers are preferring Microsoft and Amazon over Google, arguably in search of better returns on their advertising investment.

BusinessQuant.com

If this underperformance continues in future quarters as well, then Alphabet’s growth prospects would be in question and investors would begin to rethink their thesis in the name. In my opinion, this added uncertainty is another reason that attracted short-side market participants to Alphabet in recent weeks (Read – Amazon: Last Chance To Hop On).

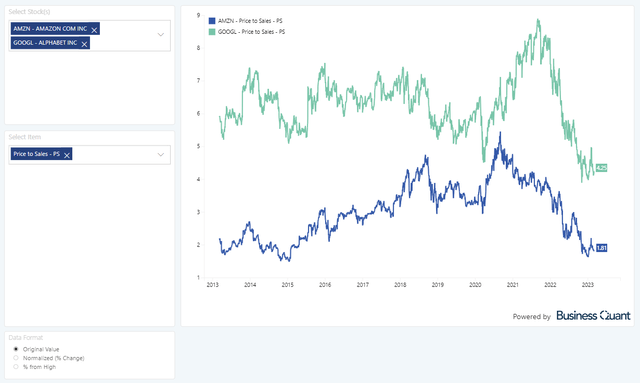

Lastly, Alphabet’s shares are trading at 4.25-times its trailing twelve months at the time of this writing. While this may seem low when in isolation, it’s actually much higher than Amazon’s multiple of 1.8-times. I say this because Amazon outperformed Google in the search business during Q4, and there’s a good chance that it’ll continue to do so in the future as well. So, I opine that Alphabet’s valuation would need to contract by way of sales growth or price correction, to be valued fairly at least in terms of Price-to-Sales metric.

Final Thoughts

I’d like to clarify that short interest data is based on trades that have already taken place in the past, and it isn’t always indicative of future price action. But the fact that short interest in Alphabet has spiked of late, suggests the Street has grown bearish on the name or at least skeptical about its prospects. This should encourage readers and investors to rethink their thesis for Alphabet, to avoid being on the wrong side of the trade direction. For now, I remain neutral on the stock and will closely watch subsequent short interest reports on the name. Good Luck!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.