Summary:

- Q4 results and 2023 guidance indicate that pre-pandemic profitability may take time to achieve.

- MCD has made remarkable progress in digitization, with 35% of its systemwide sales coming from digital channels, and has invested heavily in digital technology and menu innovation.

- The turnaround since 2015 has led to a higher return on invested capital, refranchising US stores 2015-18 was clever.

- The “Accelerating the Arches” framework is necessary to achieve a unified marketing approach and prioritize delivery, digital, drive-thru, and development, focusing on five key areas to drive growth.

- MCD is a good company with many strengths, but I am staying on the sidelines due to the rich valuation .

hapabapa

McDonald’s Corporation (NYSE:MCD)’s fourth-quarter results and 2023 guidance indicate that reaching pre-pandemic profitability may take a while. Nevertheless, MCD is well-positioned to overcome current challenges with its value-driven menu, which has helped drive global 5% comparable guest count growth. MCD growing loyalty program, reaching 50 million guests in its top markets, should drive traffic as consumers favor their favorite brands.

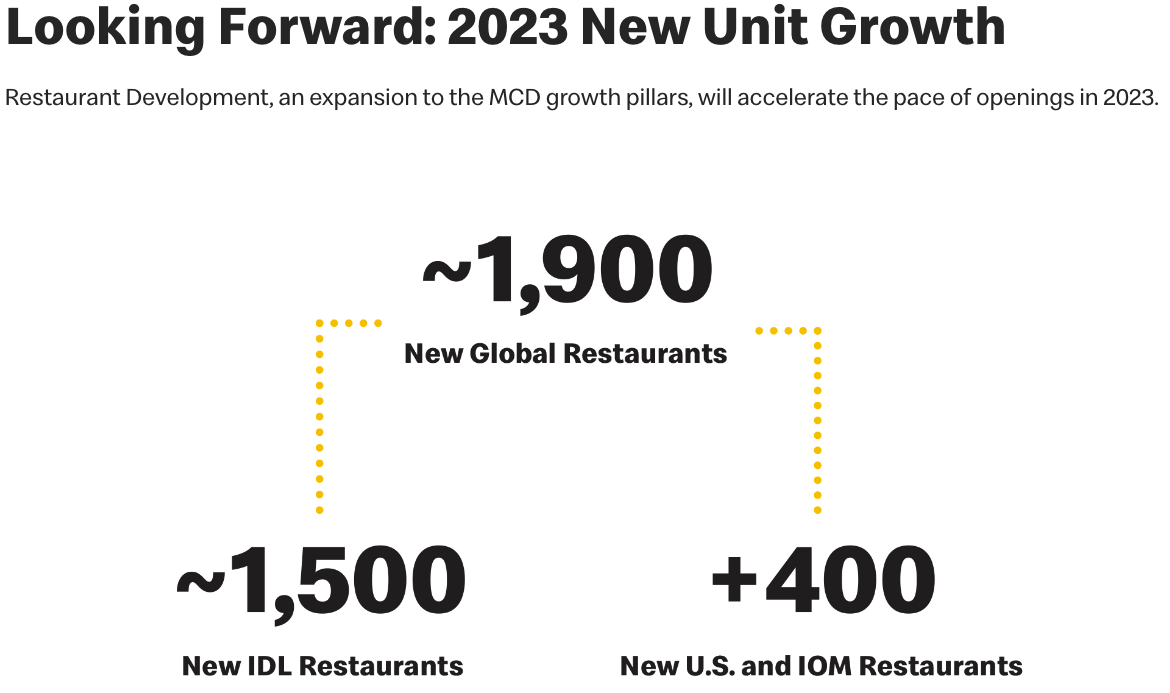

MCD plans to open 1,500 new units in 2023, which is attractive to franchisees. However, the firm will need to invest heavily in automation and franchisee support to maintain cash returns on investment in the face of higher input and construction costs.

Company website

As I will elaborate on in this article, I believe MCD is a good company with many strengths but trading at a very rich valuation. I would recommend staying away and entering if the market opens an opportunity.

The company

With its presence in over 100 markets and nearly 40,000 stores, MCD is the largest restaurant owner-operator globally. In 2021, it generated system sales worth $112 billion. MCD is known for its pioneering franchise model, allowing it to expand rapidly through partnerships with independent restaurant franchisees worldwide. The company earns the majority of its revenue, over 60%, from franchise royalty fees and lease payments. It operates across three main segments: the United States, internationally operated markets, and international developmental/licensed markets. At the end of 2021, MCD owned 55% of the real estate and 80% of the buildings in its franchise system. This substantial ownership gives the company significant leverage in maintaining quality standards and consistency.

Q4 shows healthy comparable sales growth

On January 31, MCD announced its results for the fourth quarter and for the full year. The company’s “Accelerating the Arches” strategy drove growth and built brand strength, delivering exceptional full-year performance in 2022.

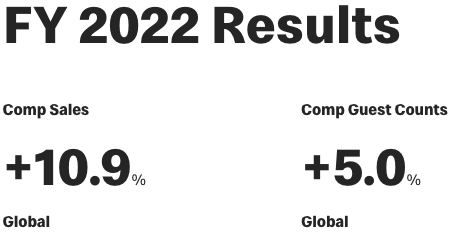

In addition, digital systemwide sales in MCD top six markets were over $7 billion for the quarter, representing more than 35% of their Systemwide sales. For the full year, comparable sales grew by over 10%, and comparable guest counts grew by 5%.

Company website

Chris Kempczinski said:

While we expect short-term inflationary pressures to continue in 2023, we remain highly confident in Accelerating the Arches, which now includes a greater emphasis on new restaurant openings. The recently announced Accelerating the Organization initiative will complement this strategy to enable the MCD System to be faster, more innovative, and more efficient. We’re proud of our continued strong performance, but we’re not satisfied. That’s the hallmark of MCD.

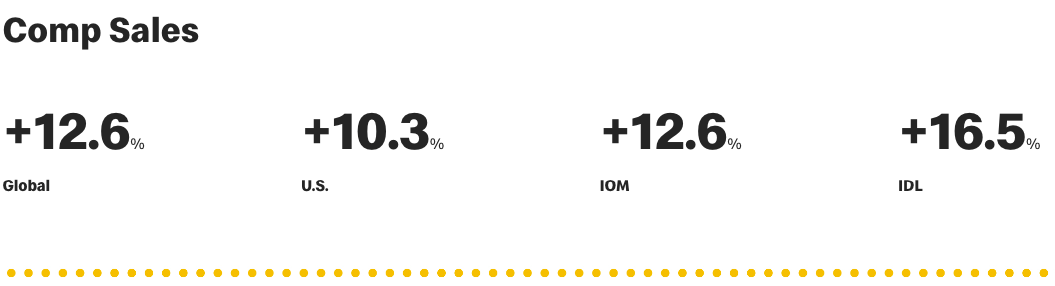

During the fourth quarter of 2022, the company’s global comparable sales increased by 12.6%, reflecting strong comparable sales across all segments. The U.S. increased by 10.3%, the International Operated Markets segment by 12.6%, and the International Developmental Licensed Markets segment by 16.5%.

Company website

Consolidated revenues decreased by 1%, while systemwide sales increased by 5%. Consolidated operating income increased by 8%, and diluted earnings per share were $2.59, an increase of 19%.

For the full year, global comparable sales increased by 10.9%, with the U.S. increasing by 5.9%, the International Operated Markets segment by 13.3%, and the International Developmental Licensed Markets segment by 16.0%. Consolidated revenues were flat, while Systemwide sales increased by 5%. Consolidated operating income decreased by 10%.

I believe that MCD has done an excellent job adapting to the changing competitive landscape, allowing it to stay ahead of the curve. MCD has made remarkable progress in digitization, with 35% of its systemwide sales coming from digital channels. The company has invested heavily in digital technology and menu innovation, prioritizing customer-centricity and technology since its turnaround in 2015.

Successful turnaround

By 2015, same-store sales had fallen for six straight quarters in the US, where MCD faced public criticism of unhealthy food and had been hurt by food safety scandals in Asia. In a 23-minute video, MCD’s CEO Steve Easterbrook acknowledged the company’s poor performance and outlined plans to restructure the organization, improve food quality, and focus on listening to customers. The company would be divided into four market segments and will aim to refranchise 3,500 restaurants to save $300 million annually. Since then the company advanced on most of these items and the improvements have been reflected in the higher return on invested capital.

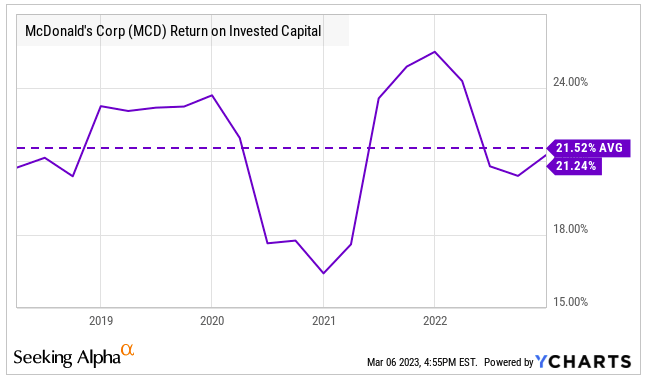

Pre-2018, the average ROIC was 13% however, in the last five years, it has increased to an average of 21%.

Ycharts

The company’s decision to extensively refranchise its U.S. store base during 2015-18 was a clever move, bringing the percentage of franchised stores to 95% from 81% in the segment and taking more than $246 million out of the general and administrative cost base from 2.2 billion in 2017 to 2.0 billion in 2018.

Accelerating the Arches

I believe MCD’s “Accelerating the Arches” framework is necessary to achieve a unified marketing approach and prioritize delivery, digital, drive-thru, and development. The framework takes advantage of the company’s cost advantages in marketing and technology investments.

Digital channels have become increasingly important for labor efficiency, improved order accuracy, and suggestive selling. Input cost inflation has also reduced restaurant margins and cash-on-cash returns, making it more critical for the company to pivot towards technology investments.

The growth strategy focuses on five key areas to drive growth: creative marketing campaigns, improving core menu items, expanding digital and delivery services, accelerating restaurant development, and implementing organizational changes to drive innovation and efficiency. They are leveraging their success with digital channels and loyalty programs to provide a more personalized experience for customers and capture increased demand by accelerating the pace of restaurant openings. The company is also focused on developing its people to drive the next chapter of growth forward.

The COVID-19 pandemic has pushed many restaurants to invest in technology, and I think that eventually, all big players in the industry will follow suit and offer omnichannel ordering capabilities. Burger King (QSR) and even Chick-fil-A are already doing it. Thankfully, MCD is already ahead of the game with their efforts towards order automation and suggestive selling, as well as their mobile app and loyalty program. These are all good moves in the right direction.

MCD’s Moat Hard to Imitate

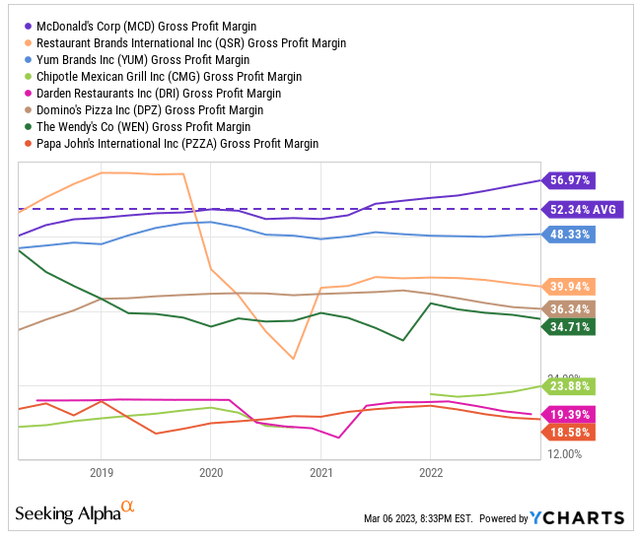

MCD operates in a highly competitive industry with low barriers to entry and minimal switching costs, making it difficult for most players to establish a moat. However, MCD has established a strong moat through its pricing power and a strong network of franchisees. Moreover, the company benefits from a durable cost advantage through its global scale, which enables it to procure supplies at lower prices and leverage investments in marketing and technology. MCD has maintained impressive margins despite rising food and labour costs.

Ycharts

Inflation to Impact Supply and Demand

MCD’s franchise model and value proposition have been pretty solid in weathering economic downturns. However, the steep rise in prime costs like food, labor, and utilities in 2022 has posed challenges. The current trend of consumers moving towards cheaper food options at home due to inflationary pressure could impact MCD’s sales momentum and pricing power if this continues. Speaking of input costs, small gradual increases can be balanced with automation and higher prices, but larger hikes can lead to dilution of margins and a decrease in restaurant margins.

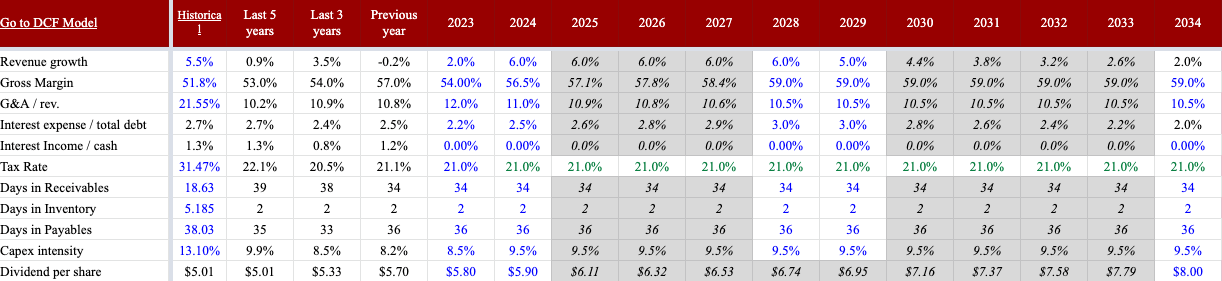

Good company but richly priced

I value the shares at $233. I used a DCF model with some key assumptions to value the company. Based on an unlevered beta of 1.17 for restaurants, I assumed a cost of capital of 7.3%. For 2023, I predicted a modest 2% revenue growth due to higher traffic of value-oriented customers offset by more customers cooking at home. But from 2024 onwards, I anticipate mid-single-digit sales growth for MCD, as the company will benefit from its pandemic investments and have fewer competitors due to smaller restaurant closures. I expect lower margins in 2023 due to inflationary pressures on input costs and wages. However, in 2024 and beyond, I anticipate margin expansion driven by automation and further digitalization. Here are the main assumptions of the model in summary.

Author estimates

Conclusion

MCD’s expansive drive-thru network and remodeled stores put it in a good position to benefit from the shift to digital ordering. The company’s investments in technology and loyalty programs can boost average check and customer loyalty. As a low-cost operator, MCD has an opportunity to gain market share despite input cost inflation and pressure from consumers to opt for cheaper food options at home. However, wage inflation in the U.S. could lead to increased price competition and a need for more automation. While the company’s shares are expensive, I will wait on the sidelines for a better entry point.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.