Summary:

- Alphabet, or Google, runs the world’s most popular search engine and has a leading advertising business.

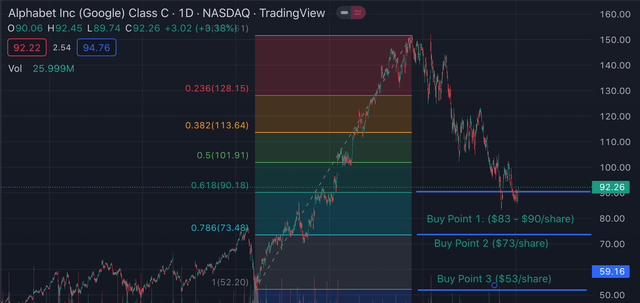

- The technical charts show Alphabet’s stock price is close to a buy range and my valuation model indicates it is undervalued.

- Alphabet’s advertising business is facing headwinds from the economy, but its cloud segment is still growing revenue rapidly.

Justin Sullivan

Google, or Alphabet, (NASDAQ:GOOGL) (NASDAQ:GOOG) owns the most popular search engine in the world and is in an advertising market duopoly along with Meta (META). Despite its strengths, the company’s stock price has been butchered by over 38% since its all-time high in November 2021. This has been driven mainly by the tepid advertising market, given then the macroeconomic environment. A positive is the advertising industry has a tendency to be cyclical by nature, thus I expect a rebound long term. In this post, I’m going to break down a technical analysis I’ve done of Google’s share price before diving into its latest business news, and valuation, let’s dive in.

Technical Analysis

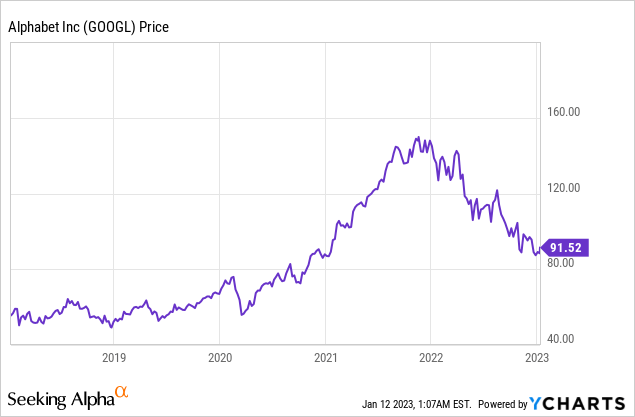

Generally, I invest in companies using fundamental indicators, however, I believe analyzing the technicals can help provide extra insight into possible buy points and drops. Below I have added a few trend lines and indicators. The first is a “Fibonacci retracement” which is the multi-colored box with lines on the graph below. The retracement has its roots in the “Fibonacci Sequence”, which is a range of mathematical numbers used in nature, from how a snail’s shell is formed to human anatomy and even structural design. In this case, I have added a Fibonacci retracement between Google’s 2020 (CV19) low share price of $52 per share and its high of ~$150 per share. This has given us a range of support and resistance lines, which I have used with my own analysis of the chart to create a range of “buy points”. The first (Buy point 1) is between $83 and $90 per share, which is where the stock trades at the time of writing. This matches with a similar buy range reported in November 2020. This looks to be an area where buyers and sellers have consolidated, which has caused horizontal movement before the stock price has blasted higher.

Google Technicals (Q3,22 report)

If the stock price breaks through Buy point 1, which is possible given the forecasted “recession”, then “Buy Point 2” at $73 per share is likely. This matches the Fibonacci retracement number and also the “top” of 2019/early 2020. In a “worst case” scenario, which would be the equivalent of another pandemic (without stimulus), Google’s share price could drop to $53/share, labeled as “Buy point 3”. Although, technical analysis isn’t an exact science it is used by investors such as billionaire Stanley Druckenmiller, who made over $1 billion in a single day shorting the British pound along with the iconic George Soros.

Business Updates and “Moonshots”

In previous posts on Alphabet I have covered its business model in more detail, but here is a quick update on new business changes and its “Moonshots”.

Alphabet has recently slashed jobs at its healthcare unit Verily by ~15%. In an email to employees on Wednesday, January 11th, Verily CEO Stephen Gillet confirmed the job cut, which was part of a financial restructuring. Verily has previously created ground-breaking technology such as a contact lens that can be used to detect diabetes. In addition, the company created one of the first CV-19 testing platforms, which former President Trump discussed in early 2020. Verily sits in Alphabet’s “Other Bets” business and is not a key part to the company’s core. The segment has also been raising capital externally for many years. This includes an $800 million capital raise from Singapore-based Temasek in 2017. However, personally, I think this recent job cut highlights the lack of focus Alphabet has with its multiple divisions and subsidiaries. The recent job cut could pave the way for a spinoff of the segment, but I am just speculating at this point.

Alphabet’s “Other Bets” strategy makes sense on paper, invest in a range of “moonshot” businesses, most will do poorly but you only need one or two major successes to generate significant revenue. This follows the “power law” of venture capital investing, which is commonly adopted. Alphabet’s “Moon shot” factory is called “X Development”. The philosophy of this R&D lab is to create a “10X improvement” in technology, as opposed to just a “10%” or incremental improvement. This follows a previous speech by founder Larry Page which highlighted that most major change must be achieved “evolutionarily”, not just “incrementally”. Its “moonshot projects” include Tidal, an underwater ocean monitoring system, internet weather balloons, and even Project Wing, a drone delivery service. Personally, I see the potential in some of these projects but some such as “Mineral” a farming project seem extremely unrelated to its core business. There have also been some unsuccessful stories in the past such as “Google Glass”. Although I personally believe this project was ahead of its time and would now make a lot of sense given the rise of the “Metaverse”. For example, competitor “Meta” has gone all in the Metaverse and is developing a range of “Google Glass” style wearables for Augmented Reality and even scoring commercial partnerships with companies such as Ray-Ban.

Google co-founder Sergey Brin wearing Google Glass (Google/Time 2014)

I believe Google’s self-driving vehicle unit Waymo has huge potential. Waymo is already fully operational in Phoenix Arizona, where you can call a taxi using the “Waymo One” application and take a ride. The company has recently expanded its vehicle range to cover Phoenix airport trips, which is a positive sign. Alphabet penciled out a ~20 square mile radius in Phoenix, which has now close to doubled to 41.2 square miles. Waymo has also been rolled out in San Francisco, where the service covers a 46.5 square mile area.

The beautiful thing about the Waymo project is its time to service has been accelerated. For example, it took the company three years to go from a “limited testing” phase to rider trips in Chandler, Arizona. But in San Francisco, it took just one year and just 6 months for downtown Phoenix. However, the company still has many challenges ahead. For example, Waymo autonomous vehicles tend to perform much better in dry climates with less rain, hence the rollout in Phoenix and San Francisco. In addition, the company is still waiting for approval by the California Public Utilities Commission to begin to charge riders for trips, thus the segment isn’t technically making real revenue yet. A positive is Waymo offers a 24-hour service, which means users can use the vehicles in day or night. This is positive for a few reasons, firstly getting a taxi early in the morning can sometimes be challenging, as us humans like to sleep. In addition, rival Cruise (owned by GM) only offers its service in San Francisco in the evening, which could be due to the low traffic, etc. Thus at first glance it looks as though Waymo is ahead on the technology front.

My only issue with Google is as they are so gigantic and successful (over $1 trillion) market cap, they seem to be moving slower and are a lot more risk-averse than certain competitors. A prime example of this is Tesla (TSLA), which offers a “gung ho” style to its self-driving vehicle rollout. Tesla is the world’s largest EV maker and it arguably has more vehicles on the road collecting “self-driving” data, than almost anyone else. If/when Tesla masters the accuracy of its self-driving, it can simply flip a switch and roll out its technology to a few million vehicles with a simple software update. The business delivered over 1.3 million cars in 2022 alone. Another example is the recent viral adoption of ChatGPT, an AI chatbot, pioneered by Open A. I institute. This platform has been adopted by millions of people and offers a more seamless alternative to Google search. This platform left Google red-faced as it was reported Alphabet has similar technology but didn’t release it because of reputational risk due to accuracy. Long story short, the viral adoption of ChatGPT caused a “code red” inside of Google, so hopefully this will sharpen the focus of this great company.

Advanced Valuation and Financial Recap

In previous posts on Google, I have already covered its financials so here is a quick recap, then I will dive into my valuation model.

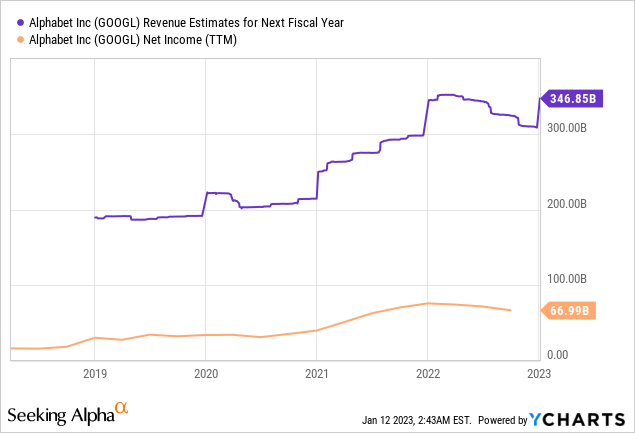

In the third quarter of 2022, Alphabet reported revenue of $69.1 billion which increased by 6% year over year. This was an extremely slow growth rate relative to historic growth rates. For example, the company grew its revenue by approximately 41% between 2020 and 2021. The good news is this slower growth was mainly driven by the aforementioned cyclical advertising market. Also on an FX-neutral basis its revenue actually increased by 11% year over year.

Google Cloud is still a growth engine for the company and increased revenue by a blistering 38% year over year to $6.9 billion. I forecast this segment to continue to grow rapidly given the trends around digital transformation. The cloud industry was valued at $429.5 billion in 2021 and is expected to grow at a 15.8% Compounded Annual Growth Rate [CAGR] reaching a value of over $1 trillion by 2028.

Google generated Operating Income of $17.1 billion, which fell by 19% year over year. This was pretty eye-watering, but if we put it into context, it’s not too bad. The company increased its investments in data center infrastructure (for its rapidly growing cloud business), as well as its R&D and marketing for new products. Thus I would deem these metrics to be more “investments” as opposed to “expenses”. Its total Operating expenses rose by 26% year over year to $20.8 billion.

Alphabet has a solid balance sheet with $116.3 billion in cash, cash equivalents and marketable securities. Alphabet does have high total debt of over $29 billion. However, a positive is this is manageable as ~$12.8 billion “long-term”. I also believe non-interest-bearing operating leases may be mixed up in this debt figure.

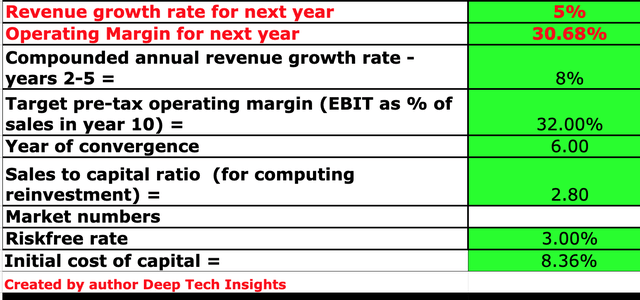

To value Google or Alphabet, I have plugged its latest financials into my discounted cash flow model and adjusted estimates based on recent business updates. I have forecast just 5% revenue growth for next year. This is very conservative and driven by the forecasted recession and a cyclical pullback in advertising spend. In addition, I have forecast 8% revenue growth in years 2 to 5, as economic conditions improve and advertising spend returns.

Google stock valuation 1 (Created by author Deep Tech Insights)

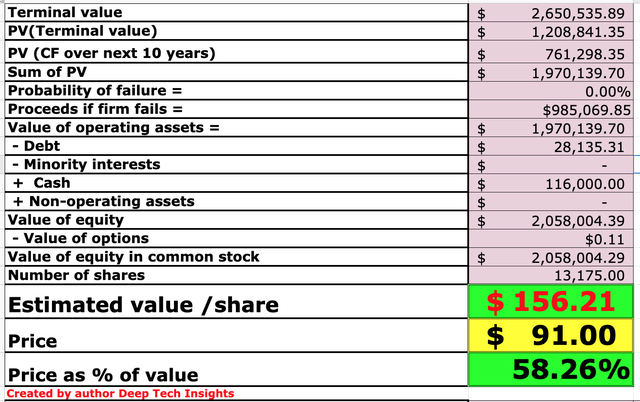

To increase the model accuracy I have capitalized R&D expenses which has lifted net income. In addition, I have forecasted a slight improvement in its “adjusted” operating margin to 32% over the next 6 years. I forecast this to be driven by continued growth in the cloud segment and improved monetization its “YouTube shorts” format.

Google stock valuation 2 (created by author Deep Tech Insights)

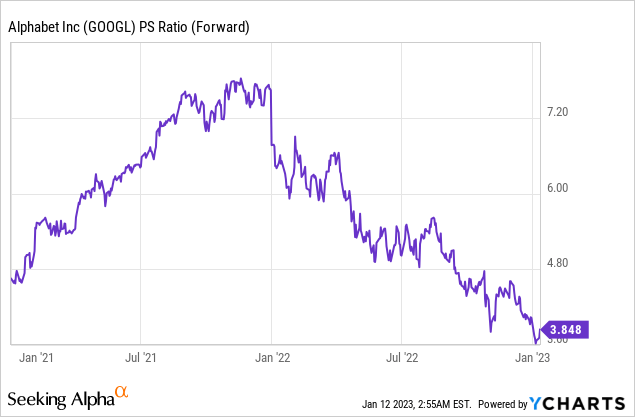

Given these factors I get a fair value of $156 per share, the stock is trading at ~$91 at the time of writing and thus is over 40% undervalued. Alphabet also trades at a price to sales ratio = 4, which is 32% cheaper than its 5 year average.

Risks

Advertising Market/Revenue concentration

Alphabet generates approximately 90% of its revenue from advertising. This means the company has a focused revenue concentration, which can make the company prone to declines in the advertising market. Many analysts have forecast a recession in 2023 due to the high inflation and rising interest rate environment. Even if a recession doesn’t occur, fear and uncertainty are already embedded into the hearts of advertisers.

Final Thoughts

Alphabet or Google is a tremendous company and one of the greatest on the planet. The company’s advertising business is extremely dominant and has been a cash cow for decades. Despite the advertising market being tough currently, it has historically been cyclical by nature. Google stock is currently undervalued intrinsically and level with a buy range on the technical chart. Things could get worse before they get better, but long term Alphabet’s success is likely to continue.

Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.