Summary:

- Alphabet stock is undervalued compared to its peers and presents an opportunity for investors.

- The company has strong financials with a large cash position and steady growth in margins and profitability.

- GOOG is the top pick among the Fab 5 stocks and has the potential for continued success in AI, search engine dominance, and advertising revenue.

Alexander Koerner

Investment Thesis

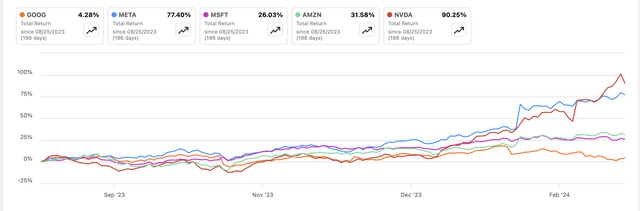

Since my first article on Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), the company saw a 7% return, and compared to the other four of the Fabulous 5 stock price performance, GOOG is not getting any love from investors, which I think presents an opportunity to get in early before the company catches up. The company’s prospects are great, with steady growth in all avenues of business, yet the performance since the first article has been somewhat underwhelming, to say the least. Alphabet is the only fundamentally undervalued company from the Fab 5 list of companies, comprising Meta Platforms (META), Microsoft (MSFT), Amazon (AMZN), and the hyped stock Nvidia (NVDA).

Price performance of Fab 5 Since first article (SA)

Briefly on Financials Performance

As of FY23 ended Dec. 31, the company had around $111B in cash and short-term investments against around $13B in long-term debt. That debt number is very small compared to its cash position and total market capitalization, so it’s safe to assume the company is at no risk of insolvency. If the company wanted, it could just pay off that outstanding debt in no time. The company is making more on interest income than it pays out in interest expenses. Furthermore, the company’s current ratio is still very strong, at around 2, so it’s safe to say the company has no liquidity issues. Let’s look at how the company’s other metrics progressed throughout 2023, starting with margins.

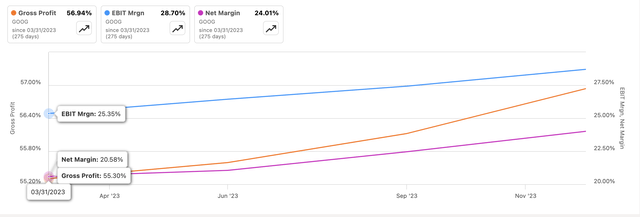

Here, we can see a clear upward trend over the year, which is a good sign. Margins across the board saw an increase of 200bps to 400bps over the last year, indicating the company is becoming more efficient and profitable.

Margins (SA)

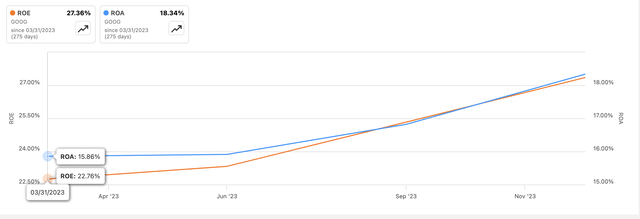

Unsurprisingly, the company’s ROA and ROE also have seen an improvement along with the bottom line, indicating management is utilizing the company’s assets and shareholder capital more efficiently and creating value. Even at the beginning of the year, these were very impressive, to say the least.

ROA and ROE (SA)

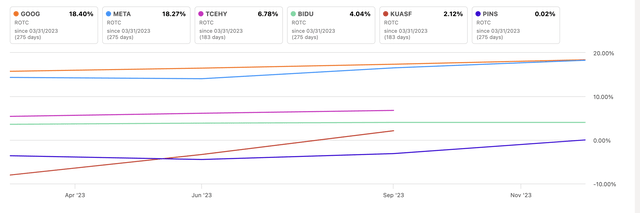

In terms of competitive advantage as compared to its peers (as per Seeking Alpha), GOOG is leading the way in terms of return on total capital, or ROTC, with Meta Platforms (META) a close second, while the rest are not even close. This tells me that the company is enjoying a decent amount of competitive advantage and has a strong moat, which is clear when you have a verb named after your search engine.

ROTC vs Peers (SA)

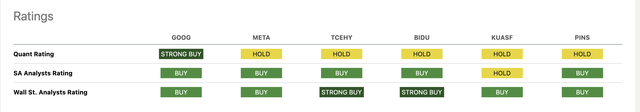

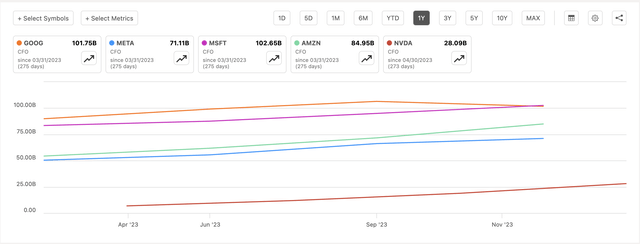

Digging deeper into comparisons vs. its peers, we can see that GOOG is the only one with either a Buy or Strong Buy rating across the board, while the rest are somewhat mixed.

Quant Ratings (SA)

Furthermore, the company’s Quant Factor Grades are either B+ or A+, except for Valuation which is a D. I don’t necessarily agree with that because the Communications Sector is not the best sector to put GOOG in because I don’t think a FW PE ratio of 20 is particularly high for GOOG. In fact, its median has been around 25 over the last five years.

Factor Grades (SA)

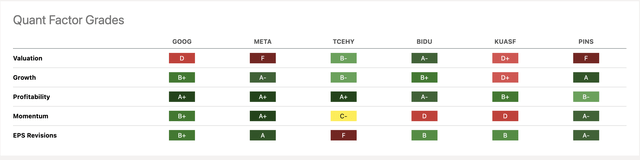

Now, let’s look back at the Fab 5 stocks and how they stack up against each other. Here, we can see GOOG is still the top pick, with Strong Buy and Buy ratings across the board.

Ratings vs other Fab 5 (SA)

In terms of total return performance, all of the companies had relatively good performance over the year, but NVDA and META have seen their share prices skyrocket, both for different reasons. META was very undervalued at the beginning of the year trading at a measly 11x P/E when I wrote my first article on it, which you can find it here. It was only a matter of time before people realized the cash cow Meta Platforms continues to be, and that translated into a 258% return since the beginning of January 2023. NVDA on the other hand saw its share price skyrocket not because of fundamentals but because of the success of transitioning into more than just a graphics card company and into a data center juggernaut with over 200% top-line growth year-over-year as the AI hype train continued to accelerate. In my opinion, the explosion in the share price of NVDA cannot be sustained for too long, and when the revenue growth begins to slow down, we will see a lot of profit taking, especially people who have tripled or even 10Xed their initial investment.

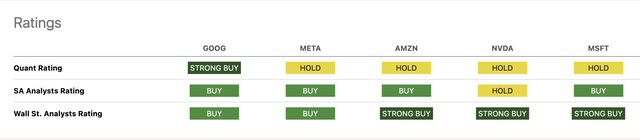

I think GOOG is going to have a situation similar to Meta, as I think it’s quite underappreciated fundamentally. The company is generating around $100B in cash from operations, which is higher than most of the Fab 5 stocks, except for MSFT, which is still just on par with GOOG while the rest are further down.

Cash from Operations of Fab 5 (SA)

If we pair the above comparison with the most fundamental metric, which is the P/E ratio, we can see that even if MSFT generates more CFO, it’s trading at a 57% premium compared to GOOG. NVDA’s FW P/E ratio is still at around 35 and is generating about a third of cash from operations and a third of total revenues.

TTM PE of Fab 5 (SA)

So, it looks like GOOG is being somewhat neglected and forgotten when every other company is trending higher on the AI hype, even though GOOG will be at the forefront of innovation when it comes to AI applications. Which one of these five seems to be the most appealing to you? I think the risk/reward is the best in GOOG in my opinion.

Comments on the Outlook

When it comes to AI and the company’s premier search engine, I see a lot of opportunities for improvement. I have been using Bard, now called Gemini for a while and before that, I was using MSFT’s Bing AI for my everyday internet searching, and I have to say I preferred Bing’s AI to the current Gemini. What I haven’t done in a while is search for terms manually as we did just a year or so back, it’s much easier now to type in natural speech rather than search for the main terms of the query. What’s missing a lot of the time when searching with Gemini, is fact checking. You can press the little “G” icon to fact-check Gemini’s answers but a lot of the time there is no source for information that the bot spits out, even though it sounds very convincing that it knows what it’s talking about. As I said, there’s a lot of room for improvement, and with such deep pockets, I’m sure we will be getting quite a competent search tool over the next year. GOOG’s search engine dominance at the end of 2023 remained strong at over 90% of all users using Google Search, so if it can create a more competent search engine bot, I don’t see how this dominance is going to be beaten.

When it comes to downtime in my household, our go-to streaming service is YouTube Premium, which is growing at a decent pace and is now the “key driver of their subscription revenues.” While there’s a decent chunk of revenues coming from subscriptions, most of the revenues on the platform come from advertising, which is what the company is known for in the first place, as around 77% of total revenues still come from some sort of advertising. This is changing but very slowly. Back in 2021, advertising revenue represented around 81% of total revenues. With the massive reach of YouTube worldwide, it’s very enticing for advertisers to run ads on the platform and that is not going to change any time soon.

The company’s Google Cloud revenue segment has seen somewhat of a slowdown. It grew at around 26% in FY23, which is much slower than what it managed to achieve over the last three years, around 43% on average. With a vast array of new implementations introduced throughout the year, the company will see decent growth in this segment of revenues, which I don’t think will become very high, but certainly contribute a decent amount to the top line. The company’s Vertex AI platform is seeing a lot of adoption with many enterprises opting to try out its comprehensive AI platform. While businesses continue to experiment with Gen AI, GOOG will reap the rewards of this curiosity of how to implement the new technologies to help customers in many different businesses.

The company has a lot of potential to continue to perform well over many years, and I think that these are not being appreciated enough by the majority of investors. Let’s look at my updated DCF model.

Valuation

For revenues, I think I went with a more conservative outlook, which should act as a margin of safety in the end. I separated revenues into three different segments, mainly Google Services, Search, YouTube Ads, Google Network, and Google Subscriptions, platforms, and devices. The other segment is Google Cloud, while the last one is Other Bets. Google Services will see around 8% CAGR over the next decade in the base case scenario, while Cloud will see around 15% CAGR, which I think is reasonable. In terms of Other Bets, I’m keeping it very conservative and will assume the company is going to lose $5B every year. For context, Other Bets were usually positive outcomes in the past, but for conservatism, I decided to assume the bets didn’t work out. Below are those assumptions and their respective CAGRs.

Revenue Assumptions (Author)

In terms of margins, I’m going to keep it quite consistent over time and have improved these by around 200bps over the next decade. As I mentioned in the beginning, the company saw improvements of 200bps to 400bps across the board in just one year, so my assumptions are more on the conservative end for sure. Below are those estimates.

Margins and EPS Assumptions (Author)

For the DCF model, I went with the company’s WACC of 8.5% as my discount rate and 2.5% as my terminal growth rate. Furthermore, I’m going to add another discount of 15% to my final intrinsic value calculation just to be extra safe and give myself more room for error. With that said, GOOG’s intrinsic value is $163.25 a share, which means the company is trading at around a 17.5% discount to its fair value.

Intrinsic Value (Author)

Closing Comments

It was no surprise that Alphabet is trading at a discount compared to the other Fab 4 mentioned above. It has been performing well over time and it will continue to perform well, which means we may not see an explosion in share prices as we did with Meta or NVDA. If GOOG was trading at a P/E ratio of 11 while retaining such performance, then yes, it would see an explosion in its shares, however, stable, constant growth in all segments is still better than declines, and if the company continues to perform at this level, shares will follow suit and people won’t even notice when the company reaches a $2T market capitalization. If there’s one company that deserves to join the $2T market cap is Alphabet, with its stable performance throughout the years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.