Summary:

- PepsiCo, Inc.’s recent revenue decline and missed targets highlight limited growth after several years of unsustainable inflation boosts.

- Investors over-love the Dividend Aristocrat concept, making the investing focus too much on dividend hikes and not enough on earnings growth rates.

- PepsiCo stock is overvalued compared to its financial goals and trades at nearly 3x the growth rate, leading to underperformance in the recent past and future.

JHVEPhoto

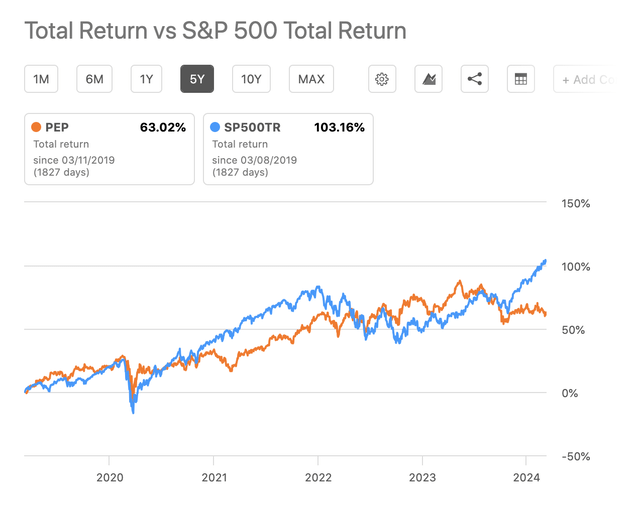

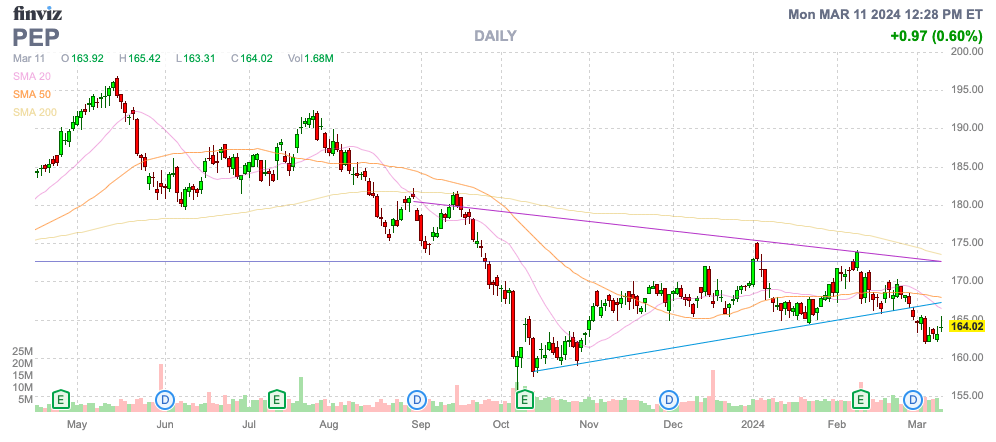

PepsiCo, Inc. (NASDAQ:PEP) has turned into one of the most over-owned stocks despite consistently meager growth results. The stock price is vastly disconnected from the growth opportunities ahead, even after years of PepsiCo underperforming the S&P 500 (SP500). My investment thesis is Bearish on the consumer staples stock still trading at a premium valuation, even after the large dip from the highs last May.

Source: Finviz

Focus On Actual Growth Metrics

PepsiCo started last month by reporting Q4 ’23 financials where revenue actually declined from last year and missed analyst targets by a large $520 million. The company is now a massive beverage and snack foods conglomerate with limited growth, as annual revenues have topped $90 billion and COVID-related inflation boosts led to unsustainable revenue growth.

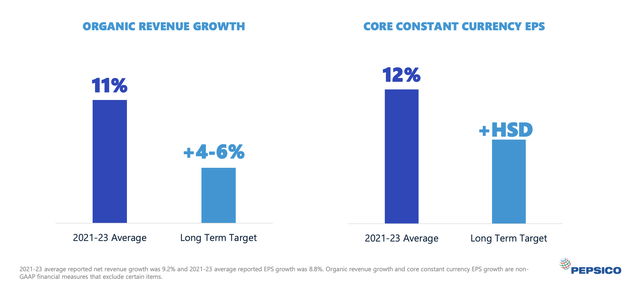

The company guided the 2024 financial targets as follows:

- Organic revenue growth of at least 4%.

- Core constant currency EPS growth of at least 8%.

Due to currency headwinds, PepsiCo guided to only 7% EPS growth in 2024 to reach $8.15 per share. By all measures, the beverage company is executing incredibly well to generate these growth measures generally aligned with the long-term targets assigned by the company.

The problem here is that the stock isn’t valued correctly based on these financial goals. PepsiCo had some elevated growth rates during COVID-19 and the latest results suggest the inflation-induced period isn’t likely to repeat going forward starting at the end of 2023.

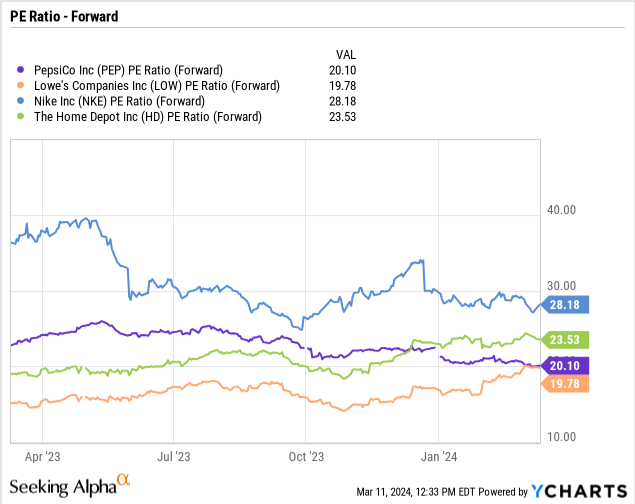

As with a lot of dividend growth companies, investors like to overpay for the stocks. A recent “core list” from Wells Fargo includes a lot of consumer stocks with excessive forward P/E multiples such as NIKE, Inc. (NKE) trading at 28x EPS targets and The Home Depot, Inc. (HD) and Lowe’s Companies, Inc. (LOW) trading close to the 20x EPS targets of PepsiCo.

The home improvement stocks outperformed over the last year in part due to trading at lower P/E multiples during 2023. The market is now making the same mistakes with Home Depot and Lowes and investors in PepsiCo should take note of how a stock like Lowe’s trading down to $180 last year with a $12 EPS target for 2024 is what made investors money over the last 6 months in those stocks.

The above target for revenue growth of only 4% to 6% makes a very difficult path for PepsiCo to generate the growth to reward investors at 20x EPS targets. The stock trades at nearly 3x the growth rate when anything above 2x is considered expensive.

Over-Loved

A prime example of how PepsiCo is over-loved was the inclusion on the Wells Fargo list of outperforming companies despite the stock not coming anywhere close to outperforming for years now. The S&P 500 has produced a 103% total return in the last 5 years, while PepsiCo has only generated returns of 63%.

In essence, PepsiCo isn’t technically expensive compared to the dividend growth market as outlined by some favorites above, the stock is just expensive compared to growth targets. This valuation scenario is a prime example of why the stock has underperformed recently.

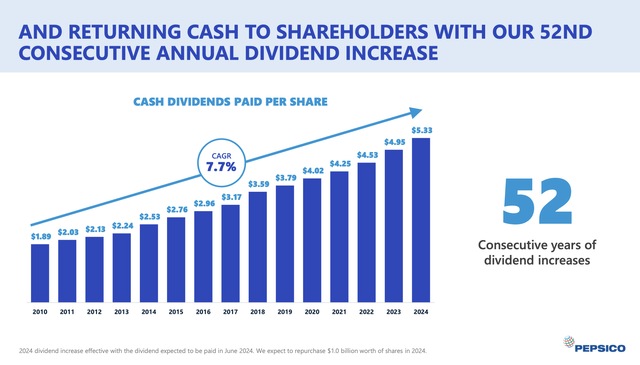

The company has consistently hiked dividends at a solid clip leading to the desire by investors to overpay for the stock. A lot of investors will automatically buy a stock like PepsiCo with 52 years of consecutive dividend increases leading to inclusion in the Dividend Aristocrat concept.

The concept pushes investors into stocks with a history of hiking dividends for at least 25 years. The problem is that the investing concept doesn’t ensure investors don’t overpay for those stocks in the process leading to subdued returns in the future with a lot of investors piling into the same stocks.

PepsiCo only has a 3.1% dividend yield due to the excessive stock valuation. The stock has already fallen from a high above $195 earlier this year to only $164 now, but PepsiCo still trades at 20x forward earnings despite this dip.

The beverage and snack food company has a net debt balance of ~$34 billion. If anything, one can argue PepsiCo should spend more cash on paying down debt versus hiking dividend yields by 7% annually. Dividend payouts shouldn’t really occur on a stock with massive debt obligations, leaving the company in a precarious position, if anything ever happened to operations or efforts to cut unhealthy soda and snacks.

The stock isn’t cheap just because PepsiCo has fallen over $30 from the highs. The company even pays out over 60% of profits for dividends, limiting any upside in the dividend hike due to profit growth.

The key is that the stock should be trading close to 15x EPS targets based on the forecasted earnings growth. PepsiCo would trade at closer to $120 based on this multiple, and investors could return to more market-type gains versus the current scenario where the premium valuation has led to vast underperformance similar to the sector as a whole.

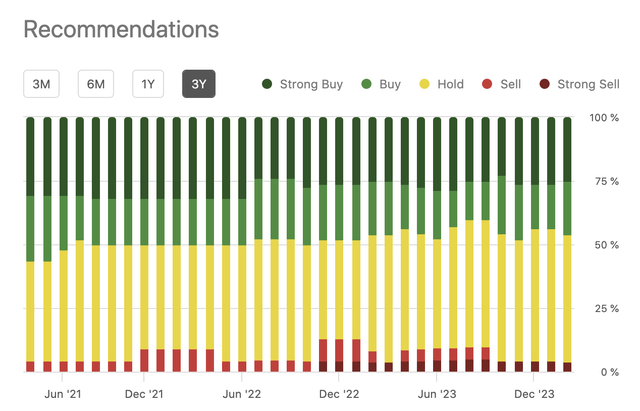

As much as the case can be made for PepsiCo not trading at this elevated valuation, and even knowing the stock has fallen 15% in the last 6+ months, analysts haven’t been bearish on the stock. Only 2 analysts had a Sell rating on the stock at the stock peak last May, and only 1 analyst is still bearish on the stock now. One has to wonder how nearly 50% of the analysts remain bullish on PepsiCo.

Takeaway

The key investor takeaway is that PepsiCo, Inc. is another stock investors shouldn’t love as much. The constant dividend hikes have led investors to overpay for the stock. At the right price, the company would offer investors great returns similar to the market, but PepsiCo is set to underperform for years in the future with the valuation mismatched with the growth targets.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.