Summary:

- Google reported a third consecutive quarter of declining YouTube advertising revenue.

- Monetization of Shorts has just started, and early numbers suggest that there is a lot of growth potential in it.

- Headwinds for TikTok will likely increase in the next few quarters, which should help increase the advertising growth on YouTube.

- The rapid increase in YouTube Premium and ad-free viewing should be taken into account while calculating future revenue growth of YouTube.

400tmax

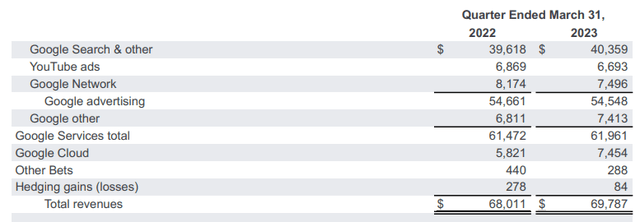

Alphabet’s (NASDAQ:GOOG) (NASDAQ:GOOGL) recent earnings showed another quarter of YoY revenue decline for YouTube ads. In the year-ago quarter, YouTube ads reported $6.86 billion of revenue while recent quarterly revenue came to $6.69 billion. This is equal to a 2.5% decline. YouTube ads growth was considered as a key growth driver for the company while the core Google Search segment faced saturation. However, the decline in the recent quarters needs to be viewed in the context of rapid growth in Shorts platform and the higher YouTube Premium subscription which allows ad-free viewing.

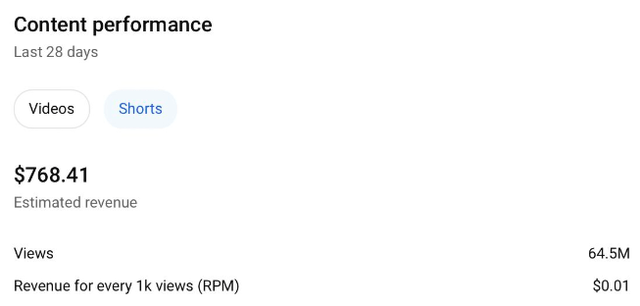

Google started monetization of Shorts in the last quarter but it is still in a very early stage according to data from creators. The RPM of views is as low as $0.01 and it will be a few more quarters before this number increases to a more respectable level. The challenges faced by TikTok should help in rapid increase of viewer engagement for Shorts as well as better monetization. Investors need to look deeper into the revenue numbers reported by YouTube to gauge the long-term potential of this segment.

YouTube trend

The decline in YouTube ads revenue for the past few quarters has led some analysts to view this segment as reaching its saturation level. However, the decline in YouTube ads needs to be looked at from a macroeconomic perspective. Other ad platforms like Meta (META) have reported slower growth and Amazon’s (AMZN) advertising business has also shown lower growth numbers due to macroeconomic headwinds. It is likely that these challenges will go away within the near term as inflation rate is tamed.

Company Filings

Figure 1: Decline in YouTube ads while increase in subscription revenue. Source: Company Filings

YouTube ads still contribute close to 10% of the revenue base for Google. The cloud segment has overtaken YouTube ads in terms of revenue but we should expect better numbers from YouTube in the next few quarters.

Shorts monetization will improve

YouTube has started monetizing the Shorts platform recently. Latest reports suggest that there has been a massive increase in the views but the revenue from these views is still quite low. Creators like Brooke Monk posted their revenue from the early monetization of Shorts. She gained $768.4 from 64.5 million views which equates to RPM of $0.01. Usually, YouTube’s longer-form videos have RPM in the range of $1 to $4 within US. Hence, we can see that there is still a long way in improving the revenue from this platform.

Figure 2: Slow start to Shorts monetization. Source: Brooke Monks LinkedIn

TikTok ban is gaining steam and is one of the few issues where there is strong support from both sides of the aisle. Other important regions including EU have also looked into banning TikTok and we might see a complete ban on TikTok before the next Presidential cycle starts. TikTok is already banned in major regions like India which should help YouTube Shorts as well as Instagram Reels.

Rapid growth in subscription

Another factor influencing YouTube ads is the rapid growth in YouTube Premium subscriber base. Google reported that it has reached 80 million subscribers in September 2022. This was a big jump from 50 million subscribers in the year-ago period. The total active user base on YouTube platform is believed to be over 2 billion. The current 80 million subscriber base on YouTube would allow 4% of viewers to watch the platform ad-free.

However, these subscribers are likely to have a higher usage of YouTube compared to non-subscribers. If the subscribers spend 2-3 times the average time spent by non-subscribers, they would account for 8 to 10% of total viewership on YouTube. Hence, on a standalone basis, the subscriptions have probably led to a 10% decline in YouTube ads in the last few quarters.

On the other hand, these subscribers provide massive recurring revenue. The subscriptions also improve the ecosystem and Google is able to add new services and hardware to improve monetization of these subscribers. The company is already promoting its new Pixel phones through Pixel Pass which YouTube subscribers can gain at a lower cost.

This is reflected in the growth of Google Other revenue. This segment increased from $6.8 billion in the year-ago quarter to $7.4 billion in the recent quarter, which is a 10% jump.

At the current growth pace, YouTube Premium subscription could reach close to 200 million by 2025 which would be 10% of the userbase of YouTube. It will certainly lead to a decline in YouTube ads segment but will also help in improving revenue from subscriptions. Wall Street has usually valued recurring subscription revenue at a higher multiple compared to online advertisement. A big jump in subscriptions should help in improving the long term returns for the stock.

Impact on Google stock

We could see another few quarters of negative or slow growth in YouTube as viewer engagement on Shorts increases. However, the improvement in monetization of Shorts is almost certain as the company reaches its goals in terms of engagement. The increase in paid subscribers for YouTube Premium lead to a decline in ad revenue for YouTube. This decline could be as high as 10% on a standalone basis and would increase in the near term as more users get paid subscriptions to allow ad-free viewership. The long-term impact of subscription would be very positive as it helps the company create a recurring revenue base and improves the ecosystem building a halo effect for other services and products.

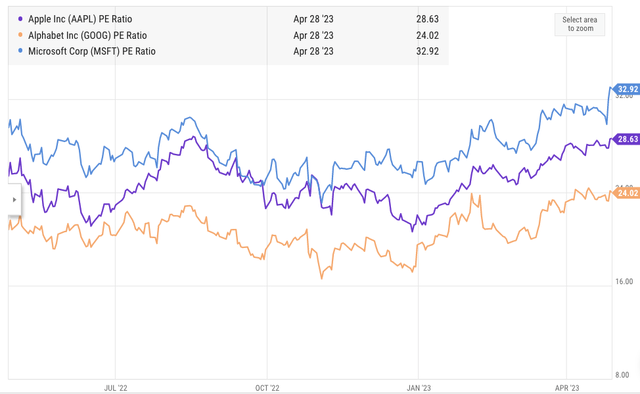

YCharts

Figure 3: Alphabet is quite cheap compared to other big tech peers. Source: YCharts

Alphabet stock has gained a lot in the year-to-date. It is still cheaper than Apple (AAPL) or Microsoft (MSFT) while showing a robust improvement in its subscriber base. The near-term headwinds for YouTube ads due to higher viewership in Shorts should pass away in the next few quarters. YouTube is still a major tailwind for Alphabet which should help the company build a better ecosystem and improve the revenue trajectory as the macroeconomic conditions become better.

Investor Takeaway

Alphabet has reported third consecutive quarter of YoY revenue decline in YouTube ads. Some of the blame is on the economic situation due to which advertisers have reduced their budget. However, YouTube is also facing a slowdown as more users watch Shorts where the monetization is very low. A complete or gradual ban on TikTok would help in improving user engagement and monetization on Shorts.

A very rapid increase in YouTube Premium subscription numbers has also reduced the advertising revenue for YouTube as more users are able to watch ad-free content. This will help the company in the long run as it builds better moat and ecosystem for its services. Alphabet stock is still quite cheap compared to other big tech options and a good buy-and-hold bet.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.