Google’s Ad-Revenue Slowdown Likely To Be Cyclical And Not Secular

Summary:

- The digital advertising market is becoming more competitive, which is usually assumed to lead to lower overall industry profitability.

- Disruption from new technology such as ChatGPT is always present, especially in the technology sector.

- Alphabet could increase shareholder value by optimizing its balance sheet.

- Alphabet’s ability to produce attractive returns on large amounts of incremental invested capital is one of its most enviable economic characteristics.

Suphachai Panyacharoen/iStock via Getty Images

Most Alphabet Inc. (NASDAQ:GOOG) (“Google”) investors were in for a rough awakening in 2022 (yours included) as the ad-tech behemoth shed roughly 40% of its market capitalization during the year (the stock has rebounded quite a bit since that). Your author confidently proclaimed over half a year ago that the company was a relatively safe wager at a price of about $110. After the volatile ride last year, you can confidently proclaim that the author shouldn’t give up his day job.

Bottom line, no company is safe from the gyrations of the market, and companies of high quality will also face a drawdown when sentiment is sour (which should be saluted as you can buy a larger share of the company’s earnings for the same dollar amount). Nothing has, in my opinion, changed in the investment thesis that I laid out in the piece I mentioned above. The highlights were as follows:

- Market leader in its segments

- Well capitalized

- Profitable

- Selling at an attractive price

- Tailwinds from the mega trends digital advertising and cloud computing.

All of these things still hold true. So why has Alphabet been hammered by the market? Has the digital advertising market’s future economics deteriorated in a significant way due to perceived increased competition from other behemoths like Amazon (AMZN), Microsoft (MSFT), and possibly Apple (AAPL)? Or are incumbent digital advertising channels such as search engines being disrupted by new technology such as ChatGPT? I believe that the short answer to these questions is no, and I’ll try to give my best account below for why I believe it is so.

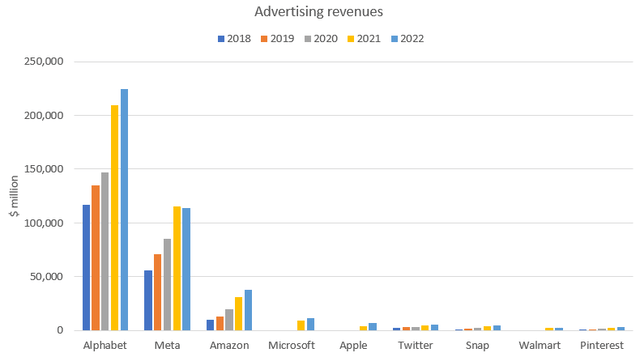

Increased competition

The digital advertising market in the West has been dominated by Alphabet and Meta for the better part of the last decade. Together, they control about half of the market. The share has, however, been decreasing due to competition from the likes of Amazon, Microsoft and Apple. The largest three advertisers are currently Alphabet, Meta Platforms (META), and Amazon (2022 figures are estimates for Microsoft, Apple, Twitter, Walmart, and Pinterest. It doesn’t alter the conclusions, however).

Advertising revenues development (Companies’ financial statements)

I would argue that Alphabet’s overall competitive position became stronger in 2022 due to the significant headwinds Meta is facing in its advertising business due to the privacy changes made by Apple and Twitter’s ongoing disruption by Elon Musk. Perhaps the largest new threats are coming from the following players:

- Amazon, which has been successful in getting advertisers on its platform

- Microsoft which has been active in the search engine advertising market for a while already with Bing. Microsoft completed the acquisition of advertising company Xandr in 2022 which helped it win Netflix as a client for their ad-supported streaming services. Also, the investment in ChatGPT has been on the news lately which some believe will disrupt the search engine advertising market

- Apple, which has been building up its own advertising efforts in its app store and Apple News. It will, however, take a couple of years to understand how successful Apple will be in this endeavor as they are still relatively small

With the increased competition and capital being allocated to digital advertising, it’s natural to draw the conclusion that the profitability of digital advertising will decrease. I believe, however, that the market can afford becoming less profitable, as it has enjoyed very attractive economics in the past (I’ll expand on this when I talk about Alphabet’s economics below). It’s also well known that the advertising market is cyclical as businesses reduce ad spending when end consumers are less likely to spend which in turn depends on where we are in the cycle (currently on the brinks of a recession). Based on this reasoning year 2023 will most likely be a slow year for advertisers but once the economy begins expanding again ad spend should come back as well. Due to Alphabet’s dominance in search advertising, they should be able to grow once this occurs.

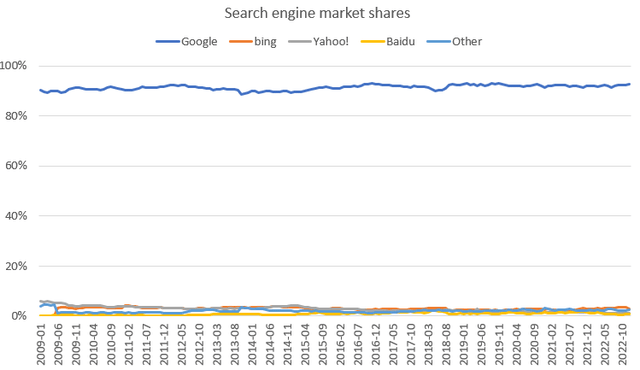

Search engine market shares (Statcounter)

Disruption

There’s been lots of talks lately about disruption in the search engine market with many headlines around ChatGPT and Microsoft’s investment in its owner OpenAI. For example Seeking Alpha reported that Microsoft may utilize ChatGPT in its Bing search engine. If Microsoft is able to showcase to advertisers that they get more bang for the buck with this new technology it may disrupt Alphabet’s search dominance. It’s worth mentioning that Alphabet has taken the threat seriously and have similar technologies such as LaMDA.

I’m personally not a visionary enough to conclude whether ChatGPT or some other nascent technology can disrupt Alphabet’s dominance in search. Someday probably. But at this point in time? I haven’t seen any evidence to back up that claim. It should be pointed out that I don’t have any competitive advantages in analyzing new and upcoming technologies which is why I leave that field to people more capable in that regard. However, if new evidence would indicate a secular decline in Alphabet’s dominated search engine market as we currently know it I would obviously adjust my assumptions to this new reality. We’re still a couple of years away from that verdict in my opinion. Most people can appreciate that disruption is inevitable in every industry (the technology industry being notoriously prone to disruption). The same happened to the newspaper industry which was enjoying very enviable economics during the 80’s due to high returns on invested capital (low incremental capex spend) and almost monopoly like characteristics (only a few local newspapers per city/town). With the ascent of new advertising channels in the 90’s (for example, Google was founded in 1998), they lost market share and their competitive position degraded in conjunction with their enviable economics. It remains to be seen when this will happen to the current top players in the digital advertising industry and whether they will be able to adapt before becoming obsolete.

Alphabet’s economics

I mentioned that I believe that the digital advertising market will become less profitable in the future due to being transformed from a duopoly (Alphabet and Meta dominated) to a market structure characterized with more competition especially from Amazon, Microsoft and Apple (although Meta’s and Twitter’s positions may weaken at the same time as described above).

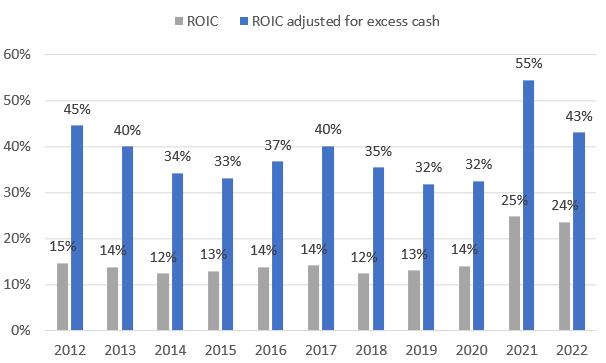

Alphabet’s ROIC development (Alphabet’s financial statements)

In the graph above, you can see what I mean when I say that I can tolerate the economics of Alphabet’s business to deteriorate to some degree. The business has returned about 12-14% on invested capital during the last decade which increased to about 24-25% during 2021-2022. I personally don’t believe that the high levels in recent years are sustainable and we’ll probably see some degradation from these levels.

A return on capital of 12-14% per year is not too unusual in the business world. What is interesting however is Alphabet’s potential returns if they would distribute all excess cash to shareholders at the end of each year (operating cash calculated fairly simplistically as 5% of annual sales which means that the rest of the cash holdings would be excess cash). The return on capital would have been above 30% for the last decade which is an extraordinary feat for a business of that size. The implications from the calculation is that Alphabet’s balance sheet, admittedly strong, is overly capitalized. As an owner of the business, it’s hard to sit by and look at all that excess cash sitting on the balance sheet idle. I would rather have it distributed so that it could be reallocated by us owners to more profitable ideas.

With that said, Alphabet’s management should be saluted for their large buyback policy in recent years (for example all free cash flow in 2022 was used to buy back shares) and I hope that it will be continued and done in even larger scale in the future. Alternatively they could implement a dividend. Anything to make the capital base more efficient so that the we as owners of the business can earn a fair return on our capital. Of course, management knows better than me what should be defined as excess cash and what is needed for their operations. What I do know is that over $100 billion sitting on the balance sheet is not needed to run the business.

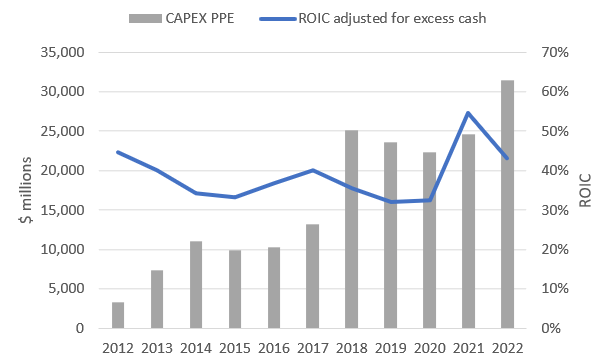

Large capex spend coupled with high ROIC (Alphabet’s financial statements)

Another enviable trait of Alphabet’s business is the vast amounts of capital it can deploy at attractive returns. If you can compound a base of $150 billion (adjusted for excess cash) at above 30% annually it sounds like a fairly attractive economic profile to me. I don’t really expect Alphabet to be able to do that in the future however due to the changing market dynamics I mentioned above. However, a 15-20% annual return on capital on a $150 billion base which is expanding is more than enough and significantly higher than the average enterprise earns.

Currently you can buy this business for about 18x year 2022 pre-tax earnings (adjusted for certain financial items) which I think is a fair deal. You probably can’t expect that much multiple arbitrage at these levels but the economics of the business are superb which in turn should increase the business (intrinsic) value for the years to come. Buy Alphabet.

Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.