Summary:

- Google parent Alphabet’s shares have jumped 21.6% since February, outperforming the S&P 500.

- The company’s cloud business, Google Cloud, is experiencing strong growth and improved profitability.

- With the global cloud computing market expected to reach $1.44 trillion by 2029, Alphabet has significant growth potential.

hapabapa

One of the best calls that I have made over the last several months has been Google (NASDAQ:GOOG) (NASDAQ:GOOGL). Since I last wrote a bullish article on the company in February of this year, shares have jumped 21.6%. That dwarfs the 4% increase seen by the S&P 500 over the same window of time. And since I originally rated it a ‘buy’ in June 2023, shares have skyrocketed by 45.2%. That’s more than double the 22.1% rise seen by the broader market. Normally, you wouldn’t expect this kind of upside from a large company. However, the market has consistently underestimated the business and the trajectory that it is on.

Of course, this doesn’t mean that shares will achieve robust upside in perpetuity. At some point, shares will become fairly valued. I would argue that the business is most certainly closer to that point than it has been at any point in the past year. However, when looking at the most recent data, particularly the burgeoning cloud business, I would argue that some additional upside is almost certainly warranted from here. Yes, the easy money has been made by this point. But I don’t think that so much has been made that it is worth downgrading the stock just yet. Because of that, I’ve decided to keep the company rated a ‘buy’ for now.

Keep your eyes on the cloud

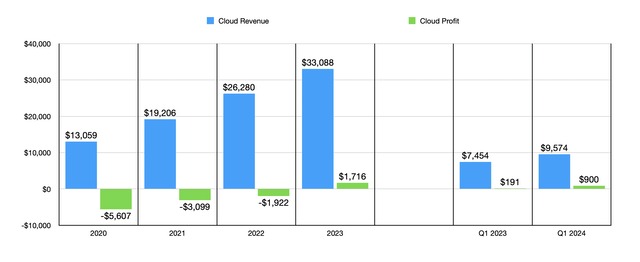

In my last article on Google, I focused on the company’s cloud business, known as Google Cloud. In that article, I talked about how the segment was achieving attractive growth on the top line and how it was improving its bottom line tremendously. From 2020 through 2022, the unit was consistently in the red. But the amount to which profits were negative was improving at a rather impressive pace. By 2023, the business had finally made it into the green. With 2024 now well underway, I think a good place to start is to cover how this segment is performing. After all, I would argue that much of the company’s future success will be tied to this set of operations.

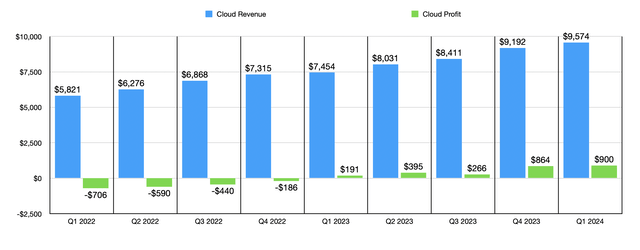

The only new data that we have since the publication of my last article is data covering the first quarter of the 2024 fiscal year. During that time, revenue associated with Google Cloud came in at $9.57 billion. This represents an increase of 28.4% compared to the $7.45 billion the segment generated one year earlier. Management does not provide much in the way of details when it comes to this set of operations. But they did say that growth was mostly driven by the Google Cloud Platform, with Google Workspace products also contributing significantly to the upside. Infrastructure and platform services were the largest drivers of growth for the Google Cloud Platform during this window of time.

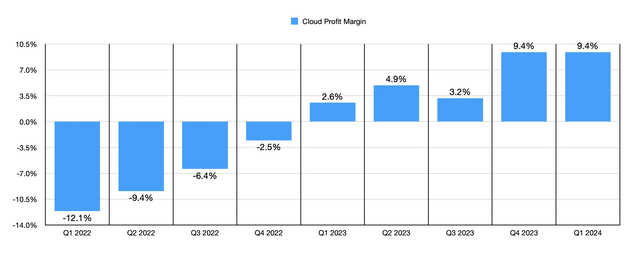

Profitability for the segment performed even better. Operating income for the quarter came in at a solid $900 million. That was nearly five times higher than the $191 million reported one year earlier. That brought the profit margin for the segment up to 9.4% compared to the 2.6% reported one year earlier. As you can see in the chart below, this profit margin matches what the company reported for the final quarter of the 2023 fiscal year. It would have been nice to see continued growth on a sequential basis. But as the chart illustrates, the overall trend for the profit margin for the segment has been quite positive.

What’s really exciting is that this is likely only the beginning for the business. There are many different estimates as to the size of the industry and its growth potential. According to one source, however, the global cloud computing market will be worth somewhere around $680 billion this year. As large as this is, it’s expected to grow further to $1.44 trillion by 2029. That implies an annualized growth rate of 16.4%. With that scale will come improved profits, especially when you consider that Google is one of the three largest players in the market, though admittedly far behind Amazon (AMZN) and Microsoft (MSFT). But with a market this size, and the kind of growth anticipated, I would argue that there is plenty of room for a handful of market participants. The fact that Google is successfully growing revenue at a rapid pace while simultaneously improving its bottom line is a testament to the quality of the service it provides. It may not end up being the big winner in the space. But serving as one of the big three is not a bad end result.

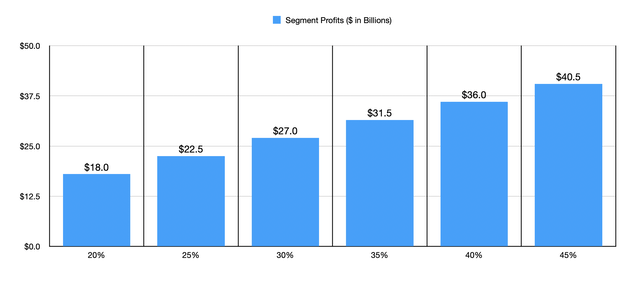

At present, it is estimated that Google’s cloud business has a roughly 11% share of the global market. Though to be honest, this is based on third-party estimates and does not scale well with the $680 billion overall market opportunity for this year. If we assume that the first quarter is indicative of what the overall growth rate for the segment will be for this year, this would imply revenue of $42.50 billion for 2024. That’s closer to a 6.25% share of the global market. Even if we take that figure, and apply it to the $1.44 trillion estimate for 2029, that would take overall revenue up to roughly $90 billion annually. Even if margins don’t improve from here, that would be around $8.46 billion in segment profits annually.

In all likelihood, margins will continue to expand. Microsoft, for instance, using the data available for the most recent quarter, has a segment operating margin for its cloud business of about 46.9%. For Amazon, this number is a bit lower at 37.6%. If we assume segment profit margins of between 20% and 45%, spaced out in 5% increments, we get the results in the chart above. In short, we could be looking at segment profits of between $18 billion and $40.5 billion each year. Considering that overall net income for Google was $73.80 billion in 2023, it’s safe to say that we are looking at significant growth potential for the firm’s bottom line.

Shares look attractive still

Obviously, there are other parts of Google that deserve attention. The most significant part of the company is the Google Services business. This was responsible for $70.40 billion in revenue in just the most recent quarter on its own. This happened to be 13.6% above the $61.96 billion generated one year earlier. Year over year, this segment saw its operating income jump by 28.3% from $21.74 billion to $27.90 billion. All other parts of the company, which fall under the ‘Other Bets’ category, generate only a modicum of revenue and are still negative when it comes to operating profit.

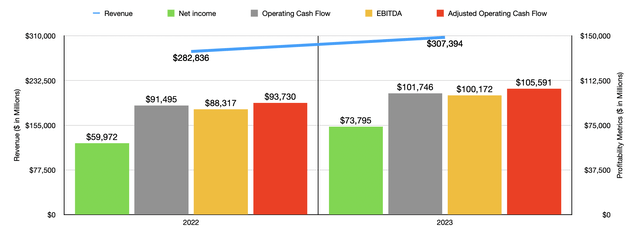

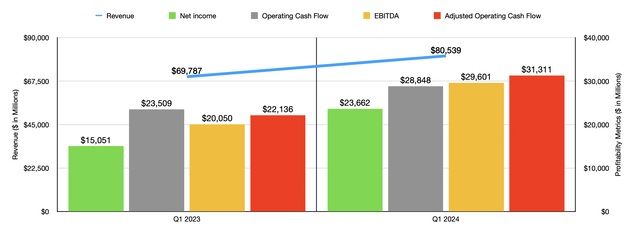

The strong performance for the Google Services business, combined with improved results across the board, have allowed the company to do incredibly well as a whole. In the chart above, you can see financial results for the 2022 and 2023 fiscal years. And in the chart below, you can see results for the first quarter of this year compared to the same time of the 2023 fiscal year. Revenue, profits, and cash flows, are all up significantly on a year-over-year basis. As far as I can see, there is no weakness in sight, and it appears as though the long-term trajectory for the company is going to be positive.

Management has not provided any detailed guidance involving the rest of 2024. But if we annualized results experienced so far for 2024, we would expect net profits of $116.02 billion, adjusted operating cash flow of $149.36 billion, and EBITDA totaling $147.89 billion. This would translate to year over year improvements of 57.2%, 41.4%, and 47.6%, respectively. In all likelihood, this means that future growth for the company should remain robust. But even if we ignore performance after the 2024 fiscal year, shares look attractively priced for such a high-quality business.

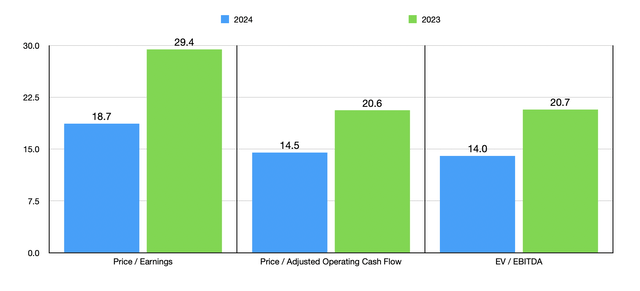

In the chart above, you can see how the stock is valued using data from 2023 and the aforementioned estimates for 2024. Normally, the value investor in me would be turned off from these kinds of multiples. But given how fast growth has been, I would say that this qualifies Google as a GARP (growth-at-a-reasonable-price) play. In the table below, meanwhile, I compared the business to five other major software businesses. I was tempted to compare it to Amazon as well. But considering how large the e-commerce side of Amazon is, I don’t believe that the firm as a whole is a good wanted to compare our candidate too. As the table below shows, on a price to earnings basis, only one of the five companies was cheaper than Google. But when it involves the other two profitability metrics, three of the five ended up being cheaper. Combined, this places Google somewhere around the middle of the pack.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| 29.4 | 20.6 | 20.7 | |

| Meta Platforms (META) | 27.5 | 16.5 | 17.6 |

| Microsoft | 37.2 | 29.2 | 24.9 |

| Baidu (BIDU) | 15.6 | 6.8 | 7.3 |

| Oracle (ORCL) | 32.4 | 19.0 | 20.0 |

| ServiceNow (NOW) | 79.0 | 39.8 | 80.7 |

Takeaway

In my view, the easy money has been made when it comes to Google. But this doesn’t mean that the company is not worth considering. We are dealing with a very high-quality firm that has achieved and continues to achieve rapid growth. Shares aren’t exactly cheap, but they are attractively priced for what we are dealing with. Obviously, there are other candidates in this market to consider. But when you look at how well Google is doing from a growth perspective, and you factor in the improvements seen for the Google Cloud operations, I would still be comfortable rating Google a ‘buy’ for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!