Summary:

- Google’s key segments, including Search, YouTube Ads, and Cloud, are performing well.

- Google Search continues to grow despite the popularity of ChatGPT.

- YouTube ad revenue has increased significantly, and AI advancements play a new role in the platform’s success.

400tmax

Introduction

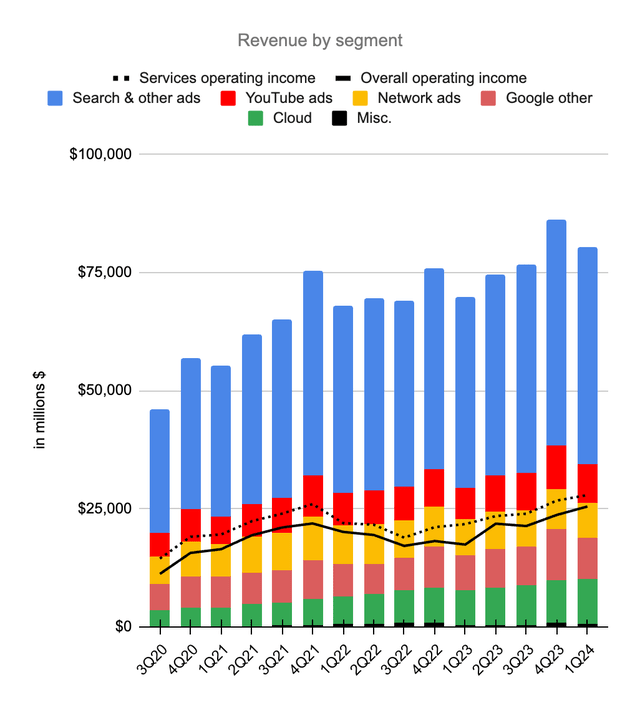

In my February article, I said Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) looks good through a long-term lens and the latest quarter is another step in the right direction as the revenue from the 1Q24 results was well above 1Q23:

Revenue by segment (Author’s spreadsheet)

My thesis is that Google’s key segments are doing well: Search, YouTube Ads and Cloud.

Search

Analysts predicted Google Search would struggle when ChatGPT became popular, but Google Search is still doing well. Revenue for Google’s Search & other segment increased more than 14% from $40,359 million in 1Q23 to $46,156 million in 1Q24. Autoregressive large language models (“LLMs”) power AI tools like ChatGPT, and they are helpful with respect to answering information queries. They are used instead of Google for some searches, but they are not a panacea. Some LLM limitations were discussed in an April Lex Fridman podcast when Meta Platforms, Inc. (META) Chief AI Scientist Yann Lecun said LLMs lack four essential characteristics of intelligent systems (emphasis added):

They don’t really understand the physical world. They don’t really have persistent memory. They can’t really reason and they certainly can’t plan.

Given these and other limitations, humans still need to gather some types of answers themselves and this is often iterative such that the process can’t easily be condensed down to a single question. LLMs are faster than humans in terms of raw compute, but humans can sometimes be better in terms of weighing different components to answers under varying circumstances. Google Search presents answers as a work in progress meaning iterative learnings can be added. AI, on the other hand, often seems like a black box where the “why” part of the answer is obfuscated; sources are readily shown in Google searches, but they are often not visible with chatbot answers. One of the nice things about Google Search is the way sources can be compared and followed up with new questions. Per Google CBO Philipp Schindler’s comments from the March 6 Morgan Stanley (MS) Technology, Media & Telecom Conference, 15% of search queries Google sees every day are new. Additionally, CBO Schindler said Google is not standing still with respect to search efforts (emphasis added):

You look at the ability to actually now question Lens. We introduced this with multisearch, where you can actually go and take a picture and then you can ask a question about the picture, and GenAI will give you a very, very good answer back to this. You look at what we have introduced with, let’s say, Circle to Search. I’m not sure here on Android who has used this already, where you can basically on any app, any picture, whatever you look at, you can just take your finger and circle it and then you search for it. And then you can also invoke the multisearch and then ask questions about it with actually very, very high-quality answers. So there’s a lot of really exciting things happening there. And we will just continue to take Search as a product to the next level with all those new technologies that we have in our hands now.

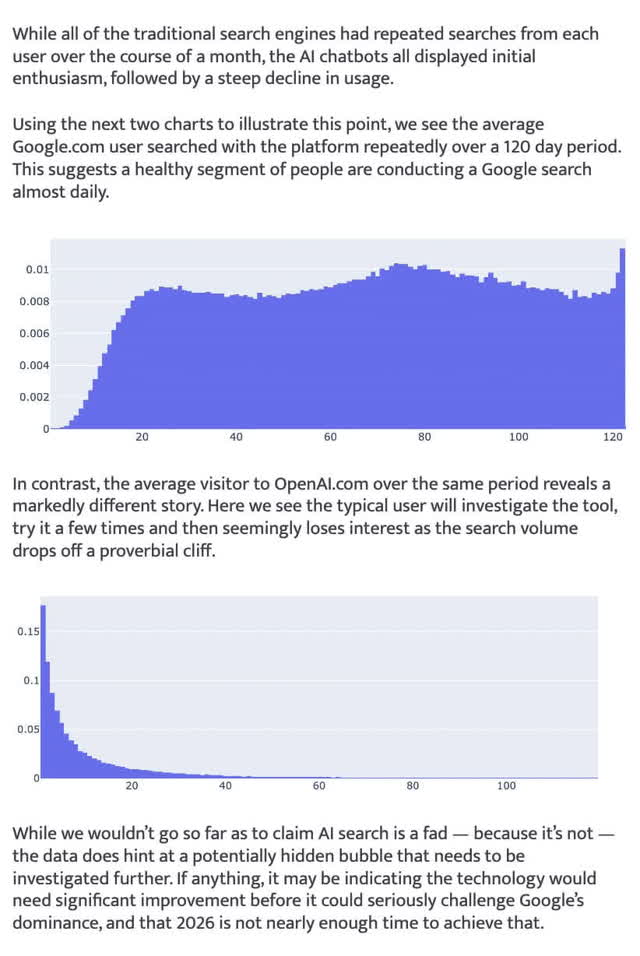

An April 23rd Datos article says traditional search engines like Google retain usage whereas chatbots up to this point have experienced declining usage after initial enthusiasm:

YouTube

YouTube ad revenue increased nearly 21% from $6,693 million in 1Q23 to $8,090 million in 1Q24.

Per comments from CBO Schindler at the March 6 Morgan Stanley Technology, Media & Telecom Conference, AI advancements are a big part of YouTube:

Look, the generative AI opportunity on YouTube is a significant one. No doubt about it. Keep again in mind, just looking a little bit back at history, we have used AI in YouTube for a very long time. The recommendation engine is built on it. A lot of our trust and safety efforts to protect users are based on this. So yes, I’m excited about it because there’s the advertising component, which is a big part. I think I covered this in terms of where creativity can go. The most important thing to understand about YouTube is that YouTube is really centered around the creator, and we’re trying everything to make the creator successful. And you look at some of the products we’ve already launched, right? You look at Dream Screen, where with GenAI, you can change the background of the screen. You look at Dream Track, that helps you on the music creation side. We have some products that help you actually find your target audience better, that help you with insight generation.

On the 1Q24 call, CEO Sundar Pichai spoke about AI-generated backgrounds for YouTube:

We announced that on average, viewers are watching over 1 billion hours of YouTube content on TVs daily. AI experiments like Dream Screen will give anyone the ability to make AI-generated backgrounds for YouTube shots.

Google Cloud

Google Cloud suffered cumulative operating losses of $12.9 billion from 4Q19 to 4Q22 until the segment finally started turning things around in the 1Q23 period a year ago when it had an operating income of $191 million on revenue of $7,454 million. One year later in the 1Q24 period, operating income was up 371% to $900 million on revenue of $9,574 million. The $12.9 billion in cumulative operating losses during the early subscale years are one of the reasons why I think it would be extremely difficult for a new company to enter the picture on a global level. For the foreseeable future, I think Google Cloud, Amazon.com, Inc. (AMZN) AWS, and Microsoft Corporation (MSFT) Azure will be the dominant forces in this space. Seeing as AWS had a 4Q23 operating income of $7,167 million for a 29.6% margin on revenue of $24,204 million, I think Google Cloud’s operating margin of 9% has significant upward potential.

CBO Schindler spoke highly about Google Cloud AI with respect to the infrastructure and platform layers at the March 6 Morgan Stanley Technology, Media & Telecom Conference (emphasis added):

You have – on one side, you have the whole infrastructure side, where we supply highly AI-optimized infrastructure based on GPUs and our beloved TPUs, obviously, number one. We have the whole platform layer. We call it Vertex AI, where we offer first-party models and third-party models and open source models and where we offer solution and development tools so everybody can develop their own AI application.

CBO Schindler also spoke about the opportunity of the AI application possibilities with Gemini and Workspace.

CEO Pichai noted on the 1Q24 call how 60% of funded generative AI startups are on Google Cloud:

Today, more than 60% of funded Gen AI startups and nearly 90% of Gen AI unicorns are Google Cloud customers. And customers like PayPal and Kakao Brain are choosing our infrastructure. We offer an industry-leading portfolio of NVIDIA GPUs along with our TPUs. This includes TPU v5p, which is now generally available, and NVIDIA’s latest generation of Blackwell GPUs.

Valuation

Capital allocation is an important part of valuation, and it is nice to see management starting a small dividend. A quarterly dividend of $0.20 per share has been announced.

Trailing twelve months (“TTM”) operating income for Google Services is $102,018 million or $27,897 million + $95,858 million – $21,737 million on revenue of $280,980 million or $70,398 million + $272,543 million – $61,961 million. I think the segment can be valued at an operating income multiple of 18 to 20x for a range of $1,835 to $2,040 billion when rounding to the nearest $5 billion.

Google Cloud has a revenue run rate of $38,296 million based on 1Q24 revenue of $9,574 million. I remain optimistic about continuing improvement of the operating margin up to a range of 15 to 20% as the business matures. Applying this hypothetical margin range to today’s run rate gives us a hypothetical operating income range of $5,744 to $7,659 million. Applying a multiple of 16 to 18x gives us a segment valuation of $90 to $140 billion when rounded to the nearest $5 billion.

My sum of the parts valuation is as follows:

$1,835 to $2,040 billion Google Services

$90 to $140 billion Google Cloud

$25 to $50 billion Other Bets

————————

$1,950 to $2,230 billion total

The 1Q24 10-Q shows share counts as of April 18. There are 5,874 million A shares plus 867 million B shares for a count of 6,741 million which we multiply by the May 1 GOOGL price of $163.86 to get a sub-total of $1,105 billion. There are also 5,617 million C shares which we multiply by the May 1 GOOG price of $165.57 to get another sub-total of $930 billion. Adding these together, the market cap is $2,035 billion. The stock is near the low end of my valuation range and I think it is a buy for long-term investors.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, GOOGL, AMZN, META, MSFT, NFLX, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.