Summary:

- Transocean’s Atlas rig has breached the $500k/d mark with a contracted dayrate of $505k/d.

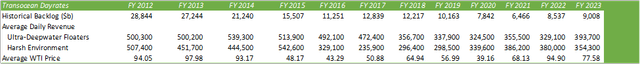

- Average dayrates for ultra-deepwater floaters have declined sequentially by -2% to $422,900/d in q1 ’24 paired with three quarters of sequential decline in their backlog.

- Operators are becoming more hesitant and pushing out starts to new greenfield offshore & deepwater projects as oil prices hover in the low $70s.

diegograndi

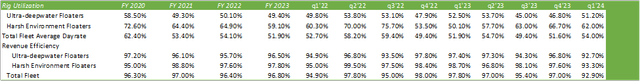

Transocean Ltd. (NYSE:RIG) is nearing a pivotal moment in contracted dayrates in which the firm has finally breached the $500k/d mark, with their Atlas rig being contracted out at $505k/d. Despite this strong push-through for higher day rates, the push for bringing the rest of the fleet up to speed appears to be stalling, with dayrates for ultra-deepwater floaters declining sequentially by -2% to $422,900/d in Q1 ’24 from $432,100 in Q4 ’23.

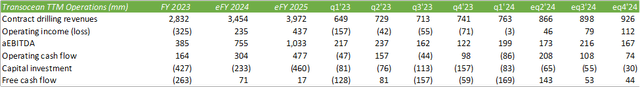

Despite this minute setback, dayrates for the floaters are still up 17% on a year-over-year basis. Given the near-term operational challenges, the lingering need for debt and equity financing to manage operations, the sequentially declining backlog, and the delayed project starts, I maintain my SELL recommendation for RIG with a price target of $4.28/share at 10.30x eFY25 EV/aEBITDA.

Transocean Operations

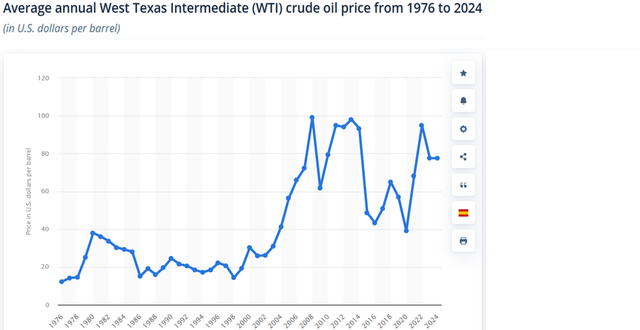

It is worth mentioning the lag effect between elevated day rates, the price per barrel of oil (CL1:COM), and the backlog during an oil bear market. Though I do not expect oil prices will crater to levels seen in 2015-2019 as producers, including OPEC+, are more disciplined with production volumes, I do believe it is only prudent to keep this factor in mind when valuing the firm’s future projected dayrates as forecasted rates are oftentimes adjusted and negotiated down in times of stress.

WTI price data is the average price during the year and may not reflect the highs and lows during the stated period.

Transocean is also facing three quarters of sequential decline in their total contracted backlog. This goes contrary to the broader market theme of producers focusing more heavily in offshore & deepwater drilling. Though it may be too soon to presume that the thesis is weakening, I do believe that the heightened demand experienced in q2 ’23 & Q3 ’23 has waned slightly as producers push back or delay start dates. I do not expect offshore or deepwater demand to evaporate as seen during the 2015 period; I do anticipate some hesitancy in project starts as WTI & Brent prices stagnate in the mid-$70s-80s/bbl. Using data provided by CME Group, WTI futures are priced in the mid-to-upper $70/bbl for the duration of 2024 with prices declining to low-to-mid $70/bbl in 2025.

My thesis as it pertains to offshore & deepwater production is aligned with Exxon Mobil’s (XOM) production strategy in which IOCs will leverage offshore & deepwater production as a baseline and dynamically approach onshore with the price fluctuations. Darren Woods, CEO of Exxon Mobil, mentioned on their Q1 ’24 earnings call that specific to the Mozambique region, the firm is currently favoring onshore production over adding another floater. Given the stalling backlog and the sequential decline in average dayrates as seen in Transocean’s Q1 ’24 results, I anticipate that producers are taking a wait and see approach for greenfield projects to ensure they do not get caught flatfooted if oil prices were to decline into the coming years.

With the assumption that offshore & deepwater production will remain aligned for future production, I anticipate producers to focus on enhanced oil recovery technologies as well as higher-yielding blocks as firms seek to manage down capex spend in favor of opex, as discussed by both Schlumberger (SLB) and Baker Hughes (BKR) in their recent earnings releases, each of which I have covered extensively. Each firm has reported significant growth in their production chemicals businesses that are designed to enhance oil production at the wellhead and allow for longer declines.

I do anticipate IOCs to maintain their focus on offshore production; however, I do expect that firms will demand fewer drillships and floaters as a result of these enhanced oil recovery techniques. If this thesis plays out, it wouldn’t be too farfetched to presume that average dayrates would remain below $500k/d throughout the cycle. I do expect high-spec rigs to maintain their higher dayrates; however, I do not expect the majority of deployed rigs to follow suit to Deepwater Asgard and its $505k/d day rate.

That said, Transocean’s challenges were primarily in the face of rig operational issues in their newly deployed Deepwater Titan. The unplanned downtime was the result of a faulty blowout preventer, which the firm has since addressed with their OEMs in recovering the component. Rig utilization rates were slightly off within their own respects, with ultra-deepwater floaters down y/y at 51.20% and harsh environment floaters down sequentially to 62%. Transocean also faced disappointing revenue efficiency for the quarter with ultra-deepwater floaters down to 92.70% and harsh environment down to 93.30%, both declining y/y and sequentially.

Transocean 2024 Financial Forecast

Looking ahead to eQ2 ’24, management anticipates contract drilling revenue to reach $866mm, with a fleet-wide revenue efficiency rate of 96.5%. This robust revenue growth is anticipated to be driven by a full quarter of operating activity on their Transocean Endurance and Deepwater Orion, as well as contract, starts for both Transocean Equinox and KGI. Deepwater Titan is also expected to be operational after the component failure experienced in Q1 ’24.

Forecasting financials through eFY25, I expect Transocean to experience significant upside potential operationally as average dayrates trickle upward as demand for offshore & deepwater production solidifies. I expect much of the demand to be driven by the EMEA regions as it pertains to verbiage from Schlumberger and Baker Hughes, as outlined in my respective reports covering the two firms. I also anticipate significant growth in the U.S. Gulf of Mexico and Latin America as firms like Occidental Petroleum (OXY) and Exxon Mobil increase exploration in the regions for expansionary production in satellite locations.

Given that much of the demand is driven from high-spec rigs, I believe that Transocean can benefit positively as these rigs deem higher dayrates. Given this dynamic, I anticipate strengthening in Transocean’s overall operations and cash flow generation.

Transocean Red Flags

As mentioned in previous reports covering Transocean, I believe the firm’s debt position may pose major challenges if rig demand begins to wane or move sideways. Much of their growth is dependent on the continued growing interest in offshore & deepwater drilling and the tightness of the market pushing up dayrates. Though I do not anticipate Transocean and competitors to be hasty in redeploying stacked rigs, I expect that the first mover in redeploying stacked inventory will lead to a domino effect that may relieve some of the pricing dynamics these firms have benefited from in the last few years.

Other risks include the bearish direction of oil and the risk of a falloff in global demand as recessionary pressures still persist. Though $70/bbl is still a strong price point for offshore & deepwater drilling, I anticipate that these prices will make operators more hesitant in deploying capital to new greenfield projects given the long-duration risks involved in these projects. If firms seek to further restrain capital investments in favor of EOR, broader demand for rigs could potentially stall or remain flat and become more restrictive on upward pricing for dayrates.

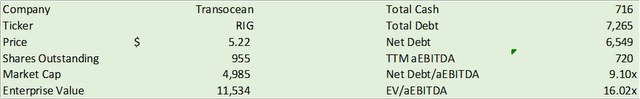

Transocean’s financial risks pose a major challenge for equity investors as those buying shares may be on the hook for further share dilution as seen in Q1 ’24. The diluted share base increased from 807 shares in Q4 ’23 to 955 shares in Q1 ’24, an 18% increase in the float. This is 31% above Q1 ’23. This pairs with the firm’s decline in their cash balance and increase in net debt, suggesting that the firm continues to require outside financing to maintain operations. Until Transocean decouples from the debt financing debt spiral, I do not believe that RIG shares will make a viable investment outside a speculative trade.

Please see my previous RIG coverage:

Transocean Continues To Face Challenges With Profitability (1/13/24)

Transocean: Drill Baby Drill (10/13/23)

RIG Stock Valuation & Shareholder Value

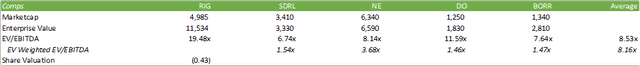

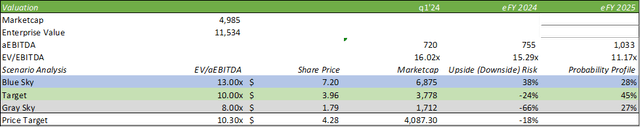

Transocean shares currently trade at 16.02x EV/aEBITDA, a significant premium above competitors in the offshore & deepwater rig space. I believe that Transocean’s leverage poses a significant risk to equity value, as 57% of the enterprise value of the firm is driven by net debt. This poses a major valuation risk, as the firm’s equity value suggests a negative value on a comparable basis.

Valuing RIG shares based on its historical valuation metrics, I price shares at $4.28/share at 10.30x eFY25 EV/aEBITDA. I maintain my SELL recommendation on RIG, as shares remain overpriced relative to the firm’s ability to generate cash flow relative to its debt balance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.