Summary:

- Halliburton achieved record margins in 2023 and is expected to continue increasing average revenue per rig.

- The oil market is projected to be balanced in Q2-Q3 2024, leading to a downward revision in the forecast for the average Brent oil price in 2024.

- Despite a reduction in drilling rigs and oil production volumes in the US, Halliburton’s financial results are expected to remain positive.

ugurhan

Investment thesis

We have covered Halliburton (NYSE:HAL) before and in Q4 2023 the company reported according to our expectations, and the forecast logic has been maintained. In this report, we present the adjustments we have made to our forecast, in particular taking into account changes in the forecast for oil prices, oil production volumes in the United States, and rig count.

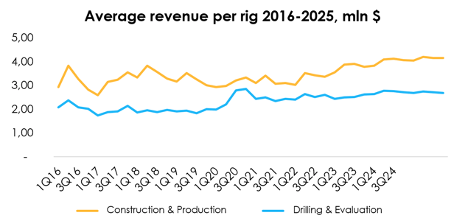

Thanks to effective price increases for its services and the use of high-tech products, the company managed to achieve record margins in both the construction and production (20.7%) and drilling and evaluation (16.5%) segments in 2023. We expect demand for the company’s services to remain strong at current oil prices, and the market for high-performance equipment and quality services to remain tight, allowing Halliburton to continue increasing average revenue per rig. The rating is BUY.

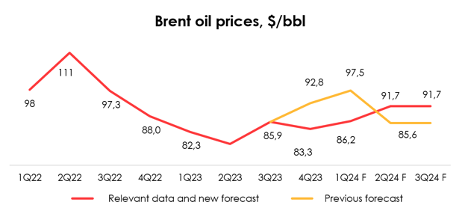

Oil market balance and Brent oil prices

In November 2023, Arabia extended the production cut program by 1 mb/d for Q1 2024. Some other OPEC+ countries will also voluntarily reduce production in this period. We expect that in Q1 2024, excluding oil production in Russia and Venezuela, OPEC+ countries’ oil production will decrease by 0.1 mb/d as of December 2023 (in Russia we expect a 0.2 mb/d decrease in production, and in Venezuela – a 0.1 mb/d increase compared to December).

Further, in 2024, OPEC+ will gradually remove voluntary restrictions on oil production. We expect the oil market to be generally balanced in Q2-Q3 2024 due to OPEC+ actions. We have slightly revised upwards our forecast for OPEC+ oil production in Q1 2024 due to higher than expected production in December and Angola’s withdrawal from the agreement. This did not significantly affect the forecast for the market balance.

We now expect the oil market to be in deficit on average in Q1 2024 (with an expected surplus in January) and the oil market to be balanced on average in Q2-3 2024 (we previously expected an average surplus from Q2 2024 onwards).

We have therefore revised downwards our forecast for the average Brent oil price in 2024 from an average of $88.6/bbl to $86.8/bbl.

Invest Heroes

US oil production

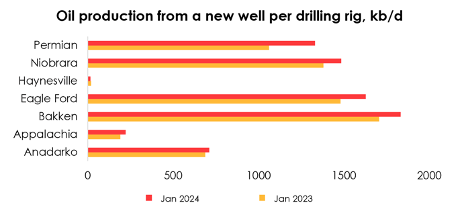

The US continues to break records. In Q4 2023, the average production level in this country amounted to 13.22 mb/d, according to the EIA report. Such a rapid increase in production (+900 mb/d for 2023) is due to higher oil production per well, as well as the use of drilled but uncompleted wells (DUCs), the number of which decreased by ~200 units in 2023.

EIA

EIA forecasts U.S. oil production to be 13.03 mb/d in Q1 2024 and then to rise to 13.18 mb/d by year-end before turning to steady growth in 2025 at a faster pace compared to the 2024 forecast.

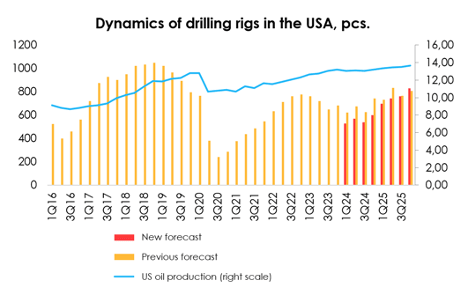

Due to the projected decline in oil production in 2024, compared to 4Q 2023, we expect US drilling rigs to decline to an average of 560 units in 2024 vs. the old forecast of 668 units, and to 757 units in 2025 vs. the previous estimate of 784 units.

Invest Heroes

Financial results

In Q4 2023, the average revenue per rig in the Construction & Production segment was $3.78 mln (+12% YoY) per rig vs. our forecast of $4 mln, and in the Drilling & Evaluation segment it reached $2.62 mln (+1% YoY) per rig vs. our forecast of $2.54 mln, which was broadly in line with our guidance.

We expect the average revenue per rig to reach $4.03 mln (+7% YoY) per rig in 2024 in the Construction & Production segment and $2.72 mln (+8% YoY) per rig in the Drilling & Evaluation segment, changed from our previous forecasts of $4.21 mln and $2.61 mln, respectively. The decrease in the forecast was driven by a downgrade in our 2024 oil price forecast from $88.6/bbl to $86.8/bbl.

Invest Heroes

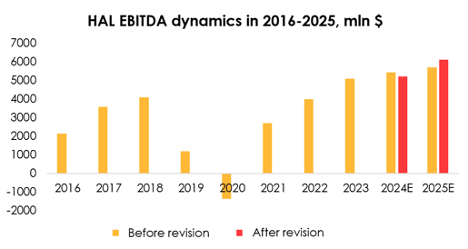

We have revised our EBITDA guidance downwards from $5424 mln (+7% YoY) to $5212 mln (+3% YoY) for 2024 and upwards from $5685 mln (+5% YoY) to $6112 mln (+17% YoY) for 2025 due to:

- reduction in the forecast for the number of drilling rigs in North America in 2024 from 831 units to 704 units and in 2025 from 975 units to 954 units due to a decrease in the rate of increase of oil production in the US;

- decrease in the aggregate average ticket in 2024 due to lower oil price forecasts;

- increasing the operating margin forecast from an average of 16.3% to 17.6% over 2024-2025 due to the development and utilization of high-tech products.

Invest Heroes

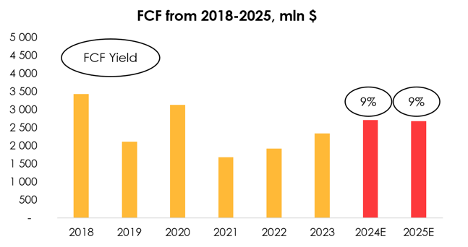

The company’s free cash flow forecast is $2711 mln (+16% YoY) in 2024 and $2678 mln (-1% YoY) in 2025. FCF yield will reach 9% in 2024 and 2025.

Invest Heroes

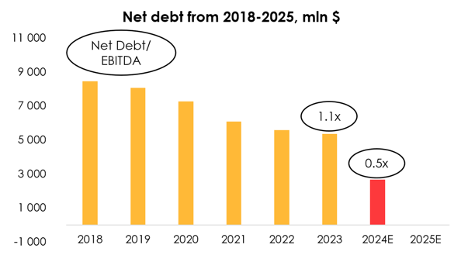

We expect the company’s net debt to decline from $5372 mln in 2023 to $2661 mln (-50% YoY) in 2024 and to ($17) mln in 2025, assuming the company allocates all cachet to debt repayment. The net debt-to-EBITDA ratio is 1.1x in 2023 and we expect this ratio to reach 0.5x in 2024, which is consistent with the company’s low debt burden.

Invest Heroes

Valuation

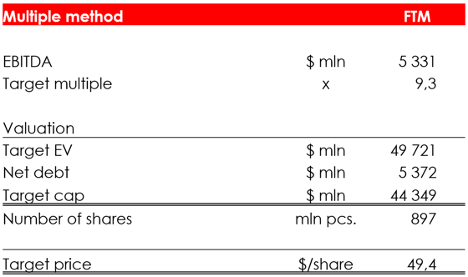

We have revised our target share price downwards from $50.6 to $49.4 due to:

- the reduced EBITDA forecast for 2024;

- the shift of the FTM valuation period.

Based on the new assumptions, we maintain the BUY rating.

Invest Heroes

The main risk associated with this stock is a correction in oil prices, which would lead to a decrease in the number of operating drilling rigs. A significant reduction in the number of drilling rigs could not be offset by an increase in average revenue per rig and would lead to a decrease in the company’s financial results and stock prices.

Conclusion

Despite the downward revision of the number of drilling rigs and oil production volumes in the United States, the dynamics of financial results in our forecast remain positive. The company achieved record margins in both the construction and production and drilling and evaluation segments in 2023. We expect continued growth in the company’s average revenue per rig.

We believe the company has solid fundamentals and is now traded at prices that are significantly below its fair value.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.