Summary:

- Harley-Davidson has seen a decline in revenue and free cash flow over the past decade, raising concerns about its market competitiveness and cash flow management.

- Despite challenges, the company has shown strong profitability with an average return on equity of 24.92% over the past decade and exceeded Q1 earnings expectations.

- However, future projections suggest limited growth opportunities and the current share price may not offer significant upside potential for investors, making it advisable to explore other investment opportunities.

Johnrob/iStock Unreleased via Getty Images

Intro

Harley-Davidson, Inc. (NYSE:HOG) is a motorcycle manufacturer operating in two segments: Motorcycles and Related Products, and Financial Services. The Motorcycles segment designs, manufactures, and sells Harley-Davidson motorcycles, parts, accessories, apparel, and related services. Sales occur through independent dealers and e-commerce channels across various regions.

The Financial Services segment offers wholesale and retail financing services, including installment lending, motorcycle insurance, service contracts, and brand licensing for credit cards.

The purpose of this article is to conduct a comprehensive analysis of HOG’s financial performance and growth prospects. We will delve into the company’s revenue patterns, profitability metrics, and its capacity to generate free cash flow. Furthermore, we will assess HOG’s strategic position within the motorcycle industry and provide an outlook for its future. By evaluating these crucial factors, investors can obtain valuable insights into HOG’s potential and ascertain its appeal as an investment opportunity in the present market context.

Performance

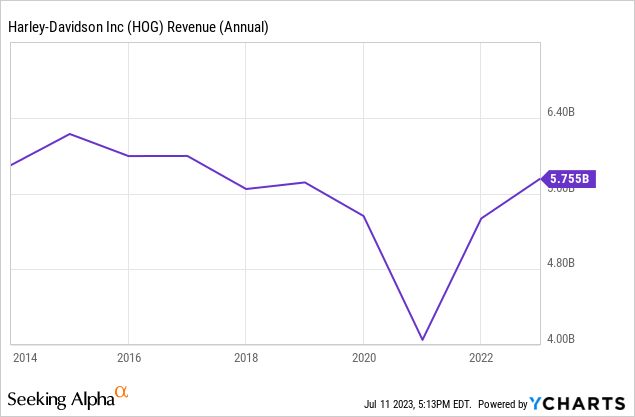

A high growth rate is crucial for any company as it indicates the company’s ability to capture market share, expand its customer base, and outperform competitors. HOG has witnessed a concerning decline in revenue over the past decade, raising doubts about its ability to generate substantial sales. From 2013 to 2022, the company’s revenue experienced a decrease of -2.45%. This downward trend can be attributed to how the demographics of motorcycle riders have been changing in recent years. The average age of a Harley-Davidson rider is now over 50, younger buyers are increasingly inclined to purchase motorcycles from a ease of use standpoint, indicating their interest in more affordable bikes.

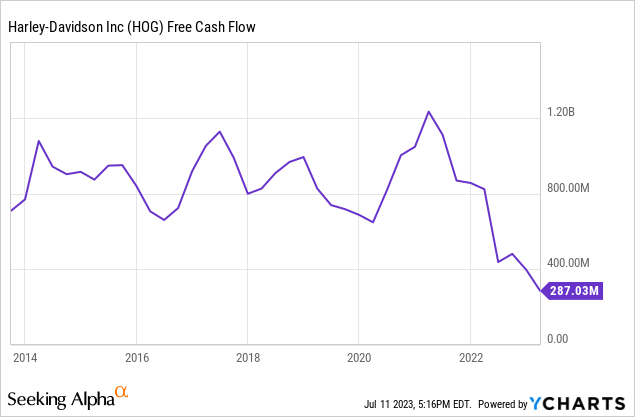

HOG’s free cash flow growth has been concerning over the past decade. The company’s free cash flow experienced a significant decline of -48.39% from 2013 to 2022. The declines observed can be attributed primarily to the decrease in operating cash flow in 2022 compared to 2021. This decline was primarily influenced by factors such as an increase in working capital and a rise in wholesale financing activity. Without addressing these challenges, HOG may face limitations in making necessary investments and sustaining future growth.

Upon analyzing HOG’s balance sheet, we can identify certain areas that warrant attention. The company’s current ratio of 1.72 indicates that it possesses a healthy level of short-term assets to meet its near-term liabilities. While it may not be significantly above 1.0, the current ratio suggests a reasonable level of liquidity, providing HOG with the ability to fulfill its obligations in a timely manner.

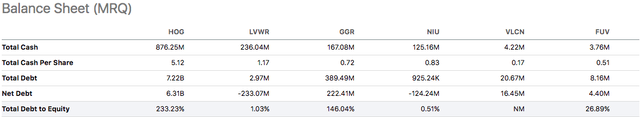

Additionally, HOG’s debt-to-equity (D/E) ratio stands at 2.33, reflecting a substantial level of leverage. A high level of leverage is unfavorable as it increases the financial risk and vulnerability of a company, potentially leading to difficulties in meeting debt obligations and negatively impacting overall financial stability. What’s most concerning about HOG’s leverage level is it appears to be higher than its motorcycle manufacturing peers.

Despite the concerns related to the balance sheet, HOG has demonstrated a strong record of profitability, as reflected in its return on equity (ROE) figures. On average, HOG’s ROE over the past decade stands at an impressive 24.92%, highlighting its ability to generate substantial returns for shareholders.

HOG’s average ROE of 24.92% over the last ten years significantly outperforms the sector median ROE of 9.84%, this demonstrates that HOG has been more profitable than its industry rivals. HOG’s impressive record of profitability can be attributed to its strong brand identity that is synonymous with American freedom and individualism. The company’s logo is one of the most recognizable brands in the world. HOG’s strong brand gives it an advantage over its peers.

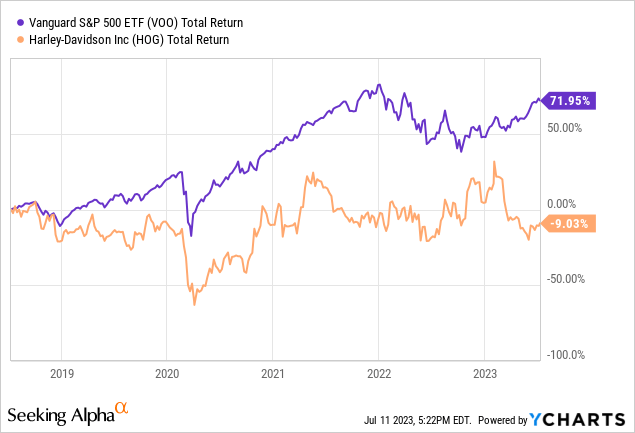

Unfortunately, HOG’s strong brand and excellent track record of profitability have not translated to returns for shareholders. Over a five-year period, HOG’s total return amounted to -9%, which, while positive, lags behind the S&P 500’s total return of 72%. This comparison implies that HOG’s stock performance hasn’t kept pace with the broader market during this period. HOG’s poor returns in recent years have likely left investors wondering what’s next for the company.

Looking Ahead

HOG’s first quarter earnings results exceeded expectations, showcasing strong performance across key financial metrics. The company reported earnings per share of $2.04, surpassing estimates by an impressive $0.64. Additionally, HOG generated $1.56 billion in revenue, representing a robust year-over-year growth of 19.54%. The revenue outperformed expectations by $175.66 million, indicating strong demand for the company’s products.

The strong performance in the first quarter was primarily attributed to growth in the HDMC and HDFS segments, while the LiveWire segment experienced a decline. HDMC’s revenue growth was driven by a notable 14% increase in wholesale motorcycle unit sales, accompanied by continued positive pricing trends across the product portfolio.

Additionally, the Harley-Davidson Financial Services segment reported a significant 16% rise in revenue compared to the previous year, primarily due to higher finance receivables. However, the LiveWire segment faced a 25% decline, primarily attributed to lower sales volume of both electric motorcycles and electric balance bikes.

Looking ahead to HOG’s fiscal period ending in December 2023, analysts are forecasting a less favorable outlook. The company is expected to achieve an EPS of $4.71, representing a slight decline of -5.02% compared to the previous year. Additionally, the estimated revenue of approximately $5.23 billion reflects only modest year-over-year growth of 6.96%.

These projections reflect the ongoing sluggish revenue growth trajectory for HOG, which has been hindered by the formidable competition within the motorcycle industry. Harley-Davidson contends with fierce rivals from both domestic and international motorcycle manufacturers, such as Honda, BMW, and Indian Motorcycle, who in some instances possess advantages in terms of cost, innovation, and product offerings. As younger riders shift their preferences towards more practical motorcycles that are typically less expensive, this negatively affects HOG who’s product lineup primarily emphasizes heavyweight cruisers and touring motorcycles which have more premium price points.

Despite the prevailing challenges, there are reasons for optimism within HOG. The company is currently in the third year of its “Hardwire” strategy, and the strong first-quarter results suggest that the strategy is yielding positive outcomes. The Hardwire approach prioritizes motorcycle segments that HOG deems to be the most profitable globally, along with selective expansion opportunities.

This strategy places a strong emphasis on desirability and underscores the premium nature of the Harley-Davidson brand and its products. As HOG navigates the evolving macro environment, the company remains committed to these guiding principles, prioritizing quality over pursuing volume alone in its core categories. Moreover, HOG retains confidence in its innovation pipeline, which is expected to drive the company’s future growth and success.

HOG’s latest innovations include its new ’23 product lineup to celebrate the company’s 120th year of business. This lineup includes special models like the CVO Road Glide limited anniversary edition and six other limited edition motorcycles. These models feature unique paint finishes and details to mark the 120th anniversary. This product release reflects Harley-Davidson’s commitment to innovation, quality craftsmanship, and honoring its long-standing heritage.

HOG’s 120th year of business is a remarkable milestone, as it is a rarity to witness a company with such a long and storied history. The key to HOG’s enduring success lies in its loyal customer base, which stands as its most vital strength in my opinion. HOG customers are renowned for their unwavering brand loyalty, often becoming repeat purchasers and enthusiastic advocates for the brand. This loyalty is further exemplified through the strong sense of community among Harley-Davidson riders, fostered by events like the annual Sturgis Motorcycle Rally and the camaraderie found within local H.O.G. (Harley Owners Group) chapters.

Despite the remarkable milestone of HOG’s 120th year in business, the company faces a challenge as the market shifts towards more practical motorcycles that are less expensive. HOG’s current emphasis on heavyweight cruisers and touring motorcycles through its Hardwire strategy may not align with this market trend. While changing their strategy to be more in line with the market could help capture new customers, it also carries the risk of alienating their loyal customer base, which is HOG’s greatest strength.

Valuation

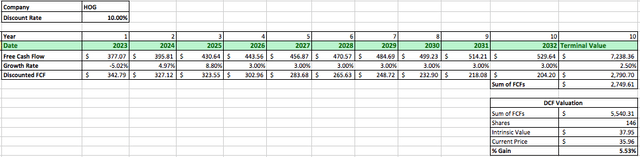

We will employ a discounted cash flow analysis to assess the valuation of HOG, taking into account the future estimates for the company’s earnings. This approach involves determining the present value of HOG’s projected future cash flows in order to estimate its intrinsic value.

Starting with HOG’s free cash flow of $397 million from last year and we will apply the average analyst estimates for free cash flow growth for the next three years. The growth rates are -5.02% for 2023, 4.97% for 2024, and 8.80% for 2025. It’s important to note that projecting cash flows beyond a few years can be challenging due to uncertainty and limited visibility into the company’s future, so we will use a secondary growth rate based on the company’s track record of growth over the past decade of just 3% for years 4 through 10.

Using a discount rate of 10%, which represents the required return rate for an investor based on the average annual return of the S&P 500 with dividends reinvested, we can calculate the present value of these future cash flows. After applying the growth rates and discounting the cash flows, we arrive at an intrinsic value for HOG of $37.95. This implies that HOG may currently be priced fairly and investors don’t stand to gain much from the company’s current share price.

Takeaway

While HOG has demonstrated strong profitability and brand loyalty, the company faces challenges in terms of declining revenue, sluggish growth, and increasing competition within the motorcycle industry. The shift in market preferences towards more practical and affordable motorcycles presents a hurdle for HOG, whose product lineup primarily focuses on heavyweight cruisers and touring motorcycles. Despite the company’s efforts through its Hardwire strategy, there is a risk of alienating their loyal customer base if they align their offerings with market trends.

Looking ahead, analysts forecast a less favorable outlook for HOG, with a slight decline in earnings per share and modest revenue growth. The company’s valuation, based on a discounted cash flow analysis, indicates that HOG may currently be priced fairly with limited upside potential for investors. Considering these factors, it may be prudent to sell the company’s shares given the lack of growth prospects and the absence of a discounted valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.