Summary:

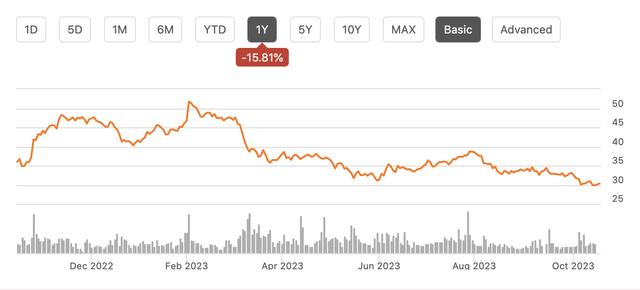

- Harley-Davidson shares have been underperforming, losing 16% of their value in the past year and over half of their value in the past decade.

- The company’s revenue has fallen by about 2% and operating income is 18% lower than a decade ago, with declining volumes and squeezed margins.

- The company’s financing unit is also declining, with credit losses doubling and operating income expected to decline by 25% from last year.

- While shares look cheap, given limited potential for long-term free cash flow growth, this appears to be a value trap.

georgidimitrov70/iStock Editorial via Getty Images

Shares of Harley-Davidson (NYSE:HOG) have been a poor performer over the past year, losing 16% of their value, continuing what has been a long period of poor performance. Shares have lost over half of their value in the past decade as the company tries to stay relevant to a new generation of consumers. With just a 6.5x forward multiple on consensus earnings and a recent increase in its share repurchase authorization, it is worth asking whether enough of the bad news is priced in and now it is time to buy HOG. I do not think it is.

Over the past ten years, Harley’s revenue has fallen by about 2% while operating income is about 18% lower than a decade ago. As prices have risen over the past decade, volumes have been steadily declining, and given rising wages and other input costs, this has squeezed margins. As HOG has struggled to connect to younger consumers and maintain brand relevance, shares have pushed lower, compressing down its valuation to today’s single-digit multiple. Ultimately, I am still struggling to see signs the company is set to embark on a growth journey. That said, some aspects do point to potential stabilization, but I still feel on balance shares are likely a value trap.

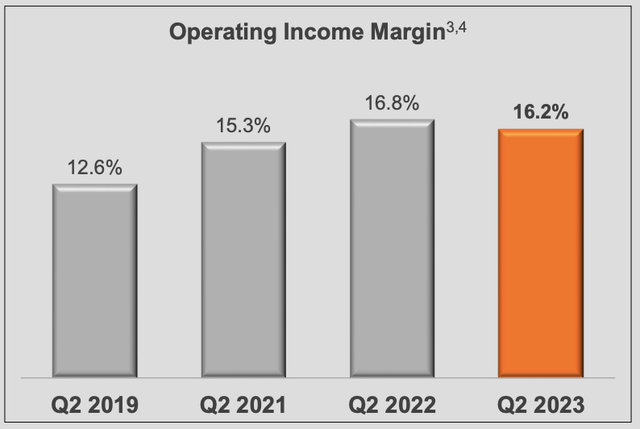

If we begin by looking at the company’s second-quarter results, it earned $1.22, down 16% from last year as total revenue fell by 2% to $1.45 billion. Motorcycle revenue fell by 4%, partially offset by a rise in financing revenue. Motorcycle operating income fell by 8% to $194 million as margins contracted 60bp to 16.2%.

In Q2, volumes were down 10% and prices up 4%, which was not enough to offset rising labor costs. Notably, gross margins for bikes rose by 390bp to 34.8% as commodity input cost pressures have abated, but this was offset by higher operating expenses.

It is important to note that HOG generates revenue by making and selling motorcycles to sell to its dealers. When the dealer buys the product, HOG books the revenue, not when the dealer goes on to sell it to a customer. During the quarter, Harley had unplanned production outages, which is a major reason its volumes declined – this is the second year in a row the company faced production issues, which does open questions about quality control of its operations.

While this outage led to the drop in deliveries to dealer blamed for the revenue decline, I am not certain HOG really under-delivered relative to end customer demand. Now, retail sales were up 3% in Q2 – seven percentage points better than Harley’s revenue. This sales growth and retail outperformance is a good thing to see, unquestionably. That said, inventories at Harley’s dealers have been rising and are probably now at an appropriate level, even after this retail sales outperformance. Harley dealers are currently carrying 52,000 units.

This is up dramatically from 2022 inventory of 27,000. Now like automobiles, motorcycle supply chains were significantly stressed during COVID, leading to production problems and product shortages. That 27k level was too low. I am not certain 52k is though. Admittedly, dealers were carrying 73,000 units in 2019. Looking at that metric, Harley could further increase deliveries to dealers, providing further revenue opportunities.

However, when there is too much inventory for demand, pricing concessions can become necessary in order to move products to create space for newer models. This was a challenge HOG faced during the 2010s as sales were falling. Pricing is the best way to measure inventory levels relative to demand; if prices are rising substantially, inventories are likely too low. Well, prices rose just 4% over the past year, broadly in line with consumer inflation. That does not appear to point to a lack of inventory.

Management aims for its bikes to sell within 2% of MSRP (manufacturer’s suggested retail price), when dealers are selling above MSRP, that points to them holding too little inventory, but when prices fall below MSRP, that can cheapen the brand, make customers trained to wait for promotions, and points to too much inventory. Last quarter, HOG was seeing transactions occurring in this 2% band. This makes me skeptical that HOG will be able to meaningfully “catch up” on revenue and volumes lost during its shortage because its dealers appear not to really need that much more inventory than they currently carry. Higher rates and inflation have also caused affordability and demand challenges, according to management, so this is unlikely to change in coming quarters. This means deliveries should largely be consistent with consumer demand trends.

Post COVID, Harley has been able to regain some margin by reversing its history of overstocking dealers with inventory. It will be important for them to retain their discipline. Particularly as the company has struggled to grow beyond its existing customer base which limits potential volume growth, maximizing profit per bike sold is critical to generating as much value as possible for shareholders. When we get Q3 earnings later this month, I will be closely watching dealer inventory levels, as I will be concerned if we see them marching much higher than the current 52k level as a sign that HOG is over-producing relative to end consumer demand.

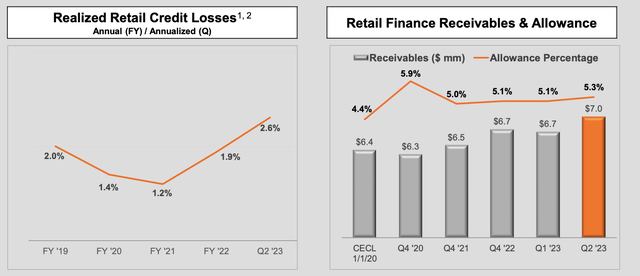

This is particularly important because HOG’s secondary source of profitability is now declining: its financing unit. Harley-Davidson has a captive finance arm, which provides loans to buyers of its motorcycles. During the second quarter, its financing segment saw revenue rise by $38 million as it has been able to pass on higher interest rates to customers. Receivables also rose by 6% to $7 billion as stretched affordability has led more buyers to take on loans when making a purchase. However, this was offset by a $38 million increase in interest expense.

HOG borrows in the capital markets, via an asset-backed lending facility and through the issuance of medium-term notes to finance its bike loans. With this 1:1 interest expense to revenue increase, HOG has essentially been interest rate neutral.

That said, its credit loss provisions nearly doubled to $57 million. Currently, Harley’s Financial Services has set aside $352 million for credit losses. Just as we have seen from banks and credit card issuers, Harley has seen a rise in delinquencies and credit losses from 2021-2022. Much of this increase was to be expected as the benefits of government stimulus wore off and consumers spent down their excess savings. While I am comfortable with some decrease in credit quality, I am a bit concerned to see credit losses now running substantially higher than 2019 levels.

Now, HOG is also reserving more than it did in 2019 in response to this, so these higher losses may already be accounted for, but I will want to see signs of credit losses stabilizing this quarter and beyond to feel comfortable that credit losses will not continue to rise. As it is, management expects operating income from financial services to decline 25% from last year.

I also think it is important to recognize captive finance units are not always run to maximize their own profitability; instead, they are sometimes used to help support the underlying manufacturing business’ profits. In other words, in the face of weaker demand, rather than cut prices, HOG may offer lower interest rates to effectively reduce the cost of a bike. Similarly, it may loosen credit standards somewhat to move sales, at the risk of having larger credit losses down the road, as we are seeing now.

Now, this is not necessarily a bad thing, by using the financing arm to smooth through fluctuations in demand, volumes can be steadier, the brand damage of excess promotion can be avoided, and production levels can be maintained at more cost-efficient levels. Given management has spoken about affordability challenges and we are already seeing delinquencies rise, some of this may be occurring. As such, I see risks skewed to interest revenue rising more slowly than interest expense in coming quarters and that losses persist at somewhat higher levels. These are metrics investors should continue to monitor.

Finally, HOG is trying to grow into electric motorcycles, an effort that has not been particularly successful yet. Its “Livewire” electric motorcycle unit is progressing slowly with revenue of just $7 million and a $32 million operating loss. It aims to deliver 600-1,000 units this year and lose $115-125 million, though production challenges have pushed out product launches. Its new Del Mar has a price point of just above $15k as Harley tries to reach a broader swathe of consumers.

As with legacy automakers, the question is whether Harley will be able to recoup its investment in electrification, though given regulatory efforts to move away from fossil fuels, some of this investment may be necessary, even if it does not generate a particularly high ROI. While there is no data one way or the other, I struggle to believe there are large numbers of consumers who would be buying Harleys except for the fact they use gasoline. As such, I tend to think eventually EV sales will be more likely to cannibalize traditional sales rather than meaningfully grow HOG’s addressable market.

Looking at the balance sheet, it appears HOG carries $1.5 billion in cash and $5.8 billion in debt, but it is important to exclude its financing arm when looking at these figures as that debt is offset by loan receivables. Its motorcycle arm has $1.06 billion of cash against $750 million in debt. Now, about $250 million of its cash is supporting its cash-burning Livewire business, providing about a two-to-three-year runway to get to breakeven.

Accordingly, its legacy business has essentially a $0 net debt position, which is appropriate given the cyclicality and capital intensity of the business and is consistent with how automakers like General Motors (GM) and Ford (F) have run their business. HOG has a healthy balance sheet, which enables it to return free cash flow to shareholders, though I would not support debt-financed returns given the cyclical cash flows and uncertain path for revenue growth.

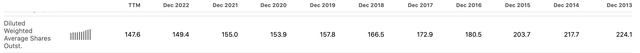

Recently, management added 10 million shares to its repurchase authorization (about 7% of the company), a sign of confidence in ongoing free cash flow. Still, I must note that the share count is down by about one-third over the past decade, and that has done little to support the share price. Indeed with most of these purchases coming at higher levels, the efficacy of this capital return is questionable.

Last quarter, management guided to full year motorcycle revenue flat to up 3% with about a 14.1% operating margin while financial services would see operating income down about 25%. I see downside risks relative to this guidance, and I believe investors should be paying close attention to the interplay between sales and margins/financing income. To what extent is management trying to keep volumes up, even at the risk of eroding per unit profits is a key question.

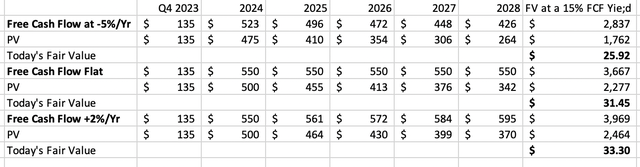

HOG has been for a prolonged period a “melting ice cube” business, one that generates cash, which it can return to investors, while seeing a gradual decline. Below, I provide three valuation scenarios: where free cash flow falls at 5% year as volumes continue to struggle, weighing on margins as seen last decade, one where free cash flow is flat, and one where free cash flow rise 2% year, discounted back to the present at 10%. I then have a terminal valuation of 15% free cash flow given the high cyclicality in the business and long-term growth questions, though markets may have a more discounted valuation in the first scenario and a more premium valuation in the third scenario.

At $30, shares are essentially pricing in a very small, persistent free cash flow decline. In the long term, I struggle to see this business generating more than 2% growth. Per the Fed, long-term nominal GDP growth is about 3.8%. Given its difficulty winning over younger customers, it is hard to see this business growing as quickly as the overall economy. One also has to question is Harley should be willing to lose $100 million/yr on its electrification efforts, which are generating minimal revenue, when that extra free cash flow may be better returned to shareholders to provide more value as the business declines.

While its 6.5x multiple looks cheap, HOG appears to be more of a value trap than value opportunity. I am not seeing signs that HOG has the demand to grow output and sustain margins while there is a risk financing profitability falls to support manufacturing output. Particularly as I see risks, with higher rates and inflation squeezing affordability of management having to reduce guidance when it reports earnings, I would avoid shares. I expect them to remain stuck in the $26-$31 zone of the -5% growth and flat growth scenarios. Downside is likely limited to 10-13% from here, but I struggle to see upside catalysts and believe investors would be better off investing elsewhere as Harley’s long-term underperformance shows no signs of reversing.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.