Summary:

- Harley-Davidson’s Q1 2023 results showed relevance to loyal customers but faced challenges with younger consumers.

- The company introduced new products and initiatives, but growth prospects remain unpromising.

- The company’s low 7x FWD P/E ratio reflects low market expectations and its struggle to adapt to new market dynamics.

Lisa-Blue

Investment Thesis

As Charlie Munger said in a recent interview with FT Time, “We were a creature of a particular time and a perfect set of opportunities.”.

“Easy Rider” (1969) epitomizes Harley-Davidson Inc.’s (NYSE: HOG) brand values of freedom, individuality, and adventure, as it follows two bikers on a cross-country journey. The film portrays their search for the “real America” and encounters that challenge their beliefs. The iconic scene with “Born to Be Wild” playing in the background embodies the sense of adventure and freedom associated with Harley-Davidson. As a cultural icon, “Easy Rider” symbolizes the 1960s counterculture movement, which helped popularize the brand.

The company reported strong Q1 2023 results, driven by a price increase and margin improvement. This proved that the company remained relevant to its loyal customers. However, Harley-Davidson’s future growth has been challenged by shifting generational values and difficulty appealing to younger consumers.

The company, however, introduced new product offerings and worked on a couple of internal initiatives to please shareholders. We thought this was a nice gesture, but from the product specs and the way they marketed the brand, we believed the company made the decision to stay where it was. Investing in the company’s bond was more attractive than investing in its equity, as the bond had downside protection. This could be seen in the pile-up of debt investors at its door.

Its EV initiatives appeared to be losing their appeal among consumers, as the company had lowered its unit sales target and sales price. The intensifying competition in this space has made it challenging for the company to stand out. Moreover, the company seemed to have failed to leverage its brand equity and reputation in the traditional motorcycle market to attract customers to its new EV offerings.

Given these factors, the growth prospects for the company do not look promising. Although the stock price rebounded from a record low of around $15 per share in 2020, this growth appears to have been driven primarily by a price increase and cheap credit rather than any significant improvement in the company’s underlying business fundamentals. Due to the tight credit situation, it’s likely that in 2023 demand will revert back to its prior downward trajectory. We rate the stock “Sell”.

Company Profile

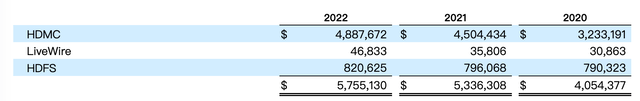

Harley-Davidson Inc. was founded in 1903 and is one of the largest motorcycle manufacturers in the world . It operated in three segments.

Revenues breakdown by segments (HOG)

Key Takeaways from Q1 2023 Earnings:

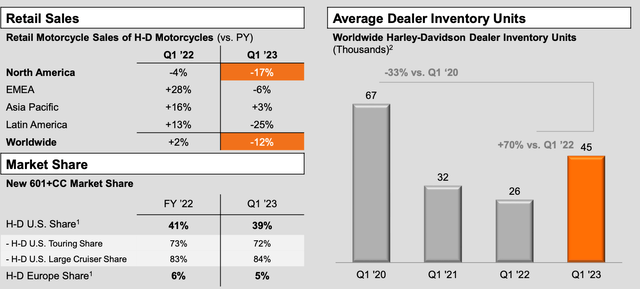

- Harley-Davidson’s Q1 2023 financial performance was ahead of expectations despite a decline in retail sales, with growth in HDMC and HDFS segments, a decline in LiveWire, and improved gross margin driven by pricing, unit mix, and cost productivity.

- Harley-Davidson reaffirmed their full-year guidance, with expected HDMC revenue growth of 4% to 7%, HDMC operating income margin of 14.1% to 14.6%, and HDFS operating income declining by 20% to 25%.

- As part of this strategic vision, Harley-Davidson has launched a new era of CVO Touring motorcycles, aimed at providing riders with unparalleled performance and luxury, combining cutting-edge technology with classic style.

- LiveWire was focused on bringing the brand to Europe, preparing for production of the Del Mar, and was within expected parameters for the year, with continued focus on getting new products to market and maximizing conversion of reservations collected.

Growth Drivers

LiveWire

The company remained optimistic about the future of the LiveWire S2 Del Mar electric motorcycle and was committed to continuing the development of the platform. The company had set a target for the first deliveries of the Del Mar for Q3 2023 and had plans to expand distribution in Europe with 34 contracted partners, signaling a commitment to reaching a wider audience.

However, the LiveWire S2 Del Mar faced various obstacles that made its future uncertain. The motorcycle experienced a price drop and lower unit sale forecast, with an initial estimate of 7000+ units at the time of IPO dropping to a range of 750-2000 units, indicating that it had not achieved the expected market success. Additionally, its low driving range had been a limiting factor for potential buyers. Furthermore, competition in the electric motorcycle market had been heating up, making it more challenging for the LiveWire S2 Del Mar to succeed.

New model

Harley-Davidson changed its strategy for releasing anniversary models to maintain excitement throughout the year, staggered product launches to support traffic in dealerships, and timed bike releases to create excitement during the riding season. They launched a new line of limited edition CVO Touring motorcycles, which offered luxury and high performance. Despite the challenges faced, the company expected to maintain a positive retail outlook for the year. They emphasized affordability and monthly rates to drive traffic to dealerships and help customers find the right bike for them.

https://www.youtube.com/watch?v=u975MM18M-I

The company focused on boosting revenue per unit and improving its profit margins. The company launched limited-edition anniversary models and staggered product releases, which were expected to attract dedicated fans and collectors. However, Harley-Davidson was criticized for failing to connect with younger generations and diversify its customer base. The company opted to feature an elderly person in their most recent advertising campaign for the CVO Touring motorcycles despite receiving criticism for not being able to draw in younger customers. This decision revealed that the campaign was aimed at existing customers and was therefore more likely a short-term monetization move than a long-term plan to draw in younger clients.

Risks

Failed to attract new customers

Unit sale and inventory (HOG)

The company blamed the production halt for the decrease in sales in Q1 2023 and expected the excess inventory to decrease later this year. Since the company’s products are less fashion-oriented, we believe the short-term pile-up of inventories is not an issue.

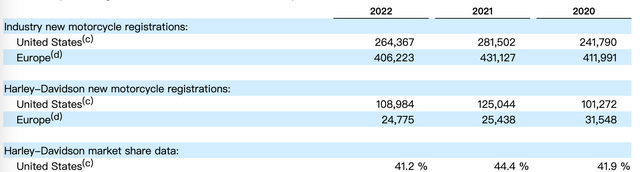

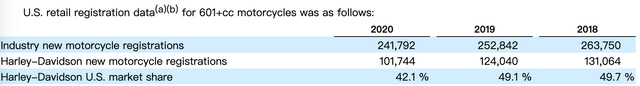

Below is the historical unit sale number for 2018–2022. The company experienced a decline in unit sales since 2018 and returned to growth in 2021. We believe the increase in unit sales in 2021 was the result of cheap credit during COVID. The unit sale started to decline again in 2022 when the interest rate was raised.

We believe that the long term decline trend of its unit sales is the result of the declining popularity of the brand, driven by a shift in generational values as younger generations prioritize different cultural aspects.

Unit Sale (HOG)

Unit Sale (HOG)

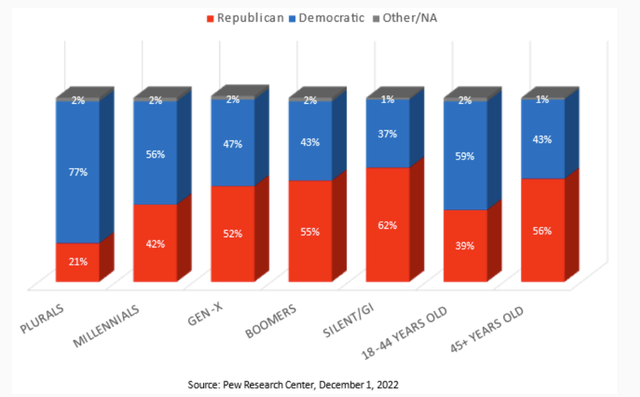

Harley’s image, epitomized by the movie “Easy Rider,” emphasizes freedom, individuality, and adventure. However, according to Brookings, today’s youth, who predominantly supported Democratic candidates in the 2022 midterms, focus more on climate change, social justice, and income inequality, as shown in the below chart.

Voter by parties (Pew Research)

Although political polls may not provide definitive proof of a link between the Harley-Davidson user group and the general public, they can serve as a useful resource for assessing the fundamental reasoning and informing subsequent analysis. By scrutinizing patterns and inclinations across diverse demographic segments, we can derive insights about the shifting cultural environment and how it could potentially influence the perception of a brand such as Harley-Davidson. Consequently, this information can be instrumental in shaping marketing approaches and product innovations that are tailored to the changing preferences and values of the intended audience.

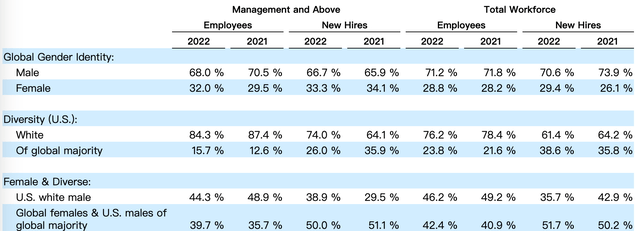

The below chart suggests that progress in enhancing gender and diversity representation within organizations has been slow. We believe that these initiatives are crucial for fostering inclusive and dynamic workspaces.

Workers by gender and diversity (HOG)

Again, we can harness the information gleaned from political poll data as a benchmark for evaluating a company’s endeavors in adjusting to cultural transformations.

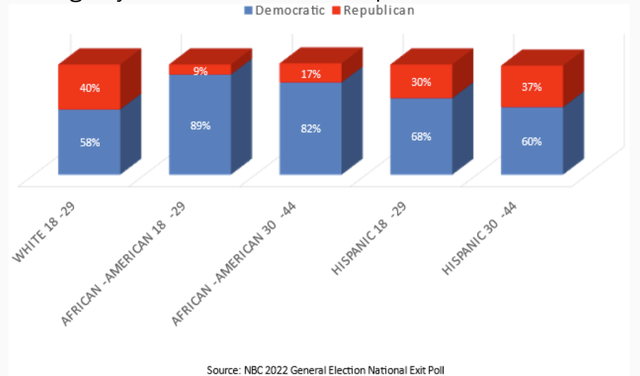

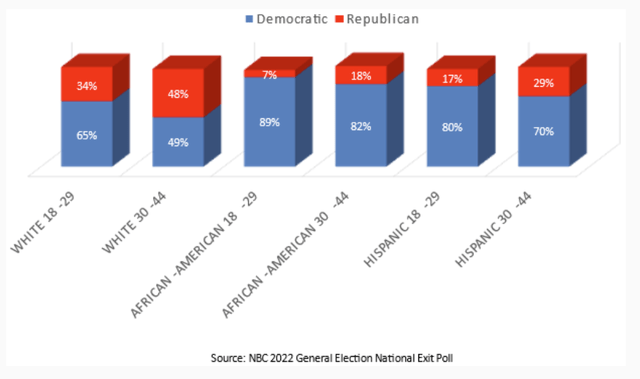

The 2022 elections revealed strong Democratic support from young voters, especially females and racial/ethnic minorities, highlighting their growing impact on societal values. Companies need to acknowledge these demographic shifts and prioritize gender and diversity balance to mirror their workforce and clientele.

Harley-Davidson’s inability to align with these values and adapt to the changing cultural landscape has led to a decrease in the brand’s appeal among younger consumers.

Young voter poll (NBC)

Female voter poll (NBC)

Valuation

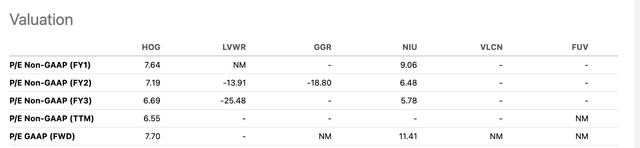

Valuation multiple for peers (Seeking Alpha)

The company’s low 7x FWD P/E ratio reflects the market’s low expectations due to its long-term decline, which is already factored into the stock price. With a history of aggressive share repurchases, the company spends approximately 50% of its free cash flow on buybacks, supporting EPS growth. However, given operational issues, it seems the company is capitalizing on its brand until the end. As a result, we don’t recommend purchasing the stock; instead, its bonds may be a more realistic investment choice.

Summary

The company introduced new products and initiatives, but failed to capture significant market interest. Its EV initiatives struggled with diminished appeal, lowered sales targets, and increased competition, as the company hadn’t effectively leveraged its brand equity to attract new customers. Given these factors, growth prospects appeared unpromising, with stock price growth driven by price increases and cheap credit, rather than improved business fundamentals. The company’s bond investment returns were more attractive than those of its equity. With expected decreased demand in 2023, Harley-Davidson stock is rated “Sell.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.