Summary:

- Harley-Davidson is at an inflection point and making progress through its five-year plan, ‘The Hardwire’, with a focus on growth and profitability, particularly in electric motorcycles.

- The company is targeting younger consumers to expand its customer base and stay relevant in the market.

- Harley-Davidson has shown improvements in operating margins and cost savings, and has a strong balance sheet to support its growth strategies.

Brandon Woyshnis

Investment Thesis

Harley-Davidson, Inc. (NYSE:HOG) is a recognizable name synonymous with motorcycles in the United States and around the world. Well-known and well-respected by motor enthusiasts, I believe Harley-Davidson is an inflection point where it is seeing significant progress through its five-year plan, ‘The Hardwire’, announced in 2021. The company’s laser focus on growth and profitability particularly through the growth in electric motorcycles is showing signs of potential and its new CEO, Jochen Zeitz, has a history of leading turnaround stories to evolve brands and get them on track. This should help Harley-Davidson resonate with younger consumers, as they have traditionally focused on an older demographic of people. With a potentially successful turnaround ahead, I believe there is significant room for the stock to see a rerating in its multiple and for the company to unlock shareholder value, should it continue to execute on its growth strategy and focus in on driving profitability through its multi-year strategy.

Business Overview

Founded in 1903, Harley-Davidson was founded by two brothers, William S. Harley and Arthur Davidson, in Wisconsin. With the goal of bringing motorized bicycles to market, their first production motorcycle was a was a single-cylinder engine with 7.07 cubic inches (116cc) of displacement, installed in a pedal-bicycle frame. Quickly experiencing growth, Harley-Davidson quickly gained popularity among the general public and started introducing larger engines with more advanced features to broaden its product line and better serve its customers. The company quickly gained traction in World War I where it began to produce motorcycles for the U.S. military, and continued to do so in World War II.

Today, with high-end motorcycles seen as a luxury, discretionary purchase, Harley-Davidson has had to reinvent itself to stay relevant. While the company is still very popular among racers and motor enthusiasts, the company has grown its international presence beyond the United States and has also begun to introduce electric vehicles onto the market and has started to appeal to a broader range of riders through new partnerships and marketing, something I view as key to its growth going forward.

In addition to selling motorcycles, Harley-Davidson also sells parts and accessories. It also has a financial services segment which provides customers with financing to both individuals and dealerships. This segment makes up roughly 15% of total revenue. Of the remaining 85% which is motorcycles and related products, 77% comes from motorcycles, 16% comes from parts and accessories, 5% is apparel, and 2% is licensing and other.

Business Strategy

Harley-Davidson laid out their five year plan in 2021, The Hardwire, and it focused heavily on the company strengthening its leading position of being the most profitable and desirable motorcycle brand worldwide. Desirability is a key point here, and it’s one Harley-Davidson has emphasized numerous times on its analyst calls and investor presentations. Desirability remains at the forefront of their mission as the company believes that its product innovation, design enhancements, marketing and branding efforts, and customer engagement initiatives will be key to this mission as it expands into new markets and demographics.

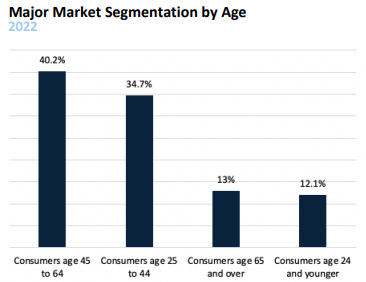

According to IBIS World, the majority of purchases in the motorcycle industry are carried out by Gen X (those over the age of 45). Motorcycles are somewhat a relic of the past, with the 1960s and 1970s synonymous with motorcycles in many parts of the world. When I think of motorcycles, I can’t help but be reminded of great American films like “Easy Rider” and all of the motorcycle clubs, rallies, and events that were so synonymous with this time period. These decades saw huge cultural shifts, with motorcycles being a symbol of rebellion and freedom. Hence, it’s no wonder the market is heavily dominated by an older generation.

Market Segmentation (IBIS World)

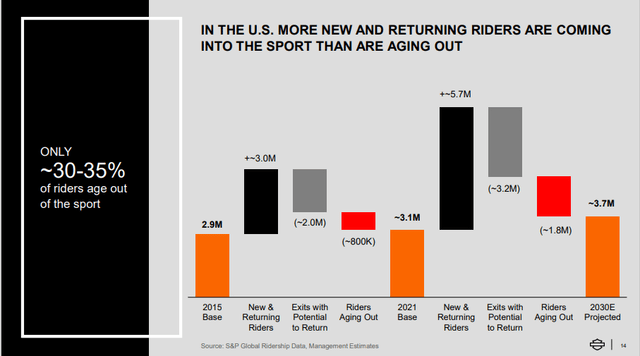

Over the next five years, demand from this aging population is expected to slow down with older generations much less likely do purchase motorcycles due to perceived risks of accidents as they get older. With lifestyle changes as baby-boomers look towards retirement, demand from younger generations will be key in order to retain a customer base and stay in business. As such, it will be important to have strong brand identity and find ways to market and cater to younger generations, who’s lifestyle, price sensitivity, and values tend to be different from that of older generations. One important note is that more customers are actually entering rather than leaving the sport, so the customer base still has potential to not only survive but also grow in the years ahead.

More riders entering than leaving motorcycles (Investor Presentation)

Another key part of Harley-Davidson’s business strategy I feel is noteworthy is its profitability. By focusing and investing into its most profitable motorcycle product segments like Grand American Touring, the large Cruiser and Trike, the company aims to get back to 15% operating margins (from 9% in 2021) by increasing unit profitability which will require a combination of increased pricing and cost-cutting.

Financials

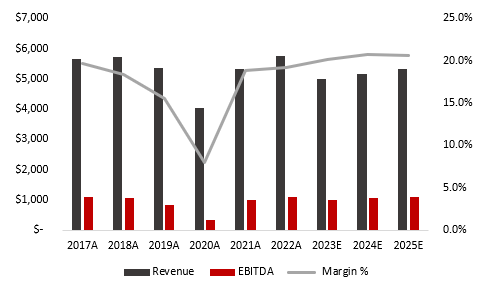

When looking at Harley-Davidson’s financials, revenue growth looks lumpy and flat over the last five and ten years. Under the new CEO, Harley-Davidson is targeting 5-7-% growth per annum until 2025 and a 15% operating margin.

So far, I believe the company’s strategy is working well, as the company reported a 12.9% operating margin for the 2022 year, illustrating that its five-year plan is proving itself out in its financial performance. With investments in automation, enhanced inventory visibility, and supply chain and material optimizations, the company is targeting $400 million of cost productivity by 2025.

This is an ambitious target in my view, but I believe Harley-Davidson will be successful, particularly under the new CEO, as they’ve already delivered with $135 million of cost savings and $92 million retuned to shareholders since the five year plan started. To me, this demonstrates Harley-Davidson’s commitment to returning cash to shareholders and unlocking shareholder value by creating a more profitable business.

Revenue and EBITDA (Author, based on data from S&P Capital IQ)

When looking at the company’s balance sheet, Harley-Davidson has $1.1 billion of cash and $765.8 million of long-term debt. While the company does have $6.3 billion of debt ($1.3 billion current) through its finance division, this is offset by $7.5 billion of finance division loans and leases owed to the company. With a Debt/Equity ratio of 14% and an ROE of 21%, I believe Harley-Davidson has ample room to grow its business without the need of outside financing and can do so through its cash generative business. Moreover, should Harley-Davidson want to continue to expand its business through M&A or other strategic initiatives, the company is in a strong financial position to take on additional debt or equity financing if necessary, as its current financial stability and profitability suggest that it can manage such expansion while maintaining a healthy financial position.

Valuation

Based on the six equity research analysts with one-year target prices on Harley-Davidson, the average price target is $39.50, with a high estimate of $45.00 and a low estimate of $33.00. From the average price target, this implies about 29.5% upside from the current price, suggests that analysts too feel Harley-Davidson is undervalued.

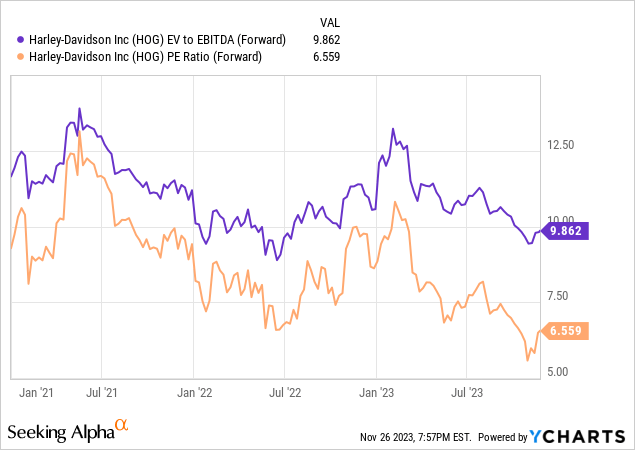

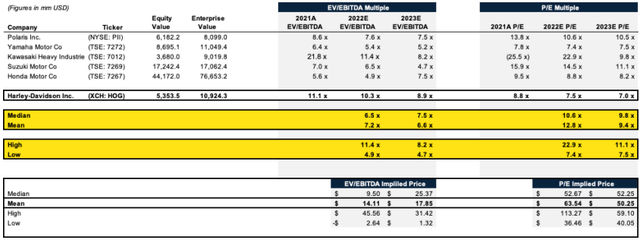

When looking at the valuation of Harley Davidson, the company trades at forward multiple of 9.9x EV/EBITDA and 6.6x P/E which are ~2-turns lower than their historical average five-year forward multiples. Notwithstanding interest rates, with a more profitable business ripe for renewed growth (in both revenue and profitability), I believe Harley-Davidson deserves a premium to its historical multiple, which priced the company for flat growth.

When looking at comparable companies in the motorcycle industry, the average forward EV/EBITDA multiple is 7.2x and average forward P/E is 12.8x. Given that much of the total debt in Harley Davidson’s cap table is part of its finance division and is more than offset by loans to customers (much like a bank), EV/EBITDA doesn’t seem like an appropriate valuation methodology unless we remove finance division debt and keep only long-term debt of the company. Another argument for removing the finance division debt is that it’s not operational debt used to finance operations of the business. Using the P/E ratio of 7.5x compared to peers at 12.8x, I believe Harley-Davidson is significantly undervalued. If the company were to trade in line with its peer group this would suggest at least 70% upside.

Comparable Companies Analysis (Author, based on data from S&P Capital IQ)

Catalysts

Harley-Davidson has successfully raised the prices of its motorcycles without experiencing a decline in sales over the last few years. With the increased pricing, this suggests that the company’s superior brand position has increased its products’ perceived value. In my view, this suggests that the willingness of consumers to pay for motorcycles is growing.

Another key catalyst is electric motorcycles through LiveWire, Harley-Davidson’s electric motorcycle division spin off. This is significant given that LiveWire is one of the first companies to transition to electric powered motorcycles and has a backing from one of the largest names in motorcycles. With the launch of the S2 Del Mar earlier this year, Harley-Davidson is creating riding for urban living through a low-cost, low-range electric vehicle motorcycle. With annual revenues of nearly $1 billion expected in the next two years, I believe this should act as a catalyst for topline growth going forward.

Under the leadership of CEO Jochen Zeitz, who is famous for his successful turnaround of Puma, I believe Harley-Davidson is being led by a qualified management team with a track record of success. In his previous role at Puma, he transformed the brand into a strong rival to footwear and apparel brands like NIKE (NKE) and adidas (OTCQX:ADDYY). While new product lines were certainly an ingredient in his strategy to turnaround Puma, it was his marketing of the company as a lifestyle brand that stood for individuality and self-expression that made it an attractive and desirable brand in the industry.

To me, I believe Harley-Davidson is in a similar position as Puma once was many decades ago. If history is any indication, CEO Jochen Zeitz is in a good place to lead a successful turnaround at Harley-Davidson and transform it into a modern and desirable brand for younger consumers, while honoring and preserving the company’s heritage and legacy.

Risks

The biggest risk to my investment thesis is that Harley-Davidson is unsuccessful in transitioning from its aging population customer base towards appealing to younger demographics. Should the company fail to garner attention and appeal from younger generations, the company could suffer longer term.

With significant capex invested in its LiveWire venture, the importance of being a market leader in the EV motorcycle market could not be more important. If LiveWire fails to produce the $1 billion of annual revenue over the next few years, this could hurt earnings for Harley-Davidson. There’s also a risk that LiveWire cannibalizes revenues from existing Harley-Davidson motorcycles.

Finally, as SA contributor Seeking Profits points out, with a higher interest rate environment and a weaker consumer, this may prompt credit and loan losses in the company’s financing division which could have an impact on earnings going forward. With a weak consumer, sales of luxury motorcycles could suffer. When looking back to the financial crisis, revenue did fall 17% that year, but this resulted in pent up demand in the following years so this risk is somewhat mitigated past on past performance.

Conclusion

In summary, Harley-Davidson is a well-known motorcycle brand with a strong legacy and heritage. Now led by an experienced CEO with the track record of successful business turnarounds, I believe Harley-Davidson will meet its 2025 targets and in the process, should create significant value for shareholders. With early signs of success showing with improvements last year, I believe the company will be successful in its pursuit to become one of the industry’s most desirable brands. With higher margins in the 15% range and identified growth opportunities ahead, I’m optimistic that the company should be able to generate significant cost savings and fund growth opportunities in the EV space or pursue potential M&A options or strategic opportunities. With a renewed sense of focus onto a younger customer base, Harley-Davidson is taking steps in the right direction. At a bargain-basement valuation compared to its historical average multiple as well as its peers, I believe Harley-Davidson’s strong fundamentals, growth opportunities, and higher profitability going forward should generate significant returns for shareholders.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.