Summary:

- Harley-Davidson’s financial performance over the past decade has been lackluster, with revenues remaining stagnant and the company struggling to attract a younger, more environmentally conscious customer base.

- Despite high expectations for its LiveWire brand, the company’s electric bikes are not selling well, and the main segment that manufactures standard Harleys lacks a catalyst for significant revenue growth.

- Harley-Davidson’s financials show a healthy interest coverage ratio and decent returns on assets and equity, but the company’s leverage and lack of a competitive edge may deter investors.

Johnrob/iStock Unreleased via Getty Images

Investment Thesis

I wanted to take a look at Harley-Davidson’s (NYSE:HOG) financial performance in the past and see what kind of prospects it may have in terms of revenue growth for the next decade because just by quickly looking at the company’s PE ratio, it seems to be cheap but is there a reason it is cheap? In my opinion, the growth prospects are not great and so I think that the PE ratio is about right where it should be, and I think that HOG is a value trap and there might be better companies to invest in for the long-term.

Outlook

I believe that investors are not pricing the company higher because, in the last decade, performance revenue went nowhere. In FY13 the company reported $5.9B in revenues, fast forward to FY22 and revenues stood at $5.75B, so in the last 10 years the company did not perform well at all. Is there enough reason to believe that this will change going forward? I was disappointed with how badly the electric bikes are performing overall, and they look nice. It seemed like the company is trying to branch out and adapt to consumers, however, it seems like the company is not able to capture any meaningful younger customer base that is more environmentally conscious. It seems like right now that the segment of bikes is still very small and is not experiencing the explosion in sales that the company expected.

Nevertheless, the company has some lofty expectations for the LiveWire brand, going as far as saying they will be able to sell over 100k units by 2026. That does sound very good in theory; however, I don’t see this happening. For starters, the bikes are not very cheap, and the company expects that the new S2 Del Mar will be the savior because it’ll be about $5,000 cheaper than the LiveWire One. The company also said they expected to sell 7,000 units of the new bike, however, in the most recent earnings call, the company said they expect to sell 750-2000 units, which is a lot less and a very wide range.

In terms of the main segment that manufactures the standard Harleys, I don’t think there is much of a catalyst that will propel revenues to new highs in the next decade. The Hardwire strategic plan sounds good in theory, however, in practice, it may be hard to achieve this. We can see that the company is not a growth company and such low revenue growth makes it very unattractive for ordinary investors who are looking for excitement.

Financials

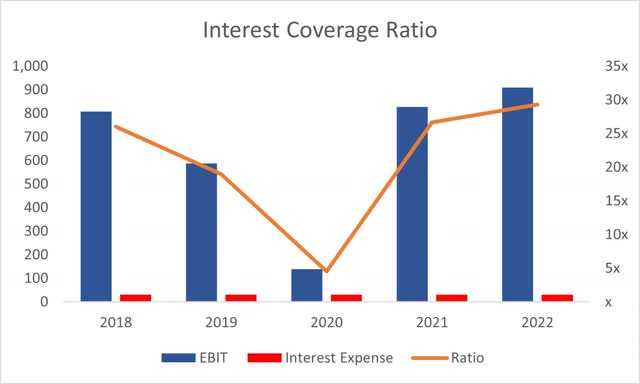

As of Q1 ’23, the company had $1.56B in cash against $5.2B in long-term debt. The market cap of HOG is around $5B. I would think a lot of investors are not happy with the amount of leverage the company has and are staying away from it, which contributes to the stock price going nowhere. I don’t think that should be a problem when considering where to park your money. Debt is another tool that a company can use to grow, and if it can manage the annual interest expense, then there is no problem in using debt. HOG’s interest coverage ratio is very healthy, standing at around 29x, meaning that operating income or EBIT can cover annual interest expense 29 times over. Debt is not an issue in my opinion.

Interest Coverage Ratio (Author)

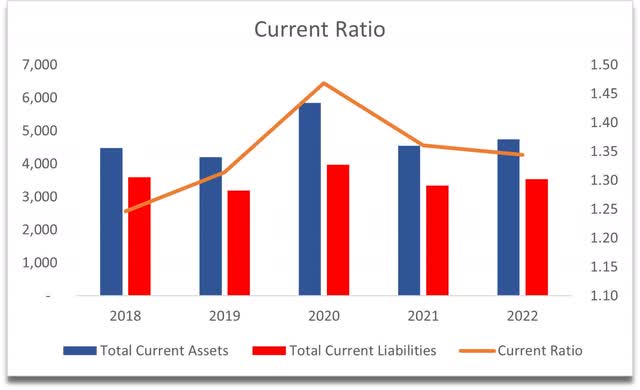

The working capital ratio or the current ratio has been decent over the last half a decade at least, standing at around 1.34 and keeping steady at this level. This means that the company can pay off its short-term obligations without an issue and still has liquidity left over. On the liquidity side, I see no issues with the company at all.

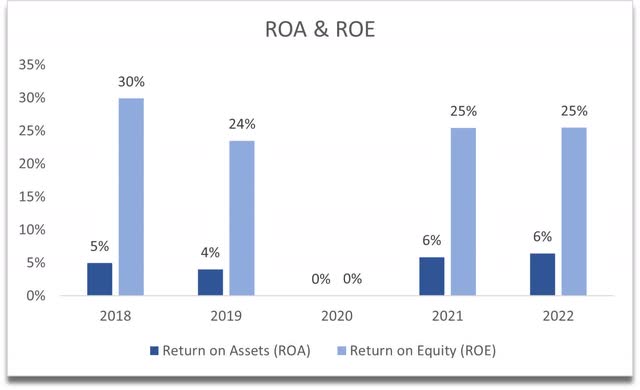

In terms of efficiency and profitability, I am also satisfied with returns on assets and equity. These numbers are above my minimum of 5% for ROA and 10% for ROE. This tells me that the management is doing a decent job of utilizing the company’s assets and shareholder capital, which should create value.

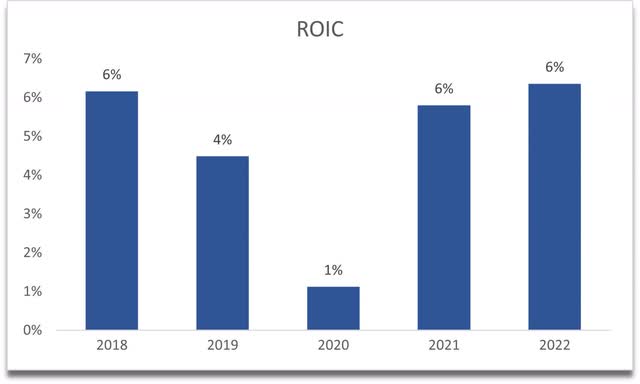

I am not, however, excited about the company’s moat and competitive advantage. The company’s return on invested capital is not very impressive in my opinion, suggesting it has pretty much no competitive edge and no moat. I’d like to see at least 10% here.

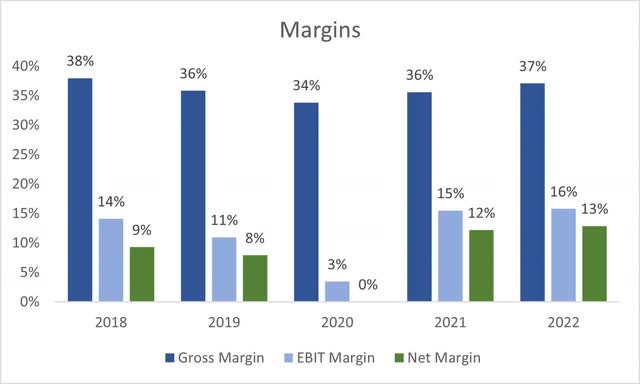

In terms of margins, the company has improved these from the previous year and are quite decent in my opinion. The Hardwire strategy plan aims to improve these further, but only time will tell if the plan works out.

It looks like the company has been operating with these sorts of metrics for quite some time now and it is hard to get excited about them. I would like to see an uptrend in the above metrics continue and reach new highs. Right now, I have a feeling that the same numbers will continue going forward and that is just not exciting.

Valuation

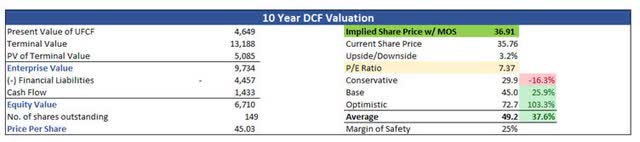

It’s hard to assume higher revenue growth than the company had previously achieved. Sure, I can see that the company might reach the 4%-7% revenue growth in ’23, I’m just not sure if it can sustain it, given that in the last decade, the company lost revenue.

For the base case revenue assumptions, I went with a 2% CAGR for the next decade, which will bring revenues to $7B by ’32 from $5.7B in FY22. This is still a better performance than the company’s last decade.

For the optimistic case, I went with about 6% CAGR, while for the conservative case, I went with 0% growth over the next decade, which is very possible too.

In terms of margins, I assume that the company will manage to improve margins very slightly over the next 10 years and net margins will improve from around 13% in FY22 to 14%. I need to see more quarters of margin improvements to assume better efficiency and profitability going forward, so I’ll stick to this conservative estimate.

To give myself some room for error, I will add a 25% margin of safety to the intrinsic value calculation. It seems like the company is valued fairly right now because the intrinsic value calculation gives me an implied share price of around $36.91.

Closing Comments

It is hard to recommend investing in the company right now, especially since the LiveWire electric bikes are not selling very well. With the revenue growth that I assumed above, the company is worth what it trades at today, and it may stay at these levels longer if its initiatives fall flat. Over the last decade, revenues went nowhere while the share price is down 36%. I am rooting for this old-timer company to succeed, and I am glad the guys are innovating still, however, if the company cannot achieve better results in the future, there are many better companies out there that will reward its shareholders handsomely.

I will sit on the sidelines and will wait for the upcoming earnings call to see how well the electric bikes are performing. My guess is not well. The company may look cheap, but it can be a value trap in the long run in my opinion.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.