Summary:

- Harley-Davidson, Inc. stock has been stagnant, moving sideways over the past five years, great for trading, awful for investing.

- The company is facing challenges in reaching younger generations and dealing with high financing rates for new bikes.

- For Q4, revenues were down in every segment other than financing.

- Margins have also been compressed thanks to volume and promotional activity.

- 2024 earnings likely will fall from 2023.

crossbrain66/E+ via Getty Images

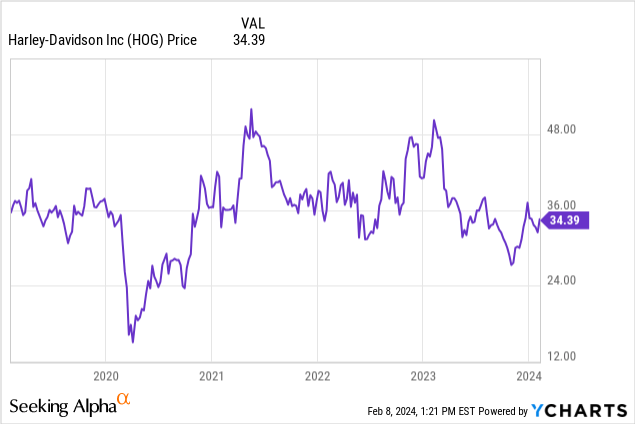

Harley-Davidson, Inc. (NYSE:HOG) is a stock we have traded a number of times, but have not checked in on the company in many quarters. It was asked about today in our investing group, and frankly, the stock has just stalled. What we mean is that it simply has moved sideways.

What we see in the chart above is a stock about flat over 5 years. There are notable dips and rips for trading. Of course, the COVID dip was an anomaly, but it took the company several quarters to rebound. Then, as you see, the stock spiked into the $40s, which were then sold off. So, as of now, we had a recent decline into the 20s in fall of 2023.

We suspect this trading range will persist, given the stock’s trading history, and the fact that operational performance is under pressure. The company has struggled reaching younger generations, and is also faced with consumers dealing with high financing rates to purchase a new bike. There is a lucrative parts business, and riders may be keeping bikes on the road longer, helping to preserve sales which, despite the stock action, are relatively holding up, but still down. The company is facing margin pressure to boot.

We think HOG shares have a limited upside to the $40 level in good market conditions, and downside to $25 if the market gets nasty again. We are neutral here long term, but in the short term for traders, we get modestly bullish here in the low $30 range to the high $20’s range for trading purposes only. The Q4 report had key strengths and weaknesses to be aware of.

Harley-Davidson’s revenue

As experienced traders who guide and offer opinion to our investors, we will tell you that HOG is a trader’s stock. Sales pressure has mounted but was better than expected in Q4. Overall revenues were down 7.9% year-over-year, from $1.14 billion to $1.05 billion. This surpassed consensus by $175 million, while annual 2023 sales were up 1% from 2022.

Discussing Harley-Davidson’s Q3 sales

Sales of the actual motorcycles drive the bulk of revenue, but Harley-Davidson also makes some significant revenue from associated parts, as well as accessories. And while rates are high, there are added streams of cash flow from their financial services. The company is in its third year of a long-term transition plan to focus on the highest margin products and to breach new markets. Admittedly, it has been a slow process, and reaching younger customers has been a challenge, but is a key goal of the company. The new model year, however, has been well-received thus far according to management commentary.

Revenues were down in every segment, and down in most operating regions. In Q4, there was a 13% decrease in motorcycle sales, driven by lower shipment volume of 29.5k units from 34.0k units last year. Revenue from motorcycles was $583 million, compared to revenue of $666 million last year.

The other segments were also pressured. Sales were down 14% in parts and accessories, as there was lower retail motorcycle volume. Apparel revenues fell 21% to $57 million, while licensing was down 27% to $8 million. Finally, the so-called “other revenues” also dropped 22% to $14 million. The pressure is on.

Global retail sales of Harley-Davidson motorcycles were down 11% versus prior year. North America retail performance was down 9%, declines driven by the aforementioned high-interest rate environment and the discontinuation of legacy Sportster at the end of 2022 in the region. In EMEA, the drop was a whopping 22%, driven by weakness in the French and German markets. In APAC, there was a drop of 10%, driven by weakness in the Australian and New Zealand markets. However, Latin America sales increases of 46% were driven by growth in both Brazil and in Mexico. Unfortunately, the volumes in this region make up only about 2% of overall bike sales.

The one big positive is that there was a 15% increase in financial services revenue to $246 million.

Expenses and margins

The reason we are not outright “buy”-rated here is the margin compression. We can stomach declining sales during periods of stress, but the heavy promotion to generate sales hurt margins. Harley-Davidson for years was working on manufacturing optimization to help control expenses and improve margins going forward, but the operating environment has softened. Gross margin was down 360 basis points in Q4 due to lower volume, higher sales incentives, and other manufacturing costs, more than offsetting the benefits of shipment mix and lower raw material costs. The Q4 operating margin fell by 2.1 points, although general operating expenses were lower in the quarter due in part to LiveWire transaction costs in Q4 2022.

This all combined to lead to a net income of $26 million, or $0.18 per share. This was down from $0.28 a year ago, but was better than expected given the overall higher sales. For the year, EPS was $4.87, down 2% from 2022. So there is value here, even if EPS has stalled.

Looking ahead

Is Harley-Davidson, Inc. stock a value trap? In the near term, the biggest catalyst to boost sales will be in our opinion rate cuts, provided they are not done so because the economy has tanked. Medium term, the company must continue to pursue the younger generations. This is the greatest challenge.

Looking ahead, expect more sideways action in Harley-Davidson, Inc. stock, as sales are looking to be flat for 2024, if not down single digits on a percentage basis. The same goes for operating income. Future growth may come from LiveWire, the electric bikes, and sales are looking to be over 1,000 units, but this will come at significant operating losses for several years. For the year, we expect EPS falls from 2023, so, we foresee more sideways stock trading. The timing and circumstances surrounding rate cuts will be a wildcard, but we are looking for EPS in the $4.20-$4.70 range, putting the valuation here at 7.5X FWD earnings. The value is there, but more multiple compression is likely for Harley-Davidson, Inc. shares if an inflection in sales and margins is not realized or in sight later this year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for lucrative trades? That is what we do at BAD BEAT Investing

Enjoy rapid-returns with our strategy to advance your savings and retirement timeline by embracing a blended trading and income approach!

Our prices rise this month, but the next 3 subscribers ONLY can a special take 20% off right NOW through this HOG article with this link.

We invite you to try us out, with a money back guarantee if you are not satisfied (you will be). There’s also a light version of BAD BEAT, on sale for 55 cents a day with great benefits too. Come take the next step! Start WINNING