Summary:

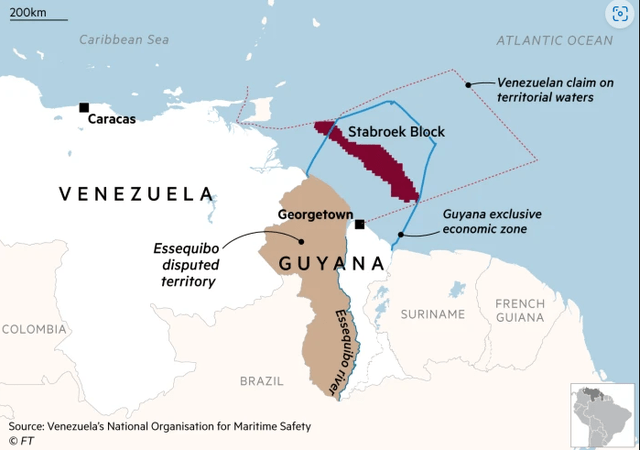

- The merger between Hess Corporation and Chevron Corporation is being questioned due to geopolitical risk in Guyana.

- Venezuela is claiming that the Stabroek block in Guyana is in disputed territory, which could threaten Exxon and Chevron’s operations in the region.

- We examine the deal spread and tell you the best way to play it.

Nicolas Maduro Telling The Press How Many Votes He Needs To Claim The Referendum Passed Getty Images/Getty Images News

In the commodity markets, you are never far away from geopolitical risk. Just look at the impact Panama closing Cobre mine has had on First Quantum Minerals Ltd. (FM:CA) and Franco-Nevada Corporation (FNV). The last week has seen this risk shift out to the energy sector with the merger between Hess Corporation (NYSE:HES) and Chevron Corporation (NYSE:CVX) being questioned.

Chevron-Hess Merger Background

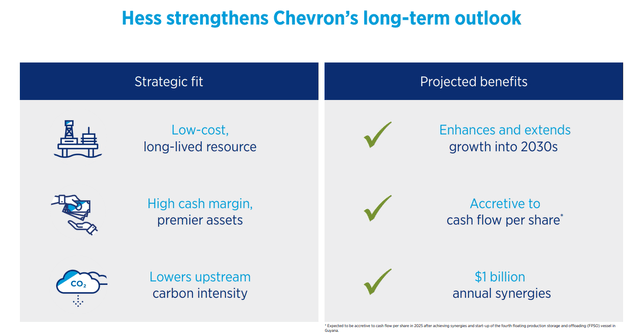

CVX announced the HES purchase on October 23, 2023.

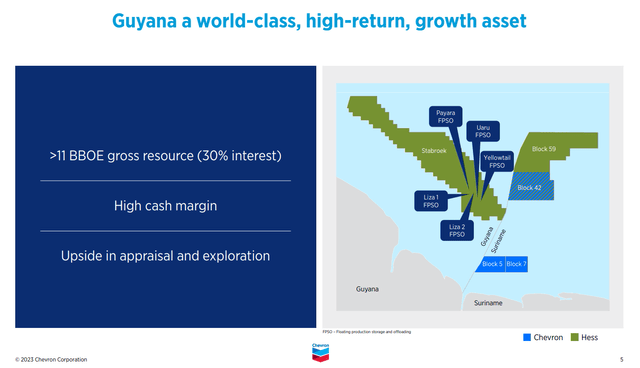

The acquisition of Hess upgrades and diversifies Chevron’s already advantaged portfolio. The Stabroek block in Guyana is an extraordinary asset with industry-leading cash margins and low carbon intensity that is expected to deliver production growth into the next decade.

“This combination positions Chevron to strengthen our long-term performance and further enhance our advantaged portfolio by adding world-class assets,” said Chevron Chairman and CEO Mike Wirth. “Importantly, our two companies have similar values and cultures, with a focus on operating safely and with integrity, attracting and developing the best people, making positive contributions to our communities, and delivering higher returns and lower carbon.”

“Building on our track record of successful transactions, the addition of Hess is expected to extend further Chevron’s free cash flow growth,” said Pierre Breber, Chevron’s CFO. “With greater confidence in projected long-term cash generation, Chevron intends to return more cash to shareholders with higher dividend per share growth and higher share repurchases.”

Source: CVX Website

As anyone who has followed the oil market knows, quality resource plays have been hard to find. There is a reason the super majors cannot grow their production to save their lives, and it is not because they have been accepting the ESG party line. HES had the resources in place and CVX pounced on the opportunity.

Chevron HESS Purchase Presentation

Now, make no mistake, this was all about Guyana. While Exxon Mobil Corporation (XOM) was okay with expanding its shale footprint with Pioneer Natural Resources Company (PXD), CVX likely would have passed on this if it was just about shale. Those 11 billion barrels of oil equivalent were the game changer.

Chevron HESS Purchase Presentation

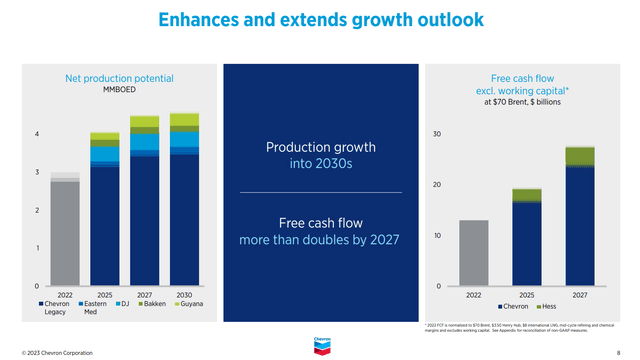

CVX will do well, if oil stays anywhere over $70 per share, though it likely is underestimating capital costs.

Chevron HESS Purchase Presentation

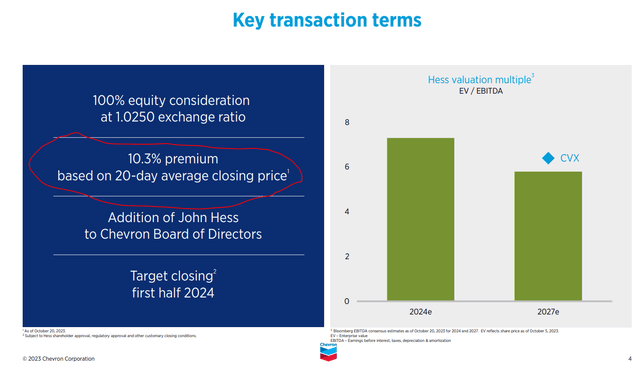

The interesting aspect of this deal was that there was almost zero premium on the transaction.

Chevron HESS Purchase Presentation

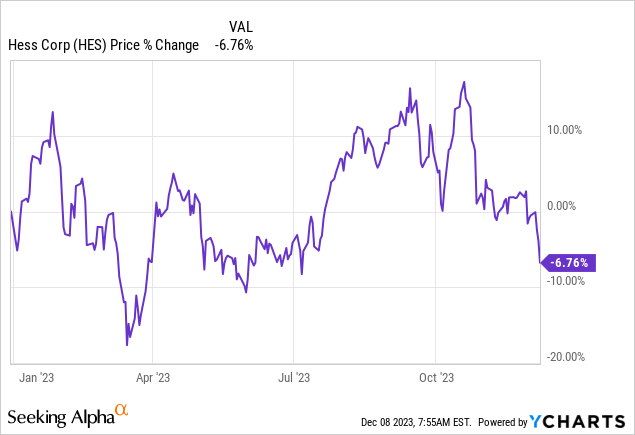

Ok 10.3% premium, but that evaporated in a heartbeat as this was an all-stock deal and CVX was taken to the cleaners after the announcement. Sometimes, the run-up happens way before as the news leaks months in advance. This also does not look like the case here, if we see the year-to-date stock performance in the October 23, 2023, news release.

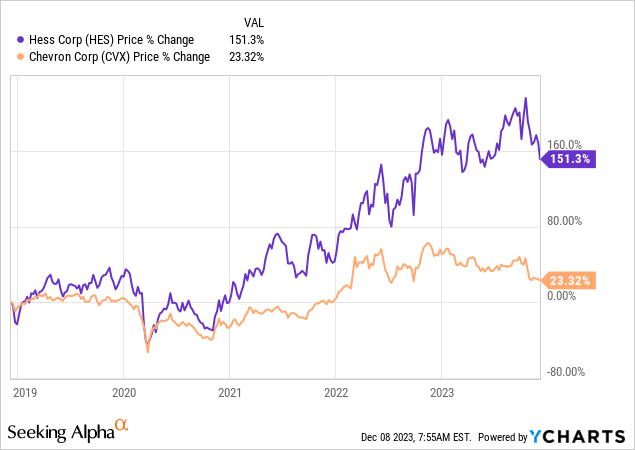

While the stock did not get a big bump on the news, perhaps it was HES realizing that the market was already pricing in the best news. Over the past five years, HES has been an outstanding performer. That is why they sold and tried to cash out.

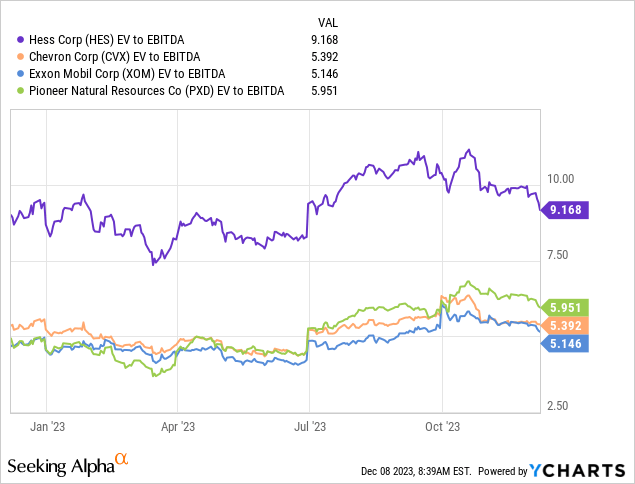

Looking at it from an EV to EBITDA perspective, HES was/is trading at a massive premium to CVX, XOM and even the recently acquired PXD.

We can get an identical result if we view the valuation on an Enterprise Value to flowing barrel metric. HES has the massive scale of the Stabroek Block’s and there have been over 30 discoveries announced to date. Development is slow though, and the first phase was brought online in 2019, and the collaboration had two phases in service at the end of 2022. Two more are being developed, and the aim is to get six total flowing by the end of 2027. HES management has previously commented that a total of 10 phases could be developed here. But the costs are likely to be huge, and it might be better suited to a firm with the financial flexibility of CVX, rather than HES. With that background in mind, let us look at the latest developments.

Venezuela Comes Into The Picture

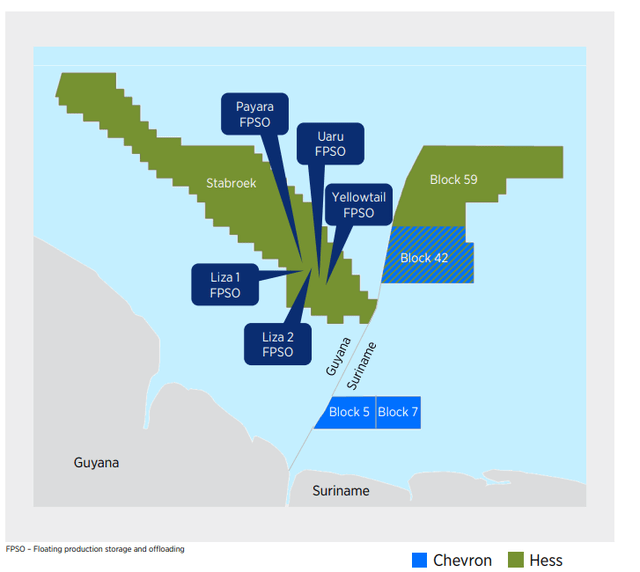

It always strikes us as hilarious as to how companies will bend over backwards to present the best possible visuals. Here is another example of that. This is the picture of the Guyana asset from the HES presentation.

Chevron HESS Purchase Presentation

Here is the same block with a slighter broader view. Guess which country should have been included in the CVX presentation?

So as the above slide shows Venezuela is claiming that the Stabroek is in disputed territory.

Venezuela’s escalating claims on oil-rich land in neighboring Guyana are threatening a key growth area for Exxon and Chevron.

Venezuelan voters on Sunday approved a referendum called by the government of President Nicolás Maduro to claim sovereignty over a large swath of Guyana it has long laid claim to, the Associated Press reported.

The simmering dispute could challenge Exxon’s ability to develop a region that has been among the world’s most productive areas since its discovery in 2015. Chevron, too, saw its potential when it agreed in October to acquire Hess and its assets in Guyana, putting Chevron front and center offshore the South American country alongside Exxon.

Source: Houston Chronicle

The real backstory here is that pretty much no one in Venezuela cares about this issue. While Maduro is claiming this is a win, the reality is far different.

But voting stations across the country were largely empty, national and international media reported.

“I have seen no independent reports of queues anywhere in the country. It looked like a normal Sunday in Caracas,” says Phil Gunson, an analyst at the international crisis group. “It was a resounding failure for Maduro.”

Nonetheless, Maduro was quick to hail the vote – in which 95% of those who voted yes to the government’s five questions – as a victory.

“It has been a total success for our country, for our democracy,” Maduro told supporters in Caracas on Sunday evening, praising the “very important level of participation”.

Venezuela’s government has said that more than 10.5 million people voted in the referendum – which would be a higher number than voted to re-elect Maduro’s more popular predecessor, Hugo Chávez, in 2012.

The government figures have been widely scrutinised, however, given that analysts say they do not correspond with the scenes at voting stations.

“They haven’t admitted it explicitly but it’s obvious [they rigged the results],” Gunson said.

An image purported to have been shared and later deleted by Venezuela’s electoral authority showed a table with about 2 million votes for each of the five questions, suggesting that they tallied the number of votes rather than voters to spin the public relations disaster.

The Venezuelan government has not published any detailed or regional results, adding to doubts about their validity.

“This is a massive PR disaster for Maduro. They’ve been firing the propaganda machine on all cylinders for months but despite their best efforts turnout is way below what we expected,” he added.

Intelligence collected by Guyana and its allies suggest the actual turnout was fewer than 1.5 million people – less than a 10th of the population – said a source close to the Guyanese government who described the move as “rigonomics”.

Source: The Guardian

Local Resident Standing In A “Long Line” From Vozdeamerica

Let’s add to this that Venezuela has resources that are far larger than Stabroek and far easier to develop, within its borders. The Orinoco Oil belt contains more oil than the Canadian oil sands and yet production has dwindled year after year. The last thing Venezuela is going to do is attack Guyana, especially considering that China’s CNOOC owns a stake there.

How To Play

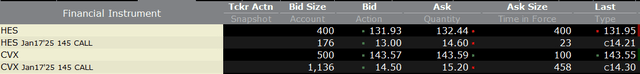

We started our position on November 21, 2023, via covered calls on CVX.

HES options have higher premiums but they have a lower dividend payout till expiration. Overall the return profile is pretty similar as the deal is almost 100% priced to go through. If it does not, we would still rather own CVX vs HES. That is the rationale for choosing CVX options.

Source: Trade Alert 390

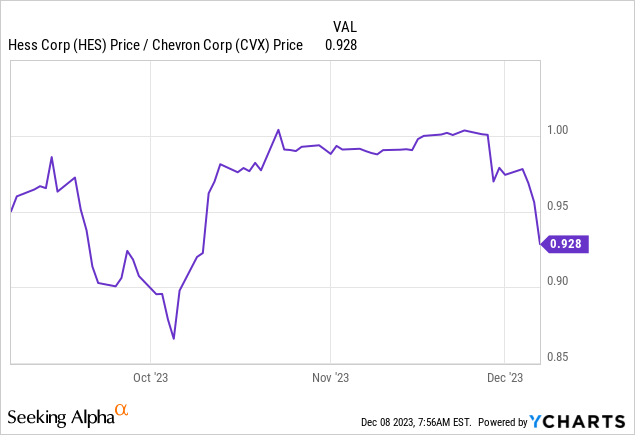

That was a fortunate call as HES has really dropped and widened the spread. We have done far better in CVX covered calls versus if we had gone with HES covered calls. Below we have shown a ratio of HES to CVX and since HES will be traded for 1.02 CVX shares, we think this metric is the best way to visualize it.

The ratio peaked at 1.00X, which makes sense as CVX shareholders will get two larger dividends until the deal closes. Now with a 7% spread to that closing, things are certainly more interesting. The odds of Venezuela doing anything rash are close to zero. The odds of CVX walking away seem similarly low. Unlike our earlier stance in November, at present, you are getting paid to take the risk to buy CVX via the purchase of HES. How should you consider playing it then? The best here for us would be to buy HES and sell the $145 Covered Calls for January 2025. Market prices are a bit volatile as we write this, but the screenshot below explains our rationale.

You are getting virtually identical call premiums for the $145 strike for both CVX and HES today. But with HES you get a far bigger return profile if the deal goes through. Put another way, if the deal went through today, HES would immediately be worth $146.44 (143.57*1.02). So you stand to make the bulk of that appreciation (till the $145 strike) and the call premium. With CVX you have a far lower upside in a flat price scenario. This stands true even when adjusting for dividends. The covered call also provides a high level of income and buffer in case the deal does not go through. We consider the net price of HES (purchase minus call premium) as acceptable even if the deal is canceled. We might add some of these in the coming days to our portfolio. For now, we are happy with our CVX covered call position and are observing the situation carefully.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

We may initiate additional long position in HES.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

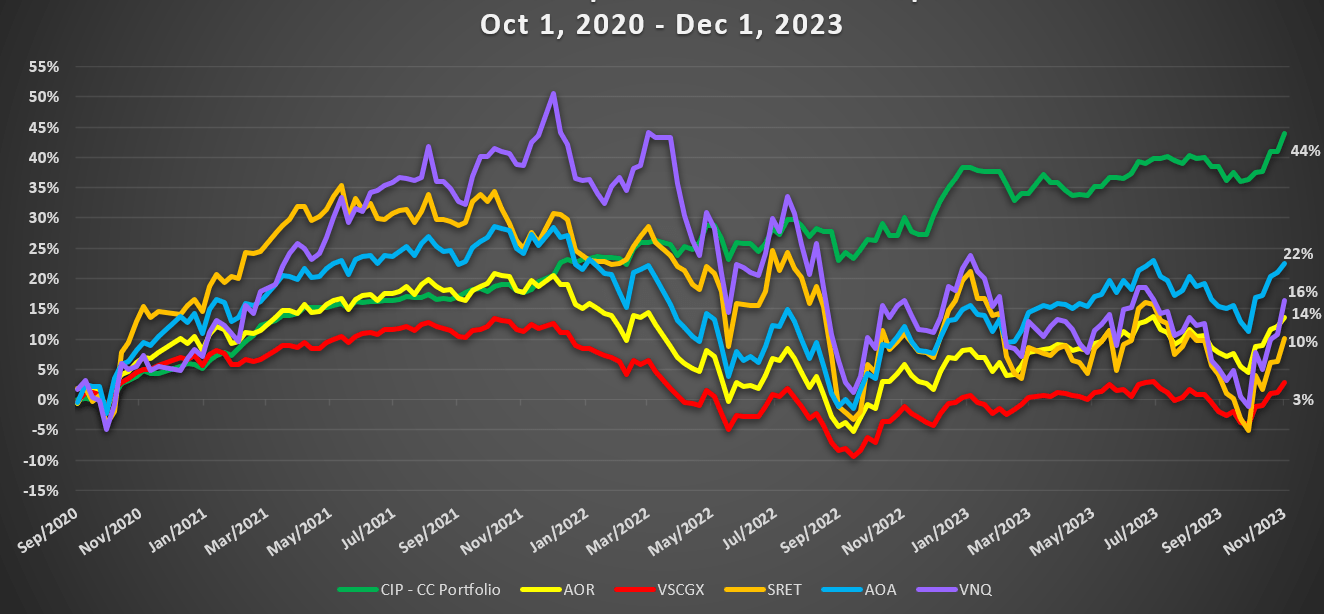

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.