Summary:

- Home Depot is set to report its 4Q22 earnings and provide FY2023 guidance next week.

- I expect a downbeat commentary for FY2023.

- However, the company continues to execute well and should gain share during this downturn.

jetcityimage

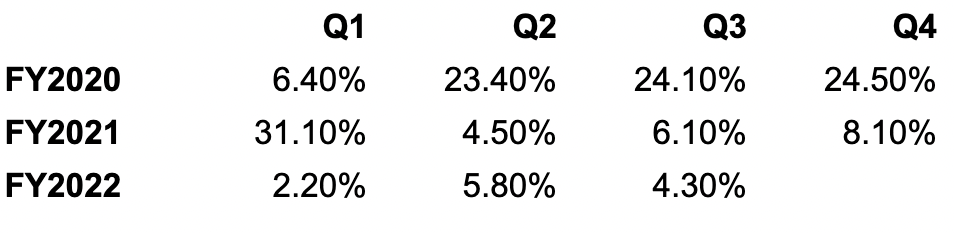

Home Depot (NYSE:HD) is set to release its 4Q22 earnings before the market opens on February 21, 2023. The company reported 4.30% comp sales growth in Q3 2022. The fourth quarter presents a 200 basis point tougher comparison on a one-year basis and a 240 basis point tougher comparison on a two-year stack basis.

HD Comp sales growth (Company Data)

In addition to tough comps, the slowdown in consumer spending sequentially from Q3 to Q4 due to worsening macros should result in an additional couple of hundred bps headwinds. I am expecting flat to slightly up comp sales for Q4 as a result. The average ticket is likely to be up high single digits Y/Y (same as Q3), offset to a good extent by a decline in transactions. Management guided for positive comps in Q4 and most of the sell-side analysts are expecting comp sales and revenues to grow in the 0% to 1% range which looks reasonable.

However, more than Q4 results, investors are interested in the company’s FY2023 guidance and outlook commentary. If we look at the commentary from its suppliers, most have indicated a slowing end market though the extent is pretty wide from a double-digit decline according to Masco (MAS) to a much more upbeat commentary from Mohawk Industries (MHK). Below are some of the relevant excerpts,

We are planning for volumes to be down in the low double-digit range, partially offset by low single-digit pricing. Based on this assumption, we expect 2023 sales to decline approximately 10%”

Q4 earning call commentary by John G. Sznewajs – VP & CFO – Masco

…we believe markets will continue to be challenged during 2023 as new housing starts are projected to decline 15% to 25% and repair and remodel activity will decline modestly year-over-year.”

Q4 earning call commentary by Donald Allan – President, CEO & Director – Stanley Black & Decker (SWK)

We currently see a very challenging demand environment in 2023, and visibility beyond our first half is limited. The Fed has also been quite clear about its intention to slow down demand in its effort to tame inflation.”

Q4 earning call commentary by John G. Morikis – Chairman & CEO -The Sherwin-Williams Company (SHW)

Looking ahead into 2023, we do expect the tail end of this negative macro cycle to be felt during the first few months of the year. We foresee macro headwinds to slowly turn into tailwinds as the year progresses. Needless to say that it is difficult to predict the exact timing of the shift in the macro cycle, but we would expect this to happen towards late Q2 or early Q3.”

Q4 earning call commentary by Marc Robert Bitzer — Chairman of The Board and CEO – Whirlpool Corporation (WHR)

..this cycle is a little bit different. It’s not typical like other cycles. The employment remains strong with wages increasing. Housing remains in short supply and low mortgages will kind of limit people moving as much, aging homes, higher home values should support future remodeling and strengthen the rebound or the pent-up demand. Commercial projects continue to be initiated, that’s holding at this point. And inflation is slowing and interest rates may actually be near peak.”

Q4 earning call commentary by James F. Brunk – CFO – Mohawk Industries

…we expect U.S. R&R declining between 4% and 6%, U.S. single-family new construction declining between 18% and 22%, with starts down around 25%…”

Q4 earning call commentary by David Barry – SVP of Finance & IR – Fortune Brands Innovation (FBIN).

I believe it is reasonable to assume a low to mid-single-digit decline in the Repair and Remodel market in 2023 with a quick rebound once the macroeconomic headwinds recede as home equity levels remain healthy. The appreciation in home prices over the last five years especially post-Covid has resulted in much higher home equity levels for homeowners. Historically, there has been a positive correlation between home equity levels and homeowners’ willingness to spend on remodeling. This factor is likely to partially offset some of the macro headwinds this time and result in a quicker recovery.

Home Depot should fare better than end markets given its value proposition which attracts customers looking to cut costs during the slowdown. The company is also investing in improving its capabilities to serve large PRO customers. Previously, while the company had a good presence among the smaller professional customers, larger professionals mainly relied on Home Depot as a backup (not for planned purchases) due to the company’s inefficient delivery system for them. In recent years, the company has optimized its logistics system and invested in flatbed distribution centers, direct fulfillment centers, and market delivery operations for big and bulky goods like appliances. The company now has the capability to deliver large quantities of materials directly to the job site which should help it gain market share in the large PRO space from regional independents and nationwide building material suppliers. In the long run, the company plans to grow its annual sales to ~$200 bn (vs.~$151 bn in FY21) by targeting these kinds of opportunities and gaining market share.

If we think about low to mid-single-digit end market declines and the company’s large pro initiative and other market share gain efforts offsetting it to some extent, I believe flat to low single-digit sales declines is a reasonable assumption for the company’s comp sales and overall revenues in FY2023.

In addition to the macroeconomic cross currents and their impact on the company’s sales, investors are also paying close attention to the margin commentary. Before the pandemic, the company’s gross margin was around 34%-35%, but it dipped below 34% in recent years due to supply chain issues and sourcing difficulties. However, as supply chain issues are starting to ease, I expect we can see some Y/Y improvement in gross margin in FY2023. I am not that optimistic about operating margin though as volume deleveraging and management’s continuous investment in various long-term initiatives to gain market share might increase SG&A as a percentage of sales.

If we look at the current consensus estimates, they are building in a slight Y/Y revenue growth of ~0.63% for FY2023 (ending Jan 2024). I am a bit more conservative than them and believe there is a chance of disappointment here. If the company does a really good job in gaining market share and traction in large PRO space, the company may do better than my estimates, but I believe it’s prudent to be conservative given the current macros. On the EPS front, the sell-side consensus is currently expecting ~0.77% growth next year which I again find a bit optimistic. However, in addition to revenue and margin prospects, share buybacks is also a big factor in deciding where the EPS ends up in FY2023 and it is a bit difficult to predict.

Given where the current consensus numbers for the next year are, I believe HD’s guidance may disappoint. However, I believe it is more a factor of the broader macroeconomic slowdown rather than the company-specific issues. The company continues to execute well and is well-placed to gain market share in this tough environment.

I believe long-term investors should pay close attention to the company’s commentary around Pro share growth and how the company plans to offset the macro slowdown and drive long-term growth. Usually, slowdowns like the current one, provide a good opportunity to buy high-quality companies like Home Depot at attractive valuations. So, even if the management outlook for 2023 misses analyst expectations and the stock sees some correction, it should be a buying opportunity for long-term investors. Hence, I have a buy rating on the stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is written by Ashish S. and Pradeep R.