Lucid Stock: Q4 Earnings Preview

Summary:

- Lucid Group will report its Q4 results next week.

- The company most likely has lost a significant amount of money during Q4.

- Deliveries growth, margin performance, and the company’s cash burn rate are important factors to consider.

Gregg DeGuire/Getty Images Entertainment

Article Thesis

Lucid Group, Inc. (NASDAQ:LCID) will report its fourth-quarter earnings results on Wednesday, February 22. We will take a look at what investors can expect from the quarterly report and at what Lucid’s outlook looks like going forward.

What Can We Expect From Lucid’s Q4 Earnings Report?

When Lucid reports its quarterly results next week, two of the most important metrics will be Lucid’s production and its deliveries. Lucid is, unlike peers such as Tesla (TSLA), at a stage where it isn’t profitable anyways. Its biggest task is ramping up production and deliveries, as Lucid will have to grow its business considerably before it eventually becomes profitable.

During the third quarter, Lucid Group managed to produce 2,280 vehicles, which was the best output in the company’s history. That is to be expected, of course, as the company is in the “ramping” stage, thus quarter-to-quarter growth should be positive, which will mean that the company will have many record quarters going forward.

During the third quarter, Lucid had delivered 1,400 vehicles to customers. That’s significantly less than the number of vehicles produced, which makes sense — it takes a while for Lucid to deliver a vehicle once it is produced, thus deliveries are growing with a lag versus produced vehicles. Similar trends were seen when other EV players were in a similar stage.

For 2022, Lucid has forecasted production of 6,000 vehicles to 7,000 vehicles as of the end of the third quarter. Earlier, Lucid had guided for significantly higher production numbers, but guidance had been reduced due to issues such as supply chain disruptions and some headwinds in ramping up production on time. Since the company produced less than 1,000 vehicles in Q2, and since Q1 production was low as well, it is likely that Q4 production levels were significantly higher than Q3 production of 2,280 — depending on where exactly in the 6,000 to 7,000 range Lucid ends up.

Lucid’s production growth during Q3 will likely result in meaningful deliveries growth in Q4, as more vehicles will likely have made the transit to customers. This, in turn, will result in higher revenues versus the third quarter. Analysts are predicting that Lucid Group will report sales of $274 million for the quarter, which would be up 41% versus the third quarter. If Lucid has delivered all the vehicles it has produced during the third quarter during the fourth quarter, its deliveries would be up more than 60% sequentially. Importantly, however, Lucid’s sales mix will change over time. While the company only sells one model, the Air, for now, this model is sold in different sub-types, such as the Dream, the Grand Touring, and so on. Lucid produced the highest-spec and highest-priced sub-types first, thus it would not be surprising to see its average sales price decline somewhat over time. There’s an exception, however — the highest-end type, the Sapphire, will be sold this year. Nevertheless, Lucid’s sales mix will likely result in revenue growing slower than deliveries, thus the forecasted revenue growth rate — less than the deliveries growth rate — makes sense.

Lucid is not profitable, and will most likely not be profitable for quite some time. Still, investors should factor in Lucid’s profitability performance when evaluating the company. Even when Lucid generates net losses, there can be positive or negative trends in its profitability. A couple of examples:

– Is Lucid’s gross margin improving? If yes, that indicates that Lucid is making progress in ramping up its production while bringing down expenses (on a per-vehicle basis). If not, Lucid isn’t becoming more efficient, which would be a problem. During the third quarter, Lucid’s gross margin was negative at -200%, meaning the company’s cost of revenue was way higher than its revenue. There thus is a big need for improvement over the coming quarters if Lucid ever wants to be profitable.

– Are operating expenses growing faster or slower than revenue? If operating expenses, e.g. for administration and sales, are growing slower than Lucid’s revenue, that is a positive sign. It means Lucid benefits from operating leverage, which will positively impact its margins in the future. If LCID’s operating expenses grow faster than its revenue, that indicates that the company is becoming less efficient and that operating margins will remain under pressure even if LCID manages to grow its gross margin meaningfully in the future.

Another important factor for investors to consider is the company’s balance sheet. Lucid Group is not generating any positive operating cash flow right now, thus the company has to utilize the cash it holds on its balance sheet for growth investments and for funding its operating cash burn. At the end of the third quarter, Lucid’s cash position totaled $1.26 billion, while the company also had $2.08 billion in short-term investments that can be easily turned into cash. In total, that’s around $3.3 billion — a sizeable amount of cash and equivalents, but Lucid also has a pretty serious cash burn rate for now. During the first three quarters of 2022, Lucid burned through $2.4 billion between its operating cash burn and its capital expenditures, which is equal to around $3.2 billion on an annual run rate basis. In other words, Lucid’s cash position, including short-term investments, was equal to around one year worth of its cash needs at the end of the third quarter. Investors will want to look for clues whether the cash burn rate has improved during the fourth quarter.

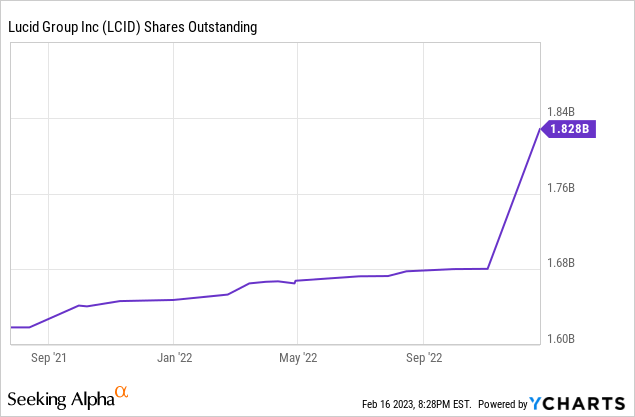

The company’s $600 million at-the-market program that was announced during Q4 has likely also had an impact on LCID stock’s cash position, although that, of course, comes at a cost — Lucid’s share count most likely has continued to climb. A rising share count dilutes existing shareholders, as their shares represent a declining portion of the company’s overall value. Over the last year, dilution has been very significant at Lucid:

And since Lucid is still pretty far from being profitable and generating positive free cash flows (or even positive operating cash flows), investors can expect further dilution in the coming quarters and years, I believe, until Lucid is able to move to a self-funded model eventually.

A non-financial item that will be important going forward is Lucid’s planned next model, the Gravity SUV. Lucid plans to open reservations in early 2023, so we could get some news on that during the earnings call. The model will likely start deliveries in 2024 if everything goes as planned. While the Gravity will most likely be a high-priced vehicle as well, it expands Lucid’s addressable market significantly and is thus an important step in growing the company in order to make it profitable eventually, as scale advantages can be captured over time.

Takeover Speculation And Final Thoughts

Lucid Group has given back some of the gains that were made in the recent past following speculation that Saudi Arabia’s sovereign wealth fund might be interested in acquiring the company. That has, so far, not happened, which is why the market has become less excited about a potential takeover bid. That being said, Saudi Arabia has added to its Lucid stake, increasing the position from 1.02 billion shares to 1.11 billion shares during the third quarter. I personally believe that buying Lucid solely as a takeover speculation play is not a great idea, as it is far from guaranteed that Saudi Arabia is interested in taking the company over.

While Lucid’s models are looking good and while they are appealing from a tech perspective, Lucid is still pretty far from being profitable. While Q4 should be stronger than Q3, Lucid will burn through a lot of money until it eventually is able to self-fund its future growth. Since Lucid is valued at around $20 billion despite not being able to generate any net profits or free cash flows in the foreseeable future, I believe that Lucid is a rather risky investment at current prices. If the company is successful in ramping up its business and if new model introductions expand the addressable market massively, Lucid could be a solid investment eventually. But these things are far from guaranteed, which is why I prefer to stay on the sidelines for now.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!