Summary:

- The Home Depot has announced the acquisition of SRS Distribution, a residential specialty trade distribution company, for $18.25 billion.

- The acquisition will provide The Home Depot access to a new market worth around $50 billion and complement its existing capabilities.

- The deal will increase The Home Depot’s leverage and temporarily suspend share buybacks.

- The stock is also looking pricey, leading to a ‘hold’ downgrade.

Justin Sullivan

March 28th ended up being a really interesting day for shareholders of home improvement retailer The Home Depot (NYSE:HD). After the market closed, the management team at the business announced a massive acquisition. According to the press release issued regarding the deal, the company has agreed to acquire SRS Distribution, a privately owned business that serves as a leading residential specialty trade distribution company that has operations serving professional roofers, landscapers, and pool contractors. Unfortunately, The Home Depot’s management team did not reveal how much in synergies might be captured from this transaction. But they did say that the move will bring with it access to an entirely new market that could be worth up to around $50 billion.

Although The Home Depot is much larger, with a market capitalization of $382.42 billion, this is still a massive purchase for the company. It will increase the firm’s leverage to some extent and, in order to pay that down, management has decided to temporarily suspend share buybacks. Relative to where shares of The Home Depot are trading at, the purchase price is not awful. But it’s also not great. Add on top of this some other implications of the transaction, combined with how much shares of the home improvement retailer have risen over the past couple of years, and I would argue that now is a good time for me to downgrade The Home Depot from a ‘buy’ to a ‘hold’.

An interesting purchase

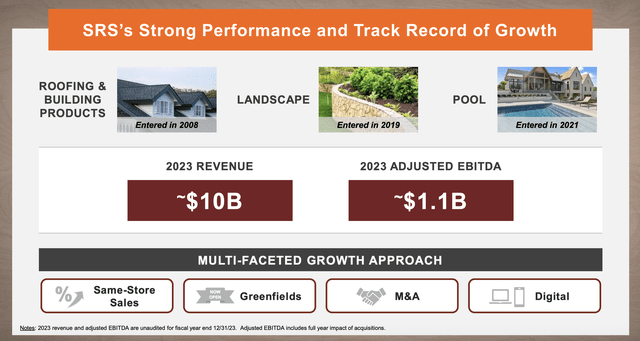

After the market closed on March 28th, the management team at The Home Depot announced the purchase of SRS Distribution in a deal valued at $18.25 billion. Through a combination of organic growth and acquisitions, SRS Distribution has grown to be a big player in three primary markets. These would be the roofing and building products market, the landscaping market, and the pool market. Based on data from 2023, the company generates around $10 billion in revenue each year. From that, it generates only about $75 million in net profits but cash flows are significantly larger. Operating cash flow, based on my own estimate, is around $615 million. Meanwhile, EBITDA is approximately $1.05 billion.

As I mentioned already, The Home Depot has not revealed how much in synergies might be captured from this transaction. That’s disappointing because it could play a big role in determining how appealing the deal ultimately is. However, even if synergies are not captured, this transaction makes sense from an operational perspective. This is because, instead of already playing heavily in the markets that The Home Depot plays in, SRS Distribution actually complements the capabilities of the home improvement giant. This is especially true when considering the ‘Pro’ ecosystem that The Home Depot has created as a major area of focus for it in recent years.

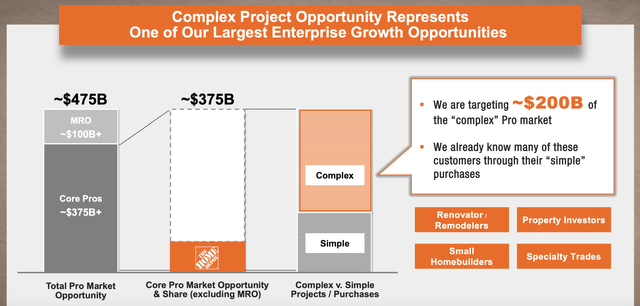

All combined, the market opportunities that The Home Depot plays in are worth around $950 billion. But a large chunk of this market, known as the complex project market, which is focused on professionals, is worth around $475 billion. $375 billion of that is to the core group of professionals, of which The Home Depot is focused on complex projects such as renovation and remodeling, property investments, specialty trades, and small home builders. That’s about a $200 billion market opportunity in all. There’s also the $100 billion maintenance, repair, and operations space.

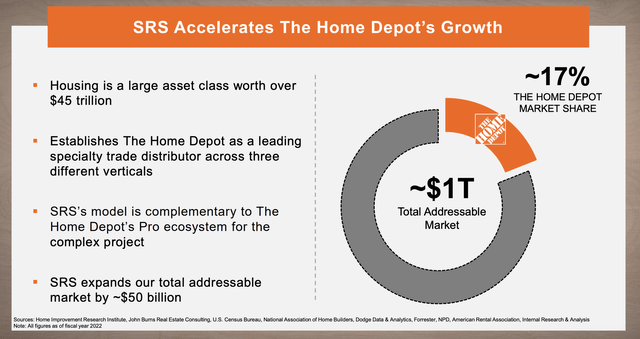

When it comes to the work that professionals do in this space, The Home Depot sees itself as a one-stop supplier for all of their needs. Naturally, picking up a company like SRS Distribution can help further this goal. But because of its own end markets, the management team at the home improvement behemoth believes that another $50 billion worth of market opportunities is now being opened up to it. That brings the total addressable market for The Home Depot up to around $1 trillion. Of this, the company now has a roughly 17% market share.

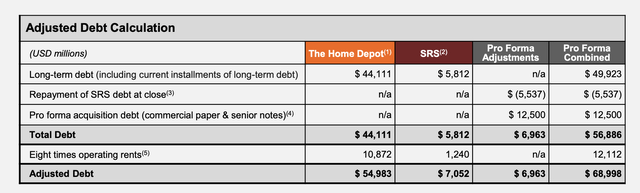

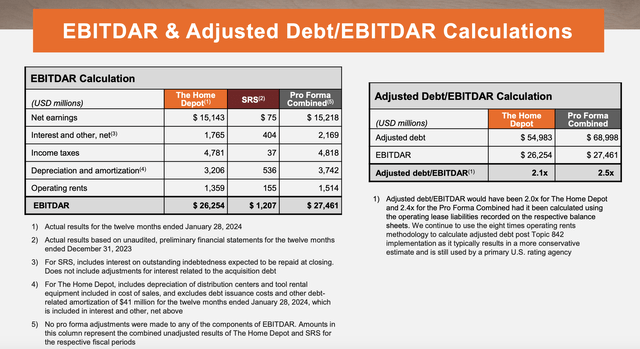

Operationally, the deal definitely makes sense. But it’s not an easy deal to make. For starters, the $18.25 billion transaction value is rather lofty. This works out to about 16.1 times the EBITDA of the company being acquired. What’s more, in addition to absorbing an extra $5.82 billion worth of debt, The Home Depot is taking on another $12.5 billion of debt in the form of commercial paper and senior notes. In its investor presentation regarding the transaction, the management team at The Home Depot provides some of their own calculations regarding the deal and the impact that it should have on both profitability and net leverage. These results can be seen in the image above and the image below.

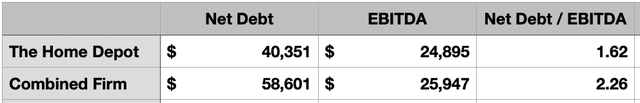

Personally, I take some issues with some of these calculations. For starters, when it comes to leverage, the firm is using gross leverage as opposed to net leverage. We unfortunately don’t know how much cash and cash equivalents SRS Distribution has on its books. But in all likelihood, it will be coming with little to no cash. The other problem on this front is that the company includes operating rents into the equation of its adjusted debt. They calculate this as being eight times the annual operating rents. When calculating net leverage, I don’t believe this makes sense since these are not actually a form of debt.

The other issue that I have involves profitability. Because it factors operating runs into the equation, The Home Depot also factors in rent into EBITDA. This overstates profitability in my view, though I understand the rationale for somebody who might include operating rents into the leverage picture. In my own analysis, I prefer to stick to traditional EBITDA and traditional leverage figures.

Using management’s calculations, net leverage for the combined company will come in at around 2.5. That’s up from the 2.1 that the company calculated for itself without the deal. Using my own calculations, I end up with a net leverage ratio before the deal of about 1.62 and a net leverage after the deal of about 2.26. Ultimately, management subjective is to reduce debt back to around 2 times its calculation within 24 months of the closing of the transaction. To do this, the company will pause its share buybacks. This is a pretty big deal because, last year alone, The Home Depot allocated $8.07 billion toward buying back units. And over the last three years, they have allocated $29.58 billion toward the same thing. They also happen to have $12.3 billion worth of buyback capacity under the current authorization. But it appears as though further moves on that front will have to wait.

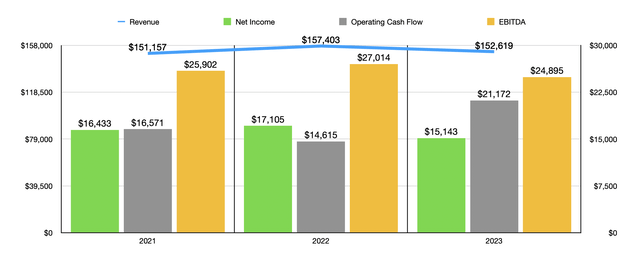

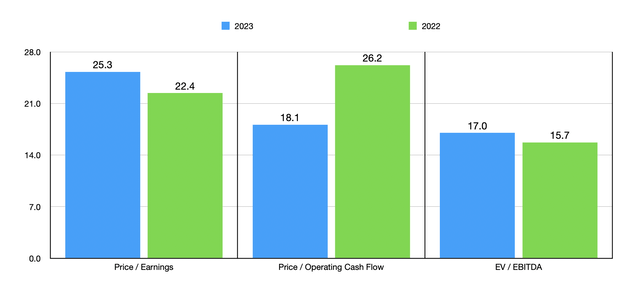

All things considered, I wouldn’t exactly call this deal bad. But I wouldn’t call it great either. In the chart above, you can see how The Home Depot has performed operationally over the last three years. The company truly is a cash cow. I then, in the table below, valued it using results from 2022 and 2023. On an EV to EBITDA basis, the company is trading at a multiple of 17. That’s only marginally higher than the implied buyout price of SRS Distribution. Normally, I would be happy with this. On the other hand, we need to keep in mind that the extra debt coming to the table will bring with it additional interest expense. If management is right about having to take out an extra $6.96 billion in net debt, and if we assume a 6% annual interest rate on that debt and a 21% effective tax rate, we actually turn the profits generated by SRS Distribution into a loss rather quickly. In fact, we even bring down its operating cash flow to around $285 million. That would imply a price to operating cash flow multiple of 64. That’s well above the 18.1 multiple that The Home Depot is trading for at this time.

Takeaway

At this point in time, I applaud the management team at The Home Depot for looking for growth opportunities. However, I would say that I’m not crazy about this transaction. On an EV to EBITDA basis, the deal seems to make sense. Leverage for the company will tick a bit higher, but this is not something outside of management’s ability to work with. What I do find more problematic is that, when you factor in additional interest expense, you end up with a scenario whereby, relative to cash flows, the purchase does look quite pricey. It’s also important to keep in mind that The Home Depot has had a heck of a run in recent years. Back in October 2022, I rated the business a ‘buy’ to reflect my view that shares should outperform the broader market for the foreseeable future. And outperform they did. Since the publication of that article, shares are up 44.1% compared to the 39.6% rise seen by the broader market. And when you compare the multiples that it was trading for back then to the multiples it’s trading for now, that alone could justify a downgrade. But when you add on to this the major acquisition, downgrading The Home Depot to a ‘hold’ just makes sense.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!