Summary:

- Home Depot enjoyed unsustainable growth resulting from the pandemic and high lumber costs.

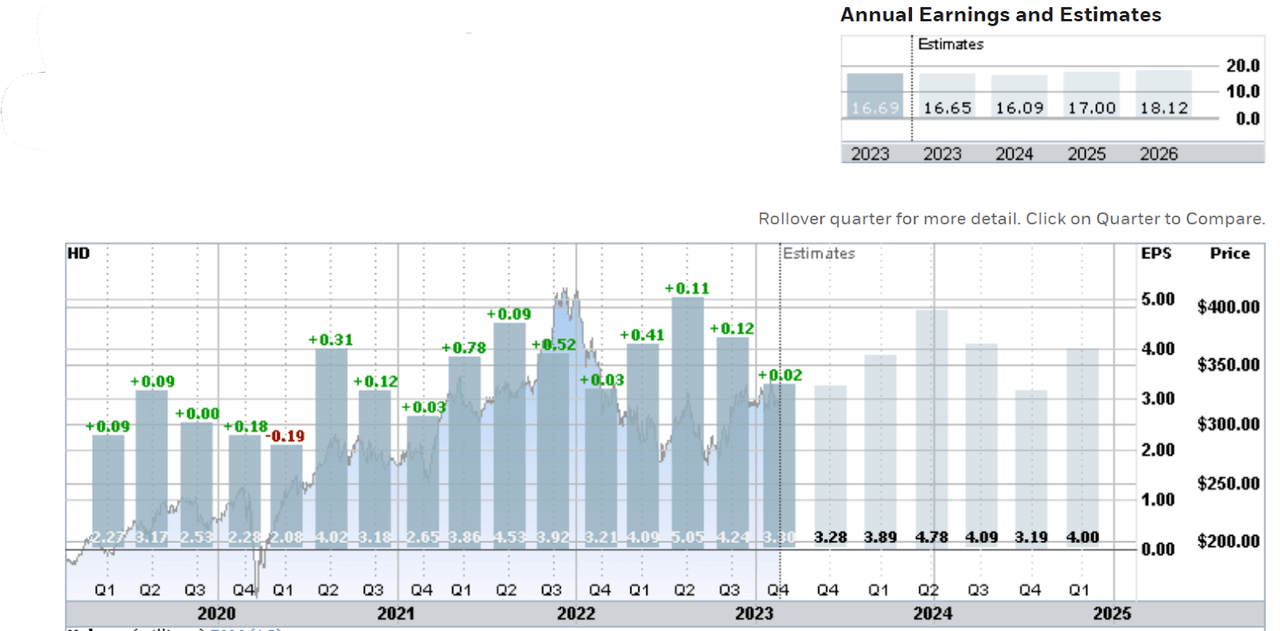

- The current outlook is reasonable, but earnings are expected to drop.

- Even after the post-earnings drop, the shares are not cheap.

- The Wall Street consensus rating is a buy, with a consensus price target that maps to a total return of 14.4% over the next year.

- The market-implied outlook continues to be modestly bullish, with moderate volatility.

jetcityimage

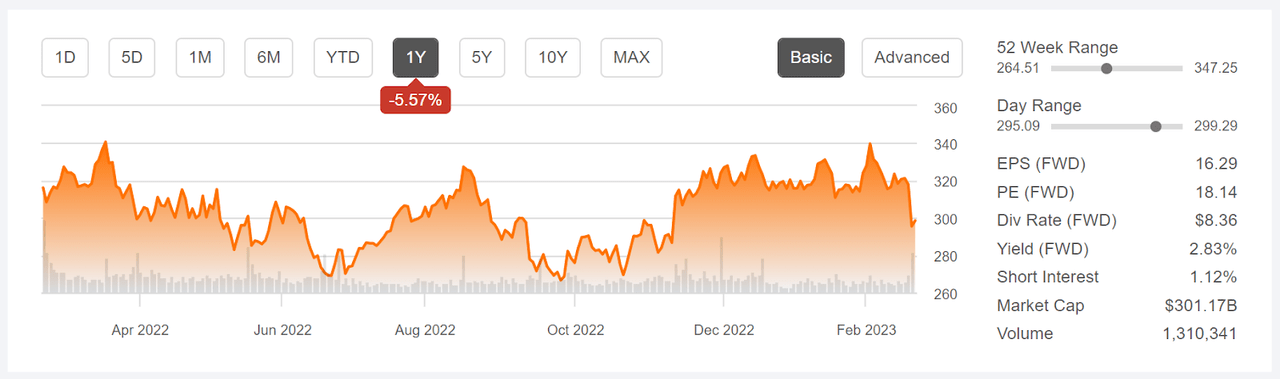

Home Depot (NYSE:HD) reported Q4 results before the market opened on Feb. 21, 2023, beating expectations on earnings, but slightly short on revenue. The forward guidance for 2023 was cautious, and indicated a slight decline in diluted EPS for the year. The shares dropped 7.1% for the day and are currently 12% below the YTD high closing price of $339.79 on Feb. 2.

12-Month price history and basic statistics for HD (Seeking Alpha)

The outlook for building supply and home improvement stores depends on several factors that the market is struggling to get a grip on. Higher labor costs are, of course, is a negative. The volatility in lumber prices in the past several years makes it harder to forecast sales and earnings. In the Q4 earnings call, management noted the negative impacts of declining lumber prices on sales. Higher interest rates have mixed impacts. Homeowners with low locked-in mortgage rates are more likely to improve their existing homes rather than trading up because of the higher costs associated with a new mortgage. On the other hand, higher rates also discourage people from transitioning from renting to owning. Higher rates also put downward pressure on home prices, tending to make homeowners more cautious as expensive home upgrades seem less likely to justify their costs.

Another challenge for investors in assessing HD is that it will be hard for 2023 results to look favorable against the backdrop of very robust earnings growth over the past three years, a period during which diluted EPS increased by 60%. The consensus outlook for quarterly EPS is that each quarter in 2023 will be slightly lighter than the corresponding quarter of 2022, with full-year EPS slightly below 2022 results. EPS for 2024 is expected to fall further in 2024. The consensus expectation for earnings growth over the next three to five years is 4.9% per year.

Trailing (4 years) and estimated future quarterly EPS for HD. Green (red) values are amounts by which EPS beat (missed) the consensus estimate (ETrade)

I last wrote about HD about five months ago on Sept. 19, 2022, and I changed my rating from a hold to a buy. The shares had sold off as part of a broad rotation away from consumer discretionary stocks, along with the decline in U.S. equities. Fears of a coming recession were quite high in September and HD has fallen 15% in a month. HD’s valuation had improved, with the forward P/E having fallen to 16.7. The Wall Street analyst consensus rating on HD was a buy and the consensus 12-month price target corresponded to an expected total return of about 30% over the next year. The market-implied outlook, a probabilistic price forecast that represents the consensus view among buyers and sellers of options, was bullish to early- and mid-2023, with expected volatility of about 31% (annualized). As a rule of thumb for a buy rating, I want to see an expected total return that’s at least half the expected volatility. Taking the Wall Street consensus at face value, the expected return is far above this threshold. The spread in the individual analyst price targets was quite high, however, which reduces the predictive value of the consensus. With the recent sell-off and the bullish views from both the Wall Street analysts and the options market, upgrading to a buy rating made sense. In the period since, HD has returned 8.85%, significantly higher than the return from the S&P 500.

Previous post on HD and subsequent performance vs. the S&P 500 (Seeking Alpha)

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it’s possible to calculate the probable price forecast that reconciles the options prices. This is the market-implied outlook and represents the consensus view among buyers and sellers of options. For a deeper discussion than is provided here and in the previous link, I recommend this outstanding monograph published by the CFA Institute.

With the substantial drop in the share price following the Q4 results, I have calculated updated market-implied outlooks for HD and I have compared these with the current Wall Street consensus outlook in revisiting my rating.

Wall Street Consensus Outlook for HD

Seeking Alpha calculates the Wall Street consensus outlook for HD by aggregating the views of 34 analysts who have published ratings and price targets over the past 90 days. The consensus rating is a buy, as it has been for all of the past three years. The consensus 12-month price target is $334.70, 11.6% above the current share price, which corresponds to an expected total return of 14.4% over the next year. For context, the trailing 3-, 5-, and 10-year annualized total returns are 8.8%, 12.2%, and 18.0% per year.

Wall Street analyst consensus rating and 12-month price target for HD (Seeking Alpha)

Of the 34 analysts included in the consensus calculation, 17 assign a strong buy rating, four assign a buy and 12 assign a hold. Only one analyst has a sell rating on HD.

Market-Implied Outlook for HD

I have calculated the market-implied outlook for HD for the 3.8-month period from now until June 16, 2023, and for the 10.9-month period from now until Jan. 19, 2024, using the prices of call and put options that expire on these dates. I selected these specific expiration dates to provide a view to the middle of 2023 and through the entire year. The options prices used in this analysis were pulled at 11:53 AM EST on Feb. 22.

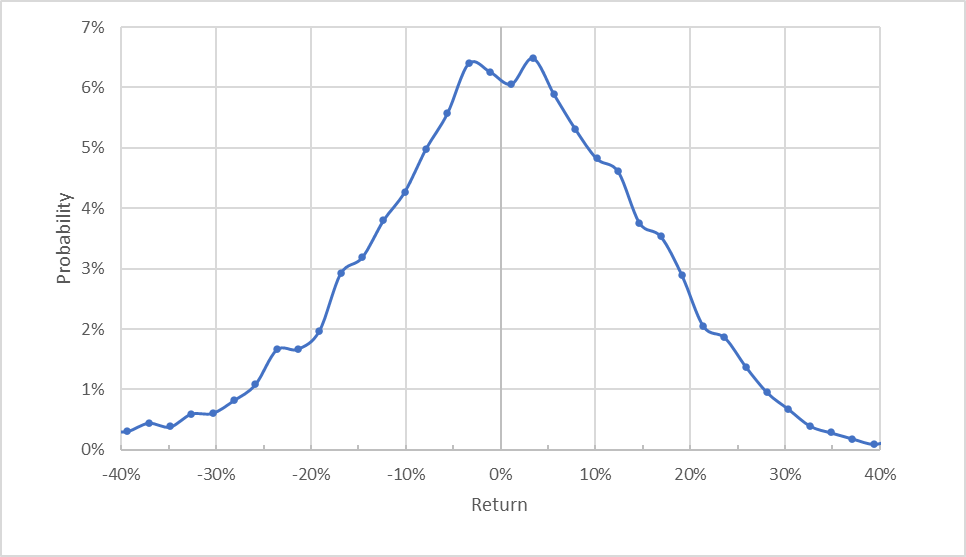

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Market-implied price return probabilities for HD for the 3.8-month period from now until June 16, 2023 (Author’s calculations using options quotes from ETrade)

The market-implied outlook to mid-2023 is generally symmetric, with comparable probabilities of positive and negative returns of the same magnitude. The expected volatility calculated from this distribution is 28% (annualized). For comparison, ETrade calculates a 28% implied volatility for options expiring on June 16, 2023.

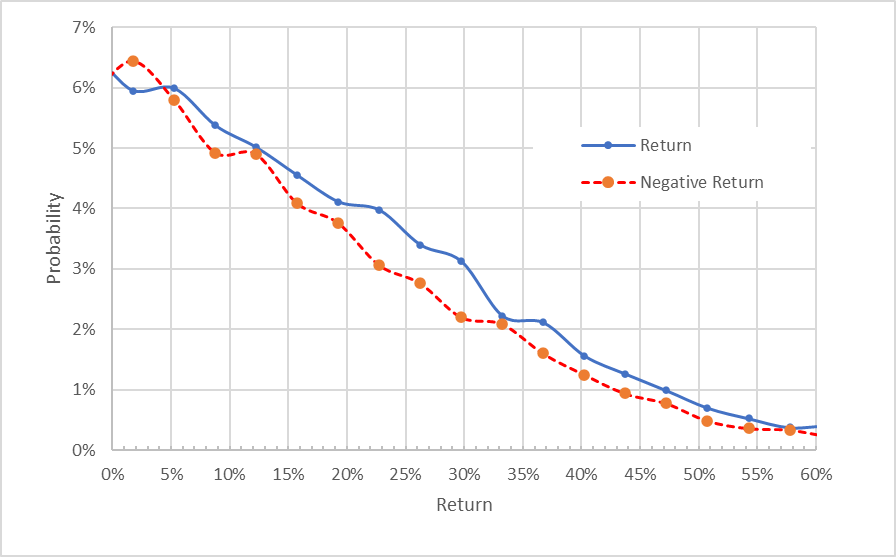

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

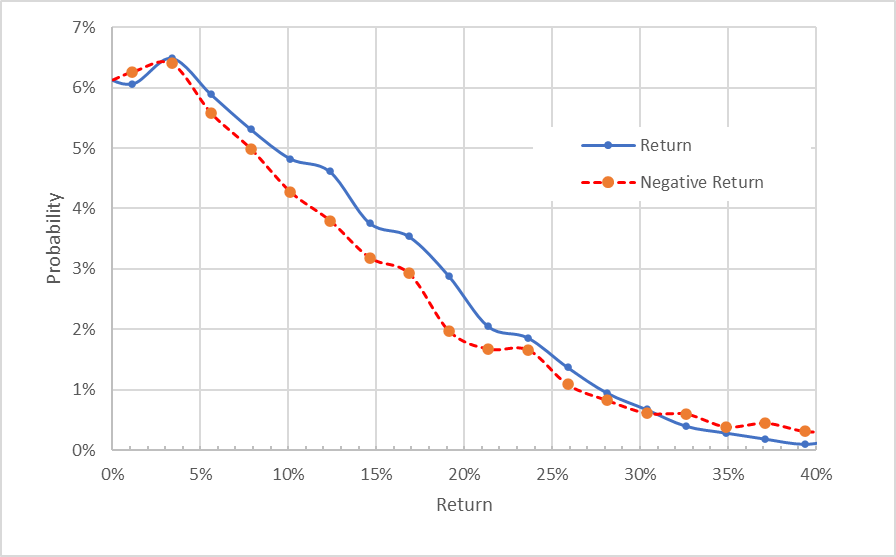

Market-implied price return probabilities for HD for the 3.8-month period from now until June 16, 2023. The negative return side of the distribution has been rotated about the vertical axis (Author’s calculations using options quotes from ETrade)

This view shows that there is a fairly small, but consistent, tilt in probabilities that favors positive returns (the solid blue line is above the dashed red line over almost all of the left ¾ of the chart above). This is a modestly bullish outlook from the options market. The positive spread in probabilities is slightly narrower than was observed in the 4-month outlook from my September analysis.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There’s no way to measure the magnitude of this bias, or whether it is even present, however. The expectation of a negative bias reinforces the bullish interpretation of this outlook.

The market-implied outlook for the 10.9-month period to Jan. 19, 2024, is consistent with the shorter-term view. There’s a narrow spread in probabilities favoring positive returns across almost all of the distribution. The expected volatility calculated from this distribution is 27.4% (annualized). This is a modestly bullish outlook and is qualitatively similar to the 8.8-month outlook from my September post, although the expected volatility at that time was 30.8% (annualized).

Market-implied price return probabilities for HD for the 10.9-month period from now until January 19, 2024. The negative return side of the distribution has been rotated about the vertical axis (Author’s calculations using options quotes from ETrade)

The market-implied outlooks calculated using options expiring in June of 2023 and January 2024 tell a consistent story, with a modest bullish tilt and expected volatility of around 28%.

Summary

When I last analyzed HD in mid-September of 2022, the shares had dropped about 15% over the past month on growing fears of an imminent recession with rising rates. Today, HD is down about 6% over the past month and down 12% from the YTD high close on Feb. 2. The market has responded negatively to management’s muted outlook for 2023, but the company is performing in line with expectations. A full-blown recession would be bad news for HD, as people rein in discretionary spending, but interest rates comparable to current levels may serve to encourage people to improve their current homes rather than moving. The Wall Street consensus outlook continues to be a buy, with a consensus 12-month price target that maps to an expected 12-month total return of 14.4% over the next year. Compared with historical averages, this is not an unattractive prospect. As a rule of thumb for a buy rating, I want to see an expected total return that is at least half of the expected volatility (28%). HD just meets this criterion. The market-implied outlooks to mid-2023 and into the start of 2024 are both modestly bullish. While the valuation is somewhat high today, even after the sell-off following the Q4 earnings call, I’m maintaining a buy rating on HD.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.