Summary:

- Tech giant Intel announced a huge cut to its healthy quarterly dividend pay-outs today.

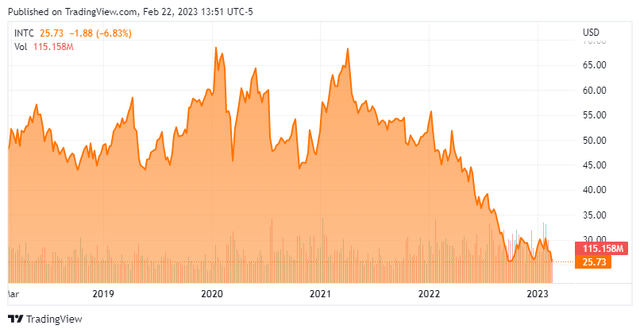

- Shares of this semiconductor manufacturer had already lost nearly half of their value in 2022 as the company attempted to make inroads in the foundry business.

- The company’s initial forecasts for FY22 and FY23 against actual results and current forecasts were embarrassingly bad, with management’s read on market dynamics head scratching.

- Prior to the dividend announcement this morning, the stock was finding technical support in the mid-20s despite almost universal bearish Wall Street sentiment.

- Where do the shares go from here? An investment analysis follows in the paragraphs below.

Photos by Painter

The sea is endless when you are in a rowboat.”― Adolfo Bioy Casares

Wednesday morning, Intel (NASDAQ:INTC) announced it was cutting its quarterly dividend by two-thirds in order to preserve ‘financial flexibility‘. This is just the latest in a series of bad news for shareholders who saw this stock get nearly cut in half in 2022. However, the equity is trading level in light to the initial reaction to the slashing of its payout. Is the big dividend cut a ‘kitchen sink’ moment that will be the last of the drip, drip, drip of negative news flow or is more pain on the horizon for this tech icon? An analysis follows below.

Company Overview:

Based in Santa Clara, California, Intel Corporation is one of the world’s top two manufacturers of semiconductors – Taiwan Semiconductor Manufacturing Company (TSMC) being the other – with nine production facilities in the U.S., Ireland, Israel, China, Malaysia, and Vietnam. Intel was founded in 1968 by Gordon Moore (of Moore’s Law) and Robert Noyce and is literally responsible for putting the silicon in Silicon Valley. The company went public two years later, raising gross proceeds of $6.8 million at $0.02 a share, after adjusting for 13 stock splits – with the last one occurring in 2000. The stock trades near $26.00 a share, translating to a market cap of just south of $110 billion.

Operating Segments

The semiconductor manufacturer operates through six units: Client Computing Group (CCG); Datacenter and AI Group (DCAI); Network and Edge Group (NEX); Accelerated Computing Systems and Graphics Group (AXG); Intel Foundry Services (IFS); and Mobileye (MBLY).

CCG creates semiconductors (most notably, the Intel Core processor and x86 series of instruction sets) for desktops, laptops, notebooks, 2-in-1s, amongst others. Intel is the market leader in this mature category that is expected to grow in the low to mid-single digits to $90 billion by 2026. CCG was responsible for FY22 segment operating income of $6.3 billion on revenue of $31.7 billion, which represented significant declines of 60% and 23% (respectively) from FY21 operating income of $15.7 billion on revenue of $41.1 billion.

As the name implies, DCAI develops data center and artificial intelligence products (most notably, the Intel Xeon processor). These categories are expected to expand into a $65 billion opportunity by 2026. DCAI accounted for FY22 segment operating income of $2.3 billion on revenue of $19.2 billion, which like CCG were down profoundly from operating income of $8.4 billion on revenue of $22.7 billion in FY21, representing 73% and 15% declines, respectively.

NEX provides server solutions throughout the network to the intelligent edge, primarily to enterprise level customers with offering such as its Intel Atom processor. This vertical is expected to grow at a low double-digit CAGR to $75 billion in 2026. NEX contributed FY22 segment operating income of $740 million on revenue of $8.9 billion versus FY21 operating income of $1.71 billion on revenue of $8.0 billion.

AXG delivers high-performance computing and graphics solutions for enterprise and data center applications, a market expected to reach $100 billion by 2026. The unit lost $1.7 billion of operating income on revenue of $837 million in FY22, as compared to a loss of $1.2 billion on revenue of $774 million in FY21.

IFS is Intel’s fully vertical, standalone foundry business that provides third-party manufacturing for bespoke product needs. To bolster its capabilities in this area, the company is in the process of acquiring specialty analog semiconductor foundry Tower Semiconductor (TSEM) for $5.4 billion with expectations for the deal to close sometime in 1H23. The mature foundry business is expected to be a $140 billion opportunity in 2026. After generating a segment operating loss of $23 million on revenue of $786 million in FY21, IFS lost $320 million on revenue of $895 million in FY22.

Mobileye was the company’s driving assistance and self-driving solutions unit. It was spun out in an IPO in October 2022. Intel still owns 93.5% of the concern, which is currently valued at $35.2 billion. Albeit a small contributor like AXG and IFS, this segment was the only one to show improvement on both the operating income and revenue lines FY22 versus FY21, with operating income increasing 25% to $690 million and revenue rising 35% to $1.9 billion.

Strategy:

Shortly after CEO Pat Gelsinger returned to the company where he worked for 30 years – including a stint as the company’s first Chief Technology Officer – he began implementing Intel’s IDM (Integrated Device Manufacturer) 2.0 strategy in February 2021, which is an attempt to re-establish Intel’s dominant position in the chipmaking world after a decade of mediocrity, lost business (see Apple (AAPL)), and market share. The strategy revolves around three basic tenets.

January Company Presentation

First, the company is initially investing tens of billions of dollars into capacity expansion initiatives in Arizona, Ohio, Oregon, (as well as Germany and Ireland) to not only increase production of its own offerings, but also bring manufacturing capacity back to the U.S., where only 4.5% of the world’s semiconductor manufacturing capacity exits. By contrast, Asia holds 88% of that capacity, which was periodically shut in by the pandemic. Intel will receive U.S. government incentives from the $52.7 billion CHIPS Act for improving the domestic supply chain and bringing jobs back to America. Second, the company intends to expand its use of third-party foundry capacity for some of its offerings. Third, it aims to become a meaningful player in the foundry business with the establishment of IFS, which will attempt to exploit certain geographical, technological, and capacity gaps that currently exist in the industry. In addition to IFS, management sees growth opportunities in AXG and Mobileye.

Execution and Share Price Performance

After producing non-GAAP EPS of $5.10 on revenue of $72.9 billion in FY20 and non-GAAP EPS of $5.47 on revenue of $74.7 million in FY21, Intel expected to deliver FY22 non-GAAP EPS of $3.50 on revenue of $76.0 billion with 52% non-GAAP gross margin at the onset of that year. As can be gleaned from the segment results above, the company disappointed acutely.

With downward revisions provided throughout the year blamed on poor PC, notebook, and handset demand (and supply! – component supply tightness and logistical constraints); too much customer inventory from overstuffing the channel in prior periods; lower spending from data centers and server clients; macroeconomic headwinds; and continued market share losses (which have occurred since 2018 – specifically to AMD (AMD)), Intel’s FY22 was an unmitigated disappointment. It finished the year with non-GAAP EPS of $1.84 on revenue of $63.1 billion, with gross margin at 47.3%. The company did ‘right-size‘ itself in 4Q22 with anticipated savings of $3 billion in FY23 and ~$9 billion by FY25 – somewhat confounding considering its massive capex spend to bring additional capacity on line over the next couple of years.

January Company Presentation

To make matters worse, when Intel reported these results on January 26, 2023, it did not provide an FY23 forecast, only 1Q23 guidance, which was abysmal. The company expects to generate a loss of $0.15 a share (non-GAAP) on revenue of $11 billion with gross margin at 39.0%, representing declines of 117%, 40%, and more than 1,400 basis points year-over-year, respectively.

January Company Presentation

Balance Sheet & Analyst Commentary:

Owing to its awful execution, cash provided by operating activities declined from $29.5 billion in FY21 to $15.4 billion in FY22. Factor in its significant capital investments, and Adj. fee cash flow was negative $4.1 billion for the year. With cash and short-term investments totaling $28.3 billion and short-term debt of $4.4 billion, Intel’s balance sheet is in decent shape and will be further enhanced by a greatly reduced quarterly dividend payout going forward.

The Street has been negative and correct on Intel for a while, currently featuring only one outperform and two buy ratings against 17 holds, six underperforms, and six sells. Their median twelve-month price objective is $28 a share. Although management is not providing any FY23 guidance, the Street’s average guess is for earnings of $0.55 a share (non-GAAP) on revenue of $50.8 billion, representing 70% and 19% declines against a terrible FY22. The Street is more optimistic on FY24, with consensus calling for non-GAAP earnings of $1.88 a share on revenue of $58.5 billion.

Certainly more sanguine than the Street are CEO Gelsinger and CFO David Zinsner, who each purchased ~9,000 shares between January 30-31, 2023.

Dividend Cut Significance:

Today’s dividend cut will have two major impacts. The first is that income investors who were holding the stock are likely to be a trading headwind over the coming days as they sell off their shares. The equity has gone from north of a five percent yield before today’s announcement, to just under a two percent yield, making it non-attractive to income investors.

The reduced payout obviously helps, but not solve the company’s current cash burn rate issues as Intel is unlikely to earn enough to cover its reduced dividend payout over the next 12 months. Personally, I would have rather seen management suspend all dividend pay-outs until leadership had righted the ship and regained credibility in investors’ eyes. If you are going to take a band-aid off, it is better to rip it all the way off and quickly in my opinion.

Verdict:

The stock fell nearly 50% in 2022 as Intel’s challenges mounted. Operationally, it does not appear if there will be any uptick in PC demand with units shipped projected to by 6% lower FY23 versus FY22, which was down 16% versus FY21. Morgan Stanley (MS) lowered their 2023 forecast for PC demand yet again yesterday.

As such, growth is going to have to come from IFS, but the segment has yet to prove that it can sign up customers, although it should be positioned to do so. Tower should help, but it only generated revenue of $1.68 billion in FY22, up 11% from the prior year. Intel is going to spend as much as $50 billion to transform itself between FY22 and FY24, which will eat into cash if operations continue to plunge. After a horrid FY22 followed by an even worse beginning to FY23, Intel is a show-me stock.

That said, shares of INTC have hovered between $25 and $30 since mid-September 2022. One reason for this support in the mid-twenties is the embedded value of Mobileye. Currently valued by the market at $35.2 billion, Intel’s share is $32.9 billion, or approximately $8 a share. That algebra currently values the chipmaker’s other five segments, which generated 97% of its top line, at just under $20 a share, or $81.3 billion.

Even though the stock has found stability, operationally, the company is poised to deliver four consecutive really putrid quarters with no sign yet of a bottom. One year ago, management hinted that FY23 revenue would approach or exceed $80 billion. The Street is now calling for $50.8 billion. As such, the fact that the two generators of that pathetically bad forecast – the CEO and CFO – recently purchased stock does not hold as much weight as it normally would.

The stock is rangebound and with it previous 5.5% dividend yield, it would normally might have made for a decent covered call candidate. However, until there is some stability operationally, the recommendation is to stay on the sidelines.

When you’re at the end of your rope, tie a knot and hold on.”― Theodore Roosevelt

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author’s note: I present an update my best small and mid-cap stock ideas that insiders are buying only to subscribers of my exclusive marketplace, The Insiders Forum. Our model portfolio has nearly TRIPLED the return of its benchmark, the Russell 2000, since its launch. To join our community and gain access to our market beating returns, just click on our logo below.