Summary:

- Both Home Depot and Lowe’s are wonderful businesses to own for the long term.

- There are many reasons to own both companies, if purchased at the right valuation.

- Based on valuation and earnings growth rate, Lowe’s offers a greater expectation for higher returns in the near 1-2 years and thus has a better value proposition.

- Lowe’s leadership team has transformed the company positively; the combination of cost management, productivity initiatives, technological advancements, operational and logistical enhancement to improve customer experience, and strategic realignment to focus more on the pros, is finally bearing fruit.

kate_sept2004/E+ via Getty Images

Dear Readers, do note that most of the data here were generated between 22 and 25 December 2022, and the rest from 26 to 30 December 2022. Also, any “Buy” rating in this article is a “Conditional buy” which comes with having certain conditions being met. You will need to assess if an asset is a “buy” based on your expected returns from that asset which is a very personal decision.

Happy New Year, everyone! May your 2023 be far better than 2022 in every imaginable way.

An Introduction to Home Depot and Lowe’s

Anyone familiar with the home improvement scene in the United States will know that the two largest listed companies in this space are Home Depot (NYSE: NYSE:HD) and Lowe’s (NYSE: NYSE:LOW).

They are similar in many ways, with almost the same number of stores, having outlets of similar size, etc.

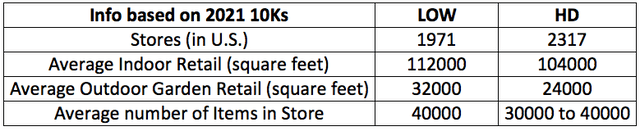

Author’s compilation of info from 10Ks and transcripts

Both companies target essentially the same profile of customers, the DIY (do-it-yourself), DIFM (do-it-for-me), and Pros Customers (professional contractors in two broad categories, those in the construction trades like renovators/remodelers and general contractors, and those in maintenance, repair and operations like building managers, handymen and specialty tradesmen such as electricians, carpenters and plumbers).

Both companies essentially sell similar products and services. They have to make the extra effort to differentiate themselves with their respective house brands, “unique” product offerings, and through their service quality. For instance, Sherwin-Williams paints are sold exclusively at Lowe’s while Ryobi are sold at Home Depot but not at Lowe’s. Home Depot sells its own proprietary products (HDX, Husky, Hampton Bay, Home Decorators Collection, Glacier Bay, Vigoro, Everbilt and Lifeproof), but Lowe’s has its Allen+, Roth, and more recently Origin21.

As mentioned in the LOW’s 10K,

We have many competitors who could take sales and market share from us if we fail to execute our merchandising, marketing and distribution strategies effectively, or if they develop a substantially more effective or lower cost means of meeting customer needs, resulting in a negative impact on our business and results of operations.

Other than each other, these two companies also compete with traditional hardware, plumbing, electrical, home supply retailers, and maintenance and repair organizations, as well as with general merchandise retailers, warehouse clubs, online retailers, other specialty retailers, providers of equipment and tool rental, as well as service providers that install home improvement products. Other than selling products at different price points to target different demographics, having locations in all the states, and reducing friction in the transaction process to make the process convenient for their customers, service quality will be the other key differentiating factor. More on service quality later.

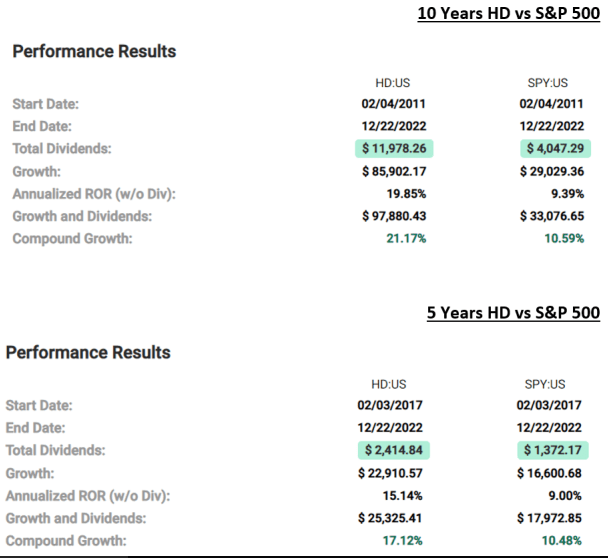

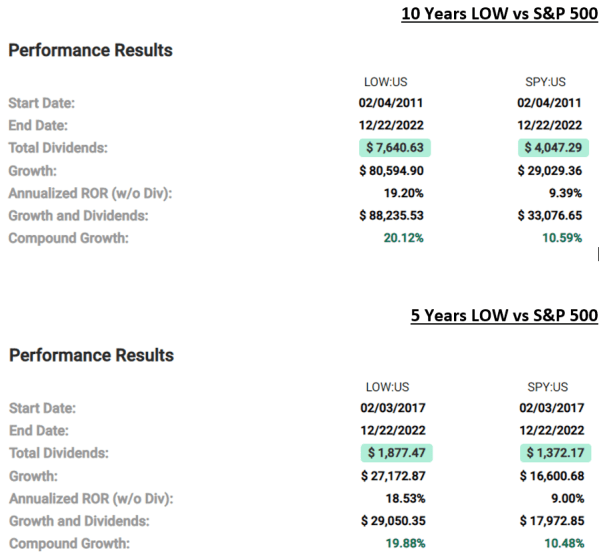

Both are Great Companies to Hold Long-Term

It is not surprising to find many shareholders of Home Depot also owning shares of Lowe’s as both companies have been performing well, trouncing the S&P 500 over a longer 10-year as well as a shorter 5-year period.

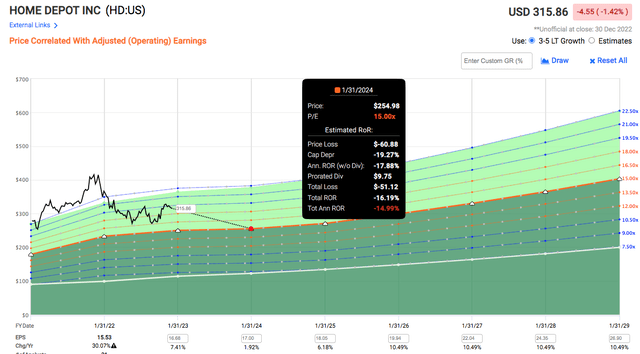

Fast Graph HD

Fast Graph LOW

Note: I chose these time frames to (1) exclude the worst of the Great Financial Crisis and (2) to factor in technological improvements that happened during the last 10 years that both companies could have leveraged such as better visibility of data via cloud computing, the use of touch screens interfaces to improve productivity, greater automation and use of robotics in the distribution centers, etc. This is important when I cover the section on “The Case for Lowe’s to Outperform Home Depot”.

Both Face Similar Headwinds and Benefit from Similar Tailwinds

A common concern that industry watchers and analysts have regarding the home improvement industry is the impact a slower housing market has on the future earnings of both companies, especially for Lowe’s since the majority of their customers are homeowners, they are likely to defer or reduce their budget for home improvement works.

This may be true but the impact should not be dire. Lowe’s CEO Marvin Ellison pointed out what he believes to be a myth regarding a positive correlation between a decline in housing with sales in home improvement, and posited three compelling arguments for a sustained tailwind in this industry

…demand drivers for home improvement are distinctly different from those that drive home building. So it’s important not to confuse the two. And as a reminder, at Lowe’s, the three highest correlating factors of home improvement demand are home price appreciation, age of housing stock and disposable personal income.

So let’s start with home price appreciation. Even if there is a broad-based decline in home prices, homeowners currently have a record amount of equity in their homes, nearly $330,000 on average, which remains supportive of home improvement investment. And even in the select U.S. markets where home prices have declined after a particularly steep run-up during the pandemic, we are not seeing any impact to sales.

Second, the average age of homes in the U.S. is over 40 years old and roughly 3 million more homes built during the housing boom in the mid-2000s, will be entering prime remodeling years by which is a key inflection point for big-ticket repairs. This is one of the key reasons why 2/3 of home improvement spend is nondiscretionary on repair or maintenance projects that cannot be delayed.

Third, consumer savings are near record highs, while disposable personal income remained strong. And more than 90% of homeowners either own or home or are locked into a low fixed mortgage insulating them from rising rates. The facts are that we have more personal disposable income today than we had before the pandemic, and that’s primarily in the bank accounts of homeowners… it was still 1.5 million to 2 million homes under current demand .

On top of these three factors, there is a persistent 1.5 million to 2 million undersupply of homes because of the lack of home building coming out of the financial crisis in 2008 and 2009, and 250000 first-time millennial homebuyers are expected per year through 2025. These factors lead homeowners to choose an investment in repairs and renovations to make their current homes meet their families’ evolving needs rather than buying a new home at record-high prices. In other words, this period of high inflation and rising interest rates actually drives greater demand for the home improvement industry.

Home Depot’s CEO Ted Decker agrees with CEO Marvin that sales can continue to be strong in 2023. In his response to an analyst who was concerned about the negative impact of a slower housing market on sales, he said,

There is a lot of noise around housing and home improvement. And you’ve heard some of this before, but if I can just step back a minute and lay out the environment the way we see it. I mean, we still feel very good, Michael, about our business. We just reported another strong quarter and reaffirmed our guidance for the year… From our core customer, we think our customer is still healthy. I mean, our customer tends to have a good job, growing wages, strong balance sheets. They own their home and have seen increased home equity.

Both CEOs also shared feedback from their Pro customers that most of them are expecting a robust backlog of projects pushing forward to 2023. Does this mean both stocks are a buy since the demand for home improvement will continue to be “strong and robust”?

So, after this brief introduction to what they do, some similarities, how they had performed, some of the industry-relevant tailwinds and headwinds, and the stance of the CEOs on the state of affairs, which is the better company to own?

The Obvious Winner is Home Depot

Home Depot has the largest market share, 17% of the $900 million to $1 trillion estimated total addressable home improvement market to be exact. That is a clear lead over second place Lowe’s 8% of the market share.

Home Depot is expected to do better than Lowe’s in an inflationary and recessionary environment that is compounded by a slower housing market scenario. The rationale goes like this: 75% of Lowe’s revenue comes from the DIY and DIFM crowd and if they choose to prioritize more immediate bread-and-butter spending needs over home improvement works, Lowe’s will take a bigger hit. On the other hand, 50% of Home Depot comes from professionals that include maintenance, repair and operations which are expected to have ongoing works in 2023, Home Depot is not expected to be hurt as much.

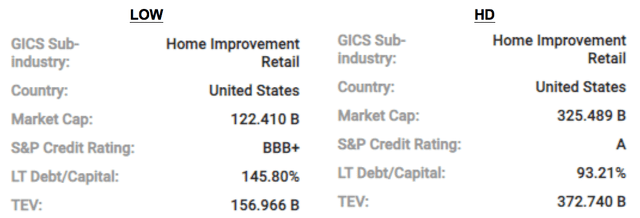

Both companies are investment grade but Home Depot is better with an A credit rating compared to Lowe’s BBB+. HD is also less leveraged than LOW, which has a higher long-term debt-to-capitalization ratio of 145.8%.

Fast Graph comparing LOW and HD

Bottom line matters and net margin affects that directly. Over the past 21 quarters, Home Depot’s net margin was consistently in the 9-10% range. Lowe’s net margin however fluctuated much more from -5.2% to 10.91%.

Fast Graph comparing LOW and HD

Those stable and consistently higher margins translate to higher sales per square foot for Home Depot. In the fiscal year 2021, Home Depot generated $604.74 in sales per square foot. In comparison, Lowe’s managed a respectable but much lower $463 in sales per square foot.

Finally, income investors will find Home Depot’s 2.4% yield more appealing than Lowe’s 1.86%.

Case closed? Not so fast. Reality is always more nuanced. I believe there is a strong bull case for Lowe’s.

The Case for Lowe’s to Outperform Home Depot

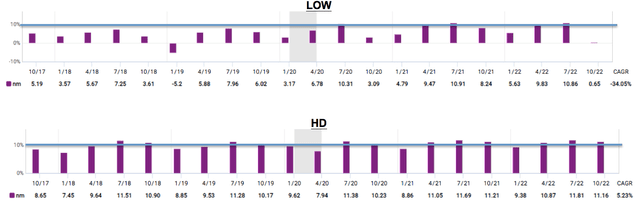

In the earlier segment under “The Obvious Choice is Home Depot“, I laid out comparisons of the fundamentals of both companies to show that Home Depot is a better choice. Yet, you may be surprised to know that an investment in Lowe’s 40 years ago would have been almost 400% better than an investment in Home Depot.

Historically, Lowe’s Had Massively Outperformed Home Depot

Previously, when comparing both companies over a 5-year and 10-year period, Lowe’s actually performed slightly better than Home Depot. To show that I did not cherry-pick the timeframe to get a favorable result for Lowe’s, I extended the comparison period to exactly 40 years, from 30 December 1982 to 30 December 2022.

A $10,000 investment in SPY would have become $87 thousand. The same amount in Home Depot would have increased to $327 thousand. But $10 thousand invested in Lowe’s would have turned into an envious $1.2 million dollars.

Past performance is definitely no guarantee of the future but it does give an indication of the possibility and the potential so let’s turn to examine the future earnings growth rate of both companies.

Based on Earnings Projections, Lowe’s Is A Better “Buy”

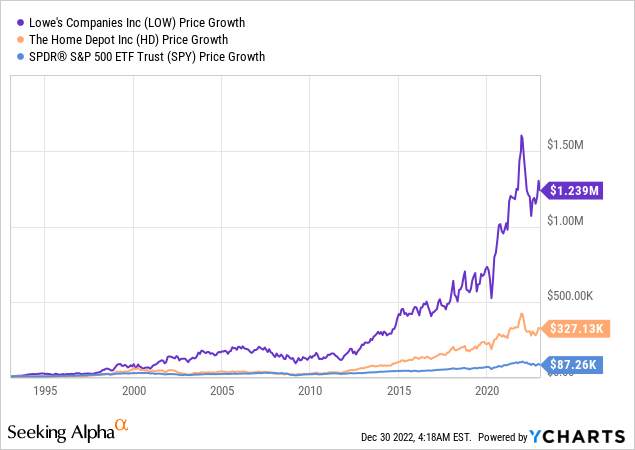

As both companies are huge, with a combined market share of 25% of the entire home improvement industry in the United States, there are levers for them to pull to improve operating margins, lower costs by ordering in bulk, pass costs on to their customers, and improve the bottom line. For instance, during the 7 December 2022 Investor Day presentation, Lowe’s CFO shared the following levers for improving their operating margins.

Lowe’s Investor Presentation Slides by CFO

Home Depot has not shared its guidance for 2023 as its investor day will be in the middle of next year but I will not be surprised to see the company do likewise if they need to squeeze out positive earnings.

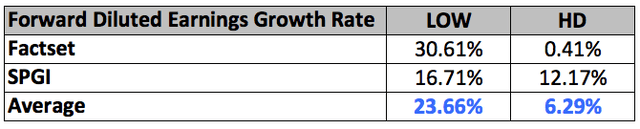

Analysts modeled the earnings growth rate and the results are tabulated below.

Author’s collation of analysts’ forecast

The disparity between these two sets of earnings growth estimates is great but believable. Morningstar analyst Jaime M. Katz wrote a memo on 15 December 2022 saying,

With continued focus on retail fundamentals (merchandising excellence, operational efficiency, supply chain improvements, and customer engagement), Lowe’s has been able to better leverage costs while maintaining its low-cost position. The firm retains some of the cost savings it achieves and passes the rest on to its customers through everyday low prices. These competitive advantages support our wide economic moat rating.

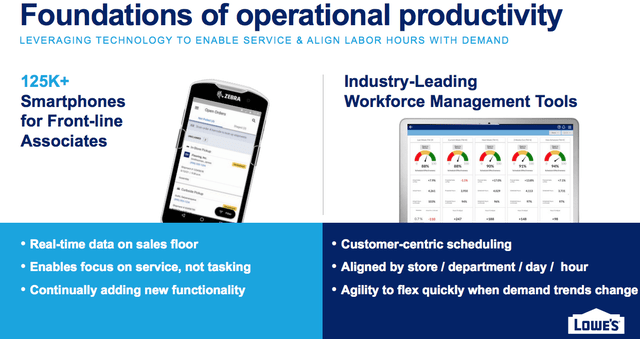

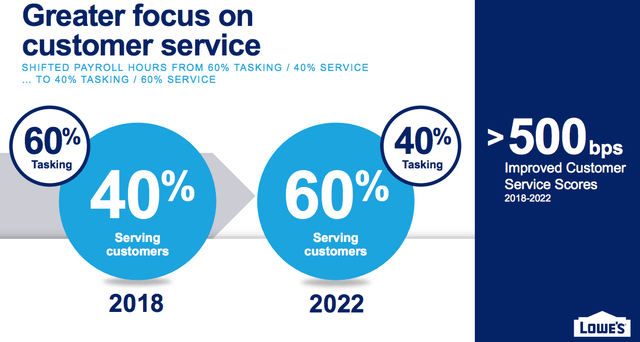

Lowe’s has been undergoing a multi-year technological and logistical transformation to improve productivity. It developed a customer-centric scheduling system to allow it to predict customer demands and align its labor with peak customer traffic for each store, each department, by each day, and even by each hour of the day to maintain its consistent and strong customer service and reduce payroll expenses. More on how Lowe’s is able to cut more expenses and improve margins to a greater degree later.

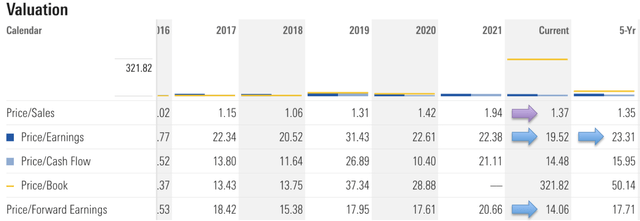

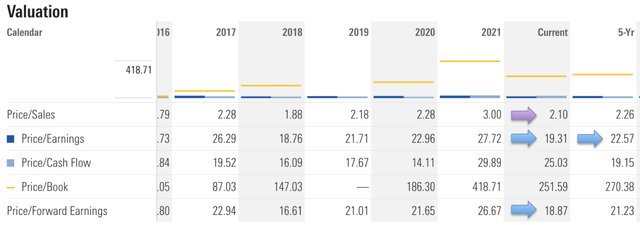

Based on Valuations, Lowe’s Is Cheaper

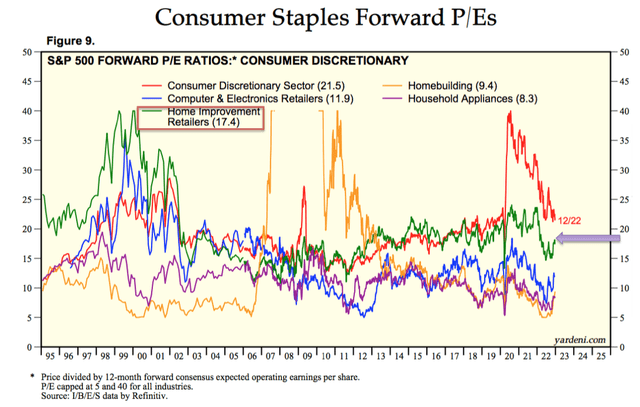

Both are trading at P/E and forward P/E valuations below their respective 5-year averages.

Lowe’s Valuation from Morningstar

Home Depot’s Valuation from Morningstar

I would like to draw your attention to the forward P/E; Lowe’s much lower price/forward earnings of 14.06 compared to Home Depot’s 18.87 is a reflection of both the better-expected future earnings for Lowe’s as well as worse-expected future earnings for Home Depot.

That also means that Home Depot is expected to continue to trade at a premium in 2023 relative to the stocks in the Consumer Discretionary category while Lowe’s is expected to trade at a much better valuation which will offer a much preferable entry point and a higher margin of safety.

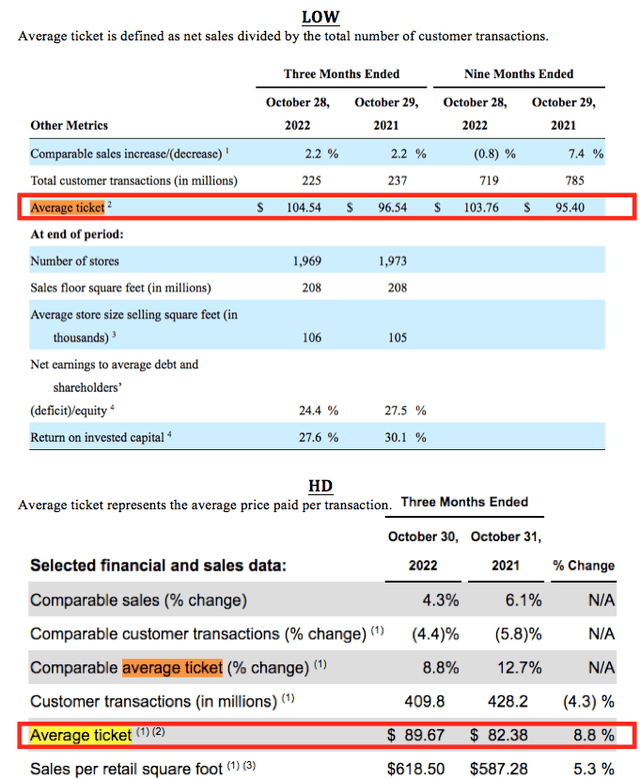

Lowe’s Has Higher Average Ticket Than Home Depot

Home Depot can boast of having a higher revenue per square foot than Lowe’s but that is not everything. Another key metric management of both companies uses to monitor the performance of the Company is “Average Ticket” as it represents a primary driver in measuring sales performance. “Average Ticket” represents the average price paid per transaction.

Comparison of The Latest Q3 2022 Average Ticket

Although Home Depot consistently chalks up a higher sales per retail square foot figure than Lowe’s, the average Lowe’s customer consistently outspends Home Depot’s customer.

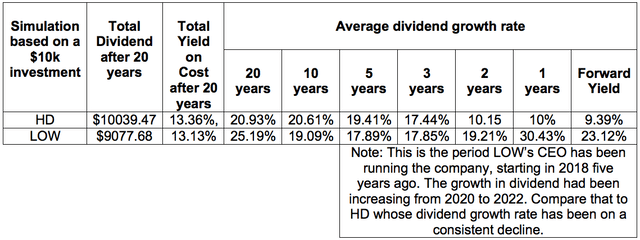

Dividend Growth Investors Would Love Lowe’s

I will be remiss if I fail to mention that Lowe’s is a Dividend Aristocrat that has risen dividends for 49 consecutive years compared to just 13 consecutive years of dividend growth for Home Depot. Although Home Depot provides a higher yield than Lowe’s, an investor with a longer investment horizon should give Lowe’s a second look. Over a 20-year period, because of Lowe’s higher dividend growth rate of 25.19%, an investor could have gotten back $9077.68 which is close to HD’s $10k of dividends.

Author’s compilation of data taken from Fast Graph and Seeking Alpha

And looking forward, one can also see the disparity in the average dividend growth rate. While Home Depot is decreasing its rate of dividend growth to 10% this year and an expected 9.39% growth in 2023, Lowe’s never fell below 17%. In fact, under CEO Marvin from 2018, the dividend increased for three consecutive years, and it is still expected to grow the yield at a lip-smacking rate of 23.12% in the fiscal year 2023.

With that, I will move on to the final bull-case argument for Lowe’s – management.

Lowe’s Management Knows What They Are Doing, And Knows What Their Competitor Is Doing

In the most recent earnings call, CEO Marvin Ellison said,

As I said in my prepared comments, we’ve got a lot of experience sitting around this table. There’s very few things that we have not seen.

Usually, we might have interpreted this casually as “we are a bunch of people who have worked for many years in the home improvement industry, so trust us to do the right thing“, and therefore dismiss the importance of his characterization. There is more to what he meant.

You see, three of the current leadership team at Lowe’s had prior experience working in various executive roles at Home Depot and one of them worked at another large competitor for almost 2 decades. They knew first-hand what had worked at Home Depot and Walmart and could adapt the relevant processes and strategies to Lowe’s. I will mention them briefly below while putting the focus on the CEO.

Joe McFarland, Executive vice president of Operations, served at Home Depot as President from 1994 to 2015. During his time at Home Depot, he led improvements in customer service and productivity so frontline staff could spend more time providing customer service and making sales.

William Boltz, Executive vice president of Merchandizing, served in different merchandising roles at Home Depot.

Donald Frieson, Executive Vice President of Supply Chain, was not a Home Depot veteran but he has more than 30 years of operations and supply chain experience, including 19 years at Walmart, joined Lowe’s in 2018. He is widely recognized as a cost containment expert.

CEO Marvin Ellison

He was brought on board at Lowe’s in 2018. Prior to that, he worked at Home Depot for 12 years from 2002 to 2014. He served as executive vice president of Home Depot’s U.S. stores from 2008 to 2014, “dramatically improving customer service and efficiency across the organization, as he oversaw U.S. sales, operations, installation services, tool rental and pro-strategic initiatives“.

And upon joining Lowe’s he had taken a hard look at his company. At the 7 December Investor Presentation Day, CEO Marvin was brutally candid about Lowe’s shortcomings,

One critical step in our evolution is moving away from a store delivery model which was terribly inefficient. With our old store-centric system, each store served as its own distribution centre for big and bulky products. We were holding the appliances in our back rooms, and storage containers behind our stores and using our store trucks to deliver them to customers. That meant customers can only purchase inventory from that single store. They didn’t have visibility into the inventory we had to offer and neither do our associates. And because or store-based trucks didn’t have delivery or routing software, customers did not have visibility into the delivery process. They didn’t know when their appliances will arrive so to say this was a poor customer experience would be an absolute understatement.

That kind of honesty was simply mind-blowing to me. And that was definitely what a leader needs to meet the challenges posed by its largest competitor with a market share that is more than twice as large.

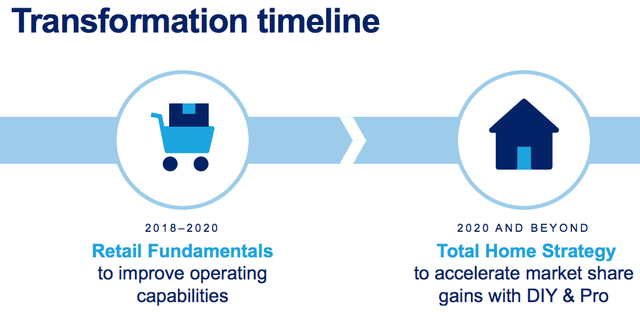

Under his leadership, he set Lowe’s on a two-stage transformation. Part one is on improving the fundamentals of the business to address the numerous issues which he had highlighted, to transit Lowe’s from a store-centric system into a more efficient customer-centric market-delivery model.

Investor Day 2022 Presentation by CEO

Part one is the low-hanging fruit, which when achieved will boost margins and earnings quickly and Lowe’s is on track; the full rollout is expected to complete by the end of 2023.

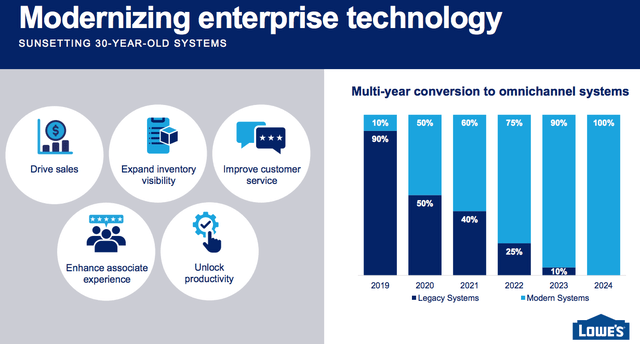

Investor Day 2022 Presentation by CEO

Likewise, Lowe’s modernization efforts are already paying off. Some examples: frontline associates in the backrooms and distribution centers are using their own smartphones to access inventory and complete fulfillment for online orders; more self-checkout stations are installed; cashiers are working with touch-screen terminals that make training new associates easier.

Investor Day 2022 Presentation by Joe McFarland

By the end of 2023, 90% of Lowe’s archaic systems will be modernized. With improved productivity and better visibility across inventory and labor, frontline associates are now able to spend 60% of their time serving customers and improving sales, compared to just 40% 4 years ago. That is a massive 50% increase in the time associates have to help customers find the best solutions for their home improvement needs. In a space that to me is very commoditized, where price matters a lot to customers and the differentiation between the supplies at different home improvement retailers is minimal, what brings a customer back, again and again, is the customer service.

Investor Day 2022 Presentation by Joe McFarland

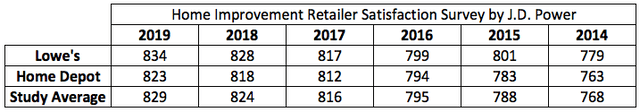

J.D. Power, a global leader in consumer insights, advisory services and data and analytics and a pioneer in the use of big data, artificial intelligence and algorithmic modeling capabilities to understand consumer behavior, has been conducting this “Home Improvement Retailer Satisfaction Survey” for the past 8 years.

J.D. Power. Data for 2020-2022 is not presented as those require payment

The two takeaways from the survey are clear: Lowe’s has consistently received a better consumer satisfaction score than Home Depot, and Lowe’s has consistently received above-industry average scores while Home Depot received scores below the industry’s average.

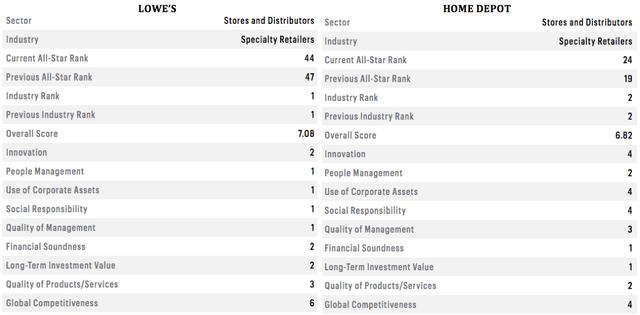

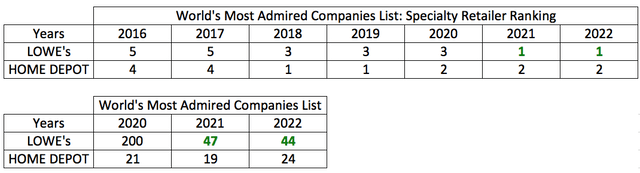

The transformations at Lowe’s also received acknowledgment at the national and international levels.

Lowe’s topped Fortune’s list under the World’s Most Admired Companies List in the Speciality Retailer category.

Fortune Ranking Comparison of Lowe’s and Home Depot

From the period when CEO Marvin took over in 2018, the multi-year improvements and innovations he and his team have been introducing are bearing fruit, and Lowe’s has been moving up this list.

In addition, Lowe’s made it into Fortune’s Most Admired Companies top 50 list for 2021 and 2022.

Data consolidated from Fortune Website

It is no wonder CEO Marvin just received the National Retail Federation Visionary Award for 2023.

And he is far from done. He has been positioning Lowe’s to enter into Home Depot’s traditional domain in a strong way – the Pro Customer space. While it remains focused on the DIY business, Lowe’s recognizes the opportunities in the Pros section and is expanding its market share there, aiming to have 30% of the revenue from this segment.

He shared the following at the recent investor day,

It wouldn’t be difficult to overstate how broken the pro service model was when we arrived at the company, but we are up to the challenge and we have completely overhauled the Pro Offering. I know some of our pro customers, suppliers and many shareholders and people in this room were originally skeptical about whether we had the commitment, and also the tenacity to succeed in this important area of the business. After 10 consecutively quarters of double-digit growth at Pro, we have demonstrated our commitment to this business.

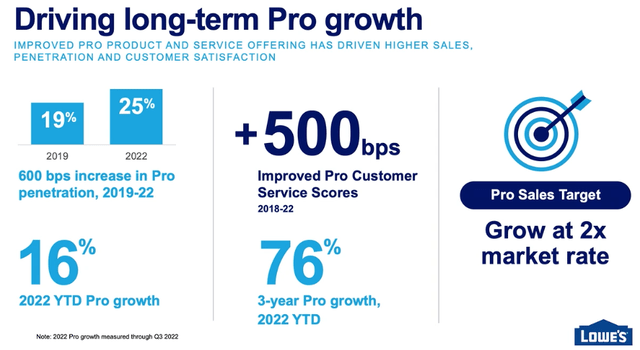

The increasing emphasis on the Pro business is not just a strategy envisioned but it is one that has been put in place. Lowe’s Pro customers in the MVP program spend three times more than pros not in the program and that has resulted in impressive double-digit growth for 10 consecutive quarters. Revenue contribution from the Pros has increased from 19% in 2019 to 25% in 2022.

And with the other initiatives that are coming to fruition in 2023 and 2024, it is not difficult to see Lowe’s reaching the targeted 30% in Pro sales revenue, and for the sales from the Pro customers to continue to grow at two times the market rate.

Risks in Investing in Both Companies: Based Only On Revenue Projections, Both Are A “Hold”

The CEOs of both companies expressed confidence in the strength of the business and downplayed the effects a slower housing market has on the business. While we should take note of the very reasonable explanations and reassurances by both CEOs, investors should also be mindful that CEOs are the spokesperson (cough… salespersons… cough) for their companies. Phrases such as “strong and robust sales” have to be qualified; actual projected numbers tell a more complete story.

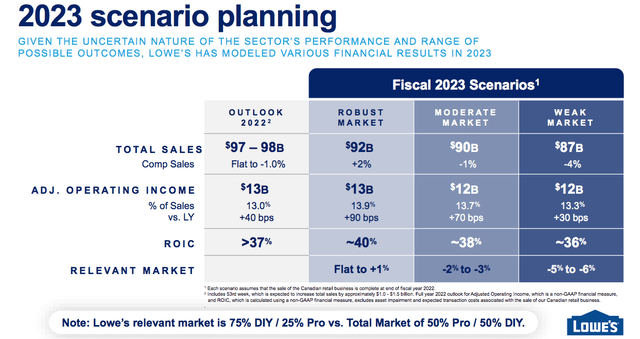

Lowe’s CFO Brandon Sink shared the following on the 7 December 2022 investor day. He projected three outlooks for the company. In the most bullish scenario of a “robust market”, sales are expected to grow 2% year-on-year. In a moderate market situation, sales are expected to drop to -1%. And if the market is really weak, sales may fall as much as -4%.

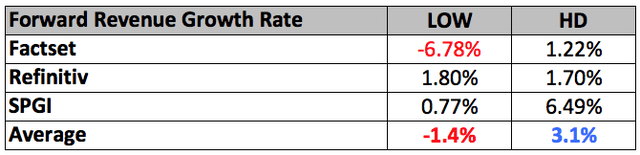

Analysts are likewise lukewarm on both companies as they are not convinced that a weaker housing market does not affect the growth prospects of these two companies. Analysts across the board are forecasting slower revenue growth rates for in next fiscal year for Lowe’s and Home Depot.

Author’s compilation of data taken from Seeking Alpha, Fast Graph and Yahoo Finance

None of these revenue growth figures are particularly encouraging or promising for investors.

Conclusion

Both Home Depot (HD) and Lowe’s (LOW) are great companies. The rivalry between them drives each other forward to be their better selves. Just as Lowe’s is improving by leaps and bounds, Home Depot is not resting on its laurels either. Home Depot recently announced the Path to Pro platform, connecting skilled tradespeople with hiring trades professionals for free for its Pro extra members. This unique and proprietary platform contains thousands of candidates and Pros have begun posting their open jobs. This serves to deepen the Pro value proposition and make the platform more “sticky” for its pro customers.

Both have generated outstanding returns over the long term, both in terms of capital appreciation as well as dividends.

The difference, however, is Lowe’s has more room for improvements than Home Depot, and hence is poised to show better results at least in 2023. The majority of the changes put in place by Lowe’s management are nearing fruition and many are bearing fruit.

Being number two is not always bad. Lowe’s is often described as playing second fiddle to Home Depot, often characterized as “playing catch-up”. Well, playing catch-up is not as bad as it sounds because it means learning from the mistakes made by the trailblazers. Playing catchup also means Lowe’s gets to install newer and faster equipment, and a newer and better inventory management system than its competitors.

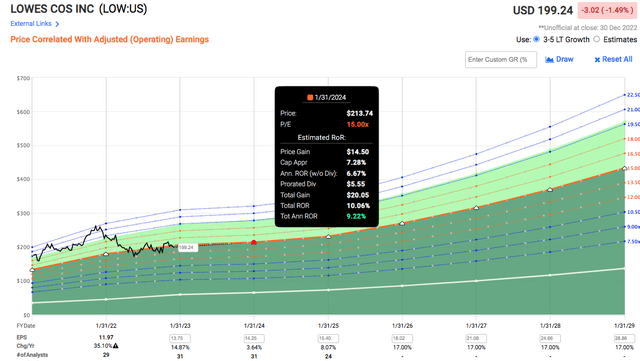

In terms of valuation Lowe’s is much cheaper than Home Depot, and with that margin of safety, it potentially offers a 9.22% return by the end of the fiscal year 2023.

In contrast, despite the market correction in 2022, Home Depot is still priced at a premium. As the expected earnings growth rate for the next two years is only in the low to mid-single digits, it will be unrealistic to expect Home Depot to trade at its past normal P/E of 19-20. If the company were to trade down to just a P/E of 15 to reflect the new normal, there is potential for a loss even with a multi-year holding period.

And with Lowe’s higher dividend growth rate, thrice that of Home Depot’s in 2022 and more than twice of Home Depot’s in 2023, it will not be long before Lowe’s yield catches up to Home Depot’s. Already, that yield difference has narrowed, from Lowe’s current 1.83% to Home Depot’s 2.37%, to an expected 2.08% for Lowe’s to Home Depot’s 2.37% in the fiscal year 2023.

Lastly, having a proven management team with a depth of relevant experience, much of which was gained working at its major competitor, who had seen firsthand what had worked is definitely a plus. Lowe’s combination of cost management, margin improvements (like selling the less profitable Canadian division), productivity initiatives, technological advancements, operational and logistical enhancement to improve customer experience, and strategic realignment to focus more on the pros, is finally bearing fruit.

To reiterate, both are fantastic companies to own. However, at their current valuation and looking at their potential in the next 1-2 years, as well as taking other factors into consideration, on a risk-reward basis it is my opinion that Lowe’s is a reasonable buy while Home Depot is a hold.

Disclosure: I/we have a beneficial long position in the shares of LOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.