Summary:

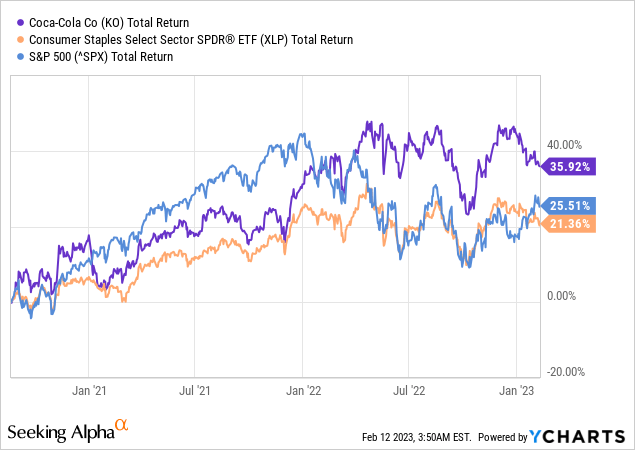

- Against all odds, Coca-Cola delivered nearly 36% total return in a matter of only two and a half years.

- As the company reports its full-year 2022 results, investors should pay close attention to certain areas of the business.

- There are a number of positive signs leading to a high probability of a dividend increase during 2023.

Jeff Schear

Coca-Cola (NYSE:KO) has been one of the best-performing large-cap consumer staple companies in recent years. Since I first laid out my investment thesis back in August 2020, the company has delivered nearly 36% total return. In spite of all the doubt that a slow-growth business such as Coke could outperform the market, it did exactly that, and by a very wide margin.

With the company scheduled to report its full-year 2022 results this week, however, the pressure to deliver is rising. On one hand, we have Coca-Cola’s premium valuation, which relies heavily on the company’s above-industry-average margins.

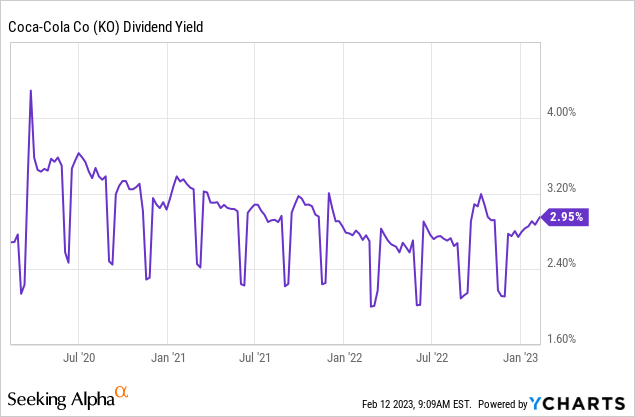

On the other hand, Coca-Cola’s dividend yield is now significantly lower than it was only a few years ago and currently sits below 3%.

The reason why this matters so much is that as a dividend aristocrat, Coca-Cola should offer both high and safe dividends. Therefore, it is crucial to assess any downside risk as well as the company’s ability to consistently increase its dividend over the coming years.

All Eyes On Coca-Cola’s Earnings

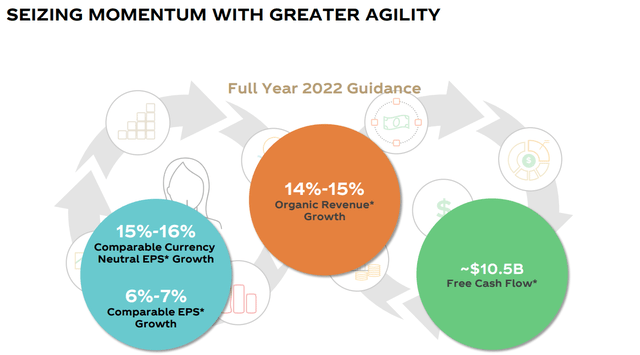

Coca-Cola’s initial guidance for the fiscal year 2022 stood at revenue growth within the range of 7% to 8% and a slightly higher rate for the ‘currency-neutral’ EPS.

Better-than-expected performance over the course of 2022, resulted in Coca-Cola’s management increasing its guidance from the one initially provided.

(…) we provided guidance for 2022 that builds on momentum from 2021. We expect organic revenue growth of approximately 7% to 8%, and we expect comparable currency-neutral earnings per share growth of 8% to 10% versus 2021.

Source: Coca-Cola Q4 2021 Earnings Transcript

Following the second quarter earnings, however, organic revenue growth for 2022 was increased to the range of 14%-15%, and ‘currency neutral’ EPS growth for the year was expected to be within the 15% to 16% range.

Coca-Cola Investor Presentation

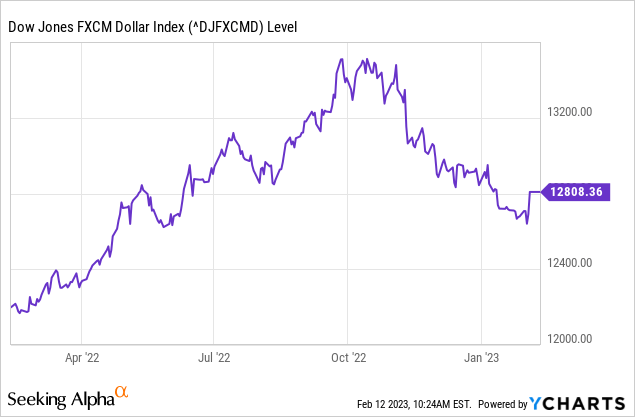

It is worth mentioning that at the time, the U.S. dollar was still at near record highs against other major currencies and this prompted Coca-Cola’s management to resort to the aforementioned ‘currency neutral’ growth rates.

During the last quarter of 2022, however, the Dollar Index has fallen sharply and should narrow down the gap between the ‘currency neutral’ and GAAP numbers in the upcoming earnings release.

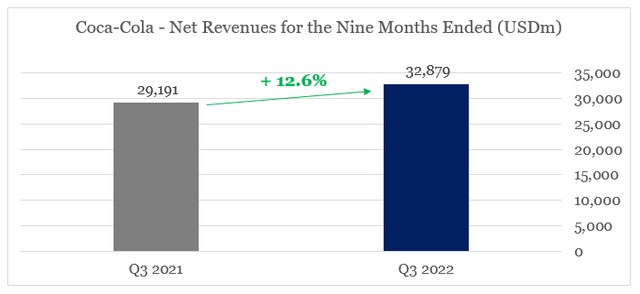

With net revenue already up more than 12% for the first nine months of the year, Coca-Cola would have no problem meeting its revisited guidance for the year.

Prepared by the author, using data from SEC Filings

Moreover, during the last quarter of 2021, there were still significant headwinds Coke’s sales as key markets around the globe were still struggling with pandemic restrictions.

In ASEAN and South Pacific, there were strict restrictions and limited reopenings in many markets for a large part of the year. (…)

In EMEA, volume in Europe in the quarter surpassed 2019 despite mobility restrictions, particularly in Western Europe. (…)

In North America, despite COVID cases leading to business closings and some mobility restrictions, value share growth was strong in the quarter

Source: Coca-Cola Q4 2021 Earnings Transcript

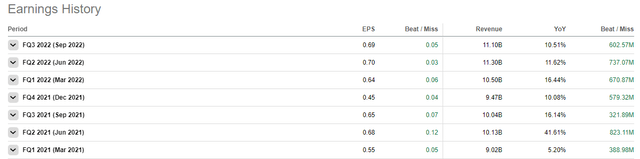

It is profitability, where things get trickier, even though Coca-Cola has had no problem beating EPS expectations over the past few years.

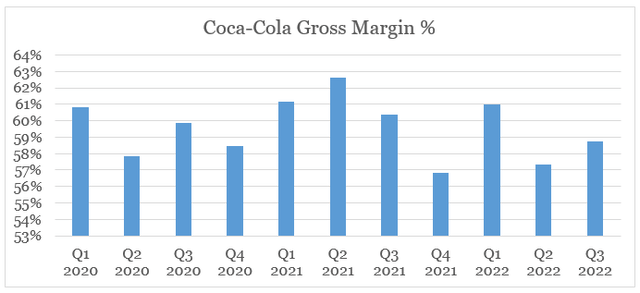

In terms of gross margins, KO has been facing significant pressures in recent quarters due to high global inflation.

Prepared by the author, using data from Seeking Alpha

With price increases being the main tool at the disposal of Coca-Cola’s management, the upcoming results will give a clear indication of where profitability is headed in the short run.

The name of the game is to optimize our revenue equation over the next 12 to 18 months. That’s going to be a combination of smart pricing, understanding the mix, both from a channel and package perspective, and being able to utilize the many levers that we have inside of the RGM toolkits that our bottlers have.

Source: Coca-Cola Q3 2022 Earnings Transcript

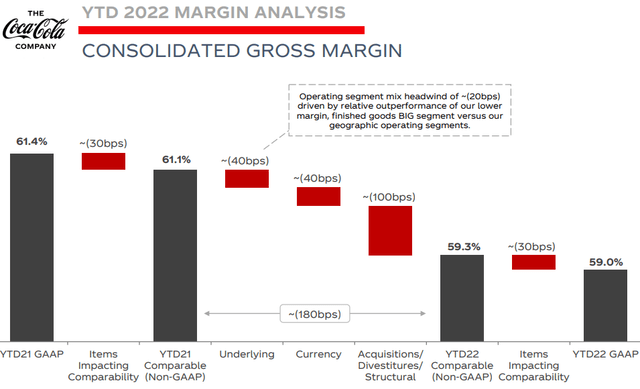

The dynamic between price increases and higher input costs and the impact it has on gross margins is quantified within the ‘underlying’ item in the graph below.

Coca-Cola Investor Presentation

The acquisition of the finished goods BodyArmor business has been the main headwind for gross margin, and exchange rate movements were also having a negative impact. With these two items most likely having a lower impact in 2023, the level of price increases should be a key area of focus for investors during the upcoming earnings release.

What About KO’s Dividend?

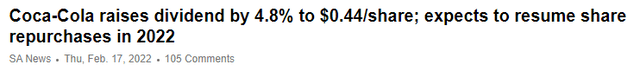

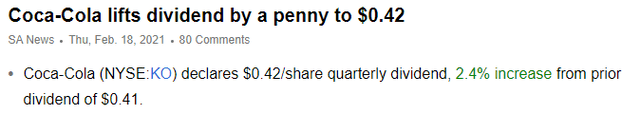

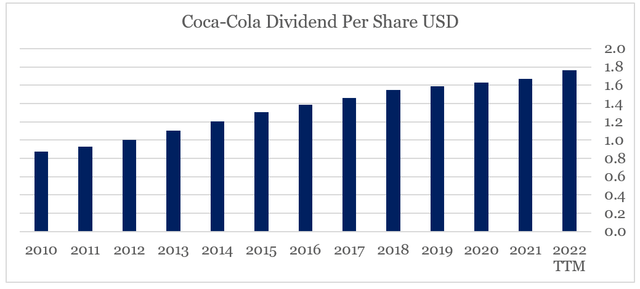

Should Coca-Cola report yet another strong quarterly result this week, investors would rightfully be expecting a dividend hike. Management already increased its quarterly dividend by nearly 5% a year ago, following a 2.4% increase in early 2021.

Having said that, Coca-Cola’s management has been consistently growing its annual dividend per share over the long run, however, last year’s increase shows a notable step-up from previous years.

Prepared by the author, using data from SEC Filings

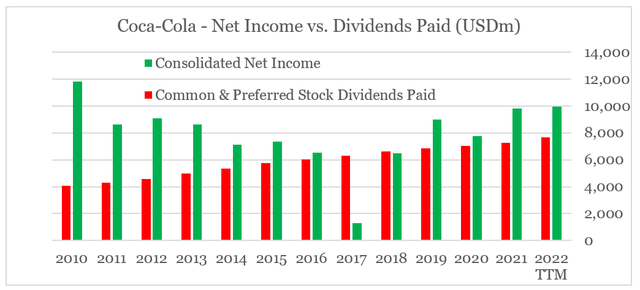

At the same time, these increased dividend payments are well-supported by the net income figure, which is now close to $10bn.

Prepared by the author, using data from SEC Filings

* 2022 TTM dividends paid were adjusted to reflect timing difference

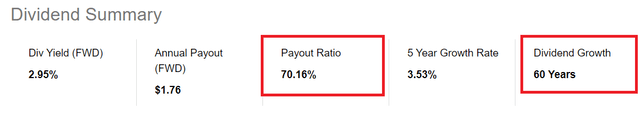

This results in a payout ratio of 70%, which is significantly lower than Coca-Cola’s long-term target of 75%.

In my view, this makes a very strong case for yet another dividend hike this year. We should also not forget that Coca-Cola has reinstated its share buyback program last year, which as I noted before is an important development given management’s conservative capital allocation.

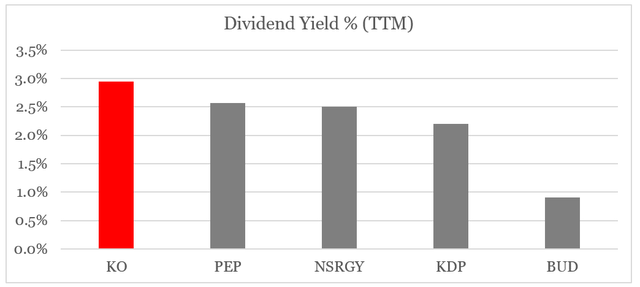

Last but not least, Coca-Cola already has one of the highest dividend yields within its peer group, which in conjunction with the high probability of a dividend hike make the company one of the most attractive dividend aristocrats in the sector.

Prepared by the author, using data from Seeking Alpha

Conclusion

As Coca-Cola reports its full-year 2022 results, investors should keep a close eye on the company’s gross margins and the overall dynamic between price increases and rising input costs. Given the already low dividend payout ratio and expectations of a record-high profitability, I see a dividend increase as a highly likely scenario. Even without a dividend hike, however, Coca-Cola is still a much more attractive dividend aristocrat than its most comparable peers in the sector.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication and are subject to change without notice.

This idea was discussed in further detail in The Roundabout Investor. To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.

This idea was discussed in further detail in The Roundabout Investor. To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.