Summary:

- Capital One announced a deal to acquire Discover Financial for $35.3 billion in an all-stock deal.

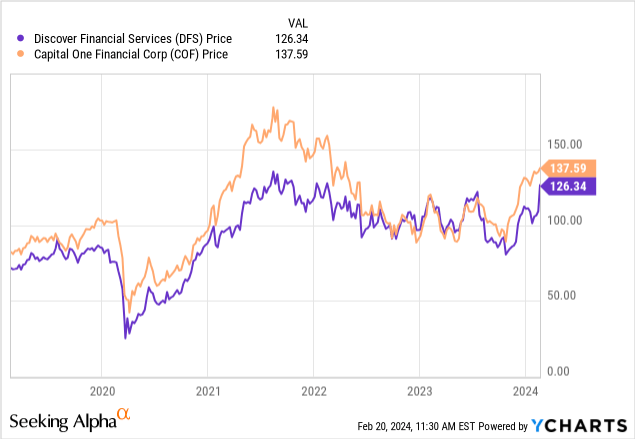

- Today’s market reaction has been positive for DFS stock and neutral for COF stock.

- Merger arbitrage, anyone? The deal presents an 11.1% premium for investors buying DFS stock that will be realized upon the deal closing, likely in late 2024 or early 2025.

ANDREW CABALLERO-REYNOLDS/AFP via Getty Images

Yesterday after market close, Capital One (NYSE:COF) announced a monster deal to acquire Discover Financial (NYSE:DFS) for roughly $35.3 billion. This represents 1.0192 COF shares for each DFS share (worth $139.56 per DFS share at current prices). In its press release, Capital One cited cost savings of $2.7 billion annually and a 20% IRR on the deal. The deal will create the largest credit card company in the US by loan volume and allow Capital One to issue its own credit cards. The initial market reaction was somewhat negative for COF stock, but the stock is now nearly flat since announcing the deal. DFS stock is up roughly 13% on the news. Both stocks are up nicely for the year.

Is The Capital One/Discover Deal Smart? Will It Close?

Judging from the press release and market reaction, the deal seems good for DFS and reasonable for COF. Analysts have cited significant IT savings that the larger combined company is likely to benefit from and the potential to cut out Visa (V) and Mastercard (MA) as middlemen. At least some investors are taking this seriously – Mastercard and Visa shares quickly dropped after the news broke. There’s the risk that DFS might be a bit of a gift horse for COF – the company saw its previous CEO exit last year amidst compliance and regulatory issues. That’s part of why Capital One can buy Discover so cheaply. Capital One and Discover also both tend to cater to a customer base that’s lower on the income and credit spectrum than say, American Express or JPMorgan Chase (JPM).

This may amplify the risks of a recession to the combined company. Delinquencies are rising across the credit card industry, but when you charge 25% annually in interest and only have to write off a few percent, it’s impossible to lose money. Even during the depths of the 2008 recession, Capital One turned an operating profit. Both shareholder bases will have to vote on the deal, but I believe that the deal will be easily approved by shareholders. As is typical for the financial industry, the deal will be done as an all-stock deal rather than cash. This means DFS and COF shareholders will split the market risk of the combined company. The deal is expected to close in late 2024 or early 2025.

Of course, there’s also the risk that the Biden administration will block the deal or that a future Republican administration could do so as well. My initial read is that this risk is not as severe as a naive expectation would be, though. Capital One appears to be aiming to undercut the oligopoly between Visa, Mastercard, and American Express (AXP). Whether they actually would compete much on price is an open question – after all, if realtors and Ivy League universities seem to not need to compete on price, four major corporations controlling the credit card market probably won’t either. However, competition from four players is better for consumers than three, and it’s hard to see a court finding this deal as harming consumers. I think there’s a high probability that this deal will close.

Merger Arbitrage In Discover Stock

This deal presents a straightforward merger arbitrage trade for those interested. DFS trades for $125.50 and the value of the deal is currently about $139.50 (I’m rounding, as the value changes with the value of COF stock). You can buy DFS here and collect a ~11.1% premium in the roughly 12 months that it should take for the deal to close. And if you own Capital One stock, that’s exactly what I would do. You can swap your COF out for DFS and get your stock back in a year with an 11.1% kicker. Of course, this strategy fails if the deal doesn’t close, but the market thinks that the deal is likely to close, as do I. Because deal premiums tend to ebb and flow, you can bet small and then double/triple down if the premium gets bigger (as it did with deals like Activision Blizzard (ATVI), Twitter, and in the crazy Grayscale Bitcoin Trust (GBTC) trade that at one point offered over 2-1 on the deal closing).

In a classic merger arbitrage trade, you usually buy stock in a company that’s being acquired for cash. This means that the acquiring company bears the risk of the market conditions changing. In a stock deal like this, this risk is split between both shareholder bases. What does this mean for you? If you buy DFS stock here, you’re being paid in COF stock, so if the market crashes or COF stock crashes then you’re going to lose money. However, Capital One has a great track record. Last year, I highlighted why Warren Buffett and Michael Burry both were loading up on the stock – since then, it’s up roughly double the S&P 500.

Bottom Line

After yesterday’s M&A announcement, buying DFS here for merger arbitrage is a good deal. I believe the deal will close, I like the 11.1% kicker, and believe that Capital One will continue to succeed in the long run. I wouldn’t bet the farm, but there’s some value to be had here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DFS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.