Summary:

- Hudson Technologies holds the largest share of the U.S. refrigerant reclamation market. This market is poised for long-term growth.

- The company’s long-term thesis regarding reclaimed HFC demand is still intact, despite a downturn in revenue and profitability in Q1 2024.

- Hudson’s management expressed concerns about achieving its previously stated 2025 revenue target of $400 million due to lower-than-expected HFC pricing and a larger-than-anticipated stockpile of virgin HFCs in the market.

- After a pullback in share price, I consider Hudson a Strong Buy for long-term investors.

DSCimage

Investment Thesis

The AIM Act may provide Hudson Technologies (NASDAQ:HDSN) with a sustainable growth catalyst and allow it to take advantage of its operating leverage as the reclamation market expands. Hudson holds the largest share of the U.S. refrigerant reclamation market and a technology advantage over competitors. With a strong balance sheet, and a management team focused on the long-term opportunity created by the AIM Act, Hudson could generate incredible returns for long-term holders. I consider Hudson a Strong Buy.

Upgrading To Strong Buy After Sell-Off

HDSN stock has fallen post-earnings due to uncertainty about the near- and medium-term outlook for revenue. In my previous article, I outlined my long-term thesis centered around the impacts of the AIM Act and how it should drive sustainable growth for Hudson. A supply and demand imbalance tilted towards increased reliance on reclaimed refrigerants is still likely to increase demand for Hudson’s services and products and drive the prices higher over the long term. However, this growth might be delayed for several quarters after Hudson CEO, Brian Coleman removed the company’s 2025 revenue target and provided uncertainty about HFC demand due to increased stockpiles of virgin HFCs.

My long-term thesis regarding reclaimed HFC demand is still intact, with the market spooked and selling the stock, I think this could provide a golden opportunity for a patient investor who believes Hudson can recapture its growth trajectory.

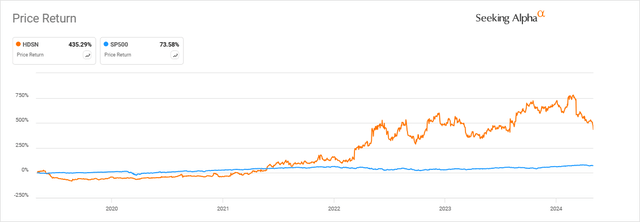

HDSN has crushed the market in recent years (Seeking Alpha Chart)

Financial Performance Overview

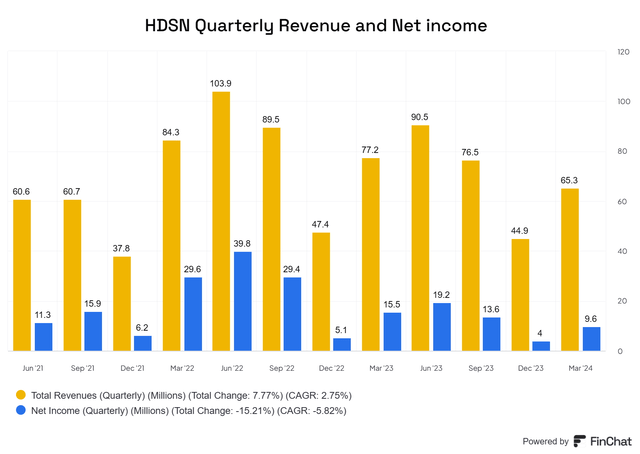

Hudson Technologies reported its Q1 2024 earnings, revealing a downturn in revenue and profitability compared to the previous year. Revenue decreased by 15% to $65.3 million from $77.2 million in Q1 2023. The revenue decline was attributed primarily to lower selling prices for refrigerants and diminished revenues from its Defense Logistics Agency (DLA) contract. Gross margin fell to 33% from 39% YoY. Net income of $9.6 million, translating to a $0.20 per diluted share EPS, was a reduction of 38% from $15.5 million, or $0.33 per diluted share, in the prior period of 2023. Operating expenses grew 12.6%, due to a 13.9% increase in SG&A expenses during the quarter.

HDSN Revenue and Net Income Trend (www.FinChat.io)

Management’s Outlook and Strategic Focus

In their earnings call, Hudson Technologies’ management discussed the challenges and strategic measures they are taking to navigate the current market conditions. CEO Brian Coleman noted that Hudson’s 2024 selling season had begun as anticipated; however, the tough comps to a strong Q1 2023 and the significant drop in certain refrigerant prices by approximately 20% pose ongoing challenges for the company. This prompted management to express concerns about achieving Hudson’s previously stated 2025 revenue target of $400 million and maintaining a gross margin of 35% in 2024. The uncertainty in reaching these targets stems from lower-than-expected HFC pricing and a larger-than-anticipated stockpile of virgin HFCs in the market. The stockpile of HFC may push back some of the anticipated demand benefits that Hudson expects to receive because of the reduction in virgin HFC supply mandated by the AIM Act. Hudson still expects the pricing of HFCs, particularly reclaimed refrigerants, to rise over the long run as virgin supply is gradually removed from the market.

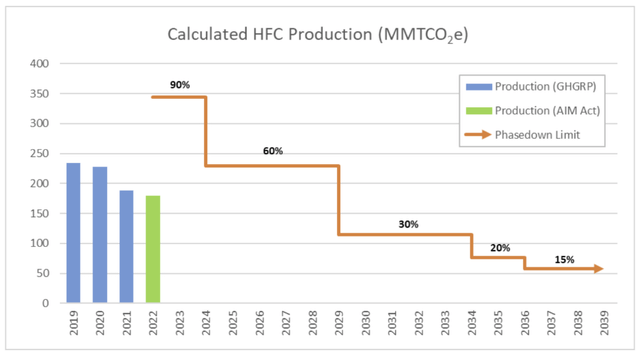

Delayed Impacts Of The AIM Act

A substantial portion of the Q&A session focused on the American Innovation and Manufacturing (AIM) Act and its implications for the industry. Management emphasized that while the AIM Act’s phase-down of virgin HFC production is expected to tighten supply and potentially increase prices, the timing remains uncertain. The expected finalization of the EPA’s Refrigerant Management rule in late summer, which mandates the use of reclaimed refrigerants in certain applications, is likely to impact the market dynamics significantly.

The stock is currently being punished because Hudson’s management expected 2024 to be an inflection year. Now that this inflection is off the table for the near term, it appears that short-term holders may be bailing on the stock.

Q&A Session Highlights

During the call, analysts raised questions about the current low pricing levels, potential acquisitions, and about the company’s growth and profitability outlook. Here are some highlights.

Removing Its 2025 Targets, For Now

When asked about the main causes of lower HFC prices and their impact on 2025 targets, CEO Brian Coleman explained that pricing is currently impacted by stockpiles from prior years, specifically 2021, when about 1.5 times the annual cap of virgin HFC was imported, which represents the equivalent of about half a year of inventory. Updated numbers as of the end of 2022 make Coleman believe that the stockpile has been reduced to about 129% of the cap, an improvement but still a larger stockpile than expected. This stockpile is likely acting as a cap on HFC prices, lowering the cost to around $8 during Q1. Not coincidentally, R-22 pricing remains closer to the $30 range, as the stockpile is not impacting the R-22 market.

He noted that while lower pricing affects this year’s margin targets, it does not necessarily impact Hudson’s long-term gross margin target of 35%. The company is temporarily removing its 2025 target of $400m until the AIM Act is finalized in late summer and the company gets a better read on HFC pricing through its peak selling seasons.

If you read my January article on Hudson, you will see that the $400m revenue target and 35% gross margins play a big role in forecasting the long-term success of Hudson. Therefore, it will be important for the company to reiterate its 2025 target at some point in 2024 or to at least express confidence in not deviating too far below that.

Regulatory Catalysts

CEO Brian Coleman expressed optimism that once the stockpile of HFCs is depleted, the pricing dynamics will shift in favor of reclaimed refrigerants due to regulatory mandates. This could potentially lead to a pricing differential favoring reclaimed over virgin refrigerants. Some states and companies are now mandating or favoring the use of reclaimed refrigerants. Hudson expects this demand to increase over time, and the value of lower Global Warming Potential (GWP) refrigerants to be enhanced. This demand comes from both regulation and ESG issues, as reclaimed refrigerants produce roughly 1/10 the GWP of virgin HFCs.

DLA and Carbon Credits

After Q4 results, HDSN stock fell following comments that the DLA contract might generate lower revenues than anticipated, as less of it will be recurring in nature. The company wouldn’t rule out the possibility of future renewals or one-time revenue items from the DLA. Coleman mentioned that DLA revenues are about $8 million per quarter, which is lower compared to the previous year, and that the company does not know if any additional revenue will come in from the DLA at this time.

Carbon credits and service sales helped to offset the lower HFC pricing, but these figures are relatively minor, in the hundreds of thousands rather than millions. Coleman emphasized the consistent increase in carbon offset prices but downplayed the significance to total revenues.

M&A Potential

There could be a silver lining to lower HFC prices in the form of lower M&A prices. Brian Coleman indicated that negotiations for acquisitions are more favorable now compared to when prices were higher. He also stressed the importance of enhancing the company’s offerings and reaching more customers, rather than for efficiency or “synergistic” acquisitions. Additionally, he stated that Hudson sees a bigger benefit from smart acquisitions than from share repurchases at this time.

Reclaimed Refrigerant Market Growth

Growth in the refrigerant reclamation market is a key part of my investment thesis. As the largest producer of reclaimed refrigerant in the U.S., Hudson stands to benefit from the changes outlined in the AIM Act.

A Dataintelo report in 2021 estimated a 10.5% CAGR from 2023 to 2031. However, I believe that the AIM Act could be more than double that growth rate, as it brings the beginning of a dramatic step down in HFC production starting this year. Hudson is perfectly positioned to benefit due to its 30% share in the U.S. reclamation market.

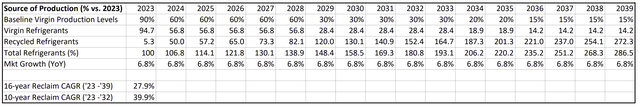

In my last article, I modeled this potential market share increase scenario for reclaimed refrigerants. This isn’t meant to be accurate, just directional correct. It shows a potential 27.9% to 39.9% CAGR. However, to remain conservative, I assumed that the growth would be 20%-plus over this period.

The HFC reclamation market is expected to grow significantly (Author-Generated Table)

The AIM Act will phase down the production of virgin refrigerants, which will force a shift towards reclaimed refrigerants.

AIM Act Phasedown Chart (Q3 Earnings Presentation – HDSN)

But at this point, we need to scale back the assumed acceleration of this shift due to the current excess stockpile of refrigerants mentioned by Brian Coleman. The above chart does not account for the excess supply that will need to be cycled out of the market.

I don’t think it’s necessary to make radical changes to my reclamation growth estimates, but I will monitor this in the coming quarters. If anything, the growth will likely end up in the same place, but initial surges in reclamation demand should be pushed back by a year or two.

Valuation

With concern that the company may not hit its 2025 targets, I have to make some adjustments to my valuation model for Hudson, but I want to wait a quarter or two for the pricing and demand for HFCs to settle before considering radical changes to my long-term free cash flow growth assumptions.

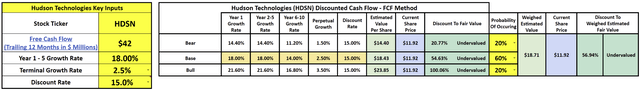

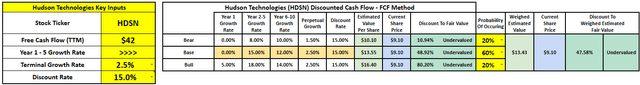

When I wrote about Hudson in January, I used these assumptions for my DCF analysis, with a base year assumption of $42 million in free cash flow.

Author’s previous DCF Model (Author-Generated DCF Model)

With the uncertainty around selling prices and demand for this year, it’s prudent to factor in lower growth for the sake of conservatism.

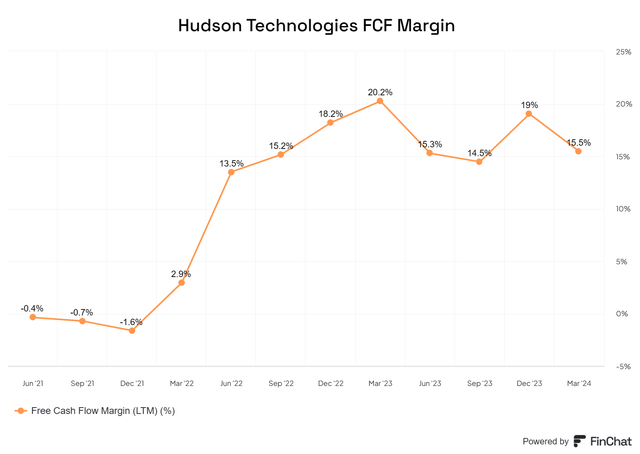

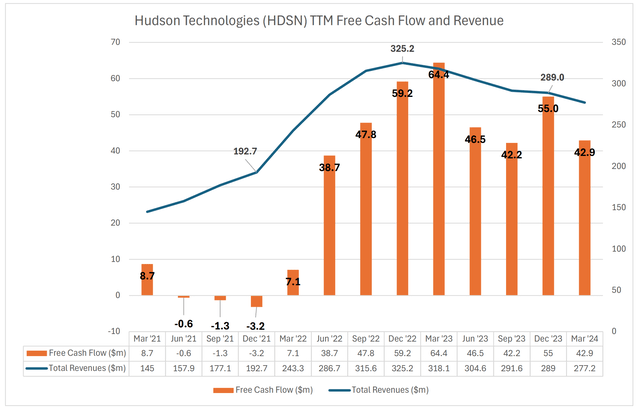

Using TTM numbers, since June 2022, Hudson has averaged a 16.5% FCF margin. Its TTM FCF margin is 15.5%. The company should be able to maintain its FCF margin in this range, but 2024 could be challenging for the company.

HDSN Free Cash Flow Margin (www.FinChat.io) HDSN Quarterly Revenue and FCF Trend (Author-Generated with data from SEC Filings)

We have not reached peak selling season yet and will not have a good idea of the near-term impact of the selling prices of HFCs, so I am projecting only $42 million in free cash flow for FY 2024. The company no longer has long-term debt and will be saving roughly $8 million in interest expense this year, which may help Hudson maintain this $42 million FCF figure even in a rough year.

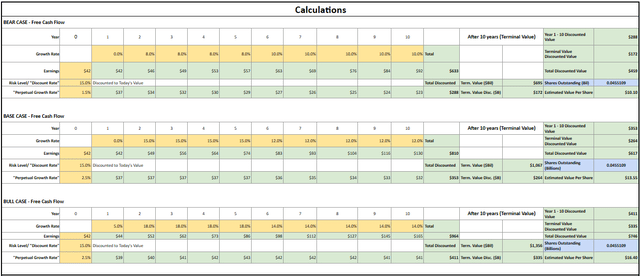

For my base case, I have lowered my growth assumptions to 0% for year one, 15% for years 2-5, and 12% for years 6-10. My terminal rate is still 2.5% due to the long runway for growth in the reclaimed HFC market. My discount rate is still 15%, a high hurdle for the stock but one that accounts for the risk of a small-cap commodity play. My bear and bull cases are also significantly more conservative than before. I weigh the base case probability to 60% and the bear and bull cases to 20% each.

With these assumptions, the stock is still potentially undervalued by 48%.

HDSN DCF Model (Author Generated) HDSN DCF Full Calculations (Author-Generated)

Risks

There is a great deal of uncertainty about the potential growth of HFC reclamation due to many variables in the market, so my model will undoubtedly be wildly incorrect. However, I believe that Hudson still presents a potentially attractive opportunity for patient shareholders who are willing to let the thesis play out.

Hudson operates in a cyclical industry, and the price of refrigerants can have outsized impacts on revenues. This impacted the company in Q1 and is likely to weigh on revenues at least into Q2. A recession would risk growth in the installed base for Hudson and is part of the cyclical nature of the business.

Volatility is another risk. I typically do not consider high-beta stocks risky investments, but for someone unwilling to stomach large downdrafts in stock prices, this might not be the right stock to invest in. I have enough confidence in the thesis that I tend to add to my position when the stock is beaten down.

Given the strength of its balance sheet, its greater foothold in the reclamation market, and the positive impact expected by the AIM Act, Hudson should return to growth at some point in 2024 or 2025. The company should also be able to weather an economic downturn, given its near-zero debt balance sheet.

Conclusion

Hudson Technologies faces a challenging year ahead with uncertainty in refrigerant pricing and regulatory impacts. Despite the near-term uncertainty caused by greater than anticipated HFC stockpiles, I trust in Hudson management’s belief that the reclamation market will benefit from the AIM Act’s long-term structural supply and demand changes, and that this will raise prices for reclaimed refrigerants and demand for Hudson’s services and products. Investors will need to monitor how these factors play out through 2024, impacting Hudson’s ability to meet its financial targets and capitalize on regulatory changes.

With the drop in share price and my long-term outlook less certain, but still intact, I upgrade my opinion on Hudson and now consider it a Strong Buy for long-term shareholders who agree with my thesis and analysis.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HDSN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I plan on adding to my position in HDSN within the coming week.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.