Summary:

- I analyzed Mastercard and found it to be a Hold due to its high valuation.

- Visa is also a growing company and grows slower than Mastercard.

- Among the two companies, I prefer Visa because it offers a better valuation and decent growth.

Justin Sullivan

Introduction

As a dividend growth investor, I constantly seek new opportunities to acquire income-producing assets, mainly dividend-growth stocks. Sometimes I add to my existing positions, primarily when I find their valuation attractive. On other occasions, I start new positions as I am trying to expand my portfolio and increase my diversification across sectors and industries. The volatile market we are experiencing may serve as a long-term opportunity.

In a previous article, I analyzed Mastercard (MA). I don’t own shares in the company, yet I found it to be a fantastic company. However, this tremendous company seems expensive as it was trading for a high price-to-earnings ratio. In this article, I will analyze its peer, Visa (NYSE:V). I own shares in Visa, and my analysis will help me determine if I should add to this position.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Visa operates as a payments technology company worldwide. The company operates VisaNet, a transaction processing network that enables the authorization, clearing, and settlement of payment transactions. It also offers credit, debit, prepaid card products, and Visa Direct, a real-time payment network. The company serves consumers, merchants, financial institutions, and government entities. Visa was founded in 1958 and is headquartered in San Francisco, California.

Fundamentals

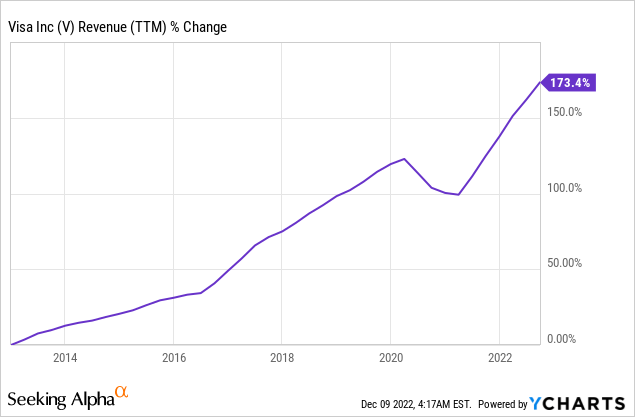

Over the last decade, the sales of Visa increased by 170%, thus almost tripling in ten years. Visa managed to achieve this growth by combining organic and inorganic growth. The company expanded its network globally and within its markets. It also acquired Visa Europe in 2016 for more than $20B, allowing the combined company to be the largest payment network. In the future, as seen on Seeking Alpha, the analyst consensus expects Visa to keep growing sales at an annual rate of ~10% in the medium term.

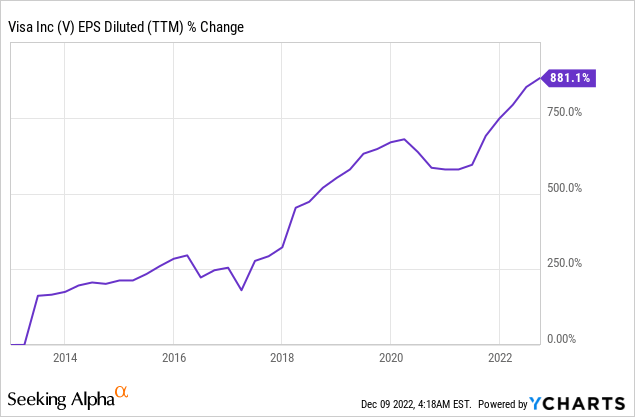

The EPS (earnings per share) has grown much faster. Over the last decade, the GAAP EPS increased almost tenfold. Visa achieved this fantastic growth due to its sales growth, buyback plan, and business model. The business model requires very little investment, and the payment volume increases almost directly to the bottom line, increasing the margins significantly. In the future, as seen on Seeking Alpha, the analyst consensus expects Visa to keep growing EPS at an annual rate of ~15% in the medium term.

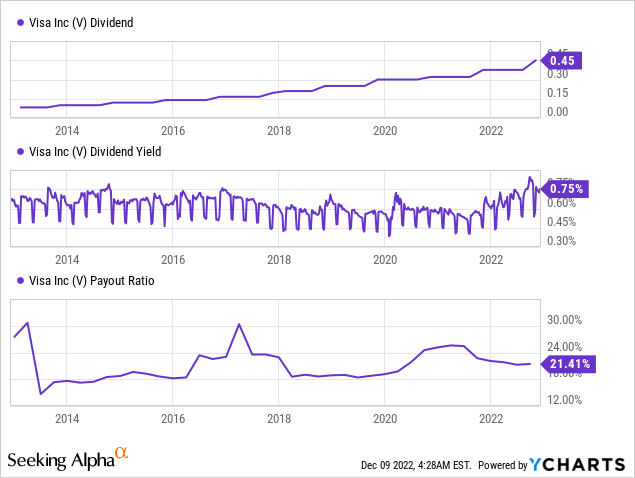

The dividend is another metric where Visa excels. Since its IPO, Visa has increased its annual payment for 14 years. The dividend growth rate is very high and stood at 18% annually in the last five years and 20% annually in the previous decade. The 0.75% yield is very safe, with a payout ratio of 21%, leaving the company with plenty of room to grow even after the 20% increase that the company announced in October 2022.

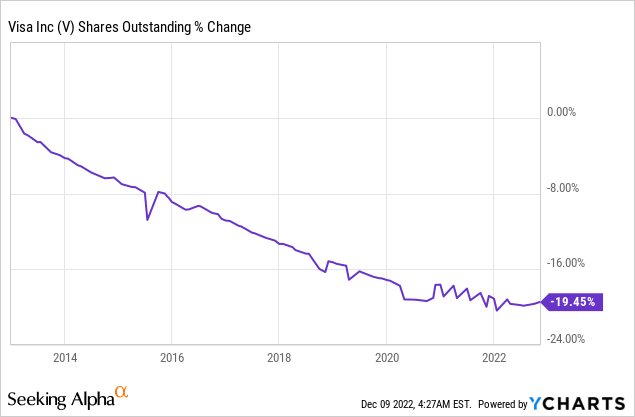

In addition to dividends, companies such as Visa return capital to shareholders via share repurchase plans. These buyback plans reduce the number of shares outstanding, thus increasing the EPS. Visa lowered the number of shares outstanding by almost 20% over the last decade. Buybacks are most effective when shares are cheap. Visa announced in October another buyback plan worth $12B, or 2.7% of its market cap.

Valuation

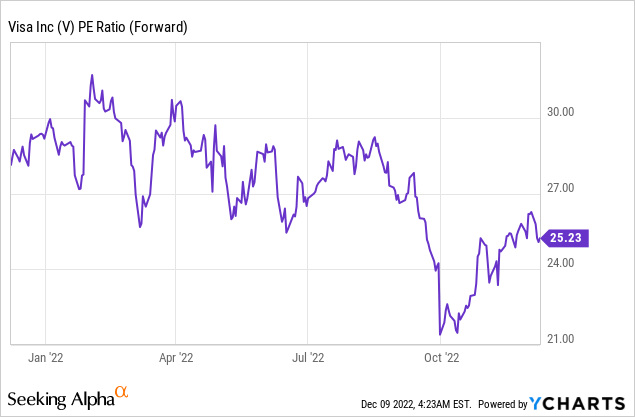

The P/E (price to earnings) ratio of Visa stands at 25 when considering the EPS forecast for the next twelve months. The valuation has declined over the past twelve months, and after reaching a P/E ratio of 30 at some point, the valuation decreased significantly. However, 25 times earnings is still a questionable valuation in the current environment as interest rates are climbing.

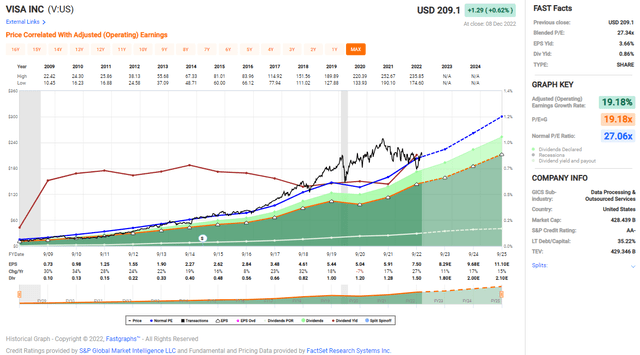

The graph below from Fastgraphs implies that while the current P/E ratio of 25 may look high, it is in line with the historical valuation. Since its IPO, shares of Visa traded for an average P/E ratio of 27 with a 19% annual growth rate. Therefore, the current metrics of a P/E ratio of 25 and a growth rate of 15% make sense to me. They mean that the shares are not cheap, and there is little margin of safety, yet the valuation makes sense.

To conclude, Visa offers investors a unique offering in terms of fundamentals. The company shows strength across the board with solid sales and EPS growth. The company also focuses on returning capital to shareholders, which makes it very investor friendly. The valuation is not low, yet unlike Mastercard, the valuation seems fair and in line with the company’s past performance.

Opportunities

Visa’s first opportunity is its dominant position in the global payment processing market, with a large and growing network of over 60 million merchants and 2 billion consumers who use its services. This strong market position can provide a foundation for continued growth and success as the company expands in Africa and Asia to increase its scale. The expansion will allow Visa to maintain its leadership position.

Another growth opportunity is that Visa is well-positioned to benefit from trends and developments in the global payment processing industry, such as the growing use of mobile payments and the increasing adoption of digital currencies. Visa’s network will process more e-commerce transactions and thus enjoy increased credit card usage in the developed world. It also offers Visa Direct, a real-time payment service that allows it to compete with new account-to-account solutions. These trends could drive growth and create new opportunities for Visa, potentially providing increased value for investors.

When looking into the uncertainty of the current business environment, Visa can shine and grow despite the challenges. It has a strong track record of financial performance and profitability. The company has consistently generated substantial revenue and earnings growth and has a solid balance sheet with significant cash reserves. These reserves can fuel future activity in the M&A market, allowing Visa to grow further in the long term.

Risks

The first risk is intensifying competition. Visa is the dominant player in the payments market. However, it faces competition from other payment processing companies, including Mastercard and American Express (AXP). This competition can pressure Visa’s margins and profitability, limiting its ability to grow and generate returns for investors. Companies offering other account-to-account payment options like PayPal (PYPL) and Block (SQ) also increase competition with other fintech startups.

Another risk for Visa is the Regulatory risk. Payment processing companies, including Visa, are subject to complex and constantly changing regulatory environments. This regulatory risk can create uncertainty and potentially limit Visa’s ability to grow and innovate. The regulation is complex and varies from country to country. Moreover, it doesn’t only limit growth. It also encourages competition, as we see regulators promoting the establishment of additional payment schemes.

Dependence on the global economy. It is becoming increasingly apparent that we are going toward a recession. Visa’s business heavily depends on the global economy’s health and growth. The current valuation relies on a significant growth rate of 15%, and lower growth, let alone stagnation, will impact the share price. Investors will suffer twice, first from the lower EPS forecasts and second from the lower P/E ratio associated with the new growth rate.

Conclusions

Visa is an excellent company, by all means. The company shows strong sales growth leading to EPS growth which fuels dividends and buybacks. The valuation is average compared to the company’s history and has plenty of growth opportunities through its payment network. While there are risks to the investment thesis, I believe Visa is positioned to keep growing.

I prefer Visa over Mastercard as both have a similar profile regarding opportunities and yet Visa is more attractively valued than its peer. Mastercard is growing faster, yet value is preferred over growth in the current environment. The stock is a BUY, yet more conservative investors may choose to wait for a better valuation with more margin of safety. At a P/E ratio of 22 and a price of around ~$180, I think they can consider it as well.

Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.