Summary:

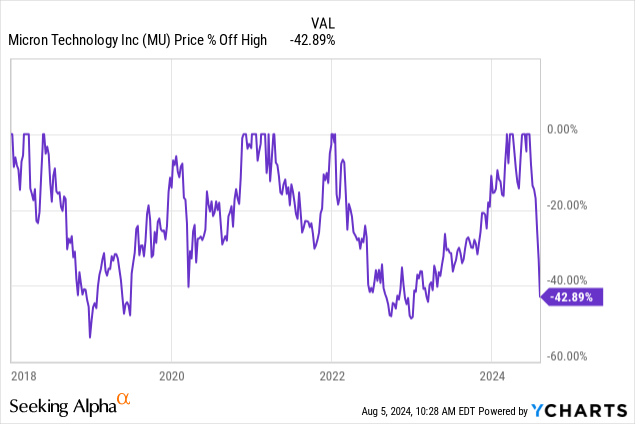

- Micron stock has experienced a significant decline of about -40% in less than 2 months, highlighting the challenges of investing in cyclical stocks.

- I share my non-standard investment strategy for Micron stock, emphasizing the importance of buying low and taking profits at higher prices.

- Despite the difficulty in predicting precise tops in deep cyclical stocks, investors can get good medium-term returns investing in cyclical stocks like Micron.

DNY59

Introduction

Cyclical stocks make tricky investments for the inexperienced investor. I suspect many recent investors in Micron (NASDAQ:MU) are discovering this fact, with the stock now down -40% off its highs in less than 2 months.

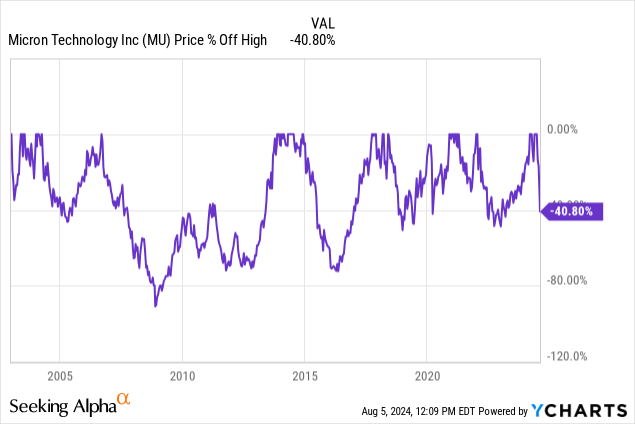

One can see in the drawdown chart above that since 2018, the year I first started covering Micron stock and sharing my investment strategy with readers on Seeking Alpha, this is the third time Micron stock has experienced such a decline. Because Micron stock can experience these sorts of declines without any warning, it is very rare to find investors or analysts who can both buy Micron when the price is low and take profits when the price is significantly higher. In order to do so, an investor needs to have an investing strategy that is non-standard and different from the crowd.

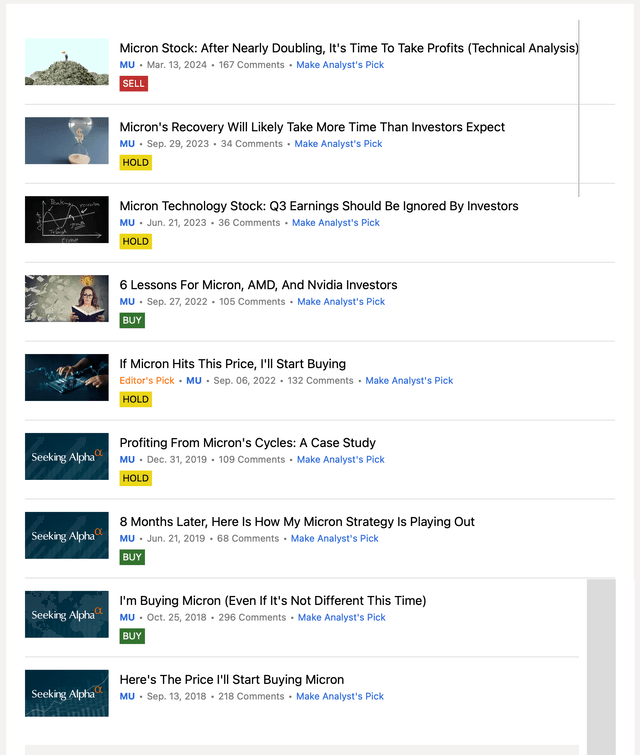

Being different is easier said than done. There are issues that arise when someone uses a non-standard strategy, and they are writing for the public. One issue is that readers are naturally skeptical of a strategy that operates on principles they aren’t familiar with, or that doesn’t try to do the things the financial media has programmed investors to think are the proper way to analyze a stock. For this reason, I almost always start these articles by sharing the results the strategy has produced in the past. (This is my 10th Micron article since I first bought the stock in 2018.) After I share my history with Micron stock, I will share the thinking and theory behind the strategy. I have to do this because otherwise readers tend not to understand what it is I’m trying to do with these investments.

I typically share the price I’m going to buy a deep cyclical stock before the stock reaches that price. That’s the purpose of this article. Additionally, I have skin in the game. I actually buy these stocks myself if they hit that price. So, I am not just sharing a commentary about the business or stock. I’m not going to try to explain every aspect of Micron’s business or what the stock price is going to do over the next few weeks or months. I’m not qualified to do the first, and don’t know what will happen with short-term stock price movements. Fortunately, neither is necessary to avoid the worst mistakes when investing in cyclicals, or to make money when most others don’t. One just needs a sound investing strategy.

My History With MU Stock

Seeking Alpha

You can see a pattern with my previous Micron articles. Usually, I write an article where I share the price I will buy Micron before the price hits. Then I write an article where I share that I’ve bought the stock. Occasionally, I’ll write an update while I’m holding the stock, and then I share when I sell. The 12/31/19 Case Study article is labeled a Hold, but it was a sell article and that’s when I sold my first MU position as I described in the conclusion of that article:

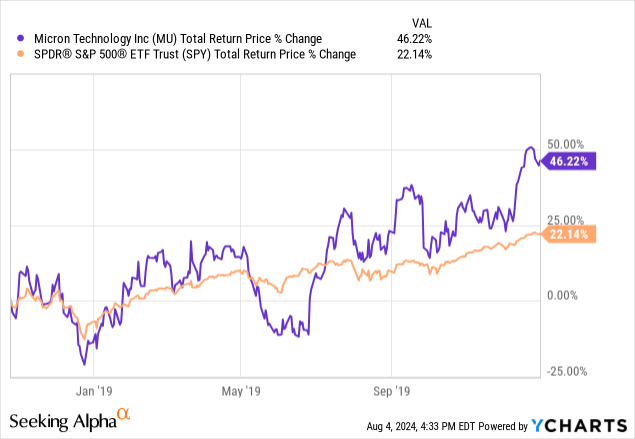

I’m very happy with a +40% gain over the last 14 months. I barely paid any attention to Micron stock after I bought it, except to see if the stock price had fallen far enough for me to buy more. But because of macro dangers, I think it’s wise to take profits here. If the economy slows down within the next couple of years there will probably be an opportunity to buy Micron stock at a lower price again.

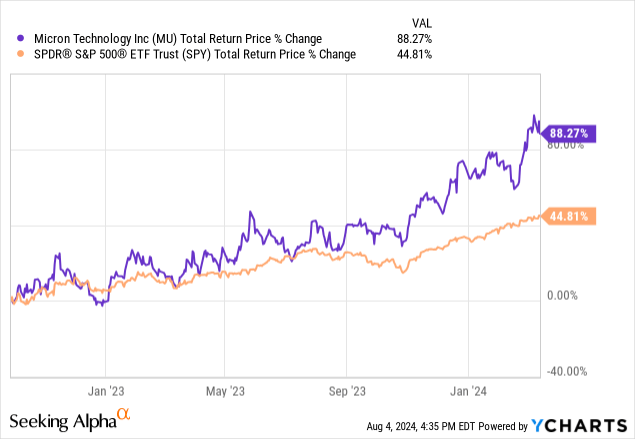

Eventually, the stock price did fall again in 2022, and I wrote a series of articles about that process. So, I’ve owned MU twice since 2018, and taken profits twice. Here is how my Micron investments performed.

During both holding periods, MU doubled the returns of the S&P 500, and cumulatively MU returned about +175% for me.

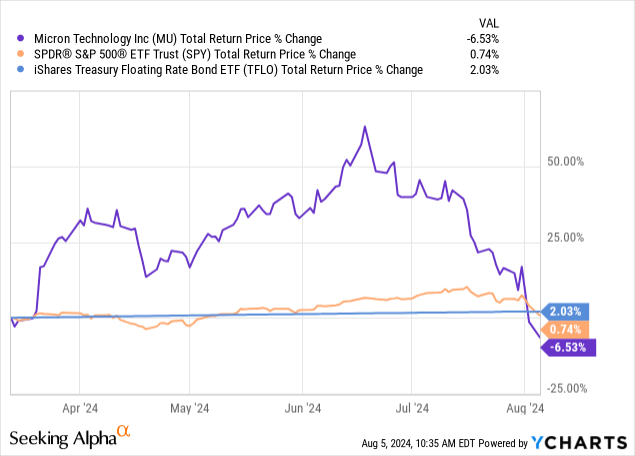

Since I sold the stock back in March of this year, here is how it has performed:

Immediately after I sold the stock, the price jumped an amazing 60%+ only to recently give all that back and then some, now down below the returns of SPY and (TFLO) which is where I’ve been parking my cash. Some may say that I missed out on higher profits by selling too soon. While technically that is correct in hindsight, I maintained at the time I sold that where Micron stock ultimately topped out was unknown by anyone (most importantly unknown by me). I strongly suggest reading my sell article “Micron Stock: After Nearly Doubling, It’s Time To Take Profits” for a full explanation (especially the comment section where I defend my decision to sell even after the price rose).

For evidence of my assertion that Micron’s recent top was unpredictable, I’ll share a quick review of articles published on SA since I sold in March. There have been 3 “Sell” articles published on Micron since mine. One is from an author who has been bearish for years (even during Micron’s rise), another had an accurate sell call but no previous buy call, and the last achieved minor profits of around 10% from their first buy article to their first sell article in 2022/3. On the flip side, there have been 28 “buy” or “strong buy” articles since I sold, all of which are currently underwater. I bring these statistics up to demonstrate how difficult it is to call any sort of precise top in deep cyclical stocks, while also being willing to buy the stocks when they are down at a price that can produce good medium-term returns.

It’s critical to understand the typical errors of the market if one wishes to profit from them. In the case of Micron, the primary error most investors have made in the past couple of years is using mismatched time-frames and trying to predict the stock price movement when it is unpredictable over the given time frame.

Investment Time Frames & Predictions

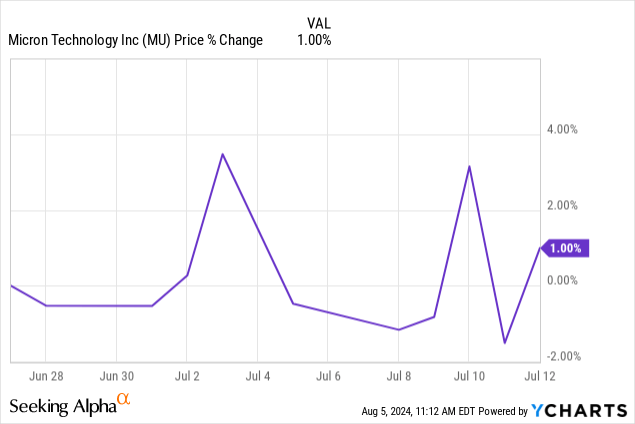

Wall Street and financial media are designed to make investors think that short-term stock price movements are predictable based on short-term fundamental data. This falsehood is so pervasive, individual investors internalize this assumption without even realizing it. Micron’s recent -42% decline in less than 2 months is a good example. Micron reported earnings on June 26th. The next day, the stock price adjusted down a little after having run up into earnings. The chart below is of MU’s performance during the two weeks after that.

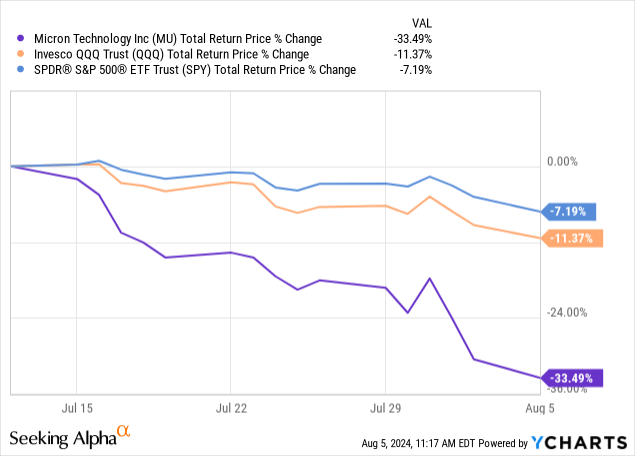

Essentially, for two weeks after MU reported earnings, the stock was trading in a relatively narrow range. We haven’t had any significant negative earnings-related news for Micron since the July 12th ending date in the chart above. Yet Micron is down -33% since then.

This is not a small or insignificant drop, and it came with zero warning, as I’m sure many current Micron investors are aware. Since my sell article, Micron’s expected future earnings for 2025 have actually improved dramatically. Back in March, analysts were expecting $6.80 per share for earnings in 2025, and now they expect an incredible $9.59 for 2025, yet the stock price is lower.

I’m pointing these facts out in order to demonstrate that short-term moves in the stock price of cyclical businesses are not predictable by fundamentals like sales and earnings. In this case, earnings expectations (and actual earnings during the last two reports) are 30% higher while the stock price is -30% lower. Over these sorts of relatively short time frames, the stock price is very unpredictable and untethered from recent fundamental data, yet the financial media will pretend as though the price is reacting to fundamentals like earnings reports or news of various sorts.

It’s not.

Importantly, I sold Micron stock because its near-term future was unpredictable, not because I was predicting a top in the stock price.

So What Is Predictable?

Nothing is perfectly predictable in the stock market, but if a deep cyclical business has a long history of earnings recoveries occurring in a timely manner and nothing has significantly changed with their business, then I’ve found after studying dozens of these types of stocks over the years that about 80% of the time, earnings and the stock price can recover previous highs within 2-5 years. Micron fits the profile of this type of business.

The key metric I check to help determine whether a business is a high-quality cyclical is its earnings history.

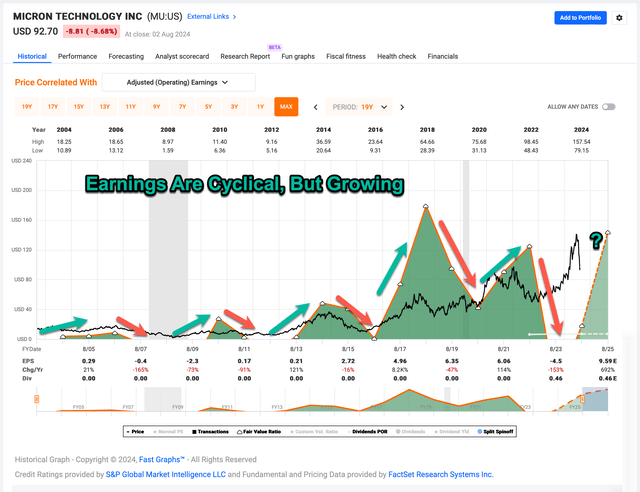

FAST Graphs

Micron’s earnings per share are represented by the dark green shaded area in the FAST Graph above. During the past 20 years, two things are clear about earnings. The first is earnings often have dramatic declines, going fully negative 4 times in the past 20 years. The second is earnings generally recover to higher highs after those declines have occurred. These are the two defining characteristics of a high-quality, yet cyclical business.

High-quality cyclical businesses are predictable to some degree as long as we determine nothing of fundamental importance has changed since the last cycle or two. The reason for this has to do with human behavior and economics. Our economic system hasn’t fundamentally changed in the global “West” for about 300 years. Human psychology and behavior haven’t changed much during all of recorded history. Very little of importance in market behavior has changed in the past 20 years. With this understanding in mind, I operate under the assumption that if similar conditions that have occurred in the past occur again in the future (like Micron’s earnings) then the market will probably value the stock similarly to what it has in the past.

However, stock prices don’t always exactly follow earnings, so once I use a fundamental analysis to determine historical earnings cyclicality and business quality, I then examine the cyclicality of the stock price to see if the market indeed cares about these earnings fluctuations.

Above is a stock price drawdown chart for MU over the past 20 years. We can see that the stock price is subject both to deep downcycles and to full recoveries from those downcycles. Below is a table breaking this down more.

| ~Year | ~Time Until Bottom | ~Duration | ~Depth |

| 1984 | 1 year | 9 years | -89% |

| 1986* | 6 months | 18 months | -79% |

| 1988 | 6 months | 1 year | -42% |

| 1989 | 18 months | 4 years | -71% |

| 1995 | 1 year | 4.5 years | -80% |

| 2000 | 2.5 years | 18 years+ | -92% |

| 2004* | 1 year | 2 years | -47% |

| 2006 | 1.5 years | 7 years | -90% |

| 2014 | 1 year | 3 years | -73% |

| 2018 | 6 months | 2 years | -53% |

| 2022 | 9 months | 1.25 years | -50% |

| 2024 | ? | ? | -42%+ |

*There are two ‘resets’ being made here. The first was after the dip Micron took after its IPO around 1984. These post-IPO dips are fairly common and a lot of times I completely disregard them if they happened over 25 years ago, but I thought I would include this one and adjust for it. The stock price did eventually recover after 9 years, but I went ahead and recorded the drawdowns during that time frame as if the stock price had recovered. The second * denotes the stock did not make a full recovery back to the 2000 super-cyclical highs, so I ‘reset’ the highs here, too.

There are three notable patterns historically with Micron stock. The first is that sell-offs and downcycles tend to happen very quickly. Since 2000, which I generally treat as a reset moment, the stock price has typically bottomed within a year of the initial sell-off. The second is this stock falls deeply off its highs. “Shallow” declines have been about -50%, and deep declines have been between -70% and -90% off its highs. These declines have consistently been much deeper than the average S&P 500 stock. And third, with the exception of the Great Recession, which took 7 years for MU’s stock price to recover, the other downturns from peak to recovered peak took about 3 years or less. This recovery period is very fast when compared to other cyclical businesses, which makes Micron an attractive investment during downcycles.

These data are not a recipe to perfectly predict what Micron stock will do over the short term, or when exactly it will do it. However, it can serve as a useful guideline for developing a rational strategy for investing in the stock. Predictions of medium-term returns using this method will be far more profitable than using recent fundamental trends or AI storylines to predict short-term stock price moves.

Simple Micron Strategy

My buying strategy for Micron is twofold, and based on how a combination of Micron’s earnings and market participants have reacted historically. The data shows that Micron stock usually falls about -50% off its high during a shallow semiconductor downcycle, but if there are additional economic pressures like a recession, then the stock price usually falls much deeper, -70% to -90% off its highs. An individual investor does not have to predict when these down cycles occur. All they have to do is watch for them, and have the courage to step in and buy the stock if it falls more than -50%. But they also need to be armed with the knowledge that a -50% decline off the high might not be the bottom for the stock. It might fall deeper than that, and, history has shown that an additional -50% decline is normal for a recession if an investor buys after the first -50% decline. Each investor can design their own investing approach around this information, but my approach is to take a 1% portfolio-weighted position at the -50% point, which for Micron will be about $78.77 per share, and then if the stock falls -75% off its highs, I will take a second position at that point.

Conclusion

I’ve observed that people hate simple investing strategies, especially if they lack a story element to them, and so they are often dismissed by the investing public. But my strategy’s simplicity is the result of a lot of work and research. I’ve spent countless hours sifting through cyclical stocks looking for ones that have 1) a long enough history to examine, 2) a history of quality earnings growth despite being cyclical, and 3) evidence that the cycles are short enough to be investable and produce an adequate return. I also have a checklist of factors I review before buying to see if anything important has changed since the last cycle. I usually review these in my “buy” articles. These are things like increased debt levels, super-cycles, and a few other things that might impair a timely recovery.

I don’t know whether MU’s stock price will fall to my buy price before going on to make a new all-time high. But as an investor, I don’t have to predict that. Analysts’ “Target Prices” are one of the tools used to convince investors that short-term stock price moves are predictable, when they aren’t. So, I don’t share “Target Prices”. I share “Buy Prices”. These are the price I will buy the stock if the market provides them because I think at that price I have a high probability of earning a good medium-term return. Think of it this way. Assume you are an investor in classic Ferraris. You have observed that in previous historical auctions, a particular Ferrari has sold at a certain price. You also know that you have a certain amount of profit you would like to make on your investment. You go attend a classic car auction where this particular car is present. You know what the market has paid in the past, and you know the profit you would like to make within 5 years. Armed with that knowledge, you can go into that auction knowing ahead of time what you are willing to pay for that particular car. It might be the case that at that particular auction, there are other bidders who are willing to bid more than you for that particular car, so you don’t get to buy it. This is effectively what happens when a stock doesn’t reach my buy price. I don’t get to buy it. That’s okay. Perhaps there is another investment I’m watching that does hit. Of course, at some point, a classic car investor needs to buy a certain number of classic cars, or they aren’t really a classic car investor, they are just a classic car auction attendee. I’ve purchased over 150 stocks during the past 5 years, so I’m getting plenty of opportunities. I’m not just an observer.

Analysts with “target prices” operate quite differently. They write reports about the classic cars, speculating about the market and the economy and what the cars will sell for during the auction 12 months from now, then never actually attend the auctions or buy any of the cars. And if their speculations are wrong, they simply change what they think the cars will sell for in 12 months again. It’s good for creating an environment where it’s naturally assumed that these short-term car prices are predictable, thereby creating interest in the auction. But it’s not good if one is trying to actually make money investing in classic cars.

I share this in order to clear up a point of confusion I often encounter with readers when I share buy prices, so they are not confused with target prices. My buy price for Micron is currently $78.77 per share. It will be up to the market to decide whether I get to buy at that price or not.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TFLO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you have found my strategies interesting, useful, or profitable, consider supporting my continued research by joining the Cyclical Investor’s Club. It’s only $40/month, and it’s where I share my latest research and exclusive small-and-midcap ideas. Two-week trials are free.