Summary:

- Amazon is the second-largest revenue-generating company in the world. However, it is very far from being one of the largest profit-generating companies in the world.

- Artificial intelligence could help improve Amazon’s profitability, in more ways than you might think.

- Today, Amazon is still far from its peak profitability, as it struggles to stir the huge ship it built during the last three years.

- For investors to generate a decent upside in the midterm, Amazon will need to improve and grow across every part of its business, and artificial intelligence will play a crucial role in determining the company’s success in the upcoming years.

Wirestock/iStock Editorial via Getty Images

Amazon (NASDAQ:AMZN) is the second-largest revenue-generating company in the world, and will probably take Walmart’s (WMT) crown by the end of this decade. However, it is very far from being one of the largest profit-generating companies in the world.

And artificial intelligence could help improve Amazon’s profitability, in more ways than you might think.

Business Overview

Amazon runs one of the most diversified and complex enterprises in the world, with expansive operations across retail, grocery, consumer electronics, cloud, infrastructure, advertising, media, streaming, logistics, healthcare, E-commerce, and the list goes on.

The company is the focal point of investor debate regarding diversification, where one side of the equation views Amazon as an unstoppable behemoth with countless synergies. In contrast, the other side believes the company is the embodiment of inefficiency and diworsification. As always, the truth is usually somewhere in the middle.

Products & Services

The company disaggregates its revenues under two categories in Products and Services. Product revenues include sales of products through Amazon’s online and physical stores, and related shipping fees; and digital media content where the revenue is recorded gross. To clarify, Amazon does not record third-party sales in its revenue.

Service sales primarily consist of third-party seller fees, which include commissions and any related fulfillment and shipping fees; AWS sales; Advertising services; Amazon Prime membership fees and; Digital content subscriptions.

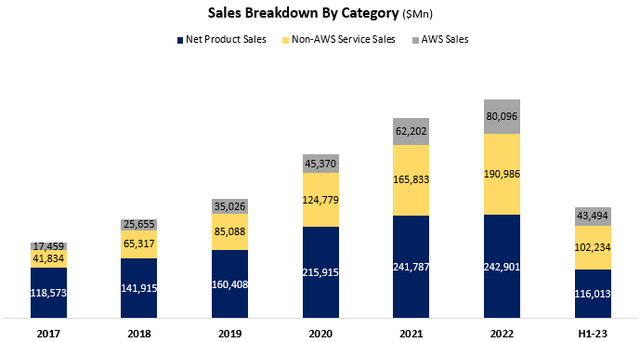

Created by the author using data from Amazon’s financial reports.

As we can see, the services portion of the business is outgrowing the products side and reached 55.7% of total sales in H1-23 (keep in mind that seasonally, the second half is better for Amazon’s product sales). Non-AWS services sales are also growing quite fast and represented a little over 39.0% of total revenues in the first half.

Generally, this is a positive trend for shareholders, as the products business is operating at break-even territory. Nevertheless, Amazon views its product arm as indispensable. Bulls would say that Amazon’s product operations are the foundation of the Prime membership, as well as support AWS as its largest customer. Additionally, at a certain scale, they should become profitable. Bears would say the cost outweighs the benefit.

In my opinion, this is a pointless debate. Amazon is most likely not going to spin off its product operations, and therefore, investors must look at the company as it is. Any analysis based on a potential spin-off is, in my view, not helpful. That being said, I will discuss what I believe is the important investor takeaway here later in the article.

Operating Segments

The company operates under three reported segments, namely, North America; International, and AWS. The North America segment includes sales of products and services in North America, excluding AWS; The International segment includes sales of products and services outside North America, excluding AWS and; The AWS segment includes revenues generated from providing Amazon Web Services, consisting of compute, storage, infrastructure, database, analytics, machine learning, and more.

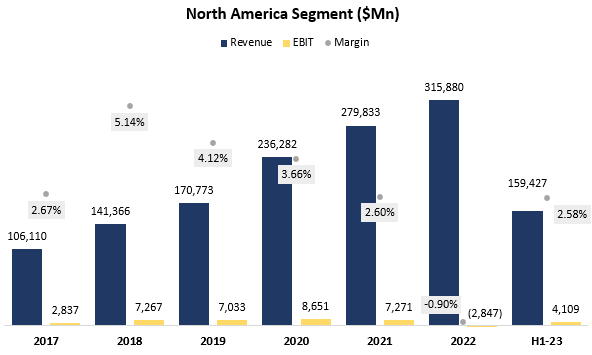

Created by the author using data from Amazon’s financial reports.

The North America segment is the largest in terms of sales. During the past six years, the segment represented around 60%-62% of the company’s sales. Profits, on the other hand, are a different story. North America achieved peak margins in 2018, at a miserable 5.1%. As we can see, the majority of the time the segment operates below the 4.0% threshold, which is approximately where you’ll find companies like Walmart and Costco (COST). The only difference is, the margins of Walmart and Costco are as steady as they come, and, those two don’t have a significant services business.

Let’s say that like total revenues, 39% of North America sales are attributed to services, and that margin number becomes much more worrisome. It’s hard to say whether it’s Amazon’s fulfillment that’s operating at a major loss, or is it the retail and grocery businesses. What we can say for sure is that the North America segment provides very low and very volatile operating profits.

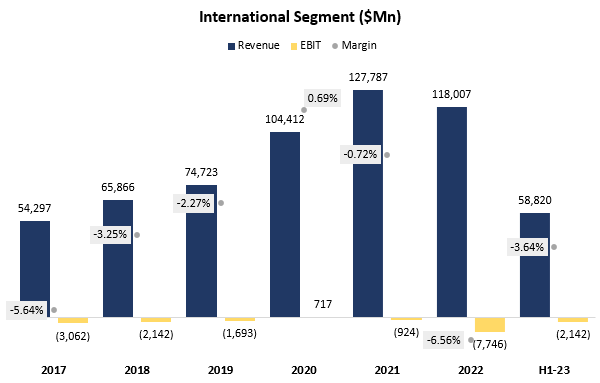

Created by the author using data from Amazon’s financial reports.

The International segment is the second-largest in terms of revenue, responsible for 22.5% of total sales. Even worse than the North America segment, 2020 was the only year the segment didn’t operate at a loss. Here’s what Brian Olsavsky, Amazon’s CFO, had to say about this segment during the last earnings call:

This segment also includes our emerging countries. It is important to remember how early we are in some of these marketplaces. We’ve launched more than 10 countries in the past six years and are always evaluating our customer experience as well as our path to profitability, and we like the path we’re on. As a reminder, it took us nine years to reach profitability in the United States.

The way I read this quote is, don’t expect any profits from this segment in the near to mid-term, and even then, the very best-case scenario would be similar to the current North America segment.

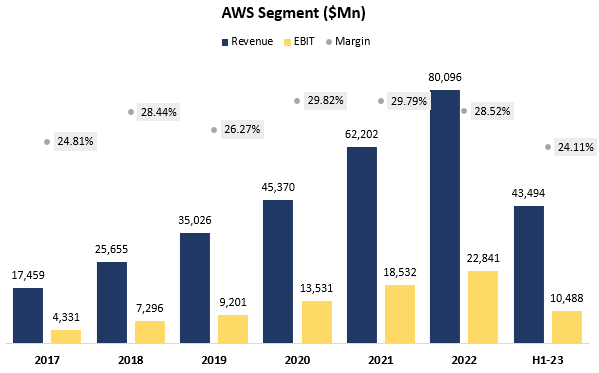

Created by the author using data from Amazon’s financial reports.

Lastly, we get to Amazon’s crown jewel. While AWS is still the smallest in terms of revenue, the segment is significantly outgrowing the other two, with a 35% CAGR between 2017-2022, compared to North America’s 24% and International’s 17%. Furthermore, it’s clearly the only reliable profit-generating segment, with operating margins in the 24%-30% range, although we’re currently in the midst of ongoing deterioration.

Many market participants believe that if AWS were to get spun out of Amazon, it would be worth, by itself, almost a trillion dollars. I find that hard to believe, but we can all agree that it’s the major contributor to Amazon’s valuation.

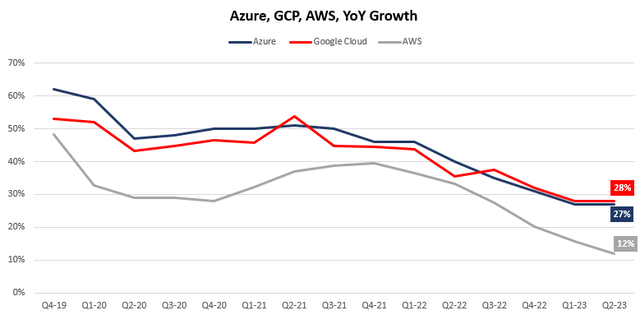

Between Google Cloud (GOOG), and Microsoft Azure (MSFT), AWS holds more than a 50% market share according to most estimates. However, Google and Microsoft are significantly outgrowing AWS, with 28% and 27% growth in the last quarter, compared to 12% for AWS. Even in terms of absolute dollars, Azure outgrew AWS in the quarter, with an estimated $3.9B increase compared to Amazon’s $2.6B.

Financial Overview

As we said before, we’ll not engage in a spin-off speculation debacle. However, we will try to figure out what drives Amazon’s near-zero profitability outside AWS, as this is key in order to determine whether or not investors can expect an improvement on that front, and in turn, significant upside.

No Profits Outside of AWS

In the Business Overview section, we saw that Amazon services were responsible for over 55% of the company’s sales in H1-23. Amazon does not break down its profitability based on revenue type, but we can assume that services are more profitable than products. Within services, we know that AWS represents approximately 29% of total sales. Thus, we know that between the North America and International segments, there’s supposed to be nearly $200 billion in annual sales, or close to 40%, of higher-margin services revenues. And yet, both segments struggle to generate consistent profitability. One of the reasons is that Amazon’s services revenues include a very costly fulfillment operation.

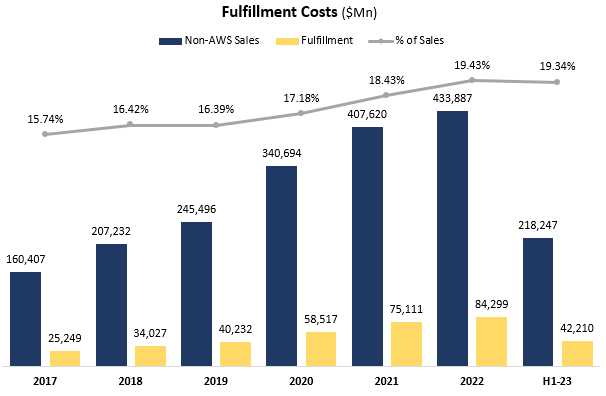

Created by the author using data from Amazon’s financial reports.

Fulfillment costs primarily consist of the costs incurred in operating and staffing the North America and International segments’ fulfillment centers, as well as payment processing expenses.

As we can see, the Amazon fulfillment network takes a 20% bite from Non-AWS sales, and we see a clear uptrend here. Investors would be wrong to look at fulfillment as a percentage of total sales and assume there’s an improvement there, as AWS revenues are unrelated and may lead to the wrong conclusion.

Despite what we see in our graph, Amazon’s CFO said operating income in North America improved in the first half of 2023 because of the following:

One of the largest drivers of this operating income improvement in the stores business has been reducing our cost to serve, with shipping costs and fulfillment costs continuing to grow at a slower pace than our unit growth.

The discrepancy is explained by a decline in COGs.

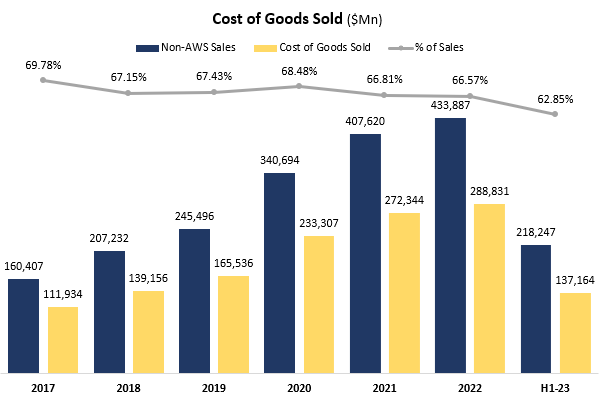

Created by the author using data from Amazon’s financial reports.

Amazon’s cost of goods sold primarily consists of the purchase price of consumer products, inbound and outbound shipping costs, and certain media expenses. COGs as a percentage of sales reached all-time lows in H1-23, primarily due to an improvement in the Non-AWS sales mix, as well as lower shipping costs, resulting from a decline in fuel and freight prices.

Even after the improvement, fulfillment expenses and COGs alone took nearly 83% of Non-AWS revenues in H1-23. In essence, this reflects a 17% gross margin for the Non-AWS businesses.

There isn’t too much left for marketing, G&A, and R&D. For those two segments to become more profitable, the company needs to continue to outgrow services (specifically advertising and third-party seller fees) over products, as well as drive a sequential improvement in fulfillment costs. We’ll discuss both of those in our AI segment.

Free Cash Flow, Capex, And Dilution

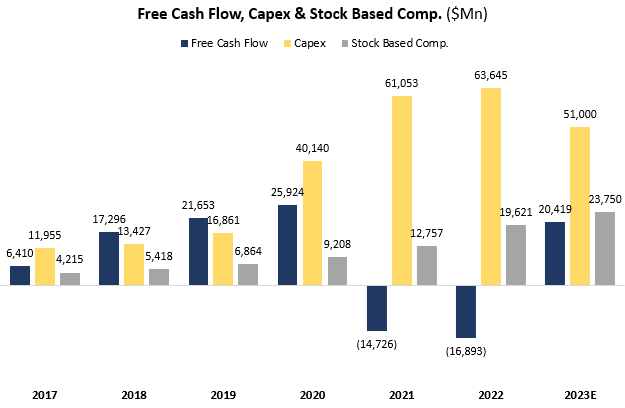

Amazon’s longstanding declared north-star is generating steady long-term free cash flow per share growth. It’s the most discussed metric by the company’s management and specifically its founder Jeff Bezos. Amazon is also one of the few companies that put their cash flow statement on the “front page” of their earnings releases.

Free cash flow is a non-GAAP metric, and it can be defined differently by different companies. For our purpose here, we’ll calculate free cash flows as net cash provided from operating activities minus capital expenditures.

Created by the author using data from Amazon’s financial reports.

After four years of consecutive free cash flow growth, Amazon’s free cash flow turned negative in 2021, as Capex surpassed $61 billion, probably the largest amount for any company during that period. In 2022, another increase in capex combined with a major decline in operating profit resulted in another decline in FCF. For 2023, Amazon is finally expecting to see a decrease in Capex, with current guidance forecasts to slightly over $50 billion. And as the company’s profitability improves, we should see free cash flow surpass the $20 billion mark once again.

Created by the author using data from Amazon’s financial reports.

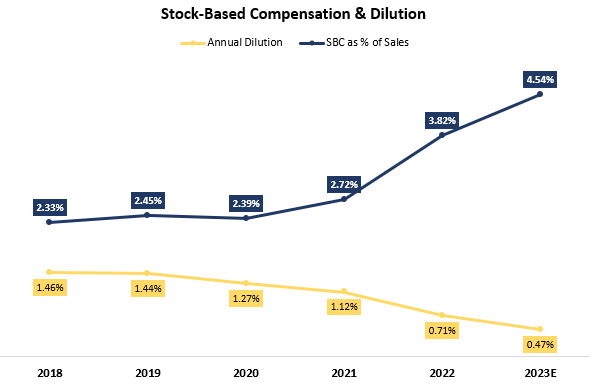

However, Amazon’s free cash flow, as we defined it, doesn’t paint the whole picture. As we can see, Amazon is paying huge amounts of money in the form of stock-based compensation and has only done a very unimpressive $6 billion buyback to offset dilution over the last seven years.

As a result, investors are constantly diluted, and if we adjust stock-based compensation from FCF, it’s actually expected to remain negative in 2023.

How Can AI Contribute To Each Of Amazon’s Businesses?

We’re finally done overviewing the Amazon octopus of a business. At this point, I think we can establish two important conclusions. First, Amazon’s businesses enjoy immense demand and should continue to grow at a rapid pace well into the future. Second, Amazon is an inefficient company, that is struggling to steadily generate positive profits and cash flows.

It could be argued that Amazon is following its historical playbook, meaning it’s willing to sacrifice near-term profits for growth. In my view, Amazon’s journey toward decent steady profitability is taking longer than it should. That being said, I believe that one of the main contributors to accelerating this process will be the success of the company’s AI ambitions, which span its entire enterprise.

For the purpose of our analysis, let’s begin with understanding the framework through which the company views artificial intelligence:

Every single one of our businesses inside of Amazon, every single one has multiple generative AI initiatives going right now. They range from things that help us be more cost effective and streamlined, to the absolute heart of every customer experience in which we offer. It’s true in our stores business. It’s true in our AWS business. It’s true in our advertising business. It’s true in all our devices. It’s true in our entertainment businesses. Every single one. It is going to be at the heart of what we do. It’s a significant investment and focus for us.

— Andrew Jassy, President, CEO & Director, Amazon Q2-23 Earnings Call

In short, AI can enhance growth in AWS and advertising, which are very steady and profitable businesses for Amazon. The more they grow, the more profitable Amazon will be. Furthermore, it can improve productivity across its fulfillment centers and R&D teams, which may result in better profitability for the currently losing businesses.

Web Services

We think of large language models in generative AI as having three key layers, all of which are very large in our opinion and all of which AWS is investing heavily in. At the lowest layer is the compute required to train foundational models and do inference or make predictions.

We think of the middle layer as being large language models as a service. Stepping back for a second, to develop these large language models, it takes billions of dollars and multiple years to develop. Most companies tell us that they don’t want to consume that resource building themselves. Rather, they want access to those large language models, want to customize them with their own data without leaking their proprietary data into the general model, have all the security, privacy and platform features, and then have it all wrapped in a managed service.

Then that top layer is where a lot of the publicity and attention have focused, and these are the actual applications that run on top of these large language models. As I mentioned, ChatGPT is an example.

— Andrew Jassy, President, CEO & Director, Amazon Q2-23 Earnings Call

On the first layer, Amazon provides computing through its infrastructure-as-a-service offerings under AWS. Furthermore, the company developed its own custom AI chips for training called Trainium and for inference called Inferentia. According to Andy Jassy, those chips provide an attractive price-performance option for customers, and the company expects a significant share of LLM training will be run on Amazon’s chips.

On the second layer, the company already offers Bedrock, which comprises the entire suite of capabilities listed above.

Lastly, on the third layer, AWS doesn’t have its own Chat-GPT rival, but it does provide generative AI services, including CodeWhisperer, which is an AI-powered coding companion, similar to Microsoft’s GitHub Copilot.

Overall, I believe that the majority of AWS customers will prefer using services offered by Amazon rather than switching to a competitor, as long as AWS will be able to provide viable alternatives.

Created and calculated by the author using data from the companies’ financial reports; Microsoft’s fiscal quarter is two periods ahead of the calendar year, meaning Q2-23 is Microsoft’s fiscal Q4-23.

As we can see, Google Cloud and Azure have been outgrowing AWS for quite some time, although AWS is sandaled by the law of large numbers. All cloud providers are seeing growth decelerating, as they increase in size and clients go through an optimization phase.

That being said, management sounded positive about growth accelerating in the following quarters, as the optimization phase is showing signs of coming to an end.

Advertising

Amazon’s advertising business primarily consists of sponsored ads on its E-commerce platform, one of the most attractive advertising spots in the digital world. Somewhat similar to Google Search, a user occasion usually begins with a search for a specific product, and thus, conversion rates for ads showing that desired product are typically very high.

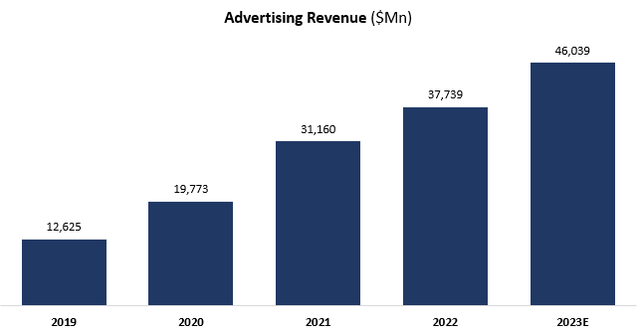

Created by the author using data from Amazon’s financial reports.

Amazon’s ads business is arguably the fastest-growing ad business in the digital market, growing at a CAGR of 44.0% between 2019-2022. The company is on pace to surpass $46 billion in 2023, reflecting over 21% growth for the year, higher than advertising giants like Google and Meta (META).

In ads, AI will be crucial to constantly improve the targeting quality and to sustain high conversion rates. Success on that front will result in continued outperformance over competitors and a steady margin expansion.

Cost-Efficiency

One of the key factors that deterred me from considering an investment in Amazon is my perception of the company’s inefficiency. Effectively overseeing and managing extensive operations of this magnitude presents significant challenges. Nevertheless, Amazon persists in its expansion, seemingly unfazed by the associated costs.

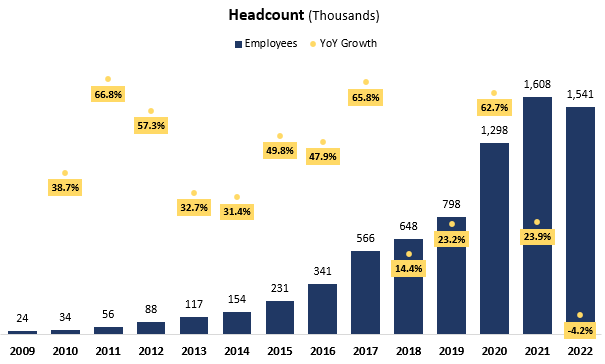

And if there’s one metric that tells the entire story, it’s the company’s headcount. Warning, it’s not a soothing sight.

Created by the author using data from Amazon’s financial reports.

Between 2019-2022, Amazon’s revenues grew 25x. The company’s growth story is one of the most magical tales in the investing world. But there’s even a more magical growth story to be told.

Amazon’s headcount grew nearly 80x during that period, from 24,000 to a whopping 1.5 million. As the company built its fulfillment capabilities, it hired an astounding amount of employees. Specifically during Covid, Amazon took in over 800,000 employees in a span of two years. That’s unheard of, and in 2022, as inflation rose and demand weakened, the company’s operating profit came tumbling down.

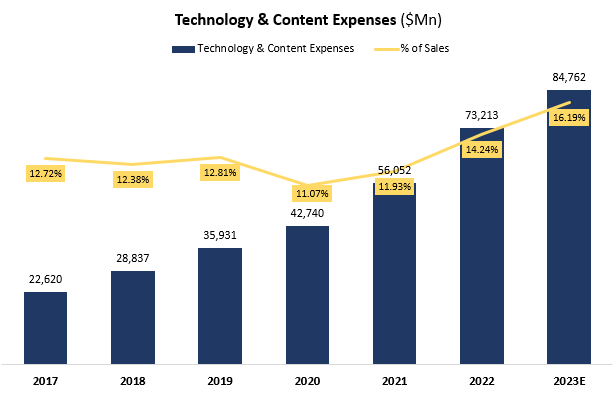

While the majority of the headcount increase is attributed to blue-collar workers, Amazon recruited employees at an unparalleled pace across other divisions as well. We already discussed the magnitude of Amazon’s SBC and the significant jump it took post-Covid, and now we can see Technology & Content expenses, which include R&D and content creation, are also increasing sharply.

Created by the author using data from Amazon’s financial reports.

Advancements in AI could drive productivity in both the fulfillment blue-collar line and R&D teams. For manual labor, Amazon is constantly working on automating parts of the fulfillment chain. And for development teams, tools like CodeWhisperer could provide efficiency and reduce the number of employees needed.

Valuation

At last, we get to the valuation discussion. To evaluate Amazon’s fair value, I’ll rely on EV/EBIT multiples, which I believe is the simplest and most accurate way to assess Amazon’s fair value in the mid-term, as the company’s operating metrics fluctuate and are essentially impossible to reliably forecast in a long-term discounted cash flow analysis.

To begin, let’s establish plain and simple that under the assumption Amazon won’t improve its margins in the mid-term, Amazon isn’t an attractive investment. To prove this point, we’ll take Amazon’s all-time high operating margin of 5.9%, which it achieved during Covid. Let’s call this a base-case scenario.

If we multiply the company’s projected 2023 sales by the base-case scenario margin and take the company’s enterprise value which stands at $1.54 trillion, at the time of writing this article, we arrive at an EV/EBIT multiple of 45x. Now, let’s say Amazon grows revenues by 12.0% annually until 2026, in line with consensus estimates. Still, in the base-case scenario, we get to a 32x multiple over the 2026 operating profit.

Clearly, the base-case scenario means the stock isn’t attractive, and thus a bear-case scenario is obviously irrelevant. We’re left with our bull-case scenario.

Under the bull-case scenario, we assume that AWS, advertising, and third-party seller fees, will continue to outgrow the less profitable parts of the business. We also assume that AI, operational leverage, and management focus, will all drive productivity that will result in higher margins.

Overall, I estimate it’s reasonable to assume that in our bull-case scenario, Amazon will achieve an operating margin of 10.0% by 2026. Assuming 12.0% growth annually, we reach an EV/EBIT multiple of 19.2x over 2026 EBIT.

If Amazon delivers the bull-case numbers, it’s reasonable to assume it will trade around a 26x multiple, slightly below Microsoft’s multiple today, as Amazon’s business isn’t as high quality as Microsoft, but its growth prospects and margin story will justify a premium. All in all, in our bull-case scenario, Amazon will deliver an annual return of 10.7% over the next two years.

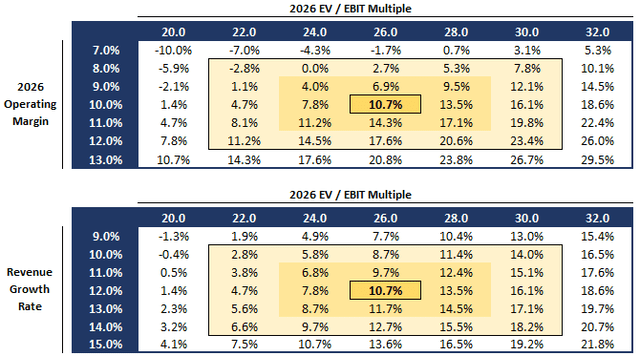

Sensitivity Analyses

Created and calculated by the author based on data from Amazon financial reports and the author’s assumptions.

As we can see, the valuation is significantly more sensitive to the operating margin assumption than it is to the revenue growth rate, reflective of the company’s situation and risks. For example, if we keep the 10% margin steady but assume a 10% growth rate rather than 12%, we’ll expect an upside of 8.7%. However, if we keep the growth rate steady at 12% but assume an 8% margin rather than 10%, we’ll expect an upside of 2.7%.

Risks

Let’s begin with the most obvious risk, which is valuation and expectations. As discussed in the previous section, the current valuation reflects high expectations for margin recovery, continued growth, and decreasing dilution. For a decent upside to be generated for shareholders, Amazon will need to achieve record margins while continuing to grow. Clearly, there are many things that could fail along the way, and investors should take that into account.

The second risk I’d like to address is Amazon’s exposure to commodities, and more specifically, energy. Unlike its big-tech peers, a significant portion of Amazon’s business is directly linked to inputs like fuel, electricity, steel, paper, and cardboard. Commodity prices are volatile and impossible to predict, and we saw their effect on the company’s profitability in 2022. Thus, investors should always expect fluctuations in the company’s margin, which will naturally cause fluctuations in the stock price as well.

Third, let’s discuss Amazon’s track record as a reckless spender, for lack of a better word. Amazon constantly engages in horizontal expansions. To name a few examples, Amazon acquired a virtual care delivery company, One Medical, at the beginning of this year. Amazon also produced the most expensive TV show of all time Lord of The Rings, and committed to pay $1 billion a year to the NFL for the rights to air Thursday Night Football (consider how much it costs to build the production capabilities for that).

Overall, Amazon’s management is spending big on projects that are clearly outside of the company’s current reach, or at least very far from its core business. It has done so even during periods of pressurized profitability and increasing capex, and it has done so despite talking about a need to focus on efficiency. There’s no reason to believe it wouldn’t continue to do so.

Conclusion

Amazon operates one of the most complex businesses in the world today. Studying the company for weeks won’t be enough to understand just how expansive its reach is. That being said, the investment thesis regarding the company is quite simple.

Today, Amazon is still far from its peak profitability, as it struggles to stir the huge ship it built during the last three years. The company took in nearly 1,000,000 employees, and spent over $160 billion in capex, probably more than any other company in the world during that time span.

For investors to generate a decent upside in the mid-term, Amazon will need to improve profitability and grow across every part of its business, and artificial intelligence will play a crucial role in determining the company’s ability to achieve that in the upcoming years.

In my view, Amazon is on the right track toward achieving record profitability while continuing to grow at a rapid pace, and its management seems to finally understand the need to emphasize profits and positive cash flows.

While there’s still a lot of work left to do and significant risks, I believe the potential upside is favorable, and rate Amazon as a Buy.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best AI Ideas investment competition, which runs through August 15. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.