Summary:

- Memory companies are facing low yield rates in their race to pass qualification tests for NVIDIA’s next-gen AI GPUs.

- Samsung may become the sole supplier of 12-layer HBM products for Nvidia, as SK Hynix’s 12-layer product is encountering process issues.

- Micron’s HBM3E solution will be part of NVIDIA’s H200 Tensor Core GPUs, with strong performance potentially moving Micron into the top tier among memory packaging companies.

- The complexity of the hybrid bonding process equipment used to make HBM structures can result in yield loss at various stages of the process.

ryasick

Background to HBM Yield Issues

A March 4, 2024 WCCF TECH article entitled HBM Manufacturers Witnesses Low Yield Rates, Making It Difficult to Pass NVIDIA’s Qualification Tests, quoted a report from DealSite, a Korean media outlet reporting:

“manufacturers such as Micron and SK Hynix are facing each other head-to-head in the race to pass qualification tests for NVIDIA’s next-gen AI GPUs, and it seems like low yield rates are in their way.”

In a March 26, 2024 article in DigiTimes, entitled “Samsung likely to solely supply 12-layer HBM3E to Nvidia as early as September,” we now learn that Samsung Electronics (OTCPK:SSNLF) may soon become the sole supplier of 12-layer HBM products for Nvidia (NVDA). According to the article:

“In late February 2024, Micron announced the commencement of mass production for its 8-layer HBM3E, and Samsung also unveiled its achievement of successfully developing 36GB 12-layer HBM3E products.”

According to the article, Nvidia CEO Jensen Huang confirmed at the recently-held GTC 2024 that Samsung’s HBM is currently undergoing the verification stage.

More importantly, the article noted:

“SK Hynix has started officially supplying Nvidia with 8-layer HBM3E in March 2024, yet its 12-layer product is reportedly encountering some process issues. Nevertheless, SK Hynix showcased its 12-layer HBM3E at GTC 2024 and allegedly provided samples to Nvidia as early as February 2024.”

Why I Moved Micron From a Hold to a Buy

As a background, I last upgraded Micron (NASDAQ:MU) from a Sell to a Hold as a result of improvements in the memory sector, as detailed in my November 21, 2023 Seeking Alpha article entitled Micron: Weak Competitive DRAM Metrics Illustrate Its Small HBM3 Market Share. I was a Sell based on the poor performance of the memory sector and the fact that I had learned from my sources that SK hynix was awarded the exclusive HBMx supplier from Nvidia, meaning that Micron was out of contention.

Now I have learned that the yield of SK hynix (HXSCL) has dropped due to processing issues, and as a result, as noted in a February 26, 2024 press release, Micron announced it has begun volume production of its HBM3E (High Bandwidth Memory 3E) solution. Micron’s 24GB 8H HBM3E will be part of NVIDIA Corporation H200 Tensor Core GPUs, which will begin shipping in the second calendar quarter of 2024.

But here’s where I was wrong, admittedly, when I interpreted the change in Nvidia’s position of SK hynix exclusivity on insufficient capacity at SK hynix. My new information on poor yields just discovered means Micron is not just getting the “leftovers” from Nvidia, but strong performance by its HBM3E package will move the company into the top tier among memory packaging companies. That also means strong opportunities for AMD (AMD) and Intel (INTC) HBM business as well.

Why the Yield Issues with HBM?

Complex Hybrid Bonding Systems for HBM

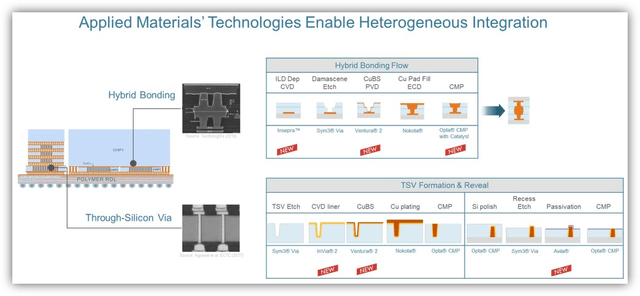

Hybrid Bonding represents a cutting-edge advancement in semiconductor technology, enabling denser, faster, and more energy-efficient memory stacks used in HBM. Hybrid bonding plays a crucial role in this context by facilitating the vertical stacking of DRAM dies with a base logic die, all connected via Through-Silicon Vias (TSVs) and micro-bumps.

Chart 1 illustrates an HBM package (left) and a Hybrid Bonding System and TSV formation from Applied Materials (AMAT) which is detailed in a press release entitled Applied Materials Advances Heterogeneous Chip Integration with New Technologies for Hybrid Bonding and Through-Silicon Vias.

Chart 1

Comparing Micron’s DRAM and NAND Metrics

Despite the HBM gains, Micron’s DRAM and NAND metrics are generally underperforming Samsung and SK hynix. In the following charts I show Revenue, ASP, and Bit Shipments for Micron’s recent fiscal 2Q 2024 earnings call in March 2024 and Sk hynix Q1 2024 earnings call on April 25, 2024. I also show Samsung’s metrics, but only to Q4 2023 as the company reports Q1 2024 earnings on April 30.

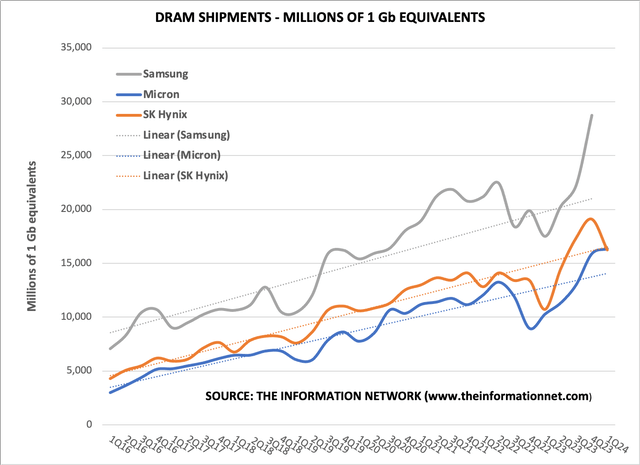

DRAM Bit Shipments

I start with DRAM bit shipments illustrated in Chart 2. Here we see that Micron’s bit shipments increased 3% in the last quarter following a 22% spurt the previous quarter. However, for Q1 2024, bit shipments from SK hynix decreased 15% QoQ. Hynix explained the drop to reduced capex in 2023 and the increased die sizes of premium products. Specifically, the die size for DDR5 is 10-15% larger, and for HBM3e, it is up to 2-3 times larger.

However, I attribute this drop to the poor yields as discussed above, which caused Micron to be awarded HBM contracts from Nvidia.

For the current quarter, Micron moved to #2 in the DRAM sector based on bit shipments.

Chart 2

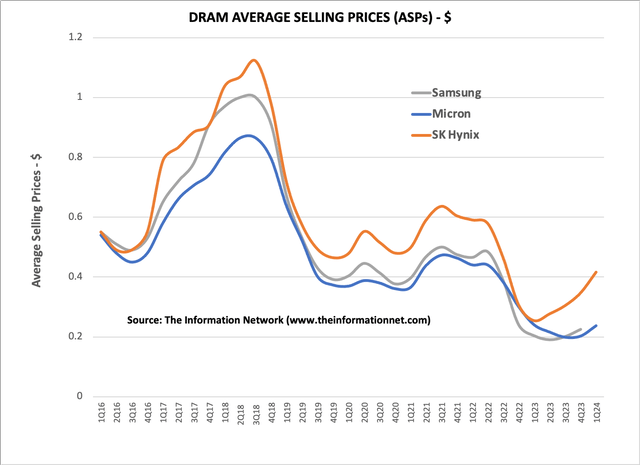

DRAM ASP

ASPs (average selling prices) is another indication that the DRAM sector SK hynix is recovering faster than competitors from the memory downturn, attributed to its lead in the HBMx market, as shown in Chart 3.

Micron’s ASP increased 17% in FQ2 following just a 2% increase the previous quarter. ASP’s for SK Hynix increased 20% in the recent quarter following a 14% increase the previous quarter. ASPs for Samsung increased 12% in Q4 2023.

Chart 3

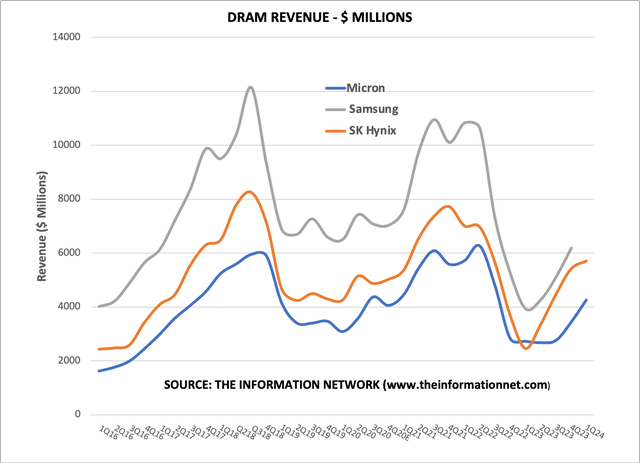

DRAM Revenue

Chart 4 shows DRAM revenue. Micron’s DRAM revenue growth was 24% QoQ, compared to a modest 3% the prior quarter. DRAM revenues for SK hynix increased 6% in Q1, but it followed a 120% increase in the previous quarter. Samsung’s DRAM revenues increased 57% QoQ in Q4 2023.

Chart 4

NAND Bit Shipments

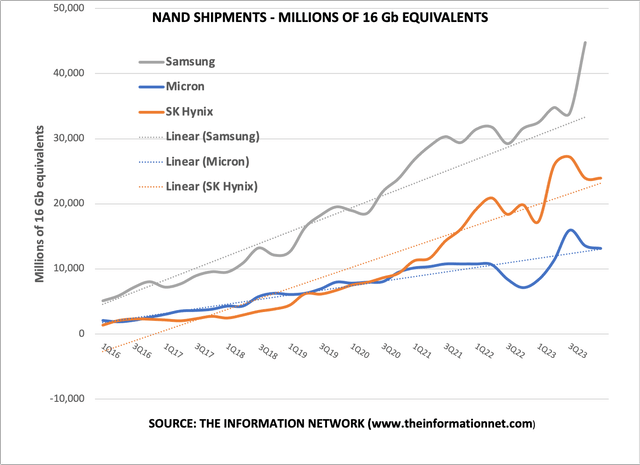

I will present just NAND bit shipments in this article, and refer readers to my Investing Group Semiconductor Deep Dive article for full NAND metrics.

In Chart 5, I show the growth in NAND bit shipments for Micron, which decreased 3% in the current quarter following a 15% decrease the previous quarter. SK Hynix reported flat bit shipments in Q1 following a 12% decrease in Q4 2023. Samsung reported a 32% increase in NAND bit shipments in Q3 2023.

Chart 5

Investor Takeaway

There are significant challenges in the current HBM processes from all three companies.

Improving the yield in the HBM hybrid bonding process flow requires meticulous control over the cleanliness and preparation of surfaces, precise alignment and bonding equipment, and careful optimization of process parameters. For example, a “killer” particle of only 1 micron height results in a bond void of 10 millimeters in diameter which would result in a defective bond.

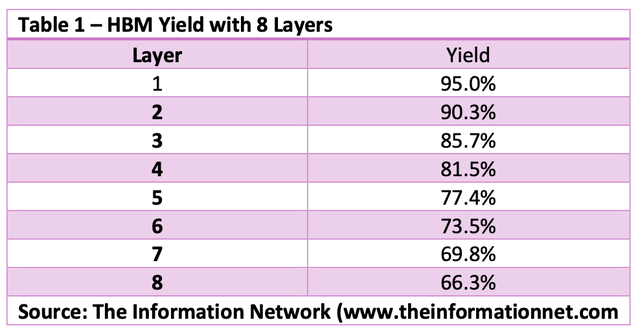

Since there are currently eight layers of DRAMs in an HBM and each layer has a yield of 95%, successive layers reduce the yield (multiplying 95% x 95% x 95%…) reaching 66.3% for the complete HBM structure, as shown in Table 1.

Chart 1 above is a graphic I received from AMAT’s IR department showing its deposition technology. When I asked by e-mail whether SK hynix was using the company’s system for its HBM, he replied:

“I haven’t heard about non-working HBMs. In any case I would have to refer you to Hynix for any comments about their products. In general, equipment customers prefer that equipment companies not speak about their choice of products (it can be an IP concern).”

Regardless of what equipment SK hynix, Micron, or Samsung are using to manufacture their HBM structures, yields at 8-layer HBMs, which are currently in production are problematic, and Nvidia recognizes this, which is why it contracted Micron as an alternative HBMx supplier.

Currently 12-layer HBM3E products from SK hynix and Samsung are being evaluated by Nvidia. Micron expects to launch its 12-layer system in 2025. According to Table 1, 12-layer HBMs will have a lower yield than 8-layer HBMs.

To reiterate, I rate Micron a Buy. Capacity is low because of its late start in the HBM business at 2.9%, according to my March 18, 2024 Seeking Alpha article entitled, Micron’s Fiscal Q2 2024 Earnings Preview With Eyes On HBMx. But I concur with CEO Sanjay Mehrotra comment in the company’s recent earnings call:

“We continue to expect HBM bit share equivalent to our overall DRAM bit share some time in calendar 2025. Earlier this month, we sampled our 12-high HBM3E product, which provides 50% increased capacity of DRAM per cube to 36 gigabyte. This increase in capacity allows our customers to pack more memory per GPU, enabling more powerful AI training and inference solutions.

We expect 12-high HBM3E will start ramping in high-volume production and increase in mix throughout 2025.”

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This free article presents my analysis of this semiconductor equipment sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here and start a risk free 2 week trial now.