Summary:

- Indonesia Energy has filed its initial registration statement for a U.S. IPO.

- The firm is developing oil & gas resources in Indonesia.

- INDO is tiny, but turned a profit in 2018 and has potential for more growth.

Quick Take

Indonesia Energy (NYSE:INDO) has filed to raise gross proceeds of up to $23 million from a U.S. IPO, according to an F-1 registration statement.

The firm operates as an oil and gas exploration and production company focused on Indonesia.

INDO is a small company with promising resources but a short operating history and subject to significant currency swings.

I’ll provide an update when we learn more IPO details.

Company & Technology

Jakarta, Indonesia-based INDO was founded in 2014 and currently holds two oil and gas assets through its operating subsidiaries in Indonesia, namely the Kruh Block, a producing block, and the Citarum Block – an exploration block.

The firm has also identified a potential third block located in the Rangkas Area.

Management is headed by Co-Founder, Director and CEO Dr. Wirawan Jusuf, who previously co-founded and served as a Commissioner of Pt. Asiabeef Biofarm Indonesia.

INDO acquired rights to the Kruh Block in 2014 and started its operations in Nov 2014 through its local subsidiary Green World Nusantara, under a Technical Assistance Contract [TAC] with Pertamina – Indonesia’s state-owned oil and natural gas corporation – until May 2020, after which operatorship of the block will continue as a Joint Operation Partnership [KSO] for 10 years until May 2030.

The Kruh Block, located 25 km northwest of Pendopo, Pali, South Sumatra and covering an area of 258 square km (or 63,753 acres), is capable of producing an average of approximately 9,000 barrels gross of oil per month.

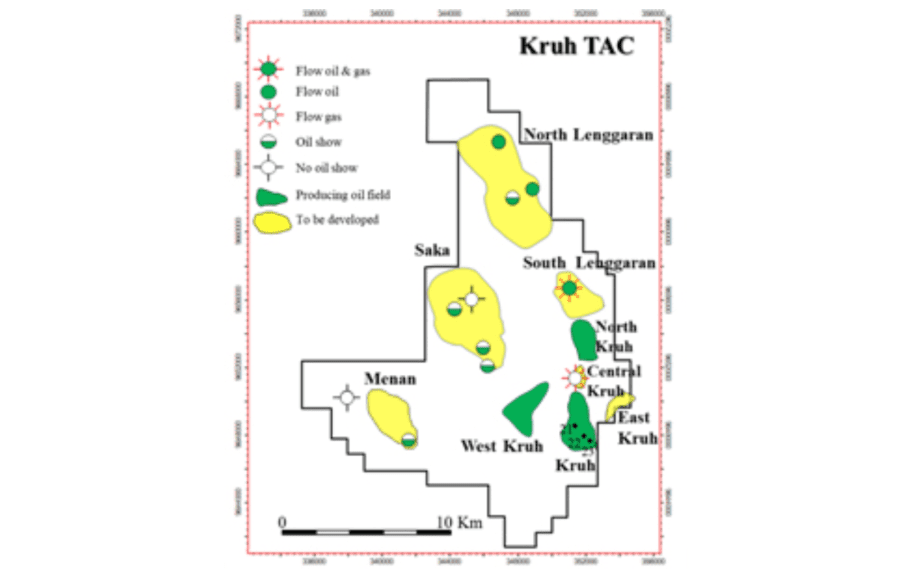

Below is an overview map of the Kruh Block and its producing fields:

Source: Company registration statement

Since 2014, the company has increased its Kruh Block gross production from 250 Barrels of Oil Per Day [BOPD] in 2014 to 400 BOPD gross in early 2018, which management believes the company achieved by the drilling of three new wells and upgrade of the production facilities.

The Citarum Block covers an area of 3,924.67 square km (or 969,807 acres) and is located onshore in West Java, only 16 miles away from Jakarta, Indonesia’s capital.

INDO is focused on the acquisition of medium-sized blocks as they are mostly overlooked by major oil and gas exploration companies who compete with larger oil assets.

Market & Competition

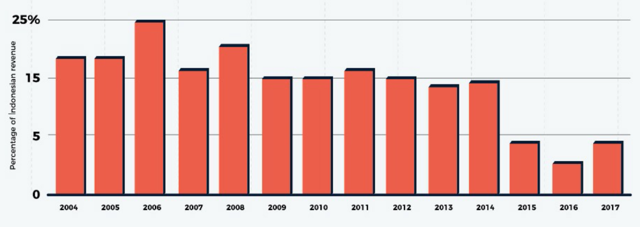

According to a 2018 market research report by The Asean Post, the Indonesian oil and gas industry accounted for nearly 25% of the country’s economy in 2006 and had decreased to 3% in 2016, as shown by the chart below:

The main factors driving market decline were falling demand for oil as well as an oversupply of the commodity, which resulted in a decline of prices per barrel from $115 in June 2014 to under $35 by the end of February 2016.

Moreover, investments for oil and gas exploration in Indonesia had fallen from $1.3 billion in 2012 to $100 million in 2016.

The country has launched initiatives to revitalize the sector, while the report cites its Energy and Mineral Resources Minister, Ignasius Johan, who forecasts $200 billion in investments over the next 10 years through incentives, including tax-free imports of drilling equipment and cost recovery.

Despite that, Southeast Asian oil analyst Johan Utama says that Indonesia’s constantly changing regulations inspire the feeling of an unstable industry, which would serve to drive investors away.

A PwC report titled Oil and Gas in Indonesia 2017 put a highlight on Indonesia’s challenge of depletion in oil resources and the availability of new reserves.

According to the International Energy Agency [IEA], Indonesia is the third-largest geothermal power producer in the world while the country’s Energy Ministry plans to increase the nation’s geothermal production capacity to 5,000 MW by the end of 2025.

Major competitors for the acquisition of new oil blocks include Pertamina, Indonesia’s state oil corporation, and other major oil and gas companies that operate in the country.

Financial Performance

INDO’s recent financial results can be summarized as follows:

-

Growing topline revenue

-

A swing to positive operating profit and operating margin

-

Small comprehensive income

-

A swing to positive cash flow from operations

Below are relevant financial metrics derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

2018 |

$ 5,856,341 |

58.1% |

|

2017 |

$ 3,703,826 |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

2018 |

$ 143,384 |

2.4% |

|

2017 |

$ (1,552,466) |

-41.9% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

|

|

2018 |

$ 161,344 |

|

|

2017 |

$ (1,609,587) |

|

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

2018 |

$ 1,920,219 |

|

|

2017 |

$ (182,737) |

Source: Company registration statement

As of December 31, 2019, the company had $2.9 million in cash and $4.8 million in total liabilities.

Free cash flow during the twelve months ended December 31, 2019, was $1.9 million.

IPO Details

INDO intends to raise $23.0 million in gross proceeds from an IPO of its ordinary shares.

Per the firm’s latest filing, it plans to use the net proceeds from the IPO as follows:

We plan to use the net proceeds of this offering primarily to fund the exploration of the Citarum Block as part of our strategy for adding new reserves and developing the field after discovery, and for general working capital and corporate purposes.

Management’s presentation of the company roadshow isn’t available yet.

The sole listed underwriter of the IPO is Maxim Group.

Commentary

INDO is seeking to raise a small fund to explore its Citarum Block of potential resources, which covers an area of 3,924 square kilometers in West Java, about 16 miles south of Jakarta, the capital city of Indonesia.

Indonesia is a country with significant energy and energy management challenges. Just recently the country faced a nine-hour blackout in the Jakarta and Java regions.

INDO’s financials show a very small exploration firm that has swung to comprehensive profit and positive cash flow, likely a function of the recovering price of oil combined with an impressive increase in total production for 2018 versus 2017.

Management also disclosed that its average production cost per barrel of oil dropped in 2018 to $21.34, making the firm more efficient in the process and able to produce profits at relatively low sale prices for its oil, even taking into account transportation costs.

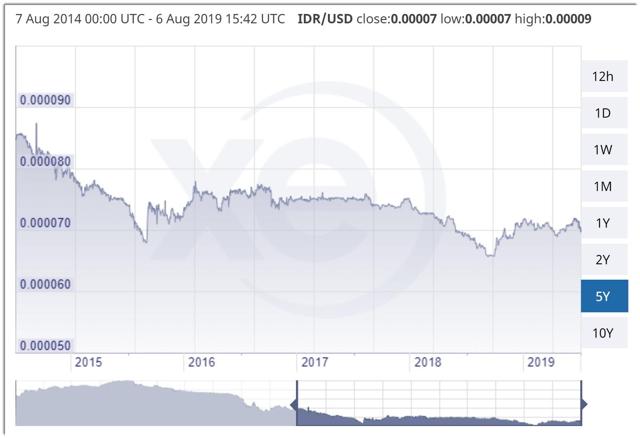

Also, the firm’s currency is the Indonesian Rupiah [IDR], which has been subject to fluctuations against the US dollar, losing 17.6% of its value in the past five year period, as shown in the chart below:

INDO is a tiny firm with only a few years of operating history and little in the way of operations. When we learn more IPO details from management, I’ll provide an opinion.

Expected IPO Pricing Date: To be announced.

Analyst’s Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I research IPOs and technology M&A deals.

Members of my proprietary research service IPO Edge get the latest IPO research, news, market trends, and industry analysis for all U.S. IPOs. Get started with a free trial!