Summary:

- Indonesia Energy Corporation is an oil and gas E&P business with an outstanding team comprising large players in the United States.

- The company believes that production could increase sufficiently to deliver a cash flow increase of more than 200% y/y.

- With the new information about the drilling of INDO’s producing block, I believe that the NPV of this asset could be worth $380 million.

asbe/iStock via Getty Images

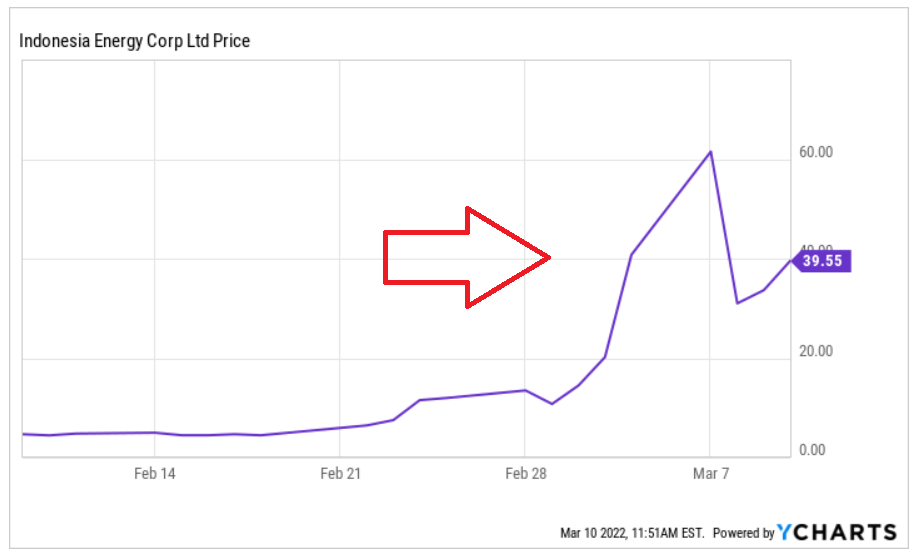

Indonesia Energy Corporation Limited (NYSE:INDO) is spiking up after management reported new information about the drilling process in the Kruh Block. In addition, the recent increase in crude oil price is moving the market. I counted the total production of crude oil from the Kruh Block, and believe that the company could be worth more than $380 million. If we also assume the exploration of the Citarum Block and the Rangkas area, the valuation could be even more significant.

Indonesia Energy Corporation: Current Team And The Kruh Block May Explain The Recent Increase In The Stock Price

Indonesia Energy Corporation is an oil and gas E&P business with an outstanding team comprising large players in the United States.

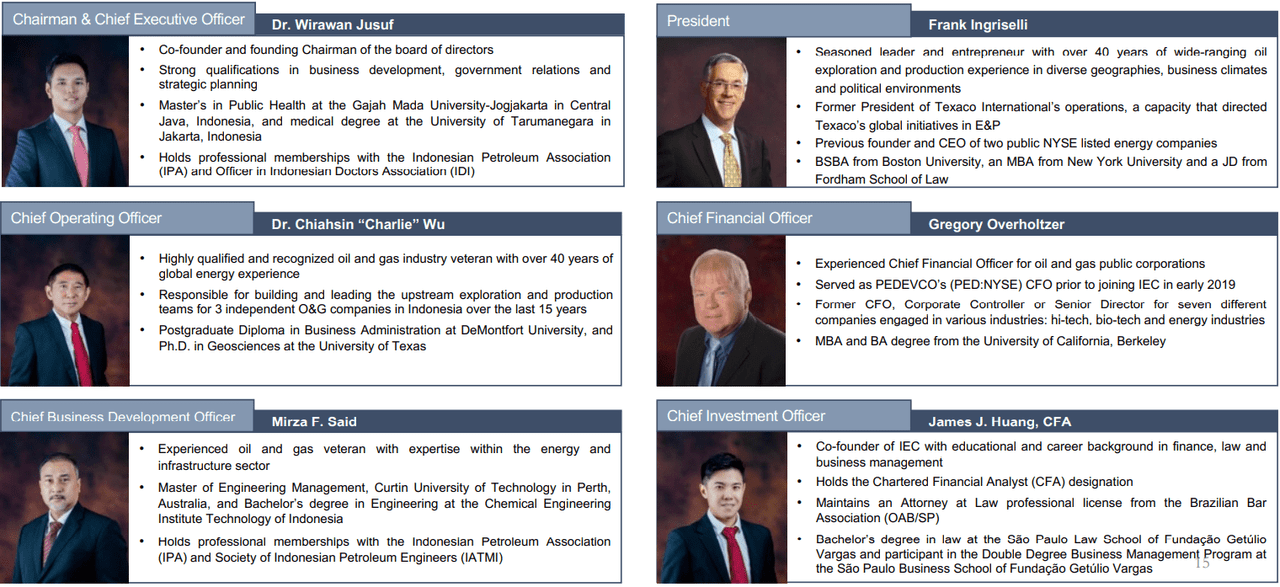

Among the members of the board and the management, I would highlight the profile of the President, who is a former President of Texaco. Another well-known veteran is the CFO, who was also the CFO of PEDEVCO (PED). I decided to conduct research on the company after reviewing the team. Readers may want to do the same:

Presentation To Investors January 2022

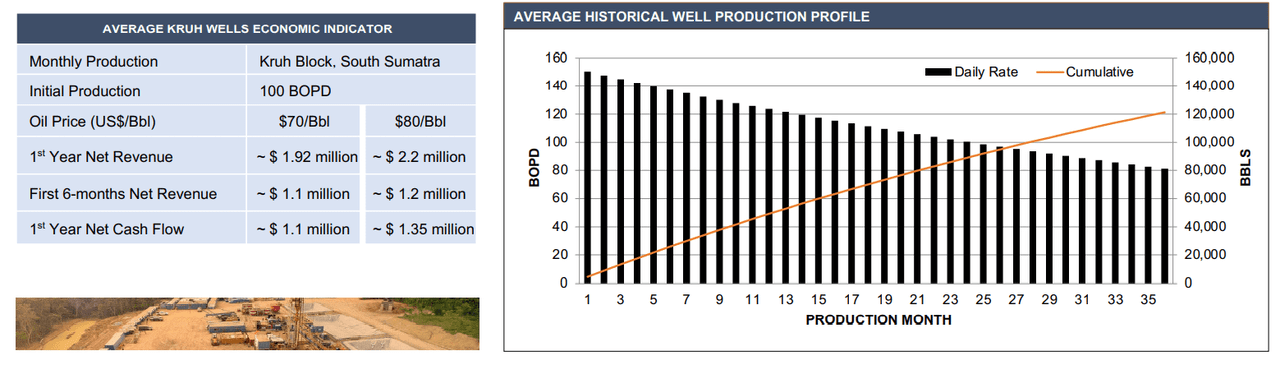

Along with the team, the reason to explain why the current valuation is at its maximum level comes from several numbers delivered very recently. As of March 10, 2020, management reported that it had successfully mobilized the drilling rig to drill 2 back-to-back producing wells. Besides, management expects that each well would generate $2.6 million in net revenue in its first twelve months:

Indonesia Energy Corporation announced that the company has mobilized the drilling rig to drill 2 back-to-back producing wells at its 63,000-acre Kruh Block. Based on the terms of IEC’s contract with the Indonesian government and an oil price of $95.00/barrel (which is 15% below yesterday’s closing price for Brent), each well is expected to generate $2.6 million in net revenue in its first twelve months, which is enough to recover the cost of drilling the wells in the first year of production. Source: Indonesia Energy Mobilizes Drilling Rig to Commence

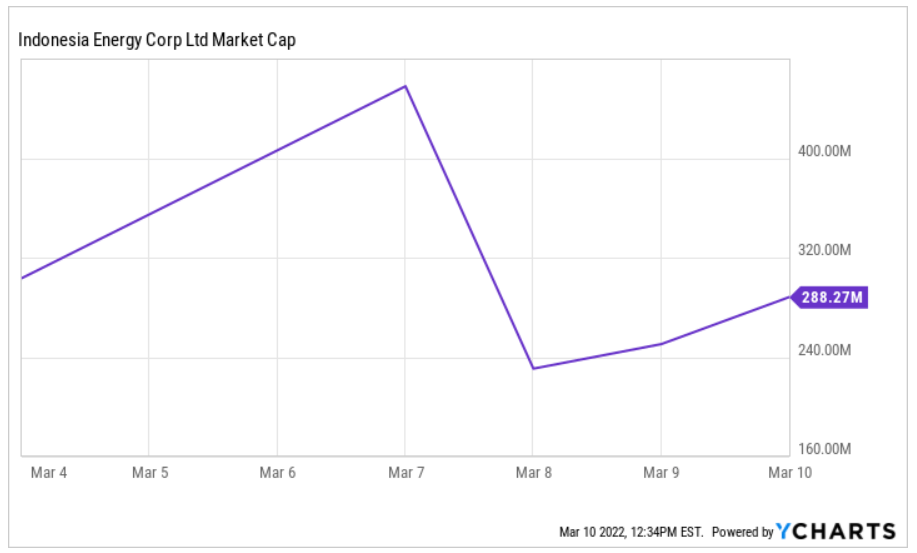

YCharts

The new information and the recent massive stock price increase interested me quite a bit. I decided to assess the valuation and potential production of Indonesia Energy’s Kruh Block.

The Net Present Value Of Kruh Block Could Reach $380 Million

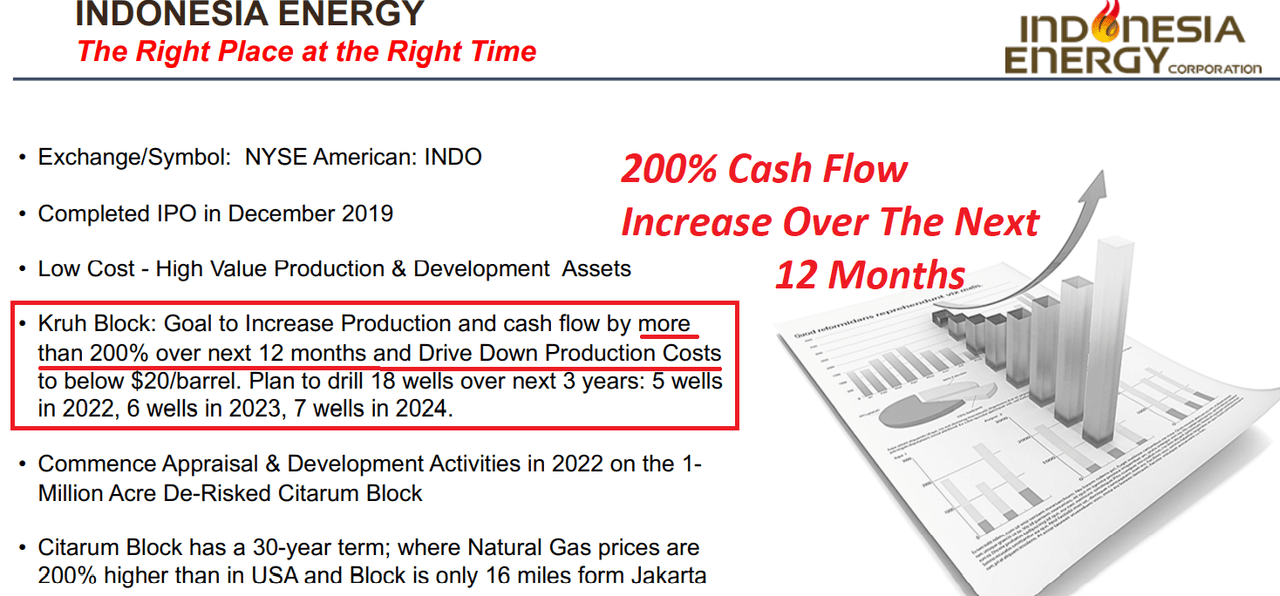

In order to assess the valuation of Kruh Block, I noted certain assumptions made by management. First, the company believes that production could increase sufficiently to deliver a cash flow increase of more than 200% y/y:

Presentation To Investors January 2022

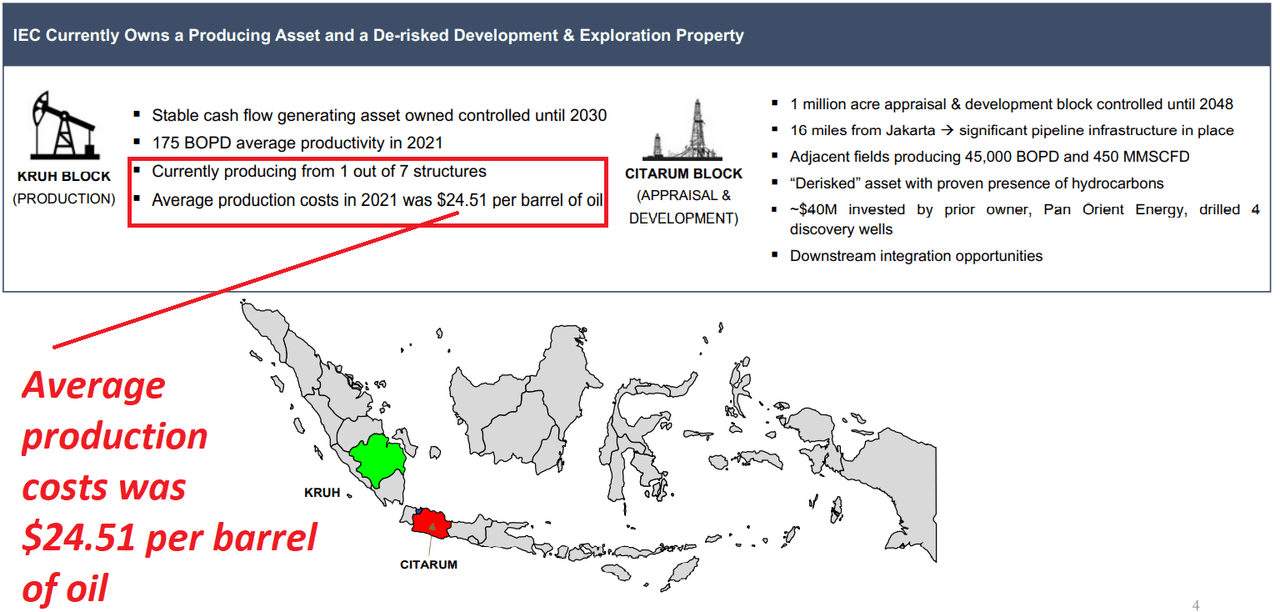

Another critical information that I obtained from a recent presentation to investors is the fact that management works with an average production cost of $24.51 per barrel. The figure may be a bit old as economies of scale could apply. With that, I will be using this financial figure because it is the only indication about the cost per barrel that I could find:

Presentation To Investors January 2022

From the company’s website, I obtained a combined proved developed and undeveloped gross crude oil reserves of 4.99 million barrels. I also assumed that the company could be producing more than 9,900 barrels of oil per month. It means that we would be talking about almost 0.119 million barrels per year:

Kruh Block covers an area of 258 square kilometers (63,753 acres) in Sumatra, Indonesia. This block produced an average of about 9,900 barrels of oil per month. Source: Company’s Website

Out of the total eight proved and potentially oil bearing structures in the block, three structures (North Kruh, Kruh and West Kruh fields) have combined proved developed and undeveloped gross crude oil reserves of 4.99 million barrels. Source: Company’s Website

Presentation To Investors January 2022

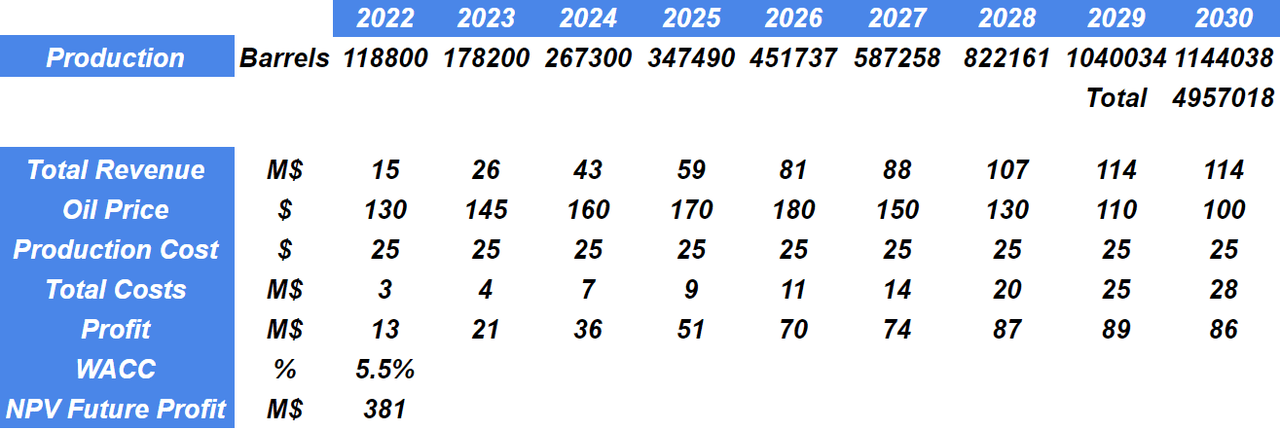

I used the previous information and assumed that the block will operate until 2030. I also assumed that the oil price will range from $130 in 2022 to $40 in 2032. With the production per barrel at $25 and a WACC of 5%, I obtained a total net present value close to $380 million. Hence, I believe that there may be even more upside potential in the stock price:

Qingshan Capital Management YCharts

The Market Capitalization Could Increase Even Further Thanks To The Exploration Citarum Block And The Rangkas Area

I do believe that we can see increases in the market capitalization if Indonesia Energy does relevant exploration work in the Citarum Block and the Rangkas Area. The team running Indonesia Energy is exceptional, and reports a lot of expertise and know-how obtained from large companies in the United States. So, I am quite optimistic about the company’s exploration activities:

We currently have rights through contracts with the Indonesian government to one oil and gas producing block (called Kruh Block) and one oil and gas exploration block (called Citarum Block). We have also identified a potential third exploration block, known as the Rangkas Area, and we may seek to acquire or otherwise obtain rights to additional oil and gas producing assets. Source: Operating Review For The Six Months Ended June 30, 2021

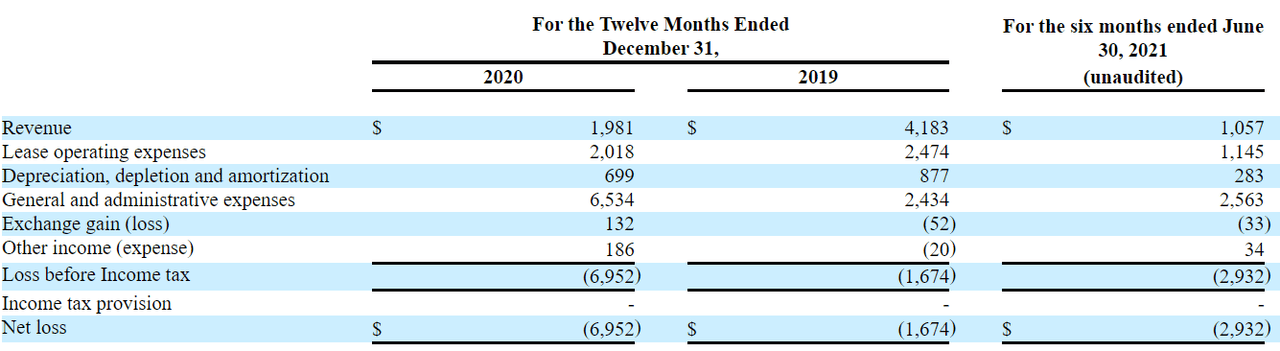

Great Expectations And The Income Statement Indicate That Expenses Are Increasing At A Large Pace

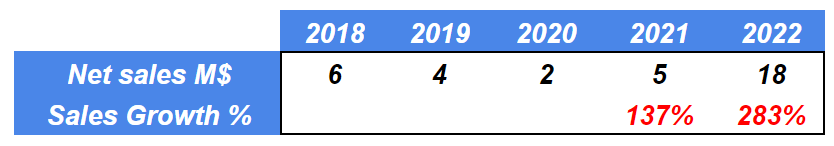

With most analysts out there expecting triple-digit sales growth in 2022, I don’t believe that reviewing what happened in the past is very relevant. With that, I need to note one thing about the total expenses reported by Indonesian Energy:

MarketScreener

In the last prospectus, INDO reported a significant increase in the total amount of general and administrative expenses. In my view, this is a great signal. More expenses mean that INDO is exploring more, and paying more personnel for oil production. As a result, I do believe that revenue growth will likely accelerate too:

Operating Review For The Six Months Ended June 30, 2021

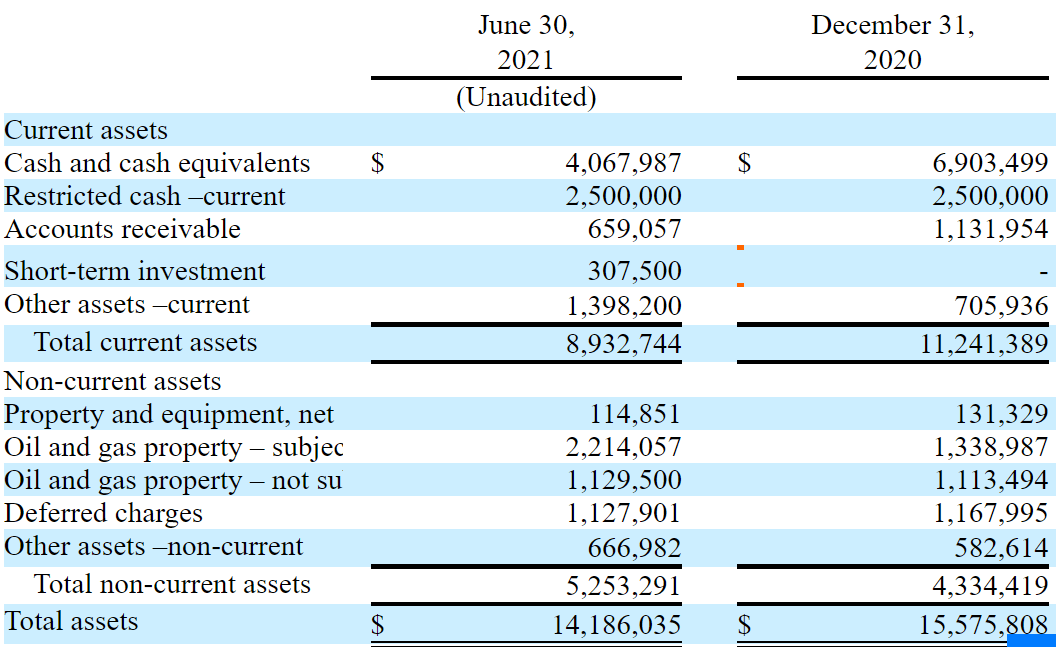

Balance Sheet

INDO’s balance sheet looks healthy with an asset/liability ratio of 3.7x. Cash in hand also represents 45% of the total amount of assets, so the company has liquidity to invest in capital expenditures in the coming years. Interestingly, oil and gas properties increased quite a bit in 2021:

F-1

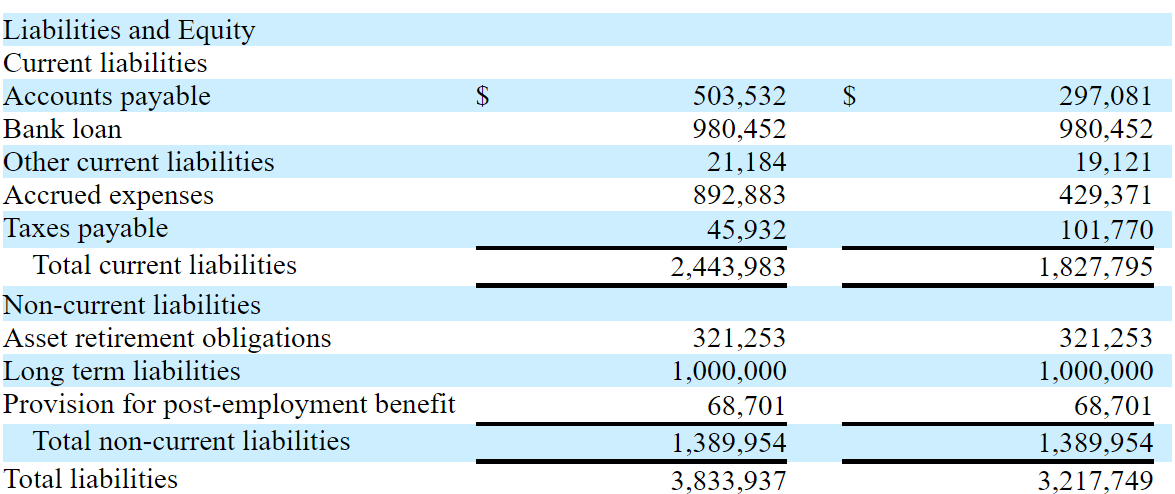

I am not concerned about INDO’s total amount of debt. I only saw a bank loan worth less than $1 million, which is significantly lower than the current amount of cash in hand:

F-1

Risk From Geographic Concentration Of Exploration And Production As Well As Supply Contracts In Indonesia

The company highlighted the fact that it is mostly based in Indonesia. If anything very relevant happens in the country, the revenue line may decline. In my view, if management really wants to receive investments, it will need to diversify its exploration efforts a bit more:

Our business focus is on oil and gas exploration in limited areas in Indonesia and exploitation of any significant reserves that are found within our license areas. As a result, we lack diversification, in terms of both the nature and geographic scope of our business. We will likely be impacted more acutely by factors affecting our industry or the regions in which we operate than we would if our business were more diversified. If we are unable to diversify our operations, our financial condition and results of operations could deteriorate. Source: F-1

INDO will have to negotiate under a jurisdiction that is very different from that of the United States, which is a significant risk. Under the agreements that INDO will have to sign, there is the take-or-pay arrangement, which could make the company lose a significant amount of money:

The common clause in gas supply contracts is a “take-or-pay arrangement” in which the buyer is required to either pay the price corresponding to certain pre-agreed quantities of natural gas and offtake such quantities or pay their corresponding price regardless of whether it purchases them. Under certain circumstances, such as industrial or economic crisis in Indonesia or globally, the buyer may be unwilling or unable to make these payments, which could trigger a renegotiation of contracts and become the subject of legal disputes between parties. Source: F-1

Without Sufficient Financing, INDO May Not Be Able To Finance CapEx, Which May Lower The Expected Production

If INDO raises less capital than expected, the company’s expected production figures may be lower than initially projected. If analysts do notice that the company will not deliver the expected cash flow, investors may sell their stakes, which may make the stock price fall. I would say that the company could fail to touch even INDO’s cash per share:

We cannot assure you that we will have sufficient capital resources in the future to finance all of our planned capital expenditures. This is particularly the case as we raised less funds than we had anticipated in our December 2019 initial public offering, which has required us to modify our drilling and other operational plans during 2020 and 2021. Source: F-1

Conclusion

INDO benefits from the increase in the crude oil price. In my view, the market does like quite a bit the team of professionals inside the organization. With the new information about the drilling of INDO’s producing block, I believe that the NPV of this asset could be worth $380 million. But that’s not all. If management is also successful in the exploration of the Citarum Block and the Rangkas area, the total valuation could be even more significant. Yes, there are also some risks. In fact, I will be following INDO in any case.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.