Summary:

- Innovative Industrial Properties is a cannabis REIT with over 100 properties in license-limited states, offering reduced competition and lower risk.

- IIPR trades at a discounted valuation with a 7%+ dividend yield and potential upside from upcoming bullish catalysts.

- The expected rescheduling of cannabis and changes to banking regulations could significantly benefit IIPR’s tenants and lead to a re-rating of the stock.

Morsa Images

Dear readers,

Innovative Industrial Properties, Inc. (NYSE:IIPR) is a cannabis REIT which owns just over a hundred properties located across the country. Similarly to its peer NewLake Capital Partners, Inc. (OTCQX:NLCP), it operates primarily in license-limited states, which significantly lowers new competition due to higher barriers of entry and reduces the risk because the license is often tied to the property which makes re-leasing (in case of tenant default or lease expiry) a lot easier.

The REIT trades at a very reasonable valuation and is potentially among the best values in the REIT sector with a 7%+ dividend yield and an almost 8% implied cap rate. Moreover, the REIT faces several relatively well-visible bullish catalysts that likely haven’t been fully priced in yet.

I started coverage on the stock in early January, with a BUY rating. My thesis was based largely on the aforementioned catalysts that haven’t fully materialized, though there has been progress (more on this below). The company has also reported its full year 2023 results in February. Since my initial article, despite the positive news being somewhat limited, the call has performed well with a RoR of 11.2%, above the return of the S&P 500 (SPX) over the same period of 8.5%. I strongly believe that there’s significantly more upside to come, which is why I reiterate my BUY rating today at $101 per share.

Positive catalysts around the corner

Recall, that there are three bullish catalysts for the cannabis industry, two of which are likely to significantly benefit IIPR’s tenants and therefore the REIT as well.

The most important catalyst, and one we’ve talked about in the past, is the expected rescheduling of cannabis from a Schedule 1 substance to a Schedule 3 substance. This would be major positive news because it would significantly lower taxes for cannabis operators (i.e., IIPR’s tenants), which in turn would improve their cash flow and therefore their rent coverage.

To put some numbers behind this, it is expected the elimination of the Section 280E tax would save operators around 20% of their gross profit, or $400 Million annually.

The last step in the formal process is for the DEA (Drug Enforcement Agency) to approve the change. And while we are still waiting on the approval, there has been a positive development in that 12 senators have requested the DEA to move along. The scientific evidence is clear that cannabis should be rescheduled, and since there seems to be political support as well. Therefore, I think it’s only a question of time before we get the approval.

Beyond this, the SAFER Banking Act includes changes which would significantly improve the access to banking capital for state-legal cannabis businesses. And while this catalyst has lower visibility, and it remains unclear whether it will be passed before elections, there is clear support for the bill in the Senate.

I am positive that at least one of these catalysts will happen over the course of this year, yet the stock continues to trade at a discounted valuation. This, in my opinion, represents an opportunity.

Cheap valuation

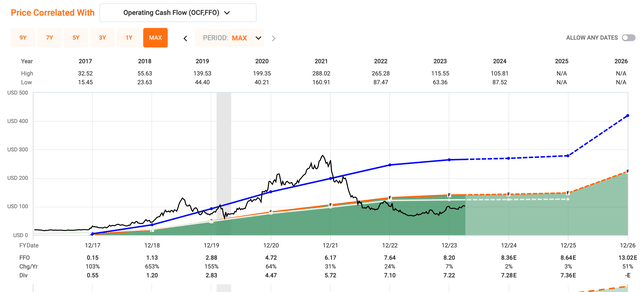

IIPR has managed to grow its FFO by 7% in 2023. For this year, consensus calls for 2% growth, followed by 3% in 2025. For the purposes of our valuation, however, we really don’t need to assume any growth and the investment still makes sense.

This is because, as is, the REIT trades at just 12x FFO. Note that just two years ago, this stock traded four times higher at 46x FFO. I’m not suggesting that we will return to the levels seen in the 2021 bull market, but at an implied cap rate of 7.8%, I see plenty of potential for multiple re-rating. For comparison, NLCP trades at an implied cap rate of around 10%, though some discount is justified there as it trades OTC, while IIPR trades on the NYSE.

The cap rate today represents about a 3.5% spread to 10-year treasury yields. And if/when cannabis gets rescheduled to Schedule 3, I can easily see a re-rating to at least 3%, if not lower. That would give us about 10-15% of upside from these levels on top of the 7.2% dividend yield, which is quite well covered with a payout ratio of 80% (despite lower than usual rent collections).

Risks

Of course, it’s not all sunshine and rainbows. While there is a reasonable margin of safety implied by the valuation, IIPR’s main risk remains tenants’ solvency.

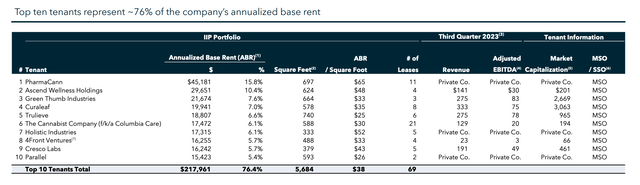

It’s a risk which should not be underestimated because (1) IIPR only has a handful of tenants and therefore has a high exposure to any of them and (2) several cannabis operators have had trouble paying their rent lately, including some of IIPR’s and also NLCP’s tenants.

On tenant diversification, the REIT can be considered somewhat risky, as it only leases its properties to 29 tenants. The two biggest ones (PharmaCann and Ascend Wellness Holdings, Inc. (OTCQX:AAWH)) each account for more than 10% of ABR, followed by Green Thumb Industries Inc. (OTCQX:GTBIF) at 7.6%.

In my last article, I mentioned that three of IIPR’s tenants had trouble paying rent. This included Green Peak, Parallel, and King’s Garden.

Green Peak‘s Summit Building included a cultivation and processing facility (under development) and 3 small retail locations which were foreclosed on mid-year 2023. In Q3 2023, IIPR signed an LOI to re-lease the asset and in Q4 2023 it successfully executed a lease with a new tenant, well ahead of scheduled completion of the building in Q4 2024. Recently, Green Peak decided to also turn back the Harvest Park property, which is another cultivation and processing facility. IIPR has, however, registered a lot of interest to re-lease the property and managed to sign an LOI for the property in February, ahead of Green Peak’s move-out date. With regards to properties from Parallel, little has changed, as management is still exploring all options with regard to one property in Texas and one in Pennsylvania. Finally, in late September, IIPR regained ownership of four properties previously occupied by Kings Garden. Two of which (McLane and 19th Avenue) are already under an LOI, with lease agreements expected to be executed no later than Q2 of this year. The remaining two assets (North Anza and Del Sol), which combined account for less than 1% of the portfolio, are still being actively marketed.

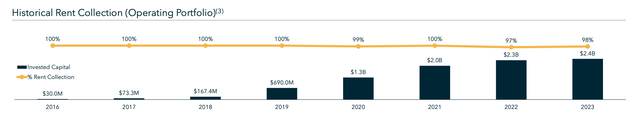

To conclude, I want to highlight that while a handful of properties have been under pressure, the majority of the portfolio continues to perform well with overall rent collections at 98%.

Bottom Line

IIPR is definitely on the riskier side when it comes to REITs, mostly because it operates in a new, unproven, and still controversial industry. It seems, however, that the industry is becoming more mainstream by the day, as confirmed by the undeniable political will to reschedule cannabis to Schedule 3. IIPR may not be a SWAN (sleep well at night) investment, but does represent an appealing opportunity to lock in a 7%+ dividend yield and potential upside with relatively visible catalysts just around the corner.

I reiterate my BUY rating here at $101 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to access my entire Portfolio and all my current Top Picks, feel free to join ‘High Yield Landlord’ for a 2-week free trial.

We are the largest and best-rated community of real estate investors on Seeking Alpha with 2,500+ members on board and a 4.9/5 rating from 500+ reviews:

![]()

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.