Summary:

- Innovative Industrial Properties has announced its full-year 2023 and Q4 2023 earnings results, beating FFO and revenue estimates.

- The company achieved a 12% increase in total revenue and demonstrated growth in adjusted funds from operations and normalized funds from operations.

- Despite challenges in the cannabis industry, IIPR has a robust business with a geographically diversified portfolio and a diversified tenant base.

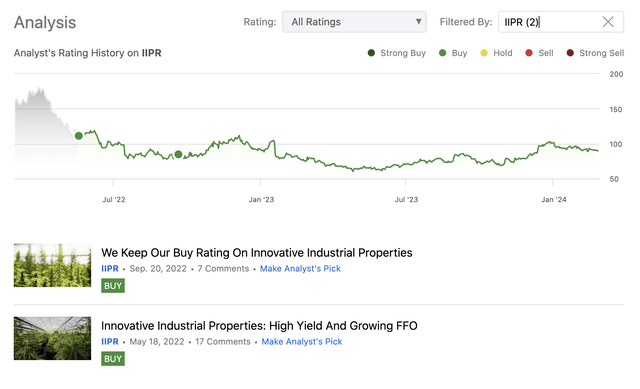

- We maintain our “buy” rating based on the firm’s valuation and future prospects.

halbergman

Innovative Industrial Properties, Inc. (NYSE:IIPR) is a self-advised Maryland REIT – real estate investment – trust – focused on the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated cannabis facilities. We started coverage of the firm in May 2022, with an initial bullish view, which we have maintained up until today. In this time frame, IIPR’s stock price has declined by 18%, while the broader market has gained as much as 29%.

The aim of today’s article is to take a look at the company’s latest earnings results, as well as at the recent developments in the macroeconomic environment, to determine, whether this bullish view is still valid or not.

Before going any further, however, it is important to quickly recap and keep in mind some of the requirements that must be met by the firm to qualify as a REIT, as these requirements can have a material impact on any investment:

- Invest at least 75% of its total assets in real estate

- Derive at least 75% of its gross income from rents from real property, interest on mortgages financing real property or from sales of real estate

- Pay at least 90% of its taxable income in the form of shareholder dividends each year

- Be an entity that is taxable as a corporation

- Be managed by a board of directors or trustees

- Have no more than 50% of its shares held by five or fewer individuals

Key Takeaways From Earnings Results

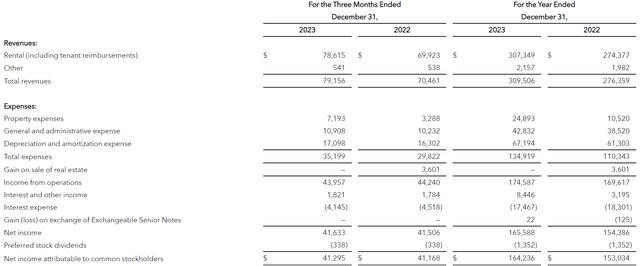

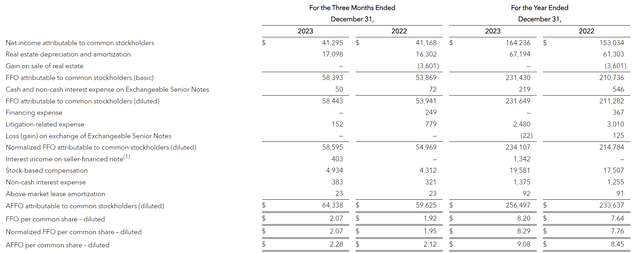

IIPR announced its full-year 2023 and Q4 2023 earnings results on the 26th of February, beating both FFO and revenue estimates. The company has achieved total revenue of $309.5 million, marking a 12% increase from the prior year, recorded a net income attributable to common stockholders at $164.2 million, (or $5.77 on a per-share basis), and demonstrated growth in adjusted funds from operations (AFFO) and normalized funds from operations (Normalized FFO), 10% and 9%, respectively, compared to 2022.

Now let us look a bit deeper into what factors have been driving these changes.

Revenue

$13.3 million of the revenue growth can be attributed to tenant reimbursements for property insurance premiums and property taxes, as a result of IIPR’s policy changes. It essentially means that tenants are no longer allowed to pay property taxes directly to the tax authorities, but these payments have to go through IIPR. IIPR then bills its tenants for property tax reimbursements.

In our opinion, this driver of revenue growth is of poor quality, as it is not sustainable and not operationally driven. It is an artificial inflation of the revenue figures, as a result of policy changes. While it improves the results on a year-on-year basis this time, this effect will no longer be visible next year.

The remainder of the growth can be attributed to adjustments to base rent and contractual rental escalations.

The disclosed defaults and termination of leases with a number of tenants during the year, including Green Peak, Kings Garden, Medical Investor Holdings, Vertical and Parallel, created headwinds, partially offsetting the above-mentioned positive impacts.

All in all, the firm has managed to collect as much as 98% of the contractual rents and has not collected about $4.8 million.

Net income

While most of the company’s expenses have increased meaningfully in 2023, IIPR has still managed to grow its net income by roughly 7%. On a per-share basis, the growth is somewhat lower, roughly 5%, as the firm has been issuing shares throughout the year. The issued senior notes also have a dilutive effect.

During the three months and year ended December 31, 2023, IIP issued 101,061 shares of its common stock under its ATM Program for net proceeds of approximately $9.6 million. Subsequent to year-end, IIP exchanged approximately $4.3 million principal amount of its Exchangeable Senior Notes for a combination of cash and shares of IIP common stock prior to maturity, in accordance with the terms of the indenture, and paid off the remaining $100,000 principal amount at maturity.”

Important to note that the tenants’ reimbursements discussed in the revenue section have no direct impact on the bottom line as they also generate an expense towards the tax authorities, included in the property expenses line item.

Further, despite the high interest rate environment, IIPR’s interest expenses have decreased. And as the firm does not have any maturities due until 2026, we do not expect extreme negative changes in this line item. We anticipate that the Fed will start decreasing the interest rates starting later this year. The extent of the decrease by 2026 is likely to be significant, and therefore, we believe that IIPR will be able to refinance its debt (if needed) under much more favourable conditions than it would be today.

All in all, we are pleased with IIPR’s net income and FFO growth. We believe that the firm’s rent definition on triple-net basis, and their rent collection of 98% both indicate robustness and stability of the business. Despite the challenging macroeconomic environment and the significant market stress within the cannabis industry, with many players going bankrupt, IIPR has still managed to deliver solid results.

Let us bring some highlights from IIPR’s portfolio, which further support the thesis of their robustness:

- 95.8% of the portfolio is leased (on a triple-net basis).

- Weighted-average remaining lease term: 14.6 years.

- Diversified tenant portfolio: No tenant represents more than 16% of annualized base rent.

- Diversified geographically: No state represents more than 15% of annualized base rent.

Looking forward, we believe there is still upside potential to be unlocked. The macroeconomic environment has been gradually improving in the past quarters, including improving consumer confidence, falling commodity prices and moderating inflation. As a result, we expect IIPR’s tenants to become more financially stable and flexible, which we expect will benefit IIPR’s business too. The legislative changes related to cannabis use are also becoming gradually more and more supportive of the industry, not just in the United States, but also in Europe, which can again provide tailwinds to the firm in the mid and long term.

Valuation

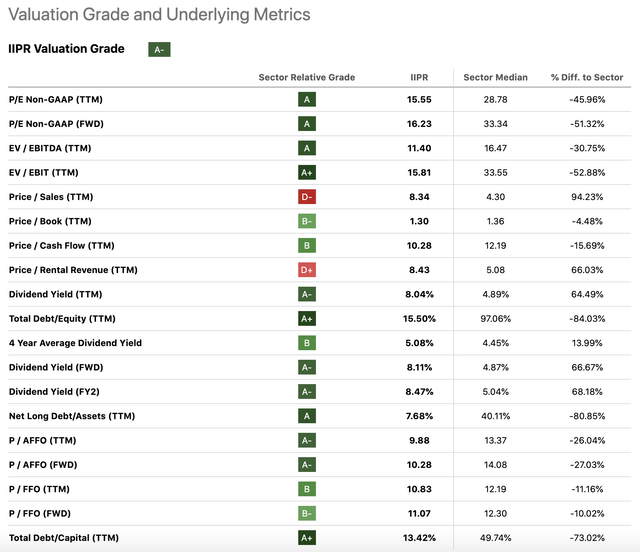

Last, but not the least, let us talk about valuation.

When valuing REITs, the traditional set of price multiples is normally not the best choice. Multiples like price to funds from operations or price to adjusted funds from operations provide a much better picture of the REIT’s operating performance.

FFO and FFO per share are operating performance measures adopted by the National Association of Real Estate Investment Trusts, Inc. (NAREIT). NAREIT defines FFO as the most commonly accepted and reported measure of a REIT’s operating performance equal to net income, computed in accordance with accounting principles generally accepted in the United States (GAAP), excluding gains (or losses) from sales of property, depreciation, amortization and impairment related to real estate properties, and after adjustments for unconsolidated partnerships and joint ventures.”

The following table summarizes both a set of traditional price multiples and a set of REIT-specific price multiples.

Considering that IIPR’s business has remained relatively stable and robust during a challenging 2023, and has even increased its dividend, we believe that these multiples are very attractive for investors looking for income and growth at the same time.

IIP paid a quarterly dividend of $1.82 per common share on January 12, 2024 to stockholders of record as of December 29, 2023. IIP’s AFFO payout ratio was 80% (calculated by dividing the common stock dividend declared per share by IIP’s AFFO per common share for the quarter). The common stock dividends declared for the twelve months ended December 31, 2023 totaled $7.22 per common share. IIP has increased its common stock dividends declared each year since its inception in 2016.”

Conclusions

IIPR has delivered solid quarterly and full-year results for Q4 and the full year of 2023. The firm has managed to increase both its revenue, net income, and FFO, although the revenue increase was only partially dictated by the operating performance.

IIPR has a robust business, which is geographically diversified and has a diversified tenant base.

The valuation of IIPR looks reasonable and attractive, considering also its commitment to returning capital to the shareholders in the form of dividends.

All in all, we remain bullish on IIPR’s business and on its outlook based on the latest results.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.